The Georgian team at EastFruit sums up the main developments in the fruit and vegetable business in Georgia in 2022.

2022 was quite a challenging year for the Georgian horticultural sector, which is no surprise given the hardships in the global economy. The 2021 global energy crisis, predominantly caused by the quick economic rebound from the COVID-19 pandemic, resulted in a spike in the demand far outpacing the supply – hence the increased prices of the energy.

The crisis was further deepened by Russia’s unjust invasion of Ukraine. The still ongoing war is having a significant impact on Georgian horticulture in major ways as the Georgian economy is tightly connected with the markets of both countries through trade and tourism. As a reflection of global drawbacks brought by the war, Georgian horticulture experienced rising costs for production and logistics. War also translated into reduced external demand for Georgian fruits, nuts, and vegetables, but there was a rise in local demand due to the migration of Russian citizens to Georgia. For example, local demand for herbs increased so much that a major Georgian supplier decided to stop exports and entirely focus on the internal market. Also, rising demand fueled imports of watermelons before the Georgian season even started, and we investigated whether Georgia could start producing earlier.

One of the key external factors from 2022 still affecting the local market is the crisis in Turkey and the country’s decision to limit exports to subdue the prices on its own market. Depreciation of the Turkish Lira, which is widely linked to the questionable policies of the Turkish government has blown into a major crisis with very high inflation rates. As Turkey is a key exporter of horticulture to Georgia, limiting the exports of course put significant pressure on the Georgian market. An illustrative example could be onions, which are at the Top-2 of horticulture produce imported by Georgia, which got extremely expensive in 2022.

Along with the influence coming from global developments, local weather also had a serious impact on the production of key Georgian horticulture products. In many cases, either the harvesting was delayed, or the quality of the crop deteriorated – or even both. Thus, prices for many products skyrocketed – like table grapes and bell pepper.

Another local factor, the labor deficit, became more noticeable in 2022.

Before we review specific products, let’s take a brief look at Georgia’s external trade in fruits, nuts, and vegetables (HS07-08).

In 11 months of 2022, Georgian exports amounted to $166 million, 17% lower than in the same period of a record-breaking 2021. The top-3 destination markets were Russia ($67 million), which despite the banking sanctions could import from Georgia as Russian traders usually come into the country and pay in cash, Italy ($25 million), and Germany ($25 million). The last two countries are importing Georgia’s top horticulture export product – hazelnut.

In the meantime, imports have grown by 30%, from $74 million in 2021 to $96 million in 2022. The top-3 markets from which Georgia imports were Turkey ($36 million), Ecuador ($23 million, main banana exporter to Georgia), and Uzbekistan ($7 million). Interestingly, Uzbekistan increased exports to Georgia by 80% in year-on-year terms as Turkey left some gaps in supply due to the country’s goal to satisfy its own market first.

All the above trade numbers exclude December for both 2021 and 2022 as the month is not over yet, but the overall picture of the Georgian external trade in fruits, nuts, and vegetables will not change even with December’s data. Exports in 2022 will be lower due to the war, but imports will be higher thanks to the growing local demand fueled by mostly Russian citizens relocating to Georgia to avoid banking sanctions or being recruited by the army. The strengthening of the Georgian currency also played a role in the import growth – the factor itself can be caused by migration.

Now we move on to review EastFruit’s material on the developments of the most important horticulture product markets in Georgia for 2022.

We would like to highlight the main events of the 2022 for main horticultural products of Georgia. Products are listed according to the size of export revenues, in descending order.

- Hazelnuts, which is a top export position for Georgia had a hard 2022, while the local supply of walnuts and almonds is increasing

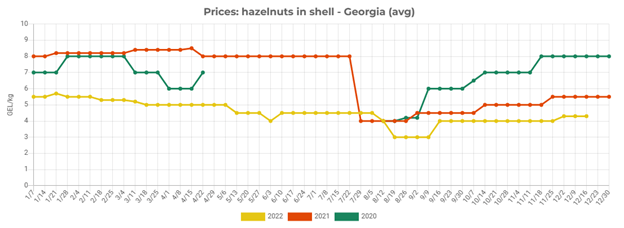

The year started with uncertainty, which resulted from the volatility of the Turkish market. Due to the latter and the fact that the quality of the 2021 harvest was questionable, local wholesale prices were low from the start of the year. Georgian exporters had to lower the prices further as another major factor came into play: Russia’s unjust war against Ukraine dwindled the demand worldwide. Hazelnut harvest season in 2022, which slowly started around September, was hard for several reasons:

- Low prices on hazelnuts were discouraging farmers to invest in orchard care – hence, lower yields were expected in 2022

- The rise in activity of Brown Marmorated Stink Bug (BMSB)

- High leftover stocks from the 2021 harvest for Georgia and other producers

An additional huge hit for the 2022 season were heavy rains in the key producing regions, which led to delayed exports and quality issues.

Given all the negative developments in the Georgian hazelnut market, the private (Georgian Hazelnut Growers Association) and public sector (Ministry of Environmental Protection and Agriculture) have joined forces to launch a massive digitalization and registration of property. The cadaster will be a tremendous help in implementing policies, coordinating activities, and channeling subsidies for the hazelnut farmers, who are having a difficult time right now.

This year has become a turning point for the industrial production of walnuts in Georgia. The harvest, which, according to preliminary estimates, amounted to 2 500 tonnes, will allow replacing about 90% of imports on the Georgian market with a domestic product, where demand is for 3 000 tonnes. Developed processing will allow to offer high-quality Georgian walnuts and a wide range of high-value products from walnuts.

As EastFruit analysts reported, blueberries, almonds, and apples were the most popular among Georgian investors since 2015. Over 17% of investments, supported by the Government of Georgia, were used to establish almond orchards. There was a first commercial harvest of almonds in Georgia this year, the sector was not quite ready for exports but will be ready in 2023. So far, Georgia has only one industrial processing factory, established by the largest almond producer – Udabno.

Dynamic sector development has triggered the introduction of regulations. The technical regulation for walnuts and almonds, aimed at regulating the export of in-shell and kernels of walnuts, in-shell and shelled almonds, and blanched almond kernels, came into force in June 2022.

In addition to the most popular nuts in the world – almonds, walnuts, hazelnuts, and pistachios – the so-called “American nuts”, pecans grow in Georgia. Although there are no commercial plantations in the country yet, pecans are already harvested and processed for export to traditional markets, namely the EU countries and China.

An important highlight of the year for the Georgian nut market was the international conference “Nuts of Ukraine: Exchanging experience with Georgia”, where Georgian and Ukrainian experts discussed various aspects of production and trade and shared outlooks of the nuts markets of both countries. The conference video is available on EastFruit’s YouTube channel.

- Peaches: Increased supply met with increased demand

Peach and nectarine season started with a very strong local demand and a significantly grown expected harvest volume of 40 000-45 000 tonnes. A larger harvest did not result in lower prices. Thanks to the growing local demand, Georgian wholesale prices in Lari terms stayed close to the previous season’s levels. More than half of the total production got exported. Sadly, exports have reduced in volume compared to 2021, but have slightly grown in value terms as export prices in USD increased. There were only two main buyers for Georgian peach and nectarine: Armenia and Russia.

- Blueberries are a driver of the Georgian berries sector

Over the past ten years, blueberries have become one of the most popular crops for planting in Western Georgia. Interest in their production does not subside, as the export opportunities are attractive.

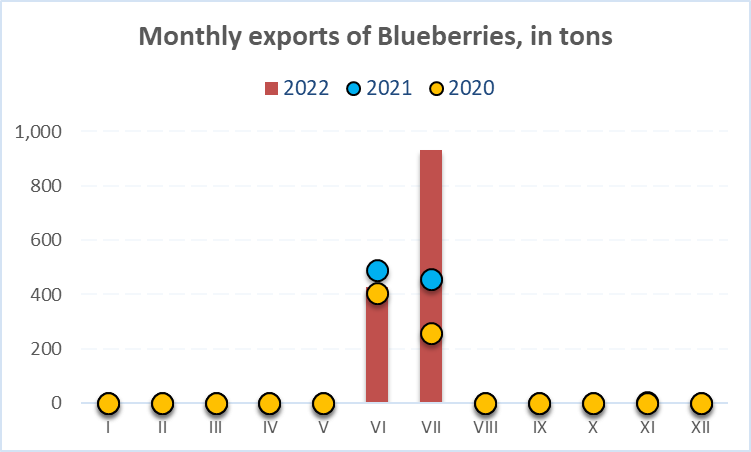

Blueberries, leading berries for Georgia, had quite a busy year here on EastFruit. We started with reviewing the possibility of exporting to the EU, and the work done towards the diversification of exports.

Data source: Ministry of Finance of Georgia

Later we went on to cover the season 2022 developments: harvesting got delayed due to rains and there was also some significant damage caused. Unfavorable weather conditions also led to some logistical problems as the roads were damaged due to heavy rain. At the end of June, local prices fell sharply as it became apparent that the local supply had grown by a large margin. Russia remained the main export destination for Georgian blueberries, where competition has increased drastically. Export volumes have increased but at the expense of lower prices.

EastFruit has highlighted blueberry production in Georgia and shared contacts of the main producers in this video.

The sector is dynamic, and growers are looking for new varieties and technologies. Thus, Georgia starts growing licensed varieties of blueberries, production in high tunnels, mechanized harvesting technologies, and innovative storage technologies for small farmers like mobile freezers and mobile storage facilities with solar panels.

The raspberry season in 2022 started with very high prices. As EastFruit reported in July, the main reasons were concentrated on the supply side. Weather shocks in the previous season, high costs this season, and the fact that many Georgian producers find it hard to manage their berry farms, have led to shortages in supply at the beginning stages of the season. There were some thoughts that the supply could possibly grow over the season as many plantations bear late, but as our latest report suggests, production fell below the demand and the prices were quite high in the later stages too. Notably, many producers have left the sector. According to the Georgian Association of Berry Growers, at least 20% of raspberry producers have left the market in recent years. Here we’ve discussed the main challenges that investors had to fight with and the experts’ recommendations.

More or less similar to raspberry prices, strawberry prices also jumped in light of the lower Georgian supply and significantly growing local demand. The latter also showed itself in the import spike. It should be noted that, unlike raspberries and blackberries production, strawberry production was not a part of the state subsidies program, thus, only the most efficient producers could grow it.

- Record-breaking apple harvest in the 2022/23 season

The year started well for Georgian apples. January exports were good, and as expected they continued to stay so. In the first 5 months of the year, which are usually an export window for the stored apples, the country exported apples worth $4.7 million. This is slightly below the record-breaking 2021 for the same period ($5.2 million), but still a good result.

Harvest of 2022 was expected to be a record-breaking one with Georgia doubling the production volume of apples compared to 2021. This sparked concerns as nobody knew where to sell this many apples. Dry weather was an issue, and harvesting was delayed, but by preliminary estimates, the total volume stays close to forecasts. The expected jump in the supply lead to difficulties in selling apples at the early stages of the season in August. This more or less remained an issue in the next months. Exports of apples from the new harvest are not unusual, but the harvest of over 130 000 tonnes is indeed extraordinary. Huge volumes of apples are stored in hopes of using the window in the first half of 2023. Even now, Russia remains a key destination for Georgian apples.

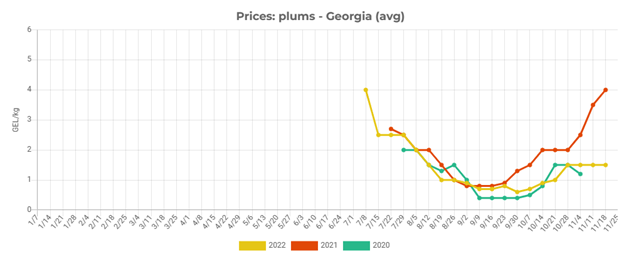

- Plum producers enjoy high demand from processors

Plum production volume has grown and was reportedly quite large this year. It may come as surprise to some, but the local demand from processors has grown tremendously. This demand is expected to grow even more in the coming years as the processors found that they were limited by capacity this year.

Supply in 2022 was so large that despite both local and foreign demand growing significantly, plum prices have fallen behind the 2021 levels. After the weak start of the exports season, plum exports broke the record in the end. Export volume has increased by 60% compared to the previous record set in 2021, but even this was not enough to hold the local prices.

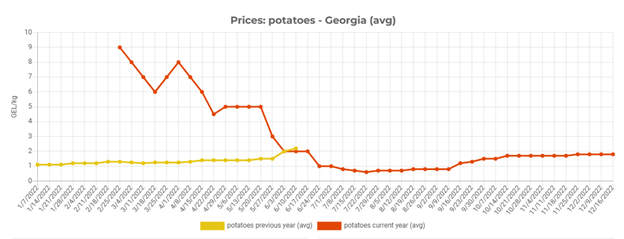

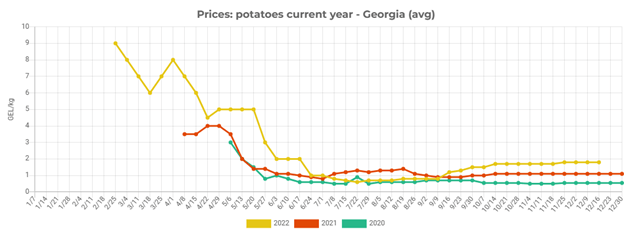

- Potatoes prices swing all year round

The year started good for potatoes, but there has been very intense turbulence throughout the year. External demand from the neighbors, especially Russia, resulted in the highest prices for the first two months of the year. Then with the outbreak of war, prices started to collapse quickly in March. Georgian exporters lost hope of exporting, but suddenly Russia bought Georgian potatoes at higher prices.

Harvest of 2022 began around May, and EastFruit’s survey revealed that the production costs had skyrocketed. Along with the quickly reducing local stocks from the previous harvest due to dynamic exports, increased costs fueled the price growth and the potato prices broke records in the second quarter of the year.

As the local supply from the new harvest filled the market and the Russian demand was gone, prices started falling again. By the middle of 2022, prices gradually fell from the peak to the lowest point for July in the last five years.

The market took another turn as it became apparent that the harvest of the major producing region Samtskhe-Javakheti, which usually begins in September, would be much low due to the long-lasting drought. Of course, potato prices started growing again as the imports were deemed problematic due to Turkey limiting exports and importing from elsewhere being expensive. However, as the prices kept rising, importing became feasible and the country started to do so right away. So far, potatoes remain way more expensive than in the same period of previous years and more imports are expected.

There were some interesting developments apart from the swings in the regular potato market discussed above. This year, Georgia showed that sweet potatoes are indeed in strong demand. The product became far more popular in 2022 compared to previous years. Georgia has more than doubled the imports of sweet potatoes.

- Mandarins’ exports will decrease

Mandarins are the most popular citrus in Georgia by far, having a share of about 90% in the citrus production volume. This has not changed in 2022 and will not change anytime soon. The mandarin yield is expected to reduce, but mandarins will remain a key export position for Georgia. The exports started right with the beginning of the season in November, but the figures were not quite good.

In 2021 the country’s export broke the record of $8.1 million. Despite positive dynamics over the recent year, a huge success in 2022 is under question due to weather shocks and two main destination markets, Russia and Ukraine, still being at war. The positive for farmers is that the Georgian government is subsidizing the purchase of non-standard mandarins, which help a lot given adverse weather effects. Total export volume is expected to reduce at least by 10% – to 30 000-35 000 tonnes – compared to the successful 2021.

A bit about hortitech trends in Georgia

We’ve observed the dynamic introduction of horticultural technologies – hortitech – in Georgian agribusiness in 2022. Increased demand for fresh culinary herbs has inspired the establishment of two vertical farms in Georgia already – with hydroponics and aeroponics production systems. Both companies are supplying mainly the HoReCa sector and are satisfied with the commercial results. We’ve included Georgian experience in the recent online International conference on vertical farming.

Having a positive experience with annual crops such as corn and wheat, the Agrodrone company also started experimenting with spraying perennial orchards of walnuts and hazelnuts. The sector has recently received state support, as an unmanned aerial vehicle (agricultural drone) and a weather stations were included on the list of Preferential Agro Loan, which enjoys state-subsidized interest rates.

If you think that we have missed any important event of the Georgian horticulture business in 2022, please write about it in the comments.

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.