This is the continuation of the first part of the material on the main events of the horticulture business in Uzbekistan

5. “Carrot bubble” and “golden” onions in 2022

2022 was a very successful year for producers of the main types of cabbage, but for carrot producers of Uzbekistan, the picture was completely different this year.

Uzbek intermediaries lost lots of money on carrots when stored late-ripening carrots of the 2021 crop, believing in the repeat of the developments in 2021 when carrot prices were high due to two factors: excessive demand for carrots in foreign markets in the first half of the year and lower carrot yields in Uzbekistan.

However, you never know what may turn up. After a successful 2021 for carrot producers and traders, an increase in the production volumes of carrots in the next 2022 was quite expected. But market participants should have wondered – “What are the chances of the same rush demand for carrots in the spring of 2022?”.

As expected, the areas planted with late-ripening carrots, which are harvested in October and November, at least doubled in July 2021. Since the yield of this carrot did not differ much from previous years, the volume of the carrot harvest in October-November 2021 also more than doubled. This led to a significant increase in the supply of carrots on the market in the following months. From mid-January to mid-February 2022, wholesale prices for carrots were growing rapidly which was strange – there was a large increase in supply on the market, carrot consumption remained unchanged, and exports at that time made no economic sense. The explanation was simple: traders bought and stored carrots in large volumes for export needs, confident in a repeat of the 2021 developments. In mid-February 2022 EastFruit analysts analyzed in detail whether the 2021 scenario could repeat and warned of an upcoming “carrot bubble” in the Uzbek market.

Five months later, traders were selling stocks of carrots 5-10 times cheaper than the purchase price, counting huge losses …

EastFruit experts have been emphasizing for many years: “Storage of vegetables and fruits is not a separate business, but part of a systematic business for growing and selling fruits and vegetables. I have been saying this since the mid-2000s and I hope that after the situation with carrots, many in Uzbekistan will understand why this is true,” says Andriy Yarmak, the economist at the FAO Investment Centre. You can read his blog on the subject here.

Quite a natural consequence of the expansion of the areas of cabbage (all its main types) and carrot plantations in the second half of 2021, which caused the growth in the production of these crops, was the reduction in the area of winter onion plantations in the same period, which is harvested in the spring of next year, EastFruit analysts note.

Thus, in the spring of 2022, the volume of onion production in Uzbekistan was lower compared to previous years. Given a reduction in the supply of onions in the domestic market of Uzbekistan, the demand for them in foreign markets increased due to factors that could not be foreseen. We remind you that Uzbekistan is the largest exporter of onions in Central Asia.

Firstly, the destruction of vegetable growing in the southern regions of Ukraine, which were under Russian occupation in the spring of 2022, led to the fact that onion production in this country decreased from 1 million tonnes by about half, and Ukraine turned from an exporter into an importer of onions.

In addition, Russia artificially strengthened its currency, which made deliveries to the Russian market when paid in rubles quite attractive from an economic point of view.

Secondly, there was a shortage of onions in Europe, caused by drought and abnormally hot weather in many EU countries in the summer of 2022.

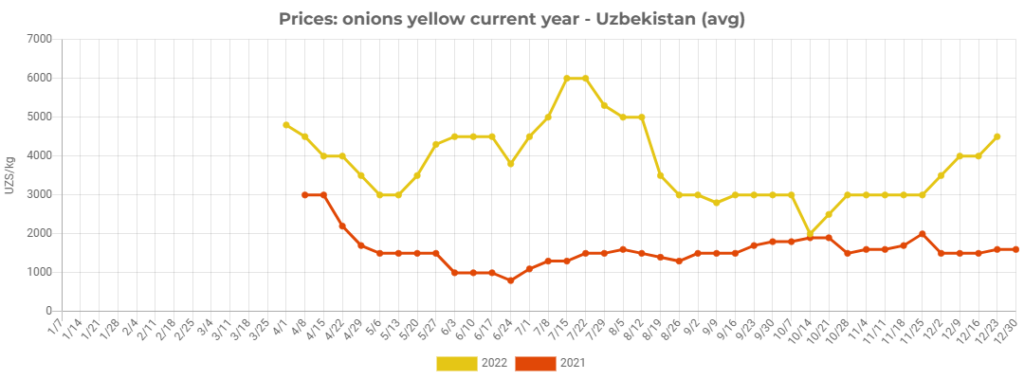

Prices for onions rose in all countries of the region. Wholesale prices for onions in Uzbekistan were record high until mid-August – the beginning of the harvest of spring-sown onions.

Starting from mid-August 2022, wholesale prices for onions in Uzbekistan decreased significantly but remained about 2 times higher than last year. Starting from the same month, Pakistan began to import onions from Uzbekistan due to the huge loss of local crops because of catastrophic floods. The exports of Uzbek onions to Pakistan continued in the following months, increasing even more.

This year, the onion export season started in the first ten days of April, and from the beginning of April to December 20, 2022, Uzbekistan exported 192 200 tonnes of onions, which is 4.3% more than in the same period in 2021.

As you see in the chart above, over the last month – from November 25 to December 23, 2022, the average wholesale prices for onions in Uzbekistan increased from 3 000 to 4 500 UZS/kg (from $0.27 to $0.40), i.e. 1.5 times. As of December 23, 2022, the average wholesale price of onions is 2.8 times higher than the same date last year.

Thus, in 2022, carrots gave the leadership to onions.

2022 was also successful for the producers of leeks – their export volume in 11 months of 2022 almost 3 times exceeded the volume in the same period last year and updated the previous record of 2019. In January-November 2022, Uzbekistan exported 15 000 tonnes of leeks worth $5.8 million, which is 2.9 times more in physical terms than in the same period last year and 2.3 times higher than the previous record figure 2019. Read more about this in the material “The exports of leeks from Uzbekistan increased by almost 3 times in 2022“.

6. Imports of potatoes decreased for the first time, and the growth rate of banana imports is slowing down

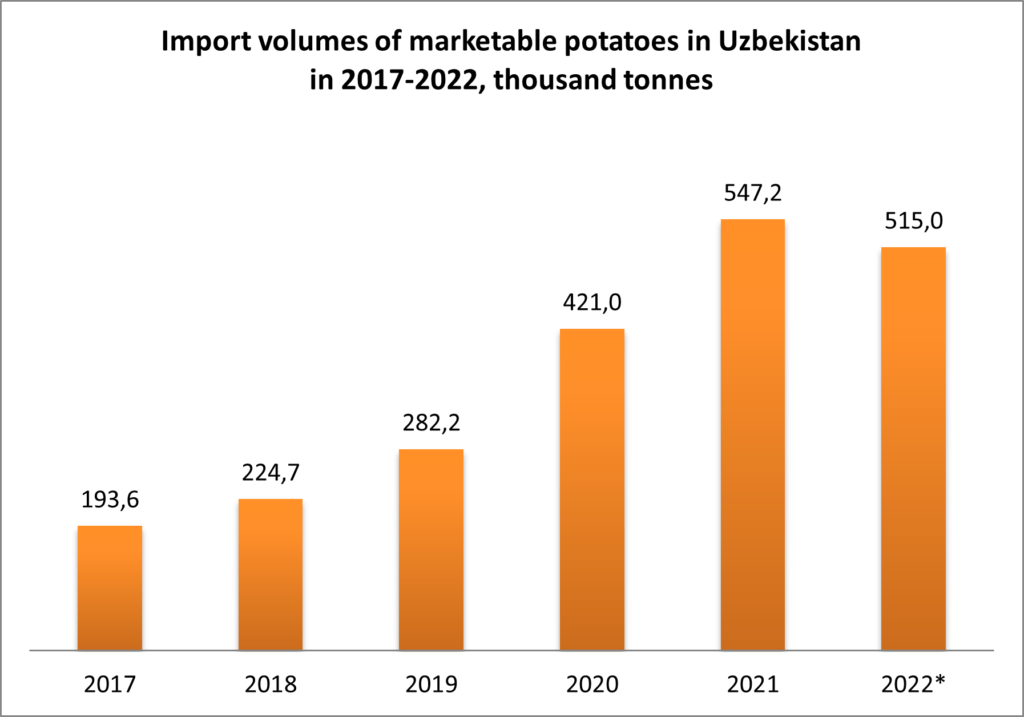

Potatoes have become the main import commodity of the fruit and vegetable sector of Uzbekistan over the past few years. Until 2016, the annual volume of potato imports did not exceed 50 000 tonnes per year, and in 2017 the imports amounted to 194 000 tonnes. From 2017 to 2021, the volume of imports increased 2.8 times.

According to preliminary estimates by EastFruit analysts, by the end of 2022, the volume of imports of marketable potatoes to Uzbekistan will be in the range of 510 000-520 000 tonnes, and thus will decrease by 5% -7% compared to the record figure of 2021. In other words, the import of marketable potatoes to Uzbekistan in 2022 may decrease for the first time since 2018.

*data for 2022 are forecast estimates by EastFruit analysts

Despite a projected decline from last year’s record high, the absolute value of imports of these products is still high and Uzbekistan is still one of the largest potato-importing countries in the world.

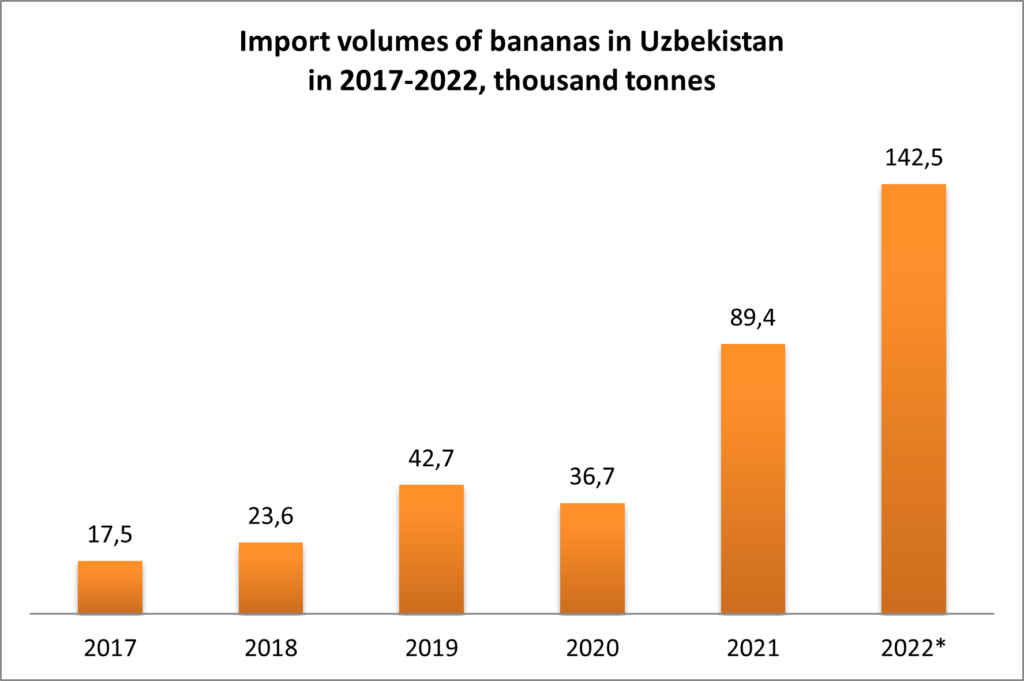

The next largest import commodity in the fruit and vegetable segment of Uzbekistan is bananas, the consumption of which in the country has been growing for the second year in a row. However, the growth rate of banana imports in 2022 will be lower than in the previous year.

According to EastFruit analysts, the total volume of banana imports to Uzbekistan in 2022 was about 140 000-145 000 tonnes, which means an increase of 57% -62% compared to last year. Considering that in 2021 the volume of banana imports increased by 2.4 times compared to 2020 and more than 2 times compared to the volume of imports in 2019, the growth rate this year will slow down significantly.

*data for 2022 are forecast estimates by EastFruit analysts

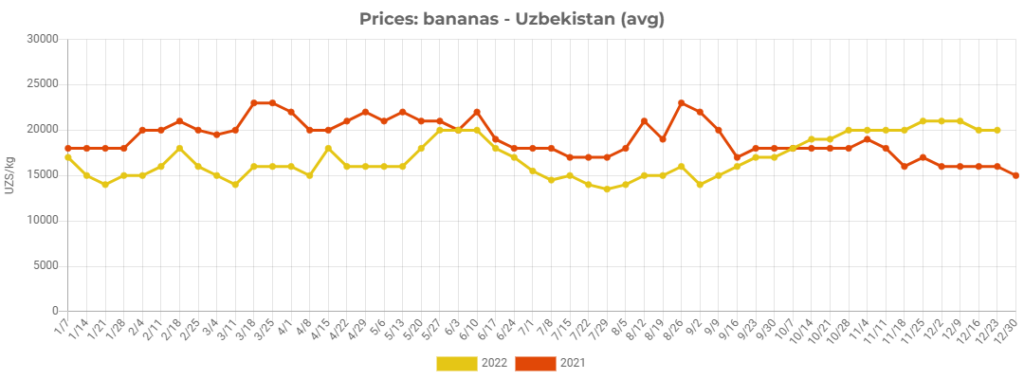

According to EastFruit analysts, the main reason for the slowdown in import growth, as well as banana consumption in Uzbekistan, is the rise in their prices, which we wrote about in early December 2022 in the article “Banana price growth may slow down the growth of banana consumption in Uzbekistan.”

The slowdown in growth is due to a decrease in imports in October-December 2022 when the average wholesale banana prices exceeded last year’s levels and the gap between current wholesale prices and last year’s levels began to grow.

According to EastFruit analysts, the volume of banana imports in October-December 2022 is 35 000-40 000 tonnes, while in the same period last year Uzbekistan imported 41 400 tonnes. In other words, in this period, a slight decrease instead of growth in imports is expected compared to last year.

7. Is the lemon crisis coming?

In the past few years, the production of lemons in Uzbekistan has been increasing, as well as in neighboring Tajikistan. Starting from March 1, 2020, a number of benefits for entrepreneurs involved in lemon production were introduced in Uzbekistan. In particular, the costs for the establishment of new lemon plantations and the purchase of seedlings are covered as subsidies, as well as transportation costs (by rail and air transport) for the export of lemons, in the amount of up to 25% of these costs. In addition, it was planned to allocate $100 million to finance projects in lemon growing.

Later, the boom in demand for lemons at the height of the COVID-19 pandemic in 2020 became a serious impetus for the development of this segment.

However, the lemon industry in Uzbekistan is currently close to overproduction if it has not already happened. EastFruit experts described in detail the current situation in the lemon industry in Uzbekistan and neighboring Tajikistan in the article published in December 2022.

The summary is that the volume of lemon production in Uzbekistan is growing, but export volumes are not. If the establishment of new lemon orchards by subsidiary farms continues at the same pace, lemon prices are likely to continue to decline. Farmers need to prepare for new price realities since the type of lemon that is grown in Uzbekistan and the way it is grown are uncompetitive in the global market.

8. Groundwater protection in Uzbekistan will be strengthened

In 2022, EastFruit experts repeatedly drew attention to the problems of water use in Uzbekistan and the possible consequences of the mass use of artesian water for irrigating plantations, which caused considerable concern, since as a result there is a threat of a shortage of drinking water. In the same year, the media reported a decrease in the level of groundwater in seven regions of the country by 5 meters, which also speaks of a rather unpleasant trend and a situation that threatens the fruit and vegetable industry. This may lead to a slowdown in growth or even a decrease in the production of fruits and vegetables in Uzbekistan in the coming years.

And in the same year, the state took up this problem seriously – in December 2022, the government of Uzbekistan announced measures aimed at protecting groundwater:

– a moratorium is introduced on drilling wells and the use of groundwater in areas where the groundwater level has dropped by more than 5 meters;

– a requirement is established for groundwater users to equip their facilities with water meters by January 1, 2024, since currently 90 percent of wells are not equipped with meters;

– from April 1, 2023, a system of issuing permits will be introduced not for each well, but for drilling activities in general, geological exploration will be carried out to completely re-evaluate the reserves of groundwater sources, the level of which is declining;

– the State Geological Monitoring Service is being created to monitor the state of groundwater and create a unified system of protection against dangerous geological processes.

It is possible that the next step could be to stimulate the rational use of Uzbekistan’s water resources through the cost of water for users, EastFruit experts say.

However, such a decision, if taken, would be quite justified and could even benefit the country’s horticulture: “The introduction of reasonable payment for water and an increase in its cost would help Uzbek farmers pay attention to product quality because, with rising costs, there is a need to increase revenue per hectare,” says Andriy Yarmak, the economist at the Investment Centre of the Food and Agriculture Organization of the United Nations (FAO). Read the expert opinion in our article.

9. Launch of new transport corridors

The changed geopolitical situation on the Eurasian continent due to the invasion of the Russian army into Ukraine has sharpened the issue of the development and diversification of international transport corridors for the countries of Central Asia as never before. Uzbekistan is one of the two countries in the world that need to cross the territory of at least two states to access the World Ocean, as all neighboring countries also do not have access to ports. The importance of developing alternative routes for the delivery of goods to European countries has also increased.

For obvious reasons, in 2022 Uzbekistan stepped up its efforts in this – the development and opening of new routes to the markets of European countries, the seaports of Iran, and Pakistan.

The first results were not long in coming.

As a result of bilateral negotiations, in early June 2022, Turkmenistan allowed transit cargo transportation from Uzbekistan to Iran and vice versa, while establishing a number of requirements for the transit of goods through the territory of the state.

A few months later, in November 2022, Turkmenistan expanded the list of checkpoints open for international cargo transportation. Now Uzbek trucks can cross the border between Uzbekistan and Turkmenistan at three checkpoints, and at least two checkpoints on the border between Turkmenistan and Iran. Also, there is the “International Maritime Point of Turkmenbashi” on the Caspian Sea in this list of border points, which creates the opportunity to deliver goods from Uzbekistan to Azerbaijan and then to Georgia, and vice versa along this transport corridor – along the shortest route.

In early December 2022, EastFruit wrote about the opening of a new rail route from Turkey to Uzbekistan and vice versa. The first freight train of 40 wagons, following the route “Turkey-Iran-Turkmenistan-Uzbekistan”, arrived at the Central Railway Station of the capital of Uzbekistan on December 3, 2022. It is planned to use an additional 250 wagons along this route. The launch of the new railway route is the result of the implementation of agreements on the establishment and development of new transport transit corridors, reached within the framework of the Summit of the Organization of Turkic States, held in November 2022 in Samarkand (Uzbekistan).

On December 16, 2022, the first container block train of 46 wagons departed from Uzbekistan to the port of Burgas (Bulgaria) along the Trans-Caspian transport corridor, along the route “Uzbekistan – Turkmenistan – Azerbaijan – Georgia – Bulgaria/Europe” with a length of more than 4000 km. This train was organized in cooperation with foreign partners from Turkmenistan, Azerbaijan, and Georgia.

The Trans-Caspian International Transport Route (TITR) is an alternative to the Russian Trans-Siberian Railway for the delivery of goods from China to Europe, which began operating in 2017. It runs through China, Kazakhstan, the Caspian Sea, Azerbaijan, Georgia, and further to Turkey and European countries. Transportation involves rail and sea transport (through the Caspian Sea).

However, thanks to the opening of a railway route from Uzbekistan to the seaports of Turkmenistan on the Caspian Sea, Uzbekistan joins the TITR in a way that provides the shortest route from Uzbekistan to Azerbaijan and then to Georgia. EastFruit analysts note the huge potential of this route, which can be used to deliver Uzbek fruits and vegetables to European markets.

10. A mixed picture of the expansion of foreign players in the retail market

2021 was remembered for the active expansion of foreign supermarket chains to the Uzbek market. This year there was a mixed picture in this field. On the one hand, we witnessed the closure of the stores of the Russian Dobrocen discounter chain in 2022 and the failed expansion of the Kazakhstani Magnum Cash & Carry chain, both of which entered the Uzbek market in the last month of last year. On the other hand, in 2022, the French bi1 chain was actively developing, which entered the Uzbek market in the last days of 2021, and the Russian discounter Svetofor announced the opening of four stores in Uzbekistan in December 2022.

The Russian discounter chain Dobrocen entered the Uzbek market in December 2021 and opened four stores in the same month in the cities of Bukhara, Tashkent, Karshi, and Margilan. In January 2022, the chain opened another store in Karshi. After working for only about three months, in early April 2022, the Dobrocen chain suddenly announced the temporary closure of all five stores in Uzbekistan and the sale of goods at half price.

The Kazakhstan chain Magnum Cash&Carry entered the Uzbek retail market also in December 2021, opening two hypermarkets in the capital of Uzbekistan. In addition, it was announced that the company plans to invest about $20 million in the first year of development in Uzbekistan and open two more hypermarkets and several supermarkets in the country in 2022.

However, the Kazakh retailer suffered huge losses during the unrest in Kazakhstan from looters during the January events of 2022. The largest trade and retail chain in Kazakhstan then estimated the damage from looters at 11 billion KZT ($25.3 million). According to the Atameken National Chamber of Entrepreneurs, during the unrest in Kazakhstan, more than 1 500 businesses in 9 regions of the country suffered from looters, and the total amount of damage was estimated at $221 million. The most affected industries are trade, catering, logistics, and finance.

It is likely that the $25 million loss situation had a serious negative impact on the retailer’s immediate plans to develop business in Uzbekistan. Perhaps this forced the company to postpone expansion plans in the Uzbek market.

On the other hand, the French chain “bi1”, which entered the market of Uzbekistan in the last days of 2021, was developing in 2022. The retailer opened its first store in the capital of Uzbekistan on December 30, 2021, and opened two more supermarkets in the same city within one week. As of December 20, 2022, the bi1 chain had 23 stores in Uzbekistan, all of them located in Tashkent.

Moreover, the company announced an ambitious expansion plan in the Uzbek market in October 2022. According to a company representative, the retailer’s goal in this market is to open 250 stores in Tashkent (the capital of Uzbekistan) and the Tashkent region.

In October 2021, EastFruit wrote that the Russian chain of discounters “Svetofor” launched the process to enter the retail market of Uzbekistan. Although the chain did not make official statements about entering the market, it began to search for employees in cities in Uzbekistan, posting on job portals.

However, more than a year has passed since the opening of the first store in Uzbekistan of the Svetofor chain was officially announced. In December 2022, the retailer plans to open two stores in the capital of Uzbekistan and two more in the cities of Ferghana and Andijan.

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.