There are only a few days left until the end of 2022, and EastFruit analysts sum up the results of the year. What did the participants of the horticulture business of Uzbekistan remember this year and what important events can be noted in it?

Weather surprises in early spring for the second year in a row caused serious damage to the harvest of stone fruits, but unlike the previous year, only a few types of stone fruits suffered losses – almonds, apricots, and cherries. As for the harvest of other types of fruits, these anomalies bypassed them. As a result, prices for almonds, apricots, and cherries were high, while exports were low. At the same time, the harvest of many types of fruits was high, reducing prices and enabling record exports to be achieved.

The summer of 2022 brought another unpleasant surprise to the agricultural producers of the Central Asian countries – the intense heat “inflated” the price of tomatoes and caused a deterioration in the quality of apples, the harvest of which was a record high this year. Moreover, a disappointing forecast that such abnormally hot weather in Central Asia is becoming the new normal was published by climatologists.

In 2022, we witnessed a “carrot bubble”, although EastFruit analysts warned market participants about this. At the same time, carrots gave way to the leadership of onions, and Uzbek onion producers made good money this year. In addition, cabbage was trending again, and Uzbekistan updated records in terms of export volumes of all major types of cabbage.

Potatoes and bananas remain the largest imports of Uzbekistan in the fruit and vegetable segment. EastFruit analysts expect a decrease in the volume of imports of commercial potatoes for the first time in the last few years, as well as a slowdown in the growth rate of banana consumption.

In the context of the changed geopolitical situation in the world, Uzbekistan has stepped up efforts to find alternative routes and diversify international transport corridors for obvious reasons. The first results were not long in coming. In addition, the state seriously took up the problem of groundwater protection in December 2022, which EastFruit experts have repeatedly drawn attention to.

As for the expansion of foreign players in the retail market of Uzbekistan, there was a mixed picture. So, first things first.

Since the material is large, EastFruit experts divided it into two parts. The first part includes the TOP-4 main events, and the second has 6 more.

- March weather anomalies caused serious damage to the harvest of cherries, apricots, and almonds

In the early spring of 2022, the weather brought an unpleasant surprise to the producers of vegetables, fruits, and nuts in Uzbekistan for the second year in a row around the same period of the year.

The first half of March 2022 was unprecedented in terms of intensity and duration of rain. There were almost 2 monthly rainfalls in the capital of Uzbekistan in March 5-17, and in mountainous and foothill areas there was 2-3 times more rain than usual. It was raining almost daily with short breaks during this period. But the weather surprises did not end there, as the rainy weather was replaced by an abnormal cold snap for this time of year. There was a sharp decrease in air temperature in the second half of March throughout the country.

Long rains and the subsequent cold snap, which was abnormal for this time of year, caused serious damage, first of all, to early-flowering stone fruits – almonds and apricots, as well as to cherries.

As you know, cherries in the Fergana Valley, the main region producing cherries in Uzbekistan, bloom in March, but the weather did not contribute to their pollination. As a result, the cherry harvest in 2022 was twice lower as last year. Mid- and late-ripening varieties of cherries, from the harvest of which cherries of 26 mm and larger caliber come to the market, were the most affected. There was much less damage to early cherry varieties by the weather in March because they were pollinated by the beginning of these anomalies, but local varieties of early cherries have a small caliber of less than 26 mm.

As a result, the cherry season in 2022 in Uzbekistan was short, mainly due to a significant reduction in the harvesting season of varieties of mid- and late-ripening varieties, and prices were much higher than last year, especially for large-caliber cherries. The volume of exports of cherries from Uzbekistan in the 2022 season in physical terms decreased significantly. At the same time, the share of small-caliber cherries in total exports was much higher than in previous years.

Cherries are one of the main export commodities of Uzbekistan in the fruit segment. In the 2022 season, Uzbekistan exported 25 300 tonnes of cherries, which is 2.4 times less compared to last year’s record figure and almost 20% lower than in 2020.

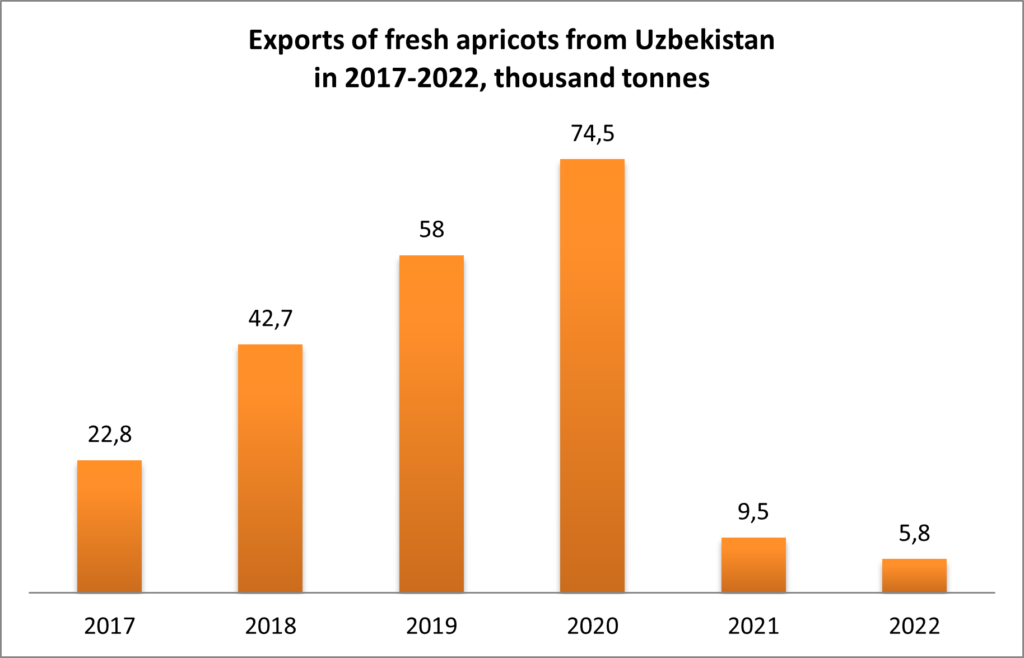

The damage to the apricot crop from the March weather anomalies was much greater than to cherries. Uzbek apricot producers have been unlucky for the second year in a row. Abnormal warming in the winter months and subsequent frosts in late February and the first half of March 2021 destroyed most of the apricot harvest in Uzbekistan. The consequences of damage by the weather were low yields, high prices, and a sharp drop in exports.

In general, a similar picture with harvest volumes, prices, and exports of apricots was repeated in the 2022 season.

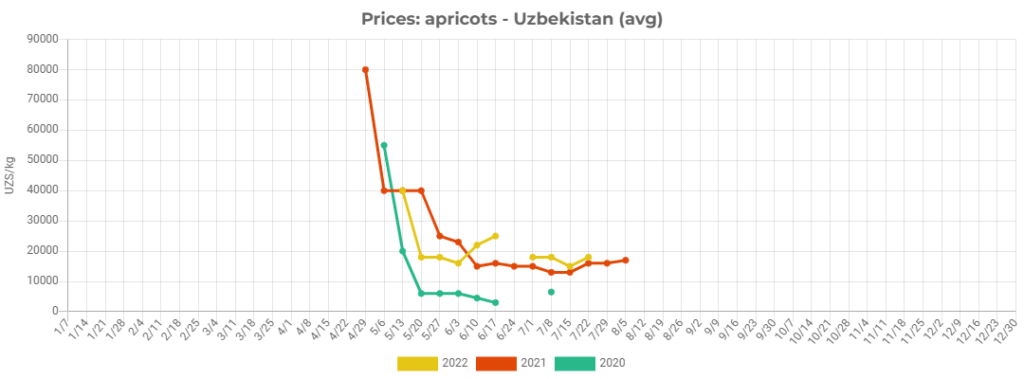

At the beginning of the season, i.e. in the second half of May, the average wholesale prices for apricots in Uzbekistan were 1.5-2 times lower than last year. This is explained by the fact that apricots enter the market mainly from the southern regions of the country at this time, as well as early varieties from the central part of the country, the harvest of which suffered from weather anomalies to a much lesser extent. Apricots in the southern regions of the country and early apricot varieties in the central part of the country had already bloomed and had been pollinated before the March weather anomalies.

However, with the reduction of supply in the market of apricots from the southern regions and early varieties from other regions, their wholesale prices began to grow. Mid-ripening apricot varieties were the most affected. Their average wholesale prices in June were 1.5 times higher than last year, and in July they were 13-40% higher than last year’s record high levels.

Overall, average wholesale prices for apricots in the 2022 season were 2 to 8 times higher than in the 2020 season, when there weren’t any weather anomalies.

With such prices and volumes available for export, exports were correspondingly low for the second year in a row. In the 2022 season, exports in physical terms amounted to only 5 800 tonnes and were the lowest in the last 6 years. It is worth noting that Uzbekistan was actively increasing the export of apricots until 2021, and the country became the second world’s largest exporter of fresh apricots after Spain in 2020.

The almond harvest in Uzbekistan in 2022 was also low due to weather anomalies in March. As a result, the average wholesale prices for in-shell almonds at the end of the harvest season in late September – early October were 1.5 times higher than last year. As of December 20, 2022, the average wholesale prices amounted to 95 000 UZS/kg ($8.5), which is 2.4 times higher than on the same date in 2021.

At such prices, exports of 2022 almonds fell sharply. The almond harvest season in Uzbekistan starts at the end of July and early varieties become available on the domestic market. According to preliminary official data, the exports of in-shell almonds from the beginning of July to December 20, 2022, amounted to only 97.5 tonnes, which is 4.7 times less than in the same period last year. Export of peeled almonds amounted to 38.5 tonnes, which is 4 times less compared to the same period last year.

- Temperature records increased tomato prices and worsened the quality of apples

The summer of 2022 brought another unpleasant surprise for agricultural producers in Uzbekistan. The abnormal heat, which lasted for about three weeks in July, influenced the work of agribusiness. The temperature in the shade exceeded 45-46 degrees Celsius, which led to excessive plant stress, water deficiency, sunburn on fruits, and a sharp deterioration in product quality. Vegetable growers spoke of a lack of plant growth and even a complete loss of crops despite their best efforts. Growers have reported that some cannot carry out fruit processing in orchards at this temperature.

Abnormal hot weather caused high prices for tomatoes – their supply on the domestic market of Uzbekistan significantly reduced since they literally dried up in the fields.

As a result, prices for tomatoes in Uzbekistan were record-high in July and in the next few months. If in July and August 2022 the average wholesale tomato prices were twice higher as last year, this gap increased in September and the average wholesale prices were 2.5-3 times higher than in the same period in 2021.

Moreover, a disappointing forecast by climatologists was published at the end of July 2022 claiming that such hot weather in Central Asia was becoming the new normal and would become a serious challenge for agricultural producers in this region.

EastFruit specialists have repeatedly noted that climate change leads to grave negative consequences for farmers around the world. Vegetable producers in Central Asia should pay attention to various options for growing in greenhouses or nethouses.

The first steps were taken in 2022 – the largest modern complex of light Nethouse greenhouses in the Asaka district of the Andijan region of Uzbekistan of 111 ha was built. As of the beginning of October 2022, ten types of products, including tomatoes, have already been harvested on 20 ha of the greenhouse complex. If the yield of tomatoes grown in the open field in the traditional way is about 20-30 t/ha, it has reached 120-130 t/ha in Nethouse greenhouses. A drip irrigation system has been installed there, which, together with soil coverage with a special net, can reduce irrigation water consumption by up to 10 times compared to the traditional method of irrigation (along furrows) in open fields and greatly reduce fertilizer consumption.

In addition, in the summer of 2022, scientists from the Research Institute of Vegetables, Melons, and Potatoes of Uzbekistan tested about 30 varieties and hybrids of tomatoes for resistance in abnormally hot weather when grown outdoors. To preserve the crop in such conditions, Uzbek breeders “covered” the tomatoes with other plants, shaded the ground with dry corn stalks and light-stemmed plants such as straw 5 cm thick, and watered at night to preserve moisture. Among the tested varieties, “Bobkat F1”, “Tomsk F1”, “Lojean F1”, “Red stone”, “Seraj F1”, “Independence-28”, “Rio Grande” withstood the hot weather conditions of July and showed good results.

The impact of the March weather on apple harvest was minimal. Farmers were expecting a good and perhaps even a record harvest of autumn apple varieties in 2022, in contrast to last season, when two waves of frost affected production and fruit quality. According to farmers, it was the lack of excess crop load in 2021 that served as another reason for the formation of a good harvest this season.

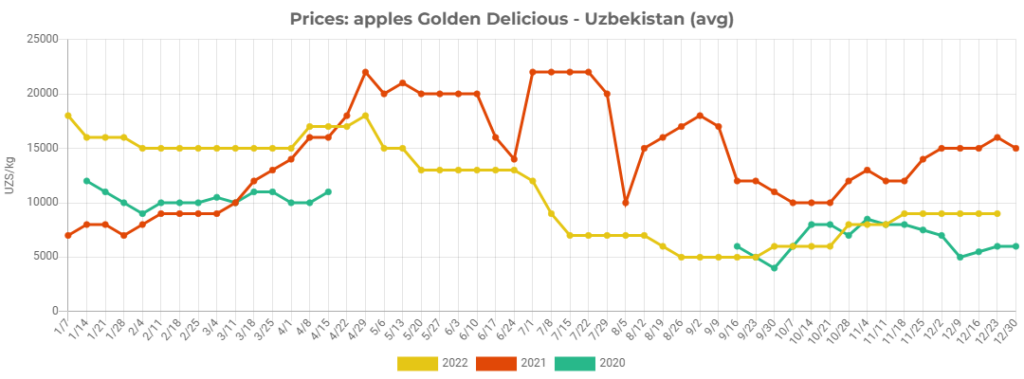

However, the abnormally hot weather of July 2022 made its own adjustments. High temperatures led to ultra-early ripening of autumn varieties of apples that had not yet gained the necessary mass, and farmers had to harvest and sell them. What’s more, there were a lot of early apples of local early varieties and cheap imported apples on the market at that time. This led to the fact that wholesale prices for apples in Uzbekistan at the end of July 2022 were more than 3 times lower than in the same period last year, and retail prices for apples were two times lower on average.

In the following months, apple prices in Uzbekistan remained low. The average wholesale prices for one of the popular Golden Delicious apple varieties in the 2022 season were much lower than last year and roughly corresponded to 2019 price levels.

However, a large harvest and low apple prices have allowed a great increase in exports compared to lean 2021. Mass harvesting of early apples of the new crop in Uzbekistan starts in mid-May, and the first exports of early apples begin. Uzbekistan exported 16 600 tonnes of fresh apples worth $6.5 million in May-November 2022, which is 2.5 times more in physical terms than in the same period last year and close to exports in the same period in 2020.

- Large harvest and record export volumes

March weather anomalies had almost no influence on the harvest of other types of fruits.

A large harvest of figs, pears, plums, peaches, and nectarines in Uzbekistan in 2022 and, as a result, low prices for them, made it possible to sharply increase their export volumes. In addition, the high yield of watermelons and melons, and relatively low prices allowed to significantly increase their exports.

Fresh figs were a highly demanded export commodity of Uzbekistan in the fruit segment in 2022. In the current season, the volume of exports of fresh figs in physical terms exceeded the total volume of their exports over the past five years by 7 times! The export season of figs from Uzbekistan in 2022 started in the second decade of June and ended in the second decade of September. Uzbekistan exported 7 200 tonnes of fresh figs worth $1.9 million in June-September, which was a record. Read more in the article “Fig breakthrough: a historical record of Uzbekistan in the export of fresh figs“.

Pears were also a highly demanded commodity for export from Uzbekistan in 2022. Exports of the first batches of Uzbek fresh pears started in the second half of June with early varieties. According to official data, Uzbekistan exported a record volume of fresh pears in June-November 2022: 5 200 tonnes worth $2.3 million, while pear exports in physical terms did not exceed 1 000 tonnes in previous years.

Shipments of the first batches of plums of the new crop from Uzbekistan in 2022 started on the 10th of May. The country has exported 48 500 tonnes of fresh plums worth $23.5 million in the past six months, which is 2.5 times more in kind than in the same period last year and almost 11% higher than the previous record figure in 2019. Read more about the results of the Uzbek plum export season here.

The current peach/nectarine season in Uzbekistan has also been distinguished by relatively low prices, a sharp increase in exports, and record export earnings. Uzbekistan exported 76 700 tonnes of peaches and nectarines worth $68.1 million in the 2022 season. The export earnings in 2022 were a record for at least the last five years, exceeding the previous record of 2020 by 11%.

Grapes are the largest export position of Uzbekistan in the fruit and vegetable segment. This year, the season for exporting fresh table grapes of the new harvest started in the second decade of June about a week earlier than last year. Uzbekistan has exported a record volume of grapes over the past six months since the start of the export season.

According to preliminary data, Uzbekistan exported 220 100 tonnes of fresh table grapes worth $184.8 million from June to December 20, 2022, which is 5% more in physical terms and 29% more in value terms than in the same period last year. Considering that a record volume of fresh table grapes was exported in the same period of 2021, Uzbekistan has updated the record this season. Read about the geography of exports of Uzbek table grapes of the 2022 harvest here.

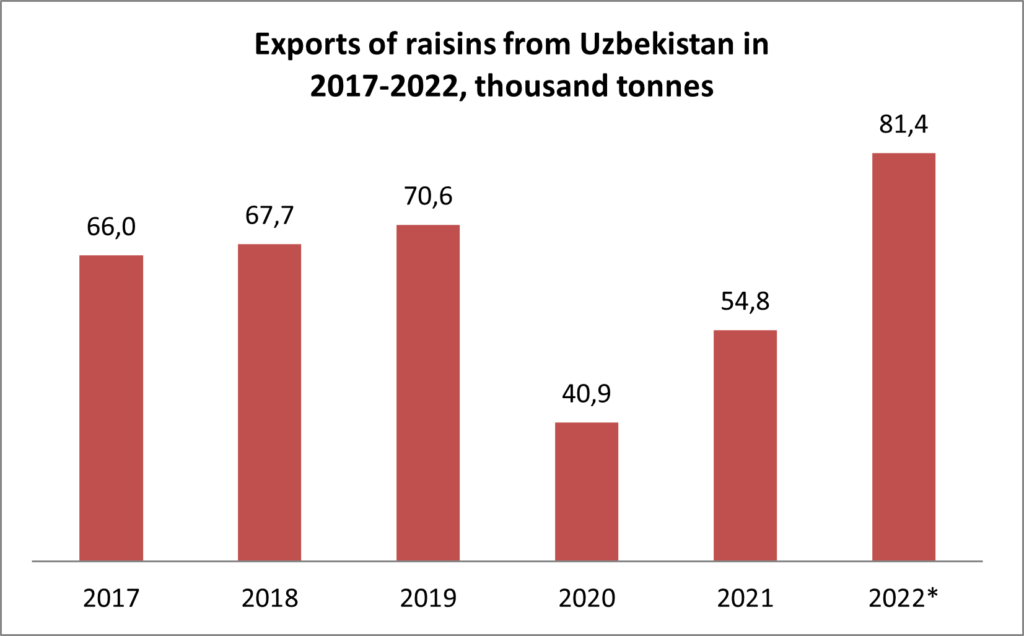

In addition, Uzbekistan updated the export record for dried grapes (raisins) in 2022. From January to December 20, 2022, the export volume of Uzbek raisins amounted to 81 400 tonnes worth $81.4 million, which in physical terms was 15% more than the previous record volume of 2019.

*data for 2022: from January 1 to December 20

Uzbekistan is the largest exporter of table grapes in Central Asia and is among the TOP-15 world’s largest exporters. Unfortunately, the export of Uzbek table grapes is limited only by the post-Soviet countries – the four EAEU countries account for about 99% of exports.

EastFruit analysts have repeatedly spoken about the need to replace grape varieties, renovate the plantations, and plant more promising and demanded table grape varieties. The competitiveness of grape varieties grown in Uzbekistan in foreign markets leaves much to be desired, including the possibility of opening new markets. An article ranking Uzbekistan’s most popular table grape varieties published in May 2021 sparked a discussion among winegrowers and showed that the industry needs to take urgent action if it wants to maintain its position in this competitive market.

In 2022, the first steps were taken to replace local varieties with seedless varieties of table grapes of foreign selection. Currently, in special greenhouses of the National Center for Knowledge and Innovation in Agriculture in the Tashkent region of Uzbekistan, seedlings of seven varieties of table grapes of foreign selection are grown using the “in-vitro” method, including Venus, Vanessa, Romulus, Lakemont, and Ximrod. These seedlings will be planted on experimental fields in spring 2023 and transferred to farms for laying new grape plantations. Read more about this in our material “Seedless varieties of table grapes are being prepared for planting in Uzbekistan”.

In 2022, Uzbekistan also set a record for the export of watermelons, exceeding last year’s exports by almost twice. The increase in the volume of exports was possible mainly due to an almost twofold increase in the volume of deliveries to Kazakhstan and multiple increases in the volume of shipments to Tajikistan and Kyrgyzstan.

The season of watermelon exports from Uzbekistan started on May 15-20 and ended by mid-November in 2022. From the beginning of May to the end of November 2022, Uzbekistan exported 81 800 tonnes of watermelons worth $18.1 million, which is 1.9 times more in physical terms than in the same period in 2021 and 1.7 times higher than the record figure of 2020 in the same period. Read more about it here.

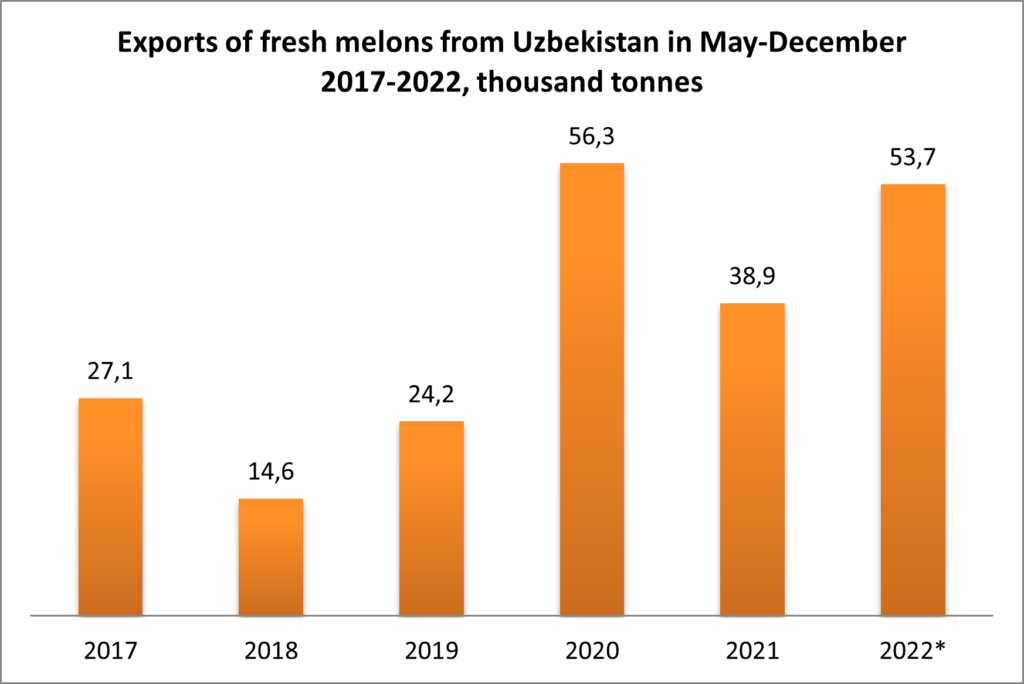

As for the export volumes of melons from the 2022 harvest, the exports also increased significantly compared to last year and were close to the record level of 2020. The current melon export season from Uzbekistan started in mid-May – about a week earlier than last year. According to preliminary data, from May to December 20, 2022, Uzbekistan exported 53 700 tonnes of fresh melons worth $18.4 million, which is 38% more in physical terms than in May-December last year and only 5 % less than the record figure of 2020.

*data for 2022: from January 1 to December 20

EastFruit analysts have repeatedly noted and paid attention to an important trend in the fruit and vegetable sector of Uzbekistan – increasing the production and export of frozen products. In 2022, the volume of exports of frozen fruits and vegetables from Uzbekistan continued to grow, although slower than last year.

From January to December 20, 2022, Uzbekistan exported 15 100 tonnes of frozen vegetables worth $16.4 million, which is 23% more in physical terms and 73% more in terms of export earnings than in 2021.

The volume of frozen fruit exports amounted to 6 400 tonnes worth $13.4 million in the same period in 2022, which is 10% more in physical terms and 76% more in terms of export earnings than the total in 2021.

- Cabbage is back in trend

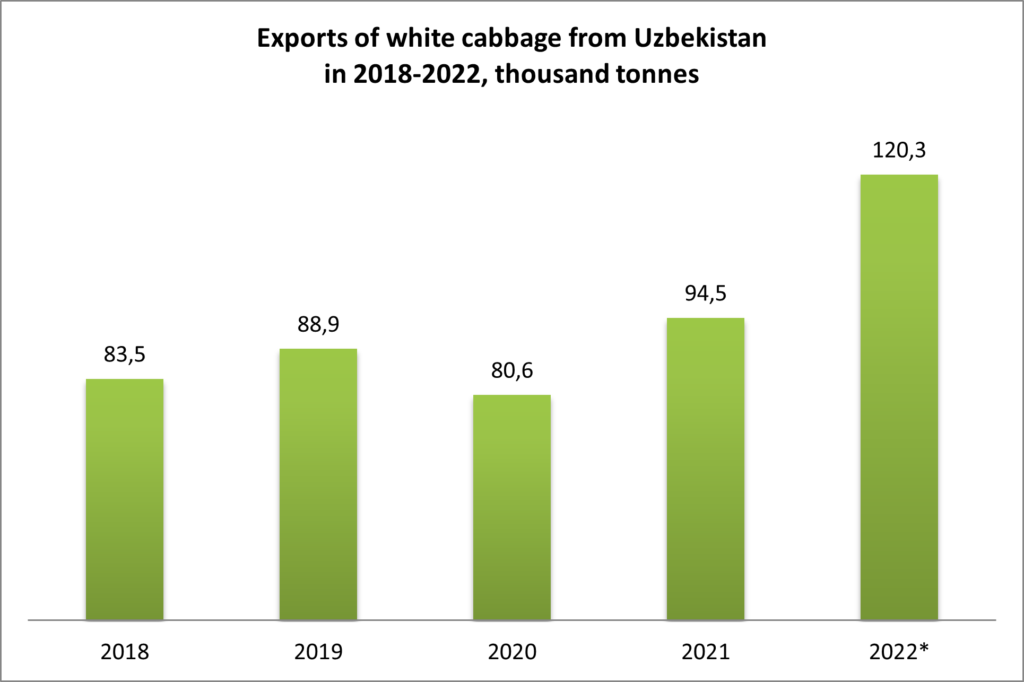

2021 was very successful for Uzbek producers of white cabbage, and in 2022 Uzbek farmers were lucky again – the year started with incredibly high prices for cabbage in almost all countries of the region. In the southernmost region of Uzbekistan – the Surkhandarya region, the harvest of white cabbage began to be harvested around mid-December 2021 and the harvest continued in the first ten days of February 2022. Since this cabbage was sown in September 2021, when no one could yet foresee the rapid growth in its prices, the farmers left the area of cabbage plantations without any changes. Vegetable growers were very pleased – cabbages were shipped from the fields at 4 000 UZS/kg ($0.37), which is about 9 times higher than in the same period in 2021. Uzbek cabbages were shipped mainly to Belarus, Russia, and Kazakhstan, but the supply was higher than demand and the prices kept growing.

Given the “crazy” demand for cabbage, Uzbek farmers have dramatically expanded the area planted with early cabbage, the harvest of which will start in the first half of March. Despite the expected unprecedented growth in the production of early cabbage in Uzbekistan, analysts forecasted a further increase in its prices in foreign markets based on the current situation in the countries of the region.

As a result, the exports of white cabbage from Uzbekistan amounted to 113 700 tonnes in the first half of 2022, which is 30% more than in the same period last year.

At the end of 2022, Uzbekistan updated the record for the export of white cabbage, recorded last year. According to preliminary data, from January to December 20, 2022, the country exported 120 300 tonnes of white cabbage worth $24.7 million, which is 27% more in physical terms, and 66% more in terms of export earnings than in 2021.

*data for 2022: from January 1 to December 20

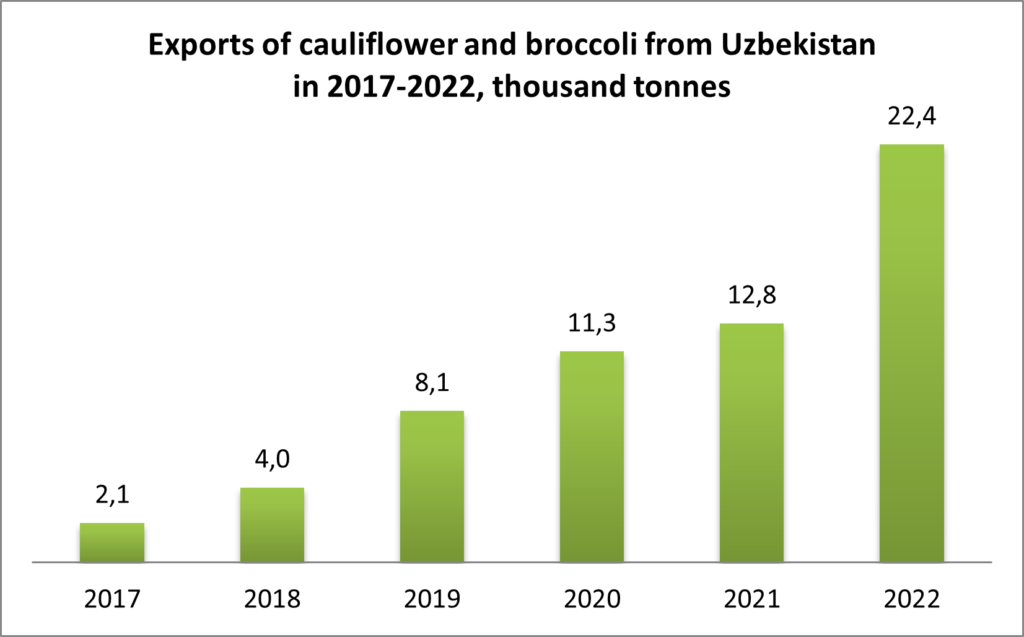

Moreover, Uzbekistan has been actively increasing the production of cauliflower and broccoli in recent years. The demand for them is growing in the domestic market, and the volume of their exports is also growing.

Uzbekistan increased the export of these types of cabbage to record levels in 2022. According to preliminary data, from the beginning of January to December 20, the country exported 22 400 tonnes of cauliflower and broccoli worth $12.4 million, which is 1.8 times more in physical terms, and 2 times more in terms of export earnings than in 2021.

*data for 2022: from January 1 to December 20

Besides, Uzbekistan dramatically increased the export of Beijing cabbage in 2022, reaching record levels. According to preliminary official data, from January to December 20, 2022, the country exported 3 500 tonnes worth $2.1 million, while in previous years the export volume of Beijing cabbage did not exceed 1 200 tonnes.

The second part is available at the link.

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.