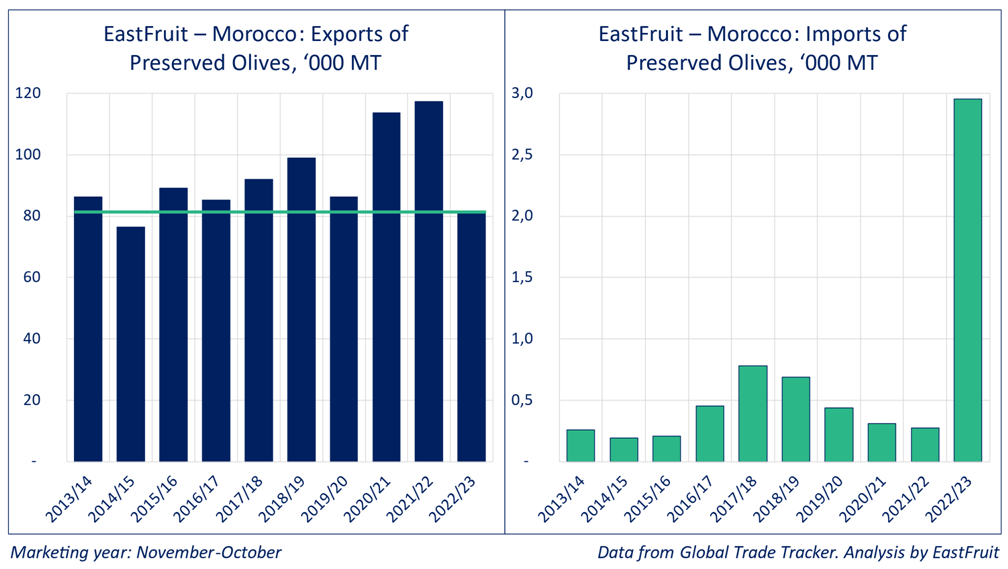

According to EastFruit, in the MY 2022/23 (November-October) Morocco experienced one of its worst seasons for exports of preserved olives in the last decade. The country was hit hard by the Mediterranean olive crisis, which prompted it to ban the export of olive oil in the fall of 2023 to keep the domestic prices stable. Meanwhile, the Moroccan market saw an unprecedented surge in canned olive imports, which reached a record high.

Moroccan exporters sold only 82 thousand tons of preserved olives in the MY 2022/23, which was nearly a third lower than the previous season. This was close to the lowest level in 10 years, as the export volume had only dropped to 76 thousand tons in the MY 2014/15. On the other hand, the import volume of preserved olives in Morocco skyrocketed to 3 thousand tons in the MY 2022/23, which was almost 11 times higher year-over-year, although the usual amount had been less than 500 tons.

Morocco is one of the world’s top olive producers, according to FAOStat. It ranked fifth in 2021 and moved up to fourth in 2022. Apart from making olive oil, where Morocco is also a global leader, the country mainly exports its olives as preserved products. The country does not ship frozen olives, and its fresh olive exports have been declining year after year: from 600 tons in 2019 to just over 23 tons in 2022.

Read also: Morocco sextuples carrot exports to Spain, seizing an opportunity from European drought

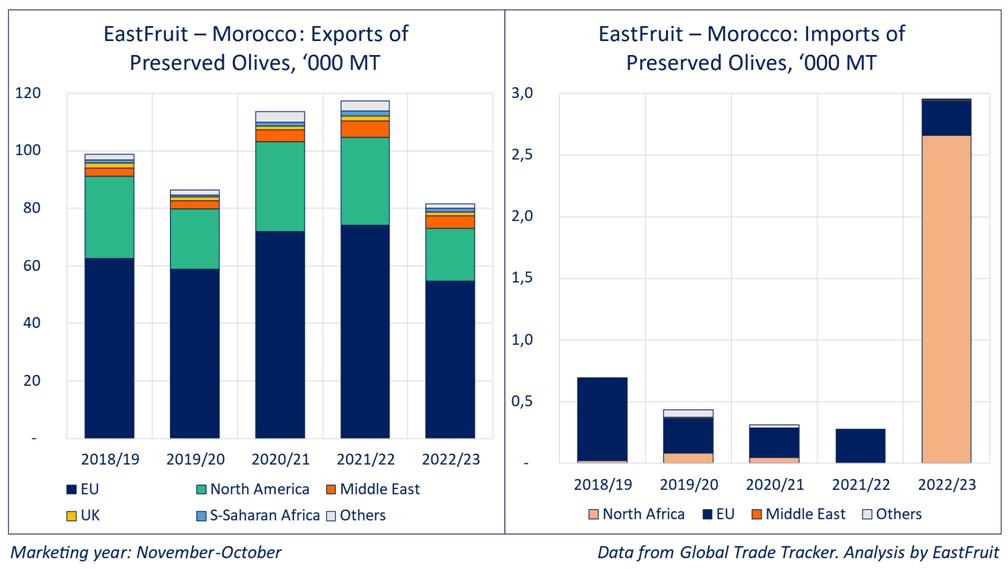

The main markets for Moroccan preserved olives are the EU and North America, which together account for about 90% of its total exports. The top five importing countries are France, the US, Belgium, Spain, and Italy. Other smaller buyers include Saudi Arabia, the Netherlands, Canada, the UK, and Libya.

Most of imports of preserved olives in Morocco came from Spain, but in the MY 2022/23, Egypt became the leading supplier of this product to the Moroccan market.

The dismal performance of Moroccan exports in the MY 2022/23 was due to the poor harvest of fresh olives caused by the 2022 drought. This resulted in a sharp decline in production of both preserved olives and olive oil in the country. Many other Mediterranean countries faced similar challenges, which led to a steep increase in olive oil prices worldwide and a series of export bans, which Morocco also joined in the fall of 2023.

The local industry expects the olive production in Morocco to bounce back in the MY 2023/24, after a significant slump in the previous year. However, the weather conditions in the country in 2023 were not ideal, as many production regions suffered from drought, scorching sun, strong winds, and hailstorms.

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.

1 comment

Dear sir / Mdm ,

We like to import fruits from Morocco. please let us know the steps to follow.

With best regards.

M>Sachidananda swamy

Hymatic , Bangalore, India