This is the second part of the analytical material by the EastFruit team on the most important events in the produce market in 2021 that will influence further developments in the sector. You can read the first part of the material here.

- Very expensive Ukrainian borsch – table beets, onions, carrots and cabbage

Never before have vegetables of a “borsch set” in been as expensive as in 2021. However, there were various reasons. It is better to break the analysis into seasons, as each was very different.

To detail all the events in the market for vegetables of the “borsch set” in 2021, we would have to write several huge analytical articles. So, we will summarize them and list the key factors that led to such high prices in the market.

The situation on the Russian market has become one of the key factors influencing the Ukrainian market. Ukraine cannot directly export food products to the Russian market, but it still affects the situation in Ukraine. The forecasts we made when discussing the crisis in Russian vegetable growing 2 years ago in the article “Crisis of vegetable farming in Russia” came true in 2021. Supply and demand in the Russian market led to such a sharp increase in table beet and carrot prices that they became the cause of memes on social networks.

Naturally, Russian importers and supermarkets tried to eliminate the shortage of products by all possible means, which led to price increases in all countries supplying vegetables to Russia. One of them was Belarus, that filled its own shortage of vegetables by imports from both the EU and Ukraine. This resulted into prices for these goods in Ukraine reaching very high levels.

This allowed both growers and resellers, who bought beets during the autumn harvest, to make very good money on their resale in spring. However, Ukrainian vegetable growers did not increase the area of beet plantations, but kept reducing it. Therefore, many market participants had an idea to hit the beet jackpot in the 2021/22 season. There is still a chance they can do it.

The developments on the cabbage market were similar. In the new season, Russia faced an acute shortage of cabbage, provoking its price increase in all countries of the region, including Ukraine. As a result, wholesale prices for cabbage in Ukraine in mid-December 2021 exceeded last year’s levels by 5-6 times and were a record for this month. Thus, the imports of cabbage from Poland started, but the exports to Belarus (and to Russia) did not stop either.

The only question is, what will be cabbage prices in Ukraine in spring, and where will Ukrainian importers buy cabbage? It is not excluded that cabbage will have to be imported from Uzbekistan in March, where its prices are also record high, but a new harvest is to start in March.

Speaking about Uzbekistan, we can move on to the most sold position of the “borsch set” – onions. Ukraine faced severe price swings here, too.

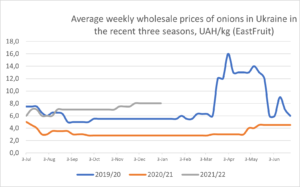

The year started with record low prices for onions in Ukraine. The export of onions was record-breaking, but it did not please vegetable growers, as it did not help to raise the price level. We advise you to study this analytical article, where the reasons for such price swings were explained in great detail.

One of the most resonant EastFruit news about the onion market in 2021 was the message that the first wholesale lots of Uzbek onions arrived at the wholesale markets of Ukraine, when the last onions were still being harvested in Ukraine. Onion prices are usually very low during this time, but this year the imports started early.

Moreover, Russia had nothing to do with the import of onions to Ukraine after the record exports. Fruit-Inform analysts explain this with several reasons. The first is the extremely low onion prices in recent seasons, which forced the least efficient vegetable growers to stop growing onions. Secondly, the weather was unfavorable during the harvesting of onions in 2021. Therefore, a lot of onions with high humidity were laid in storages, and there are very few modern onion drying and processing technologies in Ukraine. Consumers needed high-quality onions, the deficit of which was discovered in autumn.

Therefore, wholesale prices for onions in Ukraine were almost 3 times higher by the end of 2021 than in 2020 and almost 1.5 times higher than in 2019.

Among the reasons for the record high prices for vegetables of borsch set in Ukraine, experts noted a sharp rise in prices for grains in the past two seasons, which made their production almost as profitable for small farmers as growing vegetables. Nevertheless, the level of market and loss risks in the grain sector was much lower than in the vegetable sector. This has led to a reduction in vegetable acreage in favor of grain acreage in 2021.

- Upcoming changes in produce retail business

There were unusually many events in Ukrainian fruit and vegetable retail in 2021. Perhaps the main one was the rumor about the entry of the German retail chain Lidl into the Ukrainian market.

Despite the information not being official yet, EastFruit experts analyzed how this will affect the trade in fruits and vegetables in Ukraine, if the discounter opens its stores in Ukraine. We consider this quite likely to happen. Our analytics on the issue was widely discussed among owners and top managers of supermarket chains in Ukraine.

A great event of the year was another confirmation of the high objectivity of the audits of the produce departments by EastFruit – our audits again managed to foresee the fate of the whole retail business. As in the case of the purchase of the Ukrainian Billa chain by Novus, we expected the exit from the retail business of the Furshet chain through the purchase by Silpo. The possible purchase of the Ekomarket supermarket chain, constantly occupying very low positions in our audits, by the owners of the Silpo chain was reported at the end of the year.

Silpo firing the management team of the chain’s fruit and vegetable departments became top news in 2021. Obviously, the chain is striving to improve its position in the segment, especially if it is going to expand further by purchasing weaker competitors.

An extraordinary event was the first international fruit and vegetable retail forum by the EastFruit team, APK-Inform: vegetables and fruits and UHA. The results of a unique study of the retail trade in fruits and vegetables by FAO and EBRD experts was presented there. In addition, the best supermarket chains in the produce trade in 2021 were identified and awarded in various nominations.

The winner in the main nomination “Leader of fruit and vegetable retail in Ukraine” (in terms of assortment, product quality, convenience and quality of departments and price level) was the supermarket chain “Auchan”. It also became the leader in the “Assortment of Vegetables and Fruits” nomination. The winner of the “Freshness and quality of vegetables and fruits” category was Metro, and of the “Prices for vegetables and fruits” category – ATB. The ATB chain also became the absolute favorite among the suppliers of vegetables and fruits according to the results of their survey. According to consumers, LeSilpo was recognized as the best chain.

- Land market opening in Ukraine

Although the limited opportunity to buy and sell land plots which opened up in the midyear is still one of the most discussed topics in the fruit and vegetable community, it had minor impact on the market.

But the long-term impact of this event on the market will be huge. First of all, many investors will focus on buying out land in the next few years, which will somewhat reduce the investments in growing vegetables and fruits.

On the other hand, most farmers will now be more confident in investing money in land and infrastructure, knowing that this land belongs to them.

However, investments in the purchase of agricultural land for growing vegetables and fruits in Ukraine will be relatively low in relation to those made for plantation and providing infrastructure.

For example, you need to invest about $100 000 in one hectare of an intensive apple orchard, including seedlings, irrigation, apple storage, protection from hail, sorting, etc. One hectare of land is now being sold at $1 000-2 000. This means that this is only 1-2% of investments in production.

- Record prices for greenhouse cucumbers in Ukraine and imports from Russia

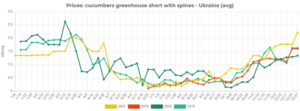

It seemed at the beginning of 2021 that the greenhouse industry of Ukraine was starting to recover and the export of greenhouse vegetables began to grow. However, the incredibly high level of gas prices in the second half of 2021 canceled all these achievements and put the Ukrainian greenhouse industry on the brink of survival. Similar was observed in many European countries.

The worst fears about the prices of greenhouse vegetables have not yet been fully justified. It is partly due to Turkey experiencing a collapse in the lira exchange rate, which spurred exports at highly competitive prices. Nevertheless, the prices did renew the records, and primarily, this concerned cucumber prices.

The last crop cycle of greenhouse cucumbers in Ukrainian farms was distinguished by record high prices, at least over the past 4 years. Many greenhouse plants have relied on growing tomatoes in the second half of 2021. As a result, the area planted with cucumbers in greenhouses was reduced. In addition, the weather was unfavorable during the growing season. The combination of the above factors led to an insufficient supply of cucumber on the Ukrainian market, and sellers often increased prices for the available volumes.

Thus, the news that Ukraine imported greenhouse cucumbers from Russia for the first time became a sensation. According to trade sources, Russian cucumbers proved to be competitive in price with the Ukrainian ones, despite the 10% import duty due to Ukraine’s withdrawal from the free trade agreement with Russia. By the way, Russia exported its greenhouse cucumbers even to Poland!

However, this did not last long, and soon problems with the supply of cucumbers occurred on the Russian market itself. Therefore, cucumber prices set new records in the second half of December in Russia and exceeded those in other countries of the region.

Russian cucumbers contributed to the stabilization of prices on the Ukrainian market, and they fell back to $1.30/kg. But when the supplies stopped, greenhouse cucumbers began to rise in price again and they were sold at no less than $1.70/kg in the second decade of December 2021 in Ukraine.

- Failures in the cherry and watermelon markets

Watermelon was one of the main export positions of the Ukrainian produce sector in 2020, when the exports record was set. Ukraine set two new exports record in 2021: the export of watermelons was record low, as were their prices. We analyzed this in more detail in the article “Watermelon Collapse in Ukraine”. As a result, many producers failed to sell watermelon even at the lowest price, and had to leave the watermelon on fields, although the season began with early watermelon being sold at record high prices!

Will this lead to a decrease in the area of watermelon plantations for 2022 harvest? The question is rhetorical.

The situation on the Ukrainian cherry market was just the same. There were record low prices and an anti-record of exports in recent years, despite an unusually high harvest.

The domestic market in Ukraine was oversaturated with cheap cherries from the very beginning of the cherry sales season, but the purchasing activity remained rather low. And it reflected the consumer perception of the quality of Ukrainian cherries, because Ukraine updated the record for cherry imports in 2021, almost doubling it compared to 2020!

Ukrainian cherry growers blamed everyone for their problems: the lack of exports opportunities to Russia, the country’s population decline, and even the COVID-19 pandemic. However, all these arguments break down on the fact that the Ukrainians preferred imported cherries because, like consumers in other countries of the world, they want high-quality cherries. And if consumers’ requirements for the quality of cherries are constantly growing, Ukrainian growers also need to grow.

In this article, we explained why cherries in Ukraine are not that cheap and why access to the Russian market would not have saved Ukrainian farmers from low prices for cherries. Here we showed that the global market for cherries is growing faster than their production, and prices are constantly increasing, as well. In other words, there is a shortage of cherries in the world! To be more precise, there is a shortage of high-quality cherries in the world, and this is the problem in Ukraine!

Cherries in Ukraine are mainly grown without irrigation, not to mention protection from rain, hail and frost. By the way, here is an example of how some leading producers are already growing cherries in Uzbekistan. And here you can read about the most effective frost protection systems for cherries and other fruits. Besides, more and more cherry growers in different countries start growing in greenhouses.

Therefore, if the approaches to the production, cooling and processing of cherries are not radically changed, Ukraine will not only reduce exports, but will continue to increase imports of cherries.

If we missed some of the important trends, please let us know in the comments section.

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.