There were many successes for the fruit and vegetable business of Ukraine in 2021, even though it was difficult. According to EastFruit estimates, Ukraine’s revenues from exports of fruit and vegetables will be record high by the end of 2021, as will the income of farmers.

However, not all segments of the fruit and vegetable market were doing so well – for example, potato and apple growers may not be quite happy with this year. There was a complete failure in the segment of walnuts in the first half of the year, which also unexpectedly turned into a seller’s market. There were many complaints from strawberry and blueberry growers in 2021, but those who had productive raspberry plantations, as well as sellers of raspberry seedlings, were on a roll.

There were significant changes both in fruit and vegetable retail and in Ukrainian vegetable growing.

We present our version of the TOP-10 events in the Ukrainian produce business in 2021, among which there are many price and exports records or anti-records.

The hyperlinks in the text will allow you to catch up on our publications on this specific issue in more detail.

- Record high global prices for raspberries provoke a raspberry boom in Ukraine

The global frozen raspberry market unexpectedly started warming up in the second half of 2021. The main reason was a reported sharp decline in the harvest of raspberries in Serbia – the main raspberry exporter in the world. At the same time, the rise in prices exceeded expectations. They reached records in July and kept growing, as low raspberry prices have been convincing processors from the dairy, confectionery, bakery and other sectors of the food industry for several years to diversify their production. Therefore, fears of a shortage of raspberries forced importers to sharply increase their purchases.

The rise in prices coincided with the start of the harvesting season of summer raspberry varieties in Ukraine, so prices began to grow rapidly. In some regions, prices for frozen raspberries exceeded $4/kg in 2021 – 10 times higher than 2-3 years ago! In other words, raspberries took away the title of the most expensive berries on the market from blueberries in 2021, because they were more expensive than blueberries in some regions in summer!

Thus, Ukraine exported raspberries to the USA and Canada for the first time, which was a meaningful event for the industry. According to our estimates, the exports of frozen berries will bring Ukraine about $200 million in s earnings in 2021, becoming the main source of income for the fruit and vegetable sector. Of course, it is the merit of expensive raspberries.

The EastFruit analyst team prepared two notable materials on the state of affairs on the global raspberry market, showing that Ukraine is the current leader in the growth rate of global frozen raspberry exports, while Poland, the main importer of raspberries from Ukraine, is the fastest to increase the imports. You can also find a detailed analysis of the markets in the main exporting and importing countries of frozen raspberries there. They are full of surprises.

Naturally, interest in the establishment of raspberry plantations has sharply increased in Ukraine, both on the part of large investors and private households. Even they made good money on raspberries in 2021! Those who had only 0.1 hectare of raspberries could earn up to 100 000 UAH (about $4 000) per season selling raspberries.

Taking into account the rush, we have prepared the material “Raspberry Boom 2”, which became one of the most discussed and cited materials on berries in 2021 not only in Ukraine, but in Poland, too. In this article, we recalled raspberries dropping to 8 UAH/kg after a period of high prices, mass planting and explained the consequences of what is happening now. Of course, we took into account the availability of capacities for deep freezing of berries in Ukraine and the impact of high prices for raspberries on their global consumption. We also considered the fact that raspberries are planted not only in Ukraine – in 2021, a huge demand for seedlings was observed in Serbia, Croatia, Poland, Moldova and even in the countries of Central Asia, where raspberries were not previously grown in large volumes.

We have also prepared a handy checklist before investing in the raspberry business – “Should I plant raspberries? Checklist to define all the pros and cons” which was much cited by the berry industry.

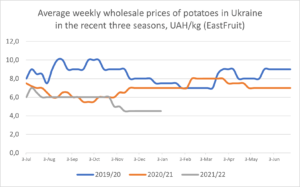

- Ukraine’s potato disappointments: imports and low prices

Potato markets in literally every country of the region was turned upside down in 2021. There were many records everywhere, but, perhaps, there were the most of them in Ukraine.

After the 2019/20 season, when Ukraine became one of the largest potato importers in the world, importing almost half a million tonnes in one season, mainly from Russia and Belarus, Ukraine continued to massively import in the 2020/21 season. However, everything changed dramatically at the beginning of the 2021/22 season – potato imports dropped sharply, and exports began to grow for the first time in three years.

Much has changed in neighboring countries: Belarus and Russia faced drought in production regions. The area planted with potatoes in Russia has significantly decreased, as prices have remained low for too long. Therefore, Belarus began to import potatoes during its own harvest, and there was a rush on the Russian market – potato prices were increasing every day. The threat of a shortage became real, given that Russia had banned many countries from supplying potatoes to its market.

Therefore, it was the turn of Ukraine to supply potatoes to Belarus and Russia, since Belarus has long been known as the largest re-exporter of “sanctioned” fruits and vegetables to Russia. At the same time, Ukraine exported potatoes even to Serbia, while importing from Moldova. But Moldova has been the main sales market for potatoes from Ukraine for many years! This is an extremely unusual season.

However, these were not all of the surprises of the potato market in 2021. Despite high exports, potato prices in Ukraine remained the lowest in the region! The situation was aggravated by the fact that the exports of Ukrainian potatoes to Belarus stopped due to changes in safety requirements for imported potatoes. The supply of potatoes from Ukraine to the EU was also impossible, and there was only the domestic market left.

The average wholesale price for potatoes in Ukraine in the first 6 months of the 2021/22 season was 15% lower than in the previous season and 37% lower than in the first 6 months of the 2019/20 season. But the cost of potato production has increased significantly!

Thus, the issue of the quality of potatoes grown in Ukraine became relevant again, after it was raised at the beginning of the year by Andriy Yarmak, economist at the Investment Centre of the Food and Agriculture Organization of the United Nations (FAO). In his opinion, the low quality of Ukrainian potatoes is the main reason for price collapses and the unprofitability of growing, alternating with periods of large imports. EastFruit asked a foreigner’s opinion of Ukrainian potatoes in supermarkets, and Andriy Yarmak gave detailed calculations of how many billions potato growers, supermarkets and consumers annually lose on low-quality and dirty potatoes on the shelves.

During the largest annual conference “Fruits and Vegetables of Ukraine 2021”, Thomas Carpenter, a potato grower from Ireland, confirmed that it is the low potato quality that is holding back the development of the potato industry in Ukraine. His experience in growing potatoes in Ukraine and the defect rates he got on Ukrainian fields compared to what his Ukrainian colleagues get were eye-opening. However, it is gratifying that many Ukrainian potato growers began to turn to Thomas for advice after his presentation at the conference. Let’s hope for at least some progress in this area and for the potato growing of Ukraine entering the phase of sustainable development.

- Walnut – price records and anti-records

The beginning of 2021 was really bad for Ukrainian walnut growers. Global prices were at record lows, and premium-quality American walnuts, mainly of the Chandler variety, were shipped to Europe cheaper than the cost of growing them in Italy and France. Walnut seedlings were not sold in Ukraine at all, and our analytical material “Walnut prices in Ukraine keep going down – temporary blip or end of an era?” published in January attracted great interest.

In addition to low global prices and low demand for Ukrainian walnuts in foreign markets, there were changes in the regime of exports of Ukrainian walnuts to Turkey. In contrast to duty-free imports from other countries, the duty on the import of walnuts from Ukraine led to an almost complete halt in supplies to Turkey. But Turkey is the world’s largest importer of inshell walnuts, and Ukraine used to exports more than half of its walnuts to Turkey.

Of course, this could not go unnoticed. There were first reports of uprooting fruit-bearing walnut orchards in Ukraine in spring. Naturally, the results of the 2020/21 season turned out to be disappointing for Ukrainian walnut exporters – a collapse in exports and revenue volumes.

However, everything changed dramatically even before the start of the new season. Severe drought in California and water shortages have led to a sharp decline in walnut yields in the United States. The USA is the global leader in the exports of walnuts, exporting mainly premium-quality walnuts. That’s why, market changes in the United States always directly affect global prices. Thus, global prices for walnuts began to rise sharply in June 2021.

Therefore, the 2021 walnut harvest in Ukraine started with quite high prices. Moreover, even walnuts of the 2020 harvest, which were previously not demanded, were sold at good prices.

As a result, the exports revenue of Ukrainian walnut exporters in October 2021 increased by 43% compared to October 2020, but was still 50% lower than in 2019. Despite the growing exports of walnuts from Ukraine to the EU countries, there is still no alternative for the Turkish market.

Also, market participants pay attention to the growing competition in the region. Georgia, which used to be one of the main markets for Ukrainian walnuts, is starting to export. In contrast to Ukraine, modern walnut processing is developing well there. You can see the full cycle of growing Chandler walnuts in Georgia, including mechanized harvesting using walnut harvesters from the United States at Agrovia, here. The whole process of drying, sorting, processing, splitting and packing walnuts at the modern plant of the Georgian company Anigozi can be seen in this video. We are confident that Ukrainian companies will have a lot to learn from their colleagues in Georgia.

- Is there a crisis of apple business in Ukraine?

The first half of 2021 greatly surprised Ukrainian apple producers. Most of them expected a sharp price rise in spring, but apple prices remained more or less stable. Moreover, apples began to fall in price in June after growing imports – the EU, Moldova, Iran and Turkey entered the spring-summer period with record high apple stocks. As a result, apple processing plants started operating in Moldova again, and it was very difficult to sell apples in Ukraine.

This set a negative tone for the new season. After all, the demand for early summer apple was low, and the forecasts for the 2021 harvest were unpromising. A good harvest was expected, but the price forecasts were disappointing.

Our forecasts of a difficult apple season in 2021/22 described in the article #freshapplecrisis have so far been confirmed. As a result, prices for high-quality apples in Ukraine dropped to their lowest level over the past three years in early October this year. Nonetheless, there was still no demand in this segment even after selling prices dropped to 5 UAH/kg ($0.19/kg).

However, later there was a series of unexpected positive news that could smooth over the damage. For example, wholesale apple prices in Ukraine have not dropped to the level of the 2018/19 season. Many believe that apple stocks this year are not lower than then, and higher prices are due to increased storage capacity in new modern fruit storage facilities.

The main positive news for Ukrainian farmers was the decision of Belarus to ban the import of apples and other vegetables and fruits from the EU and a number of other countries from 1 January 2022, and not to include Ukraine in this list. Of course, Ukraine can still be added to it, but this has completely changed the market situation so far – Belarus has sharply increased the import of Ukrainian apples. This means that many Ukrainian farmers will not uproot apple orchards with old apple varieties, and investments in apple processing and the motivation to find new markets will slow down again.

Let us recall that despite the fears, the loss of access to the Russian market became a very positive event for the produce industry and helped Ukraine to sharply increase the exports of fruits, berries and nuts, increasing the proceeds from their sale. This became possible because investments in improving the quality of fruit and vegetable pay off well. Access to the Russian market does not encourage growers to make changes for the better, and, as the example of Moldova shows, the country is losing its position even in the Russian market. Moreover, while Moldova was experiencing difficulties exporting apples to Russia, Ukraine and Poland were actively supplying to Russian supermarket chains in spring 2021, as they offered apples of appropriate quality.

Nevertheless, one cannot but rejoice at the attempts of the industry to strengthen its positions. In particular, due to the apple price crisis, the Ukrainian Horticultural Association launched the first fruit trading platform operating on the basis of cooperation.

- The collapse of prices for strawberries

In 2021, prices for the most popular berry in Ukraine brought a lot of surprises. The season for peak harvesting of strawberries in Ukraine began later than usual, so prices in mid-May were record high.

However, prices began to decline sharply at the very beginning of the season, promising a real collapse. Independent analysts also pointed to this possibility, believing that the strawberry harvest in the country will be possibly one of the highest in recent years. This is what happened – prices for Ukrainian strawberries remained extremely low from May 21 to July 8 inclusively. Freezing enterprises that have dramatically increased their capacities in Ukraine were in no hurry to buy them for processing, as there were lots of very cheap frozen strawberries from Egypt left on the global market. This led to prices remaining at record lows throughout the season.

This had a direct impact on the apple market – the abundance of cheap strawberries (and cherries) partly affected the prices of Ukrainian apples, the demand for which fell sharply at the end of May.

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.