The Republic of Moldova borders warring Ukraine. Therefore, after Ukraine itself, it experiences the largest negative impact of hostilities on the economic and humanitarian sphere compared to other countries of the EastFruit project. Ukraine reliably “shields” Moldova – both from potential Russian aggression and from the Russian market for the sale of fruits, which in many respects was the main one for Moldovan exporters. Therefore, the TOP-3, the TOP-10, and, perhaps, the TOP-100 events in the fruit growing of Moldova in 2022 and 2023 were and will be directly or indirectly related to the war in the neighboring country, the hope for its end, and with an attempt to find alternative markets for Moldovan fruits, grapes, berries, and vegetables. The rest, as they say, will follow.

- A new “Russian embargo” is another attempt to reorient the export of Moldovan fruits “from traditional to alternative markets.”

The exports of Moldovan fruits to the Russian market recovered to a high “pre-pandemic” level in January, but the picture changed dramatically the next month. In February-March 2022, it seemed to many that the outbreak of a large-scale war in Ukraine would “put an end” to the long era of fruit exports from the Republic of Moldova to the markets of all (or at least almost all) CIS countries.

The reasons were obvious and very convincing: the shock and confusion of export traders; dramatically lengthened, more complex, and expensive transport logistics; problematic and slow repatriation of proceeds. As a result, probably for the first time in the modern history of Moldovan fruit growing, the exports of local apples to the Russian market dropped sharply in March-April and fell below 90% in the total structure of apple exports.

At the same time, the export of Moldovan apples to Romania increased sharply. Until June, inclusive, about 2 000 tonnes of apples were delivered to the market of the neighboring country monthly – the same as the total volume last year. In total, more than 10 000 tonnes of the 2021 apple harvest were delivered to the EU and Moldovan markets – this is the largest seasonal export to Europe in the history of the sovereign Republic of Moldova.

Many Moldovan growers and export traders are not satisfied with the prices their partners in Romania bought their apples, but this is a matter of purely private relations between them. At the political level, for its part, the European Commission has done everything possible to stimulate the supply of fruit and vegetables from Moldova to the EU – through a sharp increase in preferential export quotas. However, EastFruit analysts suggested that, for a long list of reasons, Moldova’s chances of fully using export quotas in 2022 were initially low.

Without serious support at the political level, shipments of Moldovan apples to the countries of the Middle East jumped from almost zero to 1 000-1 500 tonnes per month. In total, more than 4 000 tonnes of last year’s apples were sent to the region as buyers demanded – sorted by piece and by weight, in telescopic boxes of the “bushel” type. It is worth recalling that the exports of apples from Moldova to the Middle East markets in the best seasons were within the limits of 1 500-3 000 tonnes.

Looking ahead, we can say that the managers of large fruit-growing enterprises with a well-developed post-harvest infrastructure consider exports in this direction as “familiar and stable.” Some of these operators of the Moldovan fruit market have already delivered 10-15 containers of 2022 harvest apples to the countries of the Middle East since November, and, in their words, “the export season to the Arab markets has just begun.” That is, we can assume that according to the results of the marketing season 2022-2023, the exports of Moldovan apples to “non-traditional” eastern markets will become almost common and, why not, will amount to tens of thousands of tonnes.

Unless, of course, there is a “renaissance of exports to the traditional eastern markets” – in the CIS. Is it possible? Practice shows that yes.

Going back a little, we must state the fact that, Moldovan growers and traders had adapted to the realities of the war by the second half of April 2022. On the one hand, some of them supplied fruits for free to temporary accommodation centers for Ukrainian refugees; on the other hand, they tried to sell canned fruits and vegetables to donor organizations dealing with the forced migrants. At the same time, Moldovan traders laid two overland routes for the supply of fruit to the Belarusian and Russian markets: the northern route through seven or eight EU countries, and the southern route through Turkey and Georgia. As a result, a little more than 200 000 tonnes of the 2021 apple harvest arrived at these markets, that is, as in usual seasons with average harvest and exports.

Apparently, this did not go unnoticed by the Russian authorities. The answer was the restriction from mid-August of the supply of horticulture products from all regions of Moldova – with the exception of pro-Russian Transnistria and the Dubasari region – “for phytosanitary reasons.” No one in Moldova doubted that the decision was reasoned by geopolitics and that it was taken for long.

That is, until the anti-Russian rhetoric of the Moldovan authorities changes (which is very unlikely in the foreseeable future, as representatives of the high-level bodies of the Republic of Moldova directly and unambiguously declare). Or until the Russian authorities deem it useful to allow fruit from Moldova to the local market, for example, to compensate for the situational shortage of quality products, bring down high domestic prices, and/or provide PR support to the opposition Moldovan politicians loyal to the Russian authorities, the resource market, sales, etc.

Probably for the reasons mentioned (and, hardly, due to the improvement of the phytosanitary background in the country), the Russian authorities lifted the restriction on the supply of fruits from 53 Moldovan enterprises in December, which Russian growers immediately opposed. Their position, voiced in the Russian media, must be a signal to both local consumers and Moldovan fruit exporters. The latter are reasonable and perceive the situation sensibly. They assure EastFruit analysts that “there was the possibility of exporting fruits to the Russian market, and now it is expanding, but there is no point in it due to the still extremely expensive and complicated logistics”.

Nevertheless, it is unlikely that anyone can firmly guarantee anything in exports to “traditional markets”. The benefit is a variable category. For example, expensive and complicated logistics did not prevent Moldovan traders from doubling their exports of cherries and sour cherries in 2022, mainly to the Russian market. By the way, this was facilitated by the rapid formation of viable “green corridors” on the Moldovan-Romanian border for the accelerated export of perishable products.

But the export of Moldovan berries through the same corridors was weak – the European route to the Russian market turned out to be too far for “soft fruits”. As a result, for example, the exports of Moldovan strawberries and raspberries in 2022 were almost halved. However, in this case, unfavorable conditions had a great influence, due to which the yields of many fruit crops decreased in the country. In addition, competitors from Serbia and Poland had their say on the European market (by the way, Polish berry producers upset Moldovan producers with low prices for frozen raspberries).

- A relatively small volume of fruits and grapes from the 2022 harvest was put into long-term storage.

This is partly due to a reduction in yields due to drought. The productivity of irrigated plantations turned out to be low, as they were affected by atmospheric (not soil) drought. As a result, for example, the forecast for the 2022 harvest of apples decreased from 484 000 tonnes to 405 000 tonnes (in 2021, apple production in the country amounted to 611 000 tonnes). Thus, according to expert estimates, about 110 000-120 000 tonnes of apples for export in the winter-spring period were stored in fruit storage facilities. Apples of the Gala group demanded in the market of both the European Union and the Middle East were stored in the first place. Much fewer apples than usual of Idared, Champion, Florina, Renet Simirenko, and other varieties, which are still in demand in the markets of the CIS countries, were stored. Moreover, growers realized before the start of the autumn harvesting campaign that due to the rise in the price of energy resources, the cost of storing would increase sharply.

Nevertheless, according to experts from fruit growers’ organizations, at least 85 000-95 000 tonnes of apples will remain in the fruit storages of the country at the beginning of 2023. Moldovan traders will hardly be able to sell such a volume of goods only on alternative markets, completely ignoring the CIS. A real, but bad solution, as in previous seasons, could be deliveries from fruit storage facilities to factories producing a concentrate (up to 40 000 tonnes of unsalable apples were shipped in the winter-spring period).

Despite the large (about 90 000-100 000 tonnes) harvest of table grapes, much fewer grapes of the main export variety “Moldova” were put into storage. Usually, about 40 000 tonnes of table grapes and plums for sale in the winter period were stored. No more than 20 000 tonnes of grapes were stored this autumn (even fewer plums were stored). At some point, it became clear that, despite the high quality of the 2022 grapes, Moldova would export fewer grapes than in the previous marketing year.

- >

- Low demand and prices for walnuts from Moldova.

First of all, it is worth noting that according to expert estimates, the country exported walnuts worth $100-120 million in the most successful marketing years. The walnut sector is one of the leaders among fruit-growing sectors in Moldova in terms of export potential.

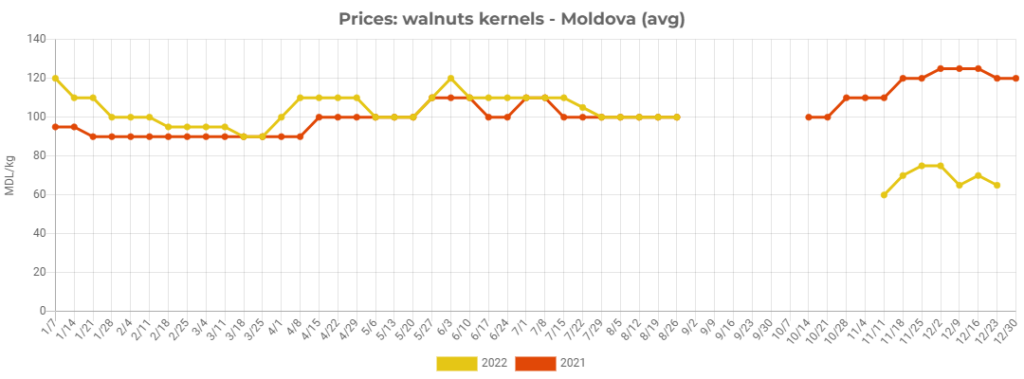

Therefore, the low demand prices for the 2022 harvest of walnut kernels from European wholesale buyers shocked Moldovan walnut growers. Because of this, the start of sales of new crop walnuts was greatly delayed. Sales and prices for walnut kernels are quite low to this day.

Nut growers and traders hope to intensify sales from January 2023, but it is unclear whether they will succeed.

Generally, the Union of Associations of Nut Producers of Moldova has been encouraging its members to rapidly develop the infrastructure for post-harvest work (drying, sorting, packaging) and increase sales of in-shell nuts for the third year.

- >

- Reducing production and rising prices for vegetables of the “borsch set”. Vegetables are the leader in food inflation in Moldova.

Despite the fact that, as EastFruit analysts forecasted, the harvest of the main root vegetables of the “borsch set” in 2022 in Moldova remained at last year’s level, their prices were relatively high (from the point of view of consumers) for almost the entire year.

This was caused by rising prices for mineral fertilizers, pesticides, and services for the supply of water for irrigation; high demand, especially for onions, from wholesale buyers from Ukraine; and the almost complete absence of imports for most of the year. Many of these factors remain relevant today (perhaps except for the last one). For this reason, some EastFruit newsmakers believe that the relatively high prices for many root crops of the “borsch set” will remain so until the future harvest.

It is not surprising in this regard that retail prices for vegetables on the Moldovan market in November 2022 were 57% higher than in November 2021. This is a record increase in prices for horticulture products.

- >

- Escalation of the labor issue for fruit growers.

For five years now, the shortage of seasonal labor has been one of the main problems and limiting factors in fruit growing in Moldova. It escalated during the COVID-19 pandemic – labor migrants sought to leave for the European Union to work as soon as possible. As the economic situation in Moldova deteriorated due to the war in neighboring Ukraine, the problem only intensified.

In this regard, before the start of mass seasonal work, the leaders of farmer organizations stated that many managers of horticultural, viticultural, and berry enterprises included an increase in the wages of daily/seasonal workers by about 10-15% in the structure of production costs this year. Some even talked about a 20% increase. Some thought that after a sharp increase in prices for fertilizers, pesticides, etc. there is simply no money left to stimulate employees. As a result, the increase in the wages of daily workers in fruit growing in Moldova was not that motivating.

Therefore, many managers of large horticultural and viticultural enterprises, as well as specialists from fruit-growing non-governmental organizations, agree that “the problem of workers will be much more acute next season.” Due to the war near the country’s borders and a severe economic crisis, another exodus of the able-bodied population is expected. As some agricultural employers say, they will have to return to the idea of importing labor from Central Asian countries.

However, it is not clear whether seasonal workers will go to work in a country with huge economic problems and war at its borders.

- >

- Another attempt to revive the centralized irrigation sector.

According to experts from Moldovan agricultural producers’ organizations, the area of irrigated farmland in the country decreased by about 20-30% in 2022 compared to rainy 2021, and it is far from the figure of dry 2020.

Irrigated agriculture in Moldova is conditionally divided into two categories: “large” – centralized (main) irrigation systems that draw water from the Dniester and Prut rivers; and “small” – irrigation systems at the local level (one village or an agricultural enterprise), with small rivers, lakes, ponds as the water sources. The basis of the “large irrigation” segment is ten main irrigation systems restored with the aid of the US Millennium Challenge Corporation under the COMPACT program. They can supply water to 10 000 ha (in fact, 3 400 ha were irrigated in 2021, and 6 500 ha in 2020). In total, there are 30 operating centralized irrigation systems in the country, capable to supply water to about 15 000 ha. According to expert estimates, “small irrigation” covers about 10 000 ha. In total, no more than 20 000-25 000 ha are irrigated in the country. The main range of crops on irrigated lands is vegetables, berries, fruits, table grapes, and to a lesser extent, table beets and cereals (in the Transnistrian region).

At the beginning of the next spring-summer session of the Moldovan Parliament, deputies should ratify an agreement with the World Bank on the implementation of the AGGRI project of $55 million, of which $25 million will be spent on restoring three more centralized irrigation systems, which will eventually be capable of supplying another 15 ha of farmland with water. The project may be expanded with a contribution promised by the French authorities (it seems that the French government has prepared a financing project of 44 million EUR).

- >

- New donor project in the agriculture of Moldova.

In October, the five-year PCRR/USAID Rural Competitiveness and Resilience Project was launched in Moldova. Its budget is almost $50 million, including a grant component of $13 million (the rest will be provided to project beneficiaries in the form of technical assistance for research, training and technology transfer, intellectual aid for the export of agri-food products to new markets, organization of business missions, participation in international exhibitions, etc.). PCRR/USAID support will be given to the production of fruits, vegetables, honey and bee products, grapes, and wine, as well as rural tourism related to the listed agribusiness sectors.

During a recent presentation by PCRR, USAID Moldova Country Director Scott Hochlander noted that the project will help consolidate the production and marketing chains of high-value-added agri-food products and, thereby, increase the return on each hectare of agricultural land. The project is also designed to mitigate the consequences of the outflow of the working-age population, the COVID-19 pandemic, and the war in neighboring Ukraine for the rural areas of Moldova.

A detailed agenda for the PCRR/USAID project has not yet been set. However, it has already been announced that one of its priorities will be to support the production of seedless and early varieties of table grapes.

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.