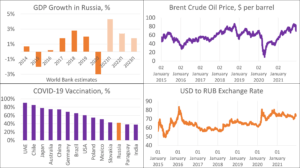

2021 was probably one of the most controversial and difficult years for the economy and the produce industry in Russia over the past few years. In the first half of the year, the country’s economy was still in the aftermath of the collapse in 2020. COVID-19 restrictions in Russia were quite tough sometimes, and the vaccination rate is still unsatisfactory.

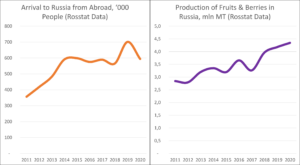

On the other hand, the second half of the year was more successful for the Russian economy, and, according to the World Bank’s forecasts, the country will have one of the highest GDP growth rates in recent years by the end of 2021. Oil prices, on which consumer demand for goods (especially imported ones) in Russia is largely dependent, also increased in comparison with the crisis year of 2020 and even exceeded five- or even six-year highs at times! In addition, we note the relative stabilization of the ruble against the US dollar, which allowed food importers to avoid setbacks in consumption due to a sharp drop in the price of the national currency.

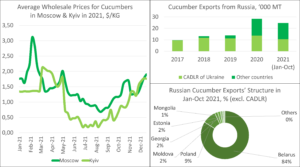

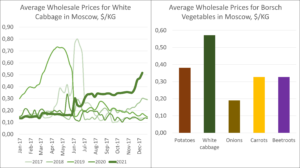

The fruit and vegetable sector in 2021 was no exception, and all its participants felt quite sharp ups and downs. For Russian consumers, the year began with record prices for bananas due to rumors about them going extinct. After that, consumers were shocked by the prices of beets and carrots in the spring and summer. In the fall they were unpleasantly surprised by the cost of cabbage, and as early as next year they may face a shortage of potatoes.

In turn, producers suffered heavy damage from frosts and bad weather in the summer and, despite the occasional shortage in the market, complained about the lack of demand from retail chains that gave preference to imports. What was especially important for producers of seasonal products, the problem of labor shortages in Russia was not resolved and only intensified.

Traders will also face tougher work conditions on the Russian market due to the closure of Belarus for the supply of fruits and vegetables from the EU and some other countries. Moreover, the issue of introducing restrictions on apple imports during their active sales already rises at a serious level in Russia itself. Both factors can significantly complicate the work of wholesale operators on the Russian market, especially those who are focused on import trade.

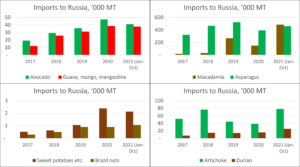

We cannot but mention the positive aspects. Despite problems in the country’s economy, consumer demand for certain groups of goods showed active growth rates. Russia will be able to set a record for the import of such exotic products as sweet potatoes, asparagus, artichoke, durian, Brazilian and macadamia nuts, avocado and mango this year. Berry imports will also hit a record, but the reason will still be a drop in their production and quality problems due to late spring and bad summer weather.

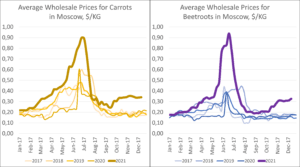

We also note the natural, but still stunning results of the development of the country’s greenhouse industry, which allowed it to switch to exporting greenhouse vegetables to the EU and Eastern Europe in just 5-6 years. In particular, Russia supplied greenhouse cucumbers to the Ukrainian market for the first time.

We bring to your attention the 10 most important events of the Russian produce market in 2021.

- Beets and carrots in Internet trends.

Event No. 1 of 2021, which was noted at all levels, from consumers to the government of the Russian Federation, was a sharp increase in prices for table beets and carrots in spring and summer.

Participants in the Russian market expected a shortage of beets and carrots even during the harvest in 2020. Due to bad weather in the summer and autumn of last year, Russian farmers reduced the production of beets and carrots, and their quality was low. Naturally, this strengthened the belief that prices would go up sharply in spring, since low-quality products were put into storage. But no one could have foreseen what actually happened in the spring and early summer of 2021!

Firstly, the cold spring delayed the start of harvesting local early root crops in Russia in 2021. Similar was observed in its neighboring countries. Secondly, heavy rains prevented the harvest of early beets and carrots after the start of the season. Thirdly, neighboring countries also ran out of stocks of last year’s root crops fast. As a result, there was nothing to satisfy the market demand, and prices soared upward.

During the peak periods of the summer of 2021, the average price for beets and carrots in Moscow reached $0.90/kg, and there were so few products offered that they became trends of the Russian Internet for some time. From Twitter to Pikabu.ru, the shock from the price of root vegetables has filled the Russian Internet. Let us recall a few humorous messages that became trends then: “More than three beets in one family at a time can serve as a reason for depriving the family of child benefits”, “Beets will soon become so expensive that they can be presented for a wedding or birthday” etc.

The main recognition of event No. 1 for the Russian fruit and vegetable market was the mention of beets in the material of the satirical news agency “Panorama” called “The Security Council will meet to discuss prices for beets“. As often happens, Panorama turned out to be close to the truth, and the issue of record prices was raised by the Deputy Prime Minister of the country at a meeting of the President of the Russian Federation with members of the government.

Prices for root crops in Russia remained high even after the start of the new season. It would seem that record prices in spring and summer should have attracted the attention of Russian farmers, and the areas planted with them were expected to rapidly grow in the fall of 2021. But due to the influence of weather, the average prices for root crops in Moscow in mid-December were 70-80% higher than last year and remain record!

- Autumn record for cabbage prices.

Nevertheless, rising prices for root crops were not the only landmark event in autumn and the beginning of winter of 2021, as cabbage made the most unpleasant surprise for Russian consumers – event No. 2 on the Russian market in 2021.

The fact is that prices for root crops in Russia, although now much higher than last year, are still relatively stable. In addition, Russian traders can count on a possible increase in production in neighboring countries and hope to maintain a high-quality supply in their markets by spring.

As for cabbage, the situation is the most catastrophic now. The average price for cabbage in Moscow in September was twice as high as last year, but the difference reached 4.2 times by mid-December, and the price exceeded $0.50/kg! Cabbage is the most expensive vegetable of the “borsch set” in Russia now, affecting both consumers and market participants, as finding free volumes for import is becoming increasingly difficult every day.

Moreover, the rapid rise in prices for cabbage in Russia has already caused a domino effect in neighboring countries, reducing the possibility of imports by next spring. Thus, Ukraine, relying on the consistently high demand from Russian buyers, sharply increased the supply of cabbage to the Belarusian market in autumn. As a result, the supply of high-quality cabbage on the Ukrainian market had decreased by December, and the prices had grown so much that Ukraine started importing cabbage from Poland. Similarly, prices for cabbage in Uzbekistan have skyrocketed, and local farmers are expecting record earnings from the exports of early cabbage to the Russian market next spring.

Thus, a rather interesting situation may develop on the Russian cabbage market by spring 2022. The offer of last year’s cabbage, most likely, will not fully satisfy the demand, since there will be nowhere to get it. On the other hand, there is a high risk of oversupply in the market for early cabbage, especially if the weather conditions for local farmers in Russia are more favorable.

As a result, a sharp increase in supplies of both local cabbages and early ones from Uzbekistan, North Macedonia, other countries of the Balkan Peninsula and Iran is quite likely. In turn, it will cause an equally rapid decline in prices.

- Expected shortage of potatoes.

Beets and carrots were a shock for Russian consumers in spring 2021, and white cabbage replaced them in autumn – these events have already passed or have become clear. Event No. 3 on the Russian market in 2021 refers to a more distant future – an emerging shortage of potatoes.

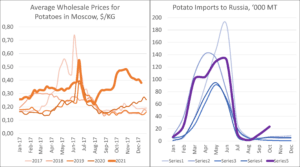

Potato prices in Russia in the first half of the 2021/22 season were also record-breaking. In autumn, the average price for potatoes grew daily and was 2-2.4 times higher than last year. Russia actively imported potatoes during its own harvest, which was previously uncommon for the country.

Moreover, potatoes were imported to the Russian market not only from rather unusual countries, such as Iran, but even from those, where Russia had exported potatoes earlier – Georgia and Moldova. Ukraine, where prices were also growing fast, supplied its potatoes to the Russian market, too.

As of mid-December, the Russian potato market appears to be saturated with supply and prices have gone down. Nevertheless, the situation by the spring of next year will only depend on the stocks that local farmers and wholesale companies have filled with imported potatoes.

If there are enough high-quality potatoes in the storages of Russian companies by that time, the situation will be relatively stable. Nevertheless, even the slightest problems with the supply of potatoes in spring 2022 will lead to an even more acute shortage, as there will be almost nowhere to import them!

Potatoes from the EU will not enter the Russian market due to the import ban recently introduced by Belarus. Possible supplies of potatoes from the EU to the Russian market through Serbia will not fully cover the volume of past re-exports through Belarus. According to local market participants, the area planted with potatoes for harvesting in spring 2022 has significantly decreased in Egypt. It is more convenient for Pakistan to supply potatoes to the markets of the Middle East (where they are more expensive) or Uzbekistan (where logistics are cheaper), and the harvest in Iran alone is not enough to fully meet Russian demand.

As a result, of the possible close suppliers, only Ukraine remains, where prices are now more than two times lower than in Russia. Nevertheless, large volumes of high-quality potatoes have already been exported from Ukraine in autumn 2021. And as recent events have shown, the possibility of deliveries through Belarus can disappear with literally one stroke of the pen of the Belarusian leadership.

- Russian cucumbers on the Ukrainian market.

The first ever entry of Russian greenhouse products into the Ukrainian market can be said to be event No. 4 on the Russian fruit and vegetable market in 2021. However, it is still more of a private nature, and the greenhouse sector of the Russian Federation should be considered in a broader perspective.

The rapid development of the greenhouse vegetable production in Russia with government subsidies and active investment support has finally started to bear fruit. Naturally, not all the finance allocated by the state for support reached the addressees and turned into modern greenhouse complexes. And it is also natural not to completely trust government statistics, which have shown a sharp increase in vegetable production in greenhouses since 2015.

What you can trust more is the statistics of the imports and exports of greenhouse cucumbers in Russia, and the trends are clear here: the imports of cucumbers decreased from 149 thousand tonnes to only 69 thousand tonnes from 2015 to 2020. The imports of tomatoes fell from 671 thousand tonnes to 490 thousand tonnes during the same period. Another decline in imports can be expected in 2021, since the indicators for January-October 2021 are also lower than last year’s.

At the same time, Russia began to actively exports its greenhouse vegetables (mainly cucumbers) last year. Of course, the volume of exports is not yet comparable to imports, and the country is still far from being a net exporter. Nevertheless, the very fact that Russian greenhouses are entering foreign sales markets is a huge step forward for a country that has always been an importer of greenhouse products.

Until 2020, the main volumes of greenhouse cucumbers were supplied mainly to the temporarily occupied territories of Ukraine in Donetsk and Luhansk regions. That is, they could not be considered a full-fledged export. But Russian greenhouse cucumbers have become available in Belarus, Moldova, the Caucasus countries and the EU since last year. The trend only intensified in 2021, and the volume of supplies to markets outside of the temporarily occupied territories of Ukraine in January-October 2021 was for the first time lower than exports in other directions!

Let’s combine these facts with the energy crisis in Europe this year. Given one of the lowest costs for heating greenhouses in Russia, it becomes a new powerful player in the market of greenhouse products in Eastern Europe – this would sound incredible several years back!

As for direct supplies to the Ukrainian market, we note that they were possible only for several days in mid-November. The volumes were small, and the difference in prices did not allow deliveries. Nevertheless, this event should still be considered in the context of the active development of the greenhouse industry in Russia over the past few years, the results of which are obviously positive.

- Apple twists and turns of the year.

We suggest to move from the vegetable segment of the Russian market to its fruit and berry part, and we chose the apple market in Russia as the event No. 5 in 2021. The number of significant events on the apple market in 2021 was so high that we decided not to single out any of them, but to consider the situation comprehensively.

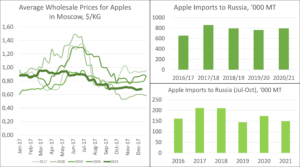

From the very beginning of the year, the participants of the Russian apple market noted the weakening demand, but hoped on the price rise by the spring-summer, typical for Russia in recent years. Nevertheless, demand did not increase by spring, and for the first time since at least 2017, the price of apples decreased in summer, in comparison, for example, with March.

That is, the country approached the start of the new apple season-2021/22 with a record harvest of apples in the countries of the Northern Hemisphere. It also experiences record stocks of last year’s apples in countries exporting them to Russia and a weakening demand for apples from buyers, who often prefer other products.

Despite the weakening demand, competition in the Russian market has only grown, both between local farmers and imports, and between importers from different countries. For example, the emergence of competitors from Iran on the Russian market back in February last year was a real shock for Moldovan apple suppliers. Then apple production in Iran reached a record level in autumn 2020, and Iranian apples continued to knock down the price on the Russian market in spring 2021.

As a result, under the pressure of high imports and the development of its own fruit production, apple prices in Russia literally collapsed at the beginning of the 2021/22 season! For example, in just two weeks at the end of August – beginning of September, “Gala” apples in Russia have fallen in price by a third. Subsequently, the prices for apples fell even more, and at the end of 2021, apples were sold in Russia on average 23% cheaper than last year. Apple prices were lower only in 2018.

Weakening demand for apples, followed by a rapid drop in prices, could not fail to cause a sharp reaction from local growers, who still felt serious competition with imports. In August of this year, when the main varieties of autumn and winter apples had not yet entered the market, rumors began to spread on the Russian market about possible quotas for apple imports.

Thus, a request was sent to the Prime Minister of the Russian Federation by branch associations of Russian farmers with the introduction of quotas on apple imports from September to April. There was no immediate government response, but access to the Russian apple market was complicated for suppliers from Serbia, Turkey, Iran, New Zealand and South Africa in November 2021.

Nevertheless, new significant restrictions on apple imports have not yet been officially introduced by the country’s authorities, and the ban on the imports of vegetables and fruits introduced by Belarus in relation to the EU and some other states can be considered the main gift to Russian growers. It is this decision that will be able to restrict the access of apples from European countries (in particular, Poland) to the Russian market, although trading companies are most likely to once again find another opportunity for re-exports.

For example, apple supplies to Russia through Serbia that already has such experience (albeit less significant than Belarus) seems quite probable. In addition, apples from Serbia can be supplied to the Russian market duty-free under the existing FTA between this country and the EAEU.

- Record-breaking bananas.

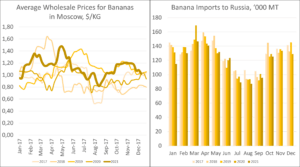

While the price situation on the apple market could be called “collapse”, the segment of another most popular fruit was characterized by record high prices, especially in the first half of the year. Event No. 6 on the Russian market is a sharp rise in prices for bananas, that in the minds of consumers coincided with the spread of information about the possible extinction of bananas!

Prices for bananas at the end of winter and in the first half of spring in Russia were the highest since 2018, and reached at least a five-year record by the end of April – May! Bananas were expensive almost everywhere during that period, and their import to Russia in January-May 2021 also reached a five-year minimum.

The widespread record prices for bananas were associated with the situation in one of their key supplying countries in the global market – Ecuador, which has been hit by a series of disasters and setbacks. Social protests, the escape of the government from the capital, the devastation of the country by the COVID-19 pandemic, the collapse of global demand for bananas in 2020 after their record production, the eruption of the Sangay volcano in September 2020 and March 2021… This is not an exhaustive list of what the global leader in banana exports is facing!

One can only imagine what was going on in the minds of consumers when the most popular fruit became record-breaking expensive, and information about the possible extinction of bananas began to spread. It was associated with the rapid spread of the Tropical Race 4 (TR4) disease, which affects primarily the most exported Cavendish banana variety. In April 2021, this disease was already recorded in Peru, neighboring Ecuador.

In the meantime, Ecuadorian exporters had to urgently respond to a problem that arose nearby and reassure global market players of complete control of the situation, but the history of banana exports shows that Cavendish became the most exported banana variety only in the 1950s. Before that, almost no one knew about it. The Gros Michel variety was in the greatest demand on the global market, which was almost completely destroyed by the rapid spread of TR4.

- Record import of berries.

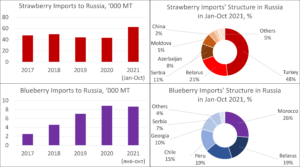

Let’s move from the fruit sector to its berry segment, as it is there that event No. 7 took place on the Russian produce market – a record import of berries over the past year. A record figure is already evident even in the first 10 months of the year for two key berries of Russian imports at once: strawberries and blueberries!

In January-October 2021 alone, the country imported over 60 thousand tonnes of strawberries, which is almost 1.5 times more than the total volume in 2020! Basically, producers of strawberries from Turkey, Belarus and Serbia took advantage of such a sharp increase in demand from importers from Russia. At the same time, Turkey provided almost half of all imports to Russia for the specified period, and the total share of Belarus and Serbia amounted to about a third.

The record imports of strawberries was mainly associated with the weather in Russia. Firstly, snowfalls in December 2020 destroyed a large part of greenhouses in the southern regions of the country, which led to a decrease in the supply of strawberries in spring next year. Secondly, the late and cold spring significantly delayed the start of the field berry season, and imports filled the vacant place freely. Thirdly, spring and summer were rainy, impeding both the stable harvest of berries and the provision of its stable quality, which was an additional factor supporting the growth of interest in imports.

In the meantime, record blueberry imports were not affected by local production levels due to their nascent stage. According to the research “Market of tall blueberries in Eastern Europe” by the “APK-Inform: Vegetables and Fruits” project, the area planted with blueberries in Russia does not yet exceed several hundred hectares. Thus, the volume of harvested local berries cannot yet have any large impact on the market, and it is almost entirely dependent on imports.

The volume of blueberry imports in Russia in January-October 2021 has almost reached the total volume in 2020 (8.7 thousand tonnes VS 8.8 thousand tonnes). Considering the stable growth rates of interest in blueberries, the record is guaranteed to be set by the end of the year! The demand for imported blueberries in Russia is satisfied by both distant countries of the Southern Hemisphere (Chile, Peru) and suppliers from neighboring countries, such as Belarus and Georgia.

Russia is the main and almost the only direction of exports for both Belarus and Georgia. It was the growth in demand from Russian importers that allowed Georgian exporters to increase supplies by almost 1.5 times in 2021. The players of the Belarusian berry market also place their main stake on sales in Russia. Belarus mostly re-exported blueberries from the EU and Ukraine only a few years ago, but Belarusian blueberries are now supplied to Russia. Naturally, there are serious questions about the quality, and blueberries are still offered at the minimum price, but it will be quite difficult to ignore this fact in the future.

The last interesting fact of Russian berry imports in 2021 is the growing importance of local blueberries for the market. The country showed an increase in imports every month from April to October 2021 (the most active sales of blueberries), with only one exception. Imports decreased in comparison with last year, and the share of Russian blueberries increased in July, during the peak of local berry harvesting. This means that, despite the emerging blueberry growing industry in Russia, it has already begun to bear fruit. In other words, in the long term, the window of opportunities for exporting blueberries to Russia during the peak of local production will nevertheless narrow, and the position of Russian berries will grow.

- A sharp increase in imports of exotic products.

Despite issues in the Russian economy, relatively sharp growth was also recorded in the import of other more exotic products – event No. 8 of the produce market in the Russian Federation.

In the first 10 months of 2021, the country has already exceeded the total volume of imports in 2020 for such products as Brazil nuts, macadamia, asparagus, artichokes and durian. Meanwhile, in the segments of avocado, guava, mango and mangosteen, as well as sweet potatoes and similar tubers, the record import is almost a sure thing, as import volumes for January-October 2021 were at a five-year high there.

Some products from this list can already be taken out of the “exotic” products, for example, avocado or mango. Others still remain unfamiliar to most Russian consumers (artichokes or durians), and some have already crossed the exotic stage, but have not yet achieved mass popularity (asparagus). Nevertheless, the demand for unusual and exotic vegetables, fruits, nuts and berries in Russia is increasing from year to year, as is the consumer’s willingness to expand their fruit and vegetable menu. 2021 was no exception in this regard!

- Labor problems are on the rise.

Event No. 9 is an increase in labor issue. It is a continuation of the issue of 2020, although the market participants hoped that it would be at least partially solved in the outgoing year. These hopes have remained hopes, and the labor shortage in the fruit and vegetable sector in Russia has only grown.

The shortage of labor is a common phenomenon for countries beginning to develop fruit and vegetable production, especially its fruit and berry segment. It is in this segment that the share of manual labor is the highest. And in order to foresee the intensification of this problem, one has only to look at the experience of other countries that started fruit and vegetable development a little earlier than Russia. For example, this can be Poland, Ukraine or even the countries of the western part of the EU, which now have to find seasonal labor even in such remote countries as Vietnam.

It turns out that for the successful development of the fruit and vegetable production sector, government subsidies, import substitution programs, a ban on the import of products from competing countries, etc. are not enough. One of the most important points, which is often overlooked, is that the plantations must be monitored, the plantings must be cultivated, the crop must be harvested, and then handled and prepared for sale.

All this requires manual labor, as the possibility of mechanizing fruit and vegetable production (especially berries and fruits) is much lower than that of grain or oilseeds, more traditional for Russia. The demand for labor, especially seasonal, is growing along with the growth in the production of berries and fruits that has increased by 1.5 times in the country over the past decade!

The previous year was a shock for many industries, as due to quarantine restrictions in Russia and in the countries from which most migrants come, their number has decreased, and the country is discussing the shortage of labor. The issue in the construction sector was especially disastrous, and the programs of state support for the search and replacement of foreign workers were launched there. Fruit and vegetable production was left alone with this problem, as it could not compete with the construction sector in its influence on the economy.

It would seem that the easing of restrictions in 2021 should have improved this situation, but it turned out it is not that simple. Firstly, farmers involved in the cultivation of vegetables and fruits, as we said above, could not get into state programs for the import of migrants. Secondly, the cost of travel to Russia has increased everywhere due to the more expensive logistics globally. Third, migrants that remained in Russia gradually switched to higher-paid or less difficult work. Fourthly, organizing internal migration and attracting local labor turned out to be an even more difficult task due to the higher demands and requirements of such workers.

- It could have been, but it did not happen – a turmoil with Turkish mandarins.

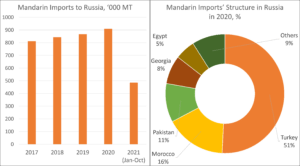

The event No. 10 on the Russian produce market is more hypothetical, but due to voluntaristic decisions of the country to ban the imports of certain products, just the discussion of the issue has sowed panic among importers and wholesale companies. We are talking about the “ban on the import of mandarins from Turkey“, which still did not come into force.

Just one inaccurate wording on the Rospotrebnadzor website, and a possible ban on mandarins from Turkey during the peak supply caused panic. Let us remind you that Turkey accounted for more than half of the total imports of mandarins in the Russian Federation last year. In addition, more than 50% of mandarins are usually imported into the country in November-December, and it would be impossible to quickly replace such volumes with supplies from other countries! The issue was that Russian consumers could celebrate the New Year without traditional fruits, and mandarins that would still enter the Russian market would be offered at record high prices.

Fortunately, the ban turned out to be a mistake, and consumers will enjoy the New Year’s fruit, and importers will not have to rack their brains to quickly arrange new shipments. Nonetheless, the latter did have problems in the past year, as we mentioned above. Firstly, the supply of apples from many countries to the Russian market was complicated by the decision of the Rosselkhoznadzor. Secondly, the re-exports of almost all fruit and vegetables from the EU through Belarus just recently became impossible due to the decision by the Belarusian authorities.

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.