This year has brought many surprises to Tajik farmers. EastFruit analysts interviewed Tajik producers, exporters and other participants in the produce business, based on which they identified the TOP-10 events of 2021 that affected the Tajik fruit and vegetable sector.

We also note that over 1.1 million people have visited the EastFruit platform in 2021. Therefore, we used statistics on the most readable fruit and vegetable materials of 2021 on our portal to determine the top events.

- Spring frosts and low yield of apricots and early cherries

2021 was extremely difficult for Tajik apricot and cherry growers in terms of the impact of weather on the harvest. Unfortunately, this happens every 5-6 years. And with climate change, extreme weather events are becoming more frequent.

Two waves of frost – at the end of February and in the first half of March, during the blooming of stone fruits, caused irreparable damage to the harvest of apricots and early cherries. Frosts even harmed vegetables and potatoes in some regions. It is not surprising that our news about the possible loss of cherry and apricot harvest in Tajikistan and Uzbekistan was one of the most read and cited.

Farmers tried to save the harvest by lighting bonfires in the orchards. Also, many farmers became interested in effective frost protection systems this year, and we have prepared a detailed analysis of how they can protect the harvest of fruits and berries from a sharp drop in temperatures available at this link.

Some stone fruit producers in Tajikistan said shortly after the frost that 90-95% of the harvest of cherries and apricots would be lost. Weather disasters resulted into a decrease in stone fruit production. Consequently, the supply on the Tajik market was very limited. Average prices for apricots and cherries in 2021 exceeded last year’s prices by 50% average or more, which also directly affected the segment of dried apricots (you can see how apricots are harvested and dried in Tajikistan here). Many apricot processing enterprises also sharply reduced their processing volumes due to lack of raw materials, and some were idle.

As a result, many plans for the exports of apricots and dried fruits were not implemented, and the contracts were not fulfilled. Prices for dried fruits in the region have largely increased.

It is interesting to note that our material on the importance of dried apricots for Tajikistan published two years ago remained very relevant in 2021.

As for apricots and dried fruits, our project held a unique online conference “Apricot business in Tajikistan: Fresh apricot, dried apricots, dried fruits, organic” in 2021. It helped to look at this traditional business for the country from the point of view of global market trends and gathered a large audience. You can watch the recording of the conference at this link.

- Growth in fruit and vegetable exports

According to the Message of the President of Tajikistan to the Parliament, more than 200 thousand tonnes of fruits and vegetables were exported in 2021, which is 70 thousand tonnes more than in 2020.

This became possible due to an increase in the gross harvest and yield, and a gradual but constant increase in the area of orchards and vineyards. The area of orchards and vineyards in Tajikistan has been increasing over the past ten years. New, more productive varieties and cultivation technologies have been introduced, the area of greenhouses and intensive orchards is growing. All this contributes to the growth of production volumes that put pressure on domestic prices and force market participants to look for export opportunities.

In part, the growth in export volumes was influenced by the difficult situation in Kyrgyzstan. Previously, a lot of fruits and vegetables were exported to the EAEU countries across this border without being reflected in customs reporting. Probably not only exports increased this year, but export data became clearer, as well.

Nonetheless, fruit and vegetable exports from Tajikistan could have been higher if frosts had not led to a decrease in the harvest of apricot and cherry. The crisis in Afghanistan in August-October also affected exports, when the government changed and the income level of Afghan population sharply decreased. At the same time, Afghanistan accounted for a large volume of exports of table grapes and lemons from Tajikistan during this period.

According to EastFruit, Russia and Kazakhstan imported twice as many fruits and vegetables from Tajikistan worth $28.6 million in the first 10 months of 2021. The exports of table grapes (340%), cherries (650%), peaches (220%), dried apricots (150%) and watermelon (130% ) increased the most. Of course, the clearance of exports becomes obvious here. Onions remained the main export commodity, with 85 thousand tonnes having been exported to Russia and Kazakhstan, which is 25% more than last year.

- Record high prices for lemons at the beginning of the year

Due to the high demand for “antiviral” fruits, their prices increased sharply in early 2021. In particular, lemon prices shot up 3 times at the beginning of the year, and traders made good money on people fearing COVID-19. In fairness, we are glad to note that the prices for lemons in December 2021 remain almost as high as at the beginning of the year – now retail lemons are sold at 15-18 TJS/kg ($1.3-1.6/kg).

The “antiviral properties of lemons”, a low harvest and late start of imports of mandarins from Pakistan, which are considered the cheapest citrus in autumn-winter in Tajikistan, contributed to high prices for lemons. Mandarins in Tajikistan are also considered very healthy for immunity and compete with lemons in the local market.

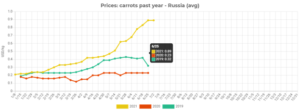

- Record high carrot prices

The year was very successful for those who grew and harvested carrots. According to growers, there have not been such high prices for carrots for at least 10-15 years. Of course, it was unrealistic to expect such a rise in prices and no one could have assumed that they would reach such a high level.

The retail price of carrots was 5 times higher than usual and reached 10 TJS ($0.88/kg). Even those who sowed carrots in March sold them with super-profit in May and June 2021. And this is after several unsuccessful years, when many procurers of carrots bought them cheap during harvesting to resale later at a higher price and went bankrupt.

In this regard, we would like to remind you that storage in the fruit and vegetable sector is not a separate business, but an integral part of growing and selling fruit and vegetables subject to long-term storage. Read more about typical mistakes in planning the infrastructure of the produce market (wholesale markets, storage facilities, distribution centers, etc.) here.

The main reason for the rise in carrot prices to incredibly high levels in Tajikistan and in the vast majority of other countries in the region in 2021, especially from April to July, was the catastrophic shortage of carrots in Russia.

Wholesale prices for quality carrots in Russia exceeded $1/kg in July 2021, and social media erupted with jokes and memes about the cosmic prices of this usually affordable vegetable.

- Collapse of prices for bell peppers. Price anomalies

Tajikistan experienced an unexpected collapse in the price of bell peppers at the end of September 2021. 11.5 kg of bell peppers can be bought for $1! Naturally, such low prices do not cover the expenses of Tajik farmers for growing these vegetables.

By the way, the drop in the price of bell pepper in Tajikistan happens every year, since growers harvest the entire crop by October and try to sell it quickly. Moreover, bell peppers of all vegetable growers in Tajikistan ripen at the same time. But there has never been such a large drop in their prices in Tajikistan.

Among the reasons are the lack of a cold chain, investment in extending the season and, most importantly, of investment in the development of pepper exports. After all, bell pepper is one of the fastest growing positions in vegetable exports, and the demand for it in Russia, where Tajikistan may well supply its products, was high during this period. We wrote in more detail about this issue, as well as the opportunities it brings, here.

- Niche breakthrough and value-added opportunities in Tajikistan’s horticultural sector

It is gratifying to see that our efforts to expand job creation and value-added opportunities in Tajikistan’s horticultural sector are bearing fruit. There have been serious shifts in the adaptation of new approaches to the fruit and vegetable business in Tajikistan in 2021.

As part of the project to support the region’s fruit and vegetable trade, implemented jointly by the FAO and EBRD, we held the first online investment conference “Tajikistan’s fruit and vegetable sector – the best investment niches. Where and how is it more profitable to invest?” that aroused genuine interest in new investment niches in the fruit and vegetable business of the country. The recording of the conference available at this link is still watched by many people.

Among other things, the cultivation of saffron in Tajikistan was discussed at the conference. This year, the country has already had the first harvest of saffron. This news caused a real stir in Tajikistan.

Another new undertaking is the construction and launch of a greenhouse for the production of strawberries with low-volume hydroponics. In addition, 6 modern promising varieties of frigo strawberry seedlings were imported from Italy. The project was implemented based on the information provided at the conference.

Thanks to this, dozens of farmers in Tajikistan started working with high-quality planting material, and the country has an opportunity to replace local outdated varieties with modern ones, better in terms of yield, appearance, size and quality of fruits, transportability and, most importantly, taste. This speaks of the prospect of export growth, as Tajikistan could grow greenhouse berries all year round!

The purchase price for strawberries from retail chains in Tajikistan exceeded $15/kg in November-December 2021, which once again proves the investment attractiveness of this business segment. At the same time, the price of strawberries in this period in Tajikistan was higher than in other countries monitored.

Also, a very resonant event was the import and retail sale of blueberries in Tajikistan’s supermarkets – the most expensive berry that can be grown in the country, both for the domestic market and for profitable export. We expect the first blueberry plantations to soon appear in Tajikistan, as we believe it is one of the most promising investment niches in Central Asia.

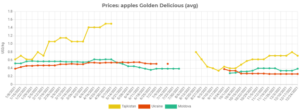

- Unprofitable apple growing

Markets in Tajikistan were oversaturated with apples of many varieties since the peak apple harvest in September till December 2021, and farmers complained about record low prices. Despite there being a lot of apples, farmers sold mainly low-quality ones that could not be stored long. In the wholesale trade, apple prices still start from $0.3-0.4/kg.

Notably, farmers in Ukraine and Moldova have long been selling apples of much higher quality at the same and even lower prices, which allows them to earn good money.

Therefore, the complaints of farmers in Tajikistan about the unprofitability of growing apples and low prices are primarily due to an inefficient cultivation. We covered this in the article “Why are Tajik farmers disappointed with intensive apple orchards? ” and analyzed the reasons in the article “Top 10 problems for intensive apple orchards in Central Asia”.

A solution to the problem would be to train Tajik apple growers in orchards in other countries such as Poland, Ukraine or even Moldova. There are also very successful apple projects in Georgia. However, the fact remains – investors are disappointed by the apple orchards and the pace of their establishment has sharply decreased in 2021.

Prices for quality apples in Tajikistan are the same as in Russia, or even higher. Russia, by the way, remains the world’s No. 1 apple importer. Therefore, those who learn how to grow high-quality modern apple varieties in Tajikistan and store them at least until January-February will earn much more than farmers of Ukraine, Moldova or even Russia. The reason is that besides a good climate, Tajikistan has one more important advantage – cheap labor.

- Onion prices are falling and planted areas are increasing

Onion production in Tajikistan is growing every year, and farmers’ incomes are falling rapidly. In 2021, they reached a critical point, after which reducing the area for the harvest in 2022 is quite possible.

The issue of low prices in Tajikistan and a decrease in exports during the period of peak ripening of onions in Kazakhstan and Uzbekistan, followed by a slowdown in exports, repeats every year. The price of onions in Tajikistan has dropped to an incredible $0.04/kg in 2021, and some traders have already tried to buy onions in bulk even at $0.03/kg.

Notably, just at a time when Tajik farmers can decide to cut onion prices, export opportunities can significantly improve. Onion prices in Russia and Ukraine have skyrocketed this season. Therefore, there may be good opportunities for exporting onions to these countries from Tajikistan in spring.

- The first plant for deep freezing of fruits and berries opened

Another interesting investment niche that we mentioned at the investment conference was taken in Tajikistan in 2021. In fact, EastFruit experts have been calling deep freezing of berries, fruits and vegetables one of the most attractive investment niches in Central Asia for many years and informing local investors about this.

As a result, Uzbekistan began to dramatically increase the export of frozen vegetables and fruits in 2021. Finally, the first enterprise for shock freezing of fruits and berries was opened in Tajikistan.

At the end of 2021, Harif LLC completed the construction and commissioning of the first freezing plant, capable of processing up to 15 tonnes of berries, fruits or vegetables per day by static freezing. The enterprise was established in the north of Tajikistan, near the city of Khujand. In spring 2022, the plant will start freezing strawberries, raspberries, cherries and apricots. However, since everything can be frozen, the possibilities of freezing other fruit and vegetable raw materials, such as plums, peaches, melons, rose hips, vegetables and even wild plants, will be considered.

In the future, the enterprise may give an impetus to the cultivation of other fruit and vegetables that are valuable for the global market but were not previously grown in Tajikistan. It is another great way to boost a country’s export earnings.

- New modern onion drying line

The Khujand Agro company installed a new modern line for industrial drying of onions in February 2021 in Tajikistan. The equipment for the line was imported from the EU, Russia, China and India.

The new processing line is capable of drying up to 30 tonnes of onions per day, which is a great support for vegetable growers in Tajikistan suffering from periodic collapses in onion prices. The segment can become very profitable given the low prices for raw materials in the country and can also bring good additional export earnings to Tajikistan, ensuring the sustainability of the vegetable business.

If you think we missed something important, please let us know in the comments!

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.