What was 2021 for the participants of the produce business of Uzbekistan and what significant events can be noted?

Like 2020, this year turned out to be difficult for the fruit and vegetable sector of the country, especially for the fruit business. Weather anomalies in winter and frosts in early spring severely damaged the harvest of many stone fruits. As a result, their prices were high, leading to a decrease in export volumes and domestic consumption.

But vegetable growers are unlikely to complain: pricey carrots, record-high cabbage, beet and onion prices helped them earn good money with the growth of export volumes. Also, Uzbekistan attracted great attention to the record volume of its potato imports, becoming one of the global leaders in it.

We also noted new interesting trends in the exports of fruit and vegetables, the adoption of a large-scale program to support the country’s fruit and vegetable industry, the continuing problems of the greenhouse business and the active expansion of foreign retailers into the vacant market of Uzbekistan. Do not forget about niche crops and new opportunities, especially in the context of record high berry prices!

Since the material is large, the EastFruit experts divided it into two parts. The first part includes the TOP-5 events and the second part will include another 5 important events.

- Weather anomalies in winter and early spring

Undoubtedly, the weather anomalies became the greatest event that influenced all the aspects of vegetable, fruit and nut production in Uzbekistan, trade and processing, and, of course, consumers.

Starting from the first month of 2021, the weather presented unpleasant surprises for growers in Uzbekistan. The unusually warm weather at the end of January caused a too early awakening of nature – almonds, apricots and cherries blossomed in the southern and central part of Uzbekistan in the 2-4 weeks of February. This was the first weather surprise that did not bode well, since the average temperature throughout the year is relatively constant. In other words, such anomalous warming increased the likelihood of a sharp cold snap or frost at the beginning of spring.

The next surprise was not long in coming – a cold anticyclone from the Volga region at the end of February. It was +26 in the afternoon and +18 at night in the capital of Uzbekistan at the peak of blooming of stone fruits (February 15-20), but in just a week the air temperatures dropped to -5 in the afternoon and -9 at night. This weather lasted 2-3 days, and it was enough to ruin the flowers on the trees. EastFruit surveyed experienced farmers from different regions of the country and published preliminary estimates of the damage from these frosts.

The third surprise and the second frost occurred after two weeks of warming since the first frost in late February. On March 13, a new cold cyclone came from the north. On March 14, the air temperature dropped sharply throughout the country, with the exception of the Fergana Valley. In Karakalpakstan, Khorezm, some areas of Navoi and Samarkand regions, snowfall and strong wind even caused damage to power lines. As a result, the stone fruit harvest in the central and middle zone of the country was again hit by the second frost. Uzbek EastFruit team re-conducted the survey to assess the damage to future harvests of stone fruit and almonds. This time, all regions were covered and more than 30 farmers from different regions of Uzbekistan were interviewed, which together form 95% of the total production of fruits and berries in the republic. Estimates of losses of apricots, cherries, peaches, plums and almonds by regions of the country were published at the end of March 2021.

After the frost, growers often began to contact us with a request to share the global experience in frost protection. Therefore, we have prepared a substantial material “How to protect your orchards and vineyards from frosts? Protection methods, effectiveness, cost and availability” and even found suppliers of these solutions.

- Imports of potatoes to Uzbekistan exceeded half a million tonnes for the first time

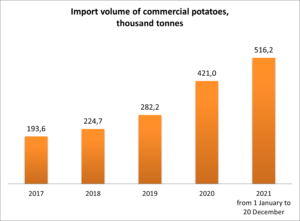

From early January to December 20, 2021, Uzbekistan imported 516.2 thousand tonnes of potatoes, which is 23% more than total imports in 2020. The previous record was set last year: according to EastFruit analysts, the imports of potatoes to Uzbekistan in 2020 amounted to 421 thousand tonnes.

Potatoes have become the main import commodity in Uzbekistan’s fruit and vegetable sector over the past few years. Until 2016, the annual import volume of potatoes did not exceed 50 thousand tonnes per year, and in 2017 it amounted to 194 thousand tonnes. Accordingly, from 2017 to 2021, the volume of imports increased 2.7 times.

By the way, such high imports in 2021 can be considered an achievement, because Uzbekistan was threatened by an acute shortage of potatoes because of a sharp decline in production in Russia and a number of other reasons. The situation can be considered controllable now, and prices have been stabilized. However, they are 56% higher than at the same time in 2021.

To reduce the volume of potato imports, the country plans to dramatically increase the area of potato plantations next year. According to the National News Agency of Uzbekistan, the projected potato planting area in 2022 will amount to 122 thousand hectares, which is 40% more than in 2021. In accordance with the government decision on planting various crops on agricultural land, 86.5 thousand hectares were allocated for planting potatoes in 2021.

However, these plans are most likely not to come true. There is a shortage of planting material, since Uzbekistan cannot yet grow high-quality seed potatoes due to climatic features, and is forced to import them. Imported seed potatoes are too expensive, which makes commercial potatoes grown in Uzbekistan expensive, as well. At the same time, prices for seed potatoes in most countries of the world, from where Uzbekistan buys them (Russia, Kazakhstan, the Netherlands, Germany and Pakistan), rose sharply in 2021. The cost of transporting has also increased. Thus, the big question is whether it will be possible to increase the area under potatoes by at least 1%.

In addition, in July 2021, the Ministry of Agriculture of Uzbekistan and the International Potato Center (CIP) launched a five-year program “Improving food security and climate resilience in Uzbekistan through breeding and seed production of potatoes and sweet potatoes”. The expected result of the program is an increase in the yield of potatoes produced in the republic by at least 30%.

Back in early 2021, EastFruit analysts studied the import of potatoes to Uzbekistan and explained why it will be extremely difficult for Uzbekistan to avoid the growth of potato imports in the coming years in an extensive article “Potatoes of Uzbekistan – what caused the high prices and can they be reduced in the future? ”. As you can see, analysts’ forecasts are coming true so far.

- Removing the import duties on apples, pears, citrus fruits and other fruits

In October 2021, the government of Uzbekistan decided to stimulate the imports of a number of fruits, exempting their import from import duties. The list of such fruits included both widely consumed, such as fresh apples, pears and quinces, and exotic ones: bananas, plantains (fresh or dried), kiwi, fresh or dried citrus fruits, dates, figs, pineapples, avocados, guava, mango and mangosteen and fresh papaya. Prior to this decision, the imports of these fruits was subject to a customs duty rate of 10 to 20%, but not less than $0.2/kg.

The next day after the relevant decree of the government of Uzbekistan was issued, EastFruit published a material where experts analysed what it means for the country’s fruit business, whether it would harm local producers and how it would affect fruit prices and the volume of their trade.

A little more than two months have passed since the decision was announced by the government. From the list of fruits exempted from duty, EastFruit monitors wholesale prices for bananas, oranges, mandarins, apples and pears weekly. Therefore, we can partially assess the effectiveness of such a government decision.

Wholesale prices for orange in Uzbekistan are currently 16,000 UZS/kg ($1.5). This means that oranges in Uzbekistan are now 33% cheaper than on the same date in 2020. Considering the sharp increase in logistics costs over the past year, one might say the result exceeds all expectations and is very positive for the consumers of the country that cannot grow orange in large volumes due to climatic features.

Wholesale prices for mandarin as of December 24, 2021 are 11,000 UZS/kg ($1.0) and they are almost 2 times lower than on the same date in 2020! Wholesale prices for banana dropped to 16,000 UZS/kg ($1.5) and as of the end of December 2021 they were 11% lower than on the same date in 2020. In other words, the reduction in import duties has allowed Uzbek consumers to have better access to fruits not grown in Uzbekistan at a much lower price.

As for apples and pears, the situation is completely opposite so far. From October 22 to December 24, 2021, average wholesale prices for apples increased by 40-64%. In terms of sorts, Renet Simerenko went up in price by 64%, Golden Delicious – by 60%, and Granny Smith – by 40%. As of the end of December 2021, apples were sold in Uzbekistan on average 2.3 times more expensive than at the end of December last year.

During the same period, average wholesale prices for pears increased by 25%. As of December 24, the average wholesale price for pears is 25,000 UZS/kg ($2.3), which is 25% higher than in 2020.

However, this does not mean that the zeroing of duties on the imports of these fruits in Uzbekistan did not work. If the duty had not been canceled, the prices for apples and pears would have been even higher. The main reason for the rise in prices was the weather anomalies described in the first paragraph of our review, that led to a decrease in domestic production. Imported apples are relatively expensive due to the increase in the cost of transportation by 2-3 times this year and the remoteness of Uzbekistan from the main centers of global apple production.

- Expensive carrots in 2021

In Uzbekistan, the per capita consumption of carrots is higher than in the countries of Eastern Europe. The main reason is that carrots are an essential component of the most famous traditional Uzbek dish – plov. Although the cost of pilaf was determined by the prices of meat, rice and vegetable oil until 2021, with record-breaking high prices for carrots in 2021, their share in the cost of cooking pilaf has become much larger.

It all started with the boom in demand for carrots and beets in the Russian market, where they were jokingly called new symbols of wealth. Naturally, Russian importers started buying them in all neighboring countries, including Uzbekistan, causing the rapid rise in carrot prices in the domestic market. In a material published in June 2021 “Even the Uzbek pilaf is becoming more expensive due to high prices for carrots and beets in Russia”, we showed how the dynamics of carrot prices in Uzbekistan repeats the respective dynamics in Russia and in neighboring Tajikistan. The conclusion was obvious – since Russia is the largest and main export market for fruit and vegetables from Uzbekistan, the rise in prices for products in Russia is reflected in the growth in prices for the same goods in Uzbekistan.

However, the influence of foreign markets on the pricing of carrots in Uzbekistan was reduced to naught in the second half of July 2021, since the excitement had subsided by that time. On 16 July 2021, EastFruit analysts noted that the further dynamics of carrot prices in Uzbekistan would depend on the ratio of supply and demand in the domestic market, but wholesale prices continued to remain high and several times exceeded those in previous years.

Due to climatic peculiarities, carrots are sown and harvested in Uzbekistan 4 times a year: in March-April, May-June, July and in September-October. However, in 2021, even after the end of the third harvest (in July), carrot prices remained unprecedentedly high. They began to decline only in the third decade of August 2021, but the decline rate was slow and prices were still several times higher than last year’s.

In mid-October 2021, EastFruit wrote that carrot production in Uzbekistan could decrease in 2021, since frosts in early spring could affect the harvest of early carrots, and dry and hot summers could not but reduce the yield of mid-ripening and late-ripening carrots. According to analysts, such a sharp rise in carrot prices in Uzbekistan is most likely a combination of two factors: an increase in exports in the first half of the year and a decrease in carrot yields.

Prices decreased and the gap with last year’s levels narrowed only in the beginning of November 2021 when the harvest of late-ripening carrots ended. From 5 to 12 November 2021, the average wholesale prices for carrots decreased from 4,500 to 3,000 UZS/kg (from $0.42 to $0.28) and remain at this level until the end of December 2021. Nevertheless, wholesale carrots are still twice more expensive than in December 2020 and 3 times more expensive than in the same period in 2019. An increase in areas and production volumes in the carrot segment are expected next year. However, vegetable growers of Uzbekistan will add this season to their successes, as they made good money, and not only on carrots.

- Successful year for onion and cabbage growers

The first lots of early winter onions became available on wholesale markets in the beginning of April, and in the same month, Russia experienced a shortage of high-quality onions from last year’s harvest. Russian supermarket chains have significantly reduced purchases of local onions due to their poor quality and were expecting the supply of high-quality newly harvested onions from Central Asian countries. Thus, the season of exports to the Russian market has started quite successfully for the onion producers of this region.

The season for selling winter onions in Russia began almost 2 weeks later than in 2020, which extended the period for shipping onions from Central Asia to the Russian market by another 2 weeks.

As statistics show, the season for exporting onions from Uzbekistan ends in July, but favorable conditions for Uzbek exporters in foreign markets allowed to extend the season until October in 2021. In particular, Uzbekistan exported 11.3 thousand tonnes of onions from August to October 2021. In total, onion exports from Uzbekistan reached 184.3 thousand tonnes from April to December 2021, which is almost 20% more than in the same period in 2020.

The developments on cabbage market were similar. In 2021, early cabbage appeared on markets and supermarkets in Uzbekistan in the second half of March. It is one of the most important products in the country’s exports, and the exports often start even before cabbage appears on the domestic market. The main importers are Russia, Ukraine and Belarus, where local cabbages ripen later.

Due to the cold spring of 2021 in Ukraine, Russia and Belarus, the start of early cabbage harvesting shifted by an average of two weeks there. Therefore, Uzbekistan had two additional weeks for export. Back in April 2021, EastFruit analysts suggested that the exports volumes of early Uzbek cabbage may increase in 2021 and the decline in export volumes in May 2021 will be less dramatic compared to May 2020.

As a result, the exports of cabbage from Uzbekistan amounted to 67.5 thousand tonnes worth $10.2 million in March-May 2021, which is 30% more in volume than in the same period in 2020. According to preliminary data, Uzbekistan exported 81.3 thousand tonnes of white cabbage worth $12.4 million from March to December 2021, which is 35% more in kind than in March-December 2020.

Note that the forecast for cabbage prices and the possibilities of its export remains very favorable for vegetable growers and traders in Uzbekistan, because of an acute shortage of cabbage in Russia.

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.