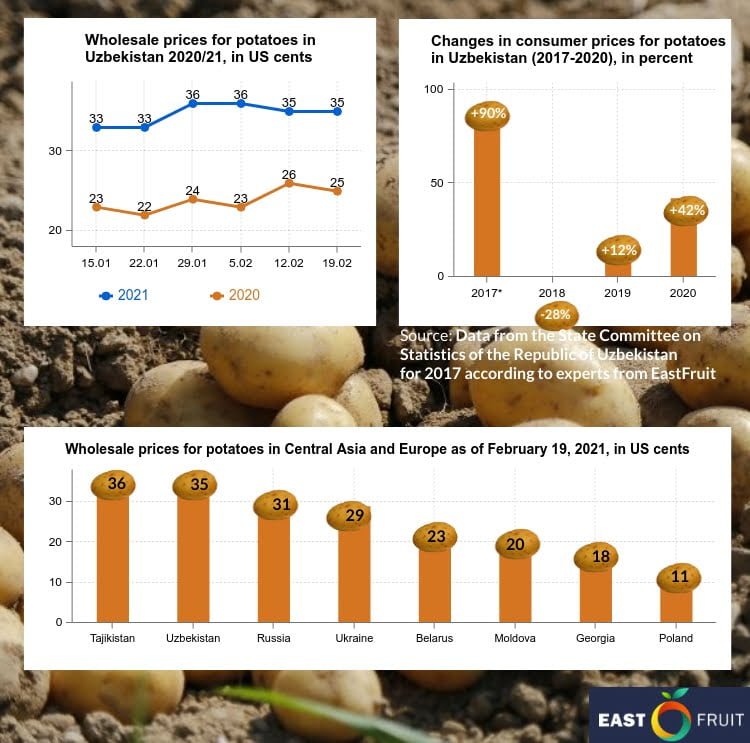

The current wholesale prices for potatoes in Uzbekistan are 1.5 times higher than the levels recorded in the same period last year. About the same jump in prices for this product was observed in Tajikistan where wholesale prices have increased by 52%. Uzbekistan retained leadership in absolute values of prices for potatoes in the region and only last week lost first place to the neighbouring republic.

Over the past 4 years, there has been high volatility in potato prices in Uzbekistan. According to EastFruit experts, in 2017 the price of this product increased by 90% and at the end of last year, the State Statistics Committee of Uzbekistan reported an increase of 42%. Inflation in these years also accelerated but the rate of price growth for potatoes exceeded several times both the general inflation rate and the group of food products.

What has caused the sharp rise in prices for potatoes in Uzbekistan over the past few years? EastFruit experts analyzed the trends in the production, imports, and consumption of potatoes over the past two decades to identify the main reasons for this growth.

Supply and Demand – Trends

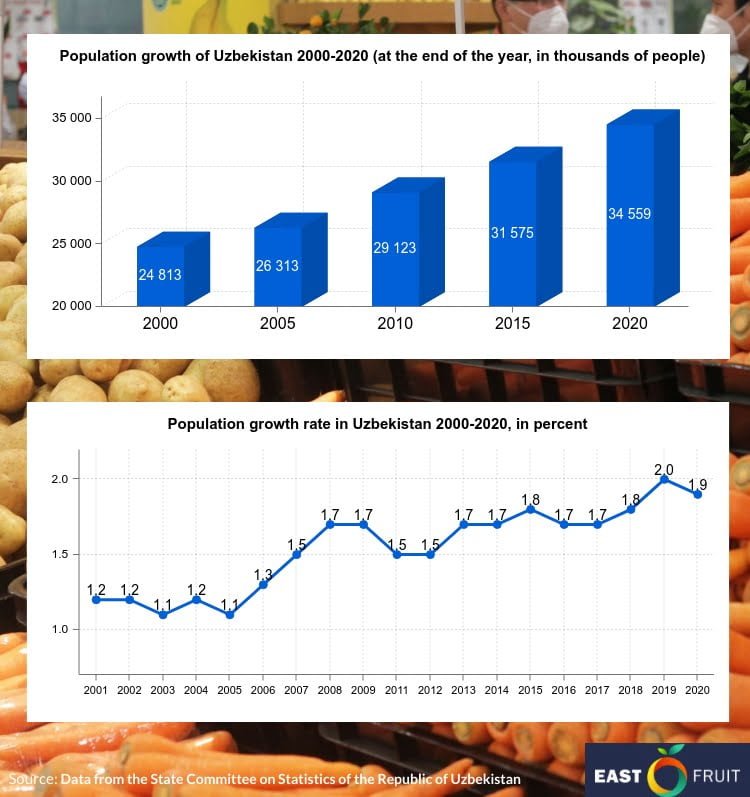

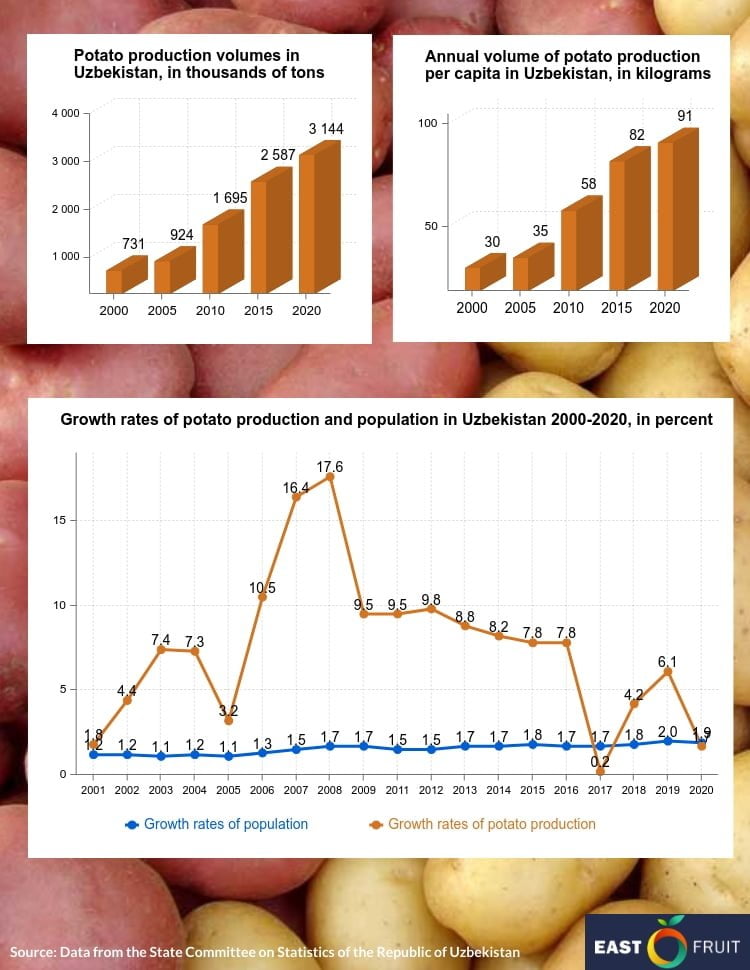

From 2000 to 2020 (at the end of the year), the population of Uzbekistan increased from 24.8 to 34.6 million people, which is an increase of 39.3%. During this period, the volume of potato production in Uzbekistan increased from 731,100 to over 3.14 million tons (by 330% or 4.3 times). These are only general summary indicators that demonstrate changes over this period. Upon closer inspection at the dynamics of the population and the volume of potato production in Uzbekistan during this period, a comparison allows us to highlight several important points in their behaviour over time.

First, the population in Uzbekistan is not only growing but also the growth rate indicator is increasing. For example, from 2000 to 2006, the annual increase in the population was averaged at 1.2%. In the next 11 years from 2007 to 2017, the annual increase in the number averaged 1.7% with the exception of the data from 2010 where the 4% growth spurt is most likely associated with a change in the calculation method or other procedures. In the last 3 years from 2018 to 2020, the population has grown by an average of 1.9%. In other words, over the past 21 years, there has been an increase in the rate of population growth on average from 1.2% to 1.9% per year. This fact is essential in predicting the consumption of the product, which ranks second in the diet of the population after bread.

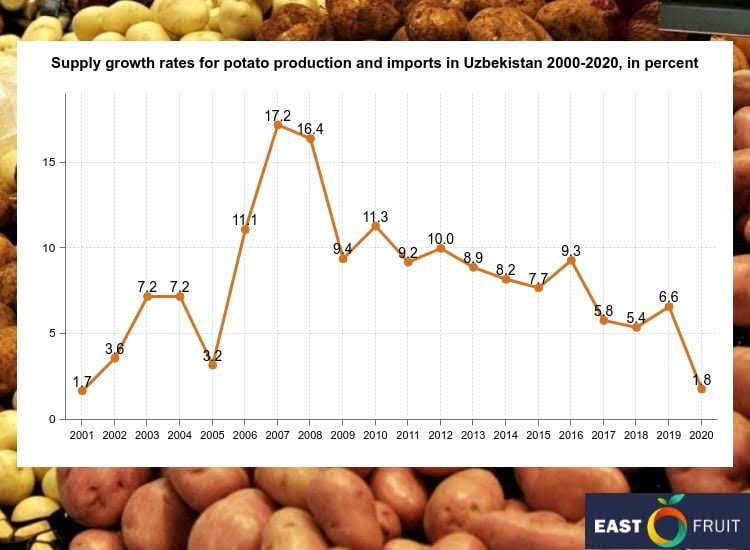

Second, the volume of potato production in Uzbekistan from year to year increased even more rapidly than the population. The annual growth rate of potato production was much higher than that of population growth. As a result, from 2000 to 2020, the annual volume of potato production per capita increased over 3 times from 29.5 to 91 kg.

If we focus attention on the dynamics of the potato production growth rate, then it highlights the data for the last 4 years. From 2017 to 2020, the average growth rate was 3.1% per year, which is still higher than the average annual population growth. However, this much lower than the same indicator for the previous 4 years from 2013 to 2016 when potato production increased by an average of 8.2%.

For the ratio of population growth rates to potato production volumes, two cases stand out. In 2017, production growth turned out to be several times lower than the population growth rate. In the second case of 2020, it was also lower but not by much. It was during these years that high levels of growth in prices for potatoes were observed. The price almost doubled in 2017 and, in 2020, increased by 42%.

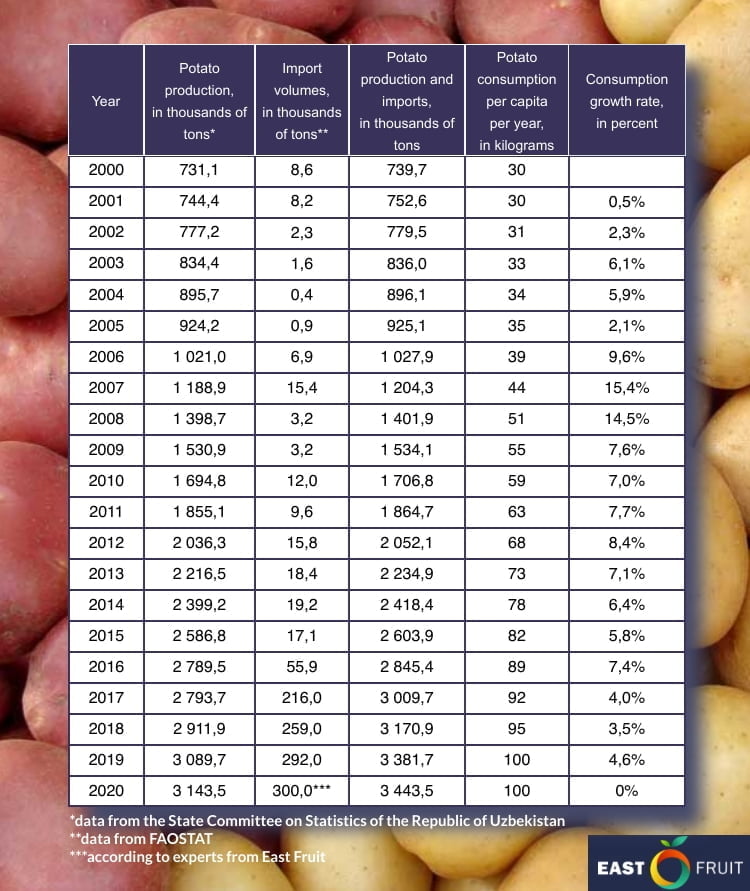

To provide the complete picture, two more components are needed – the volumes of imports and exports. Since Uzbekistan practically does not export potatoes (export volumes are so small that they can be ignored), it is enough to add imports to form a closed system that allows you to see a complete picture of the balance of supply and demand in a simplified form: production + import = consumption + export.

Why did potato prices rise so dramatically?

As shown in the table above, the stagnation in the increase in potato production was offset by imports in 2017, almost 4 times more than in the previous year. The price increase by 90%, despite supplying the domestic market with imported potatoes, is explained by the fact that the rise in prices preceded imports. This created an economic incentive for importers since the cost of imported products is formed based on the situation on the world market and logistics costs. The latter accounts for a significant share in the cost of imported potatoes in the domestic market. However, imports prevented further price increases.

In 2018, three factors reduced potato prices by 28%:

- production increased by 4.2% (2.3 times more than the population growth in the same year);

- the price of potatoes was already high, which did not prevent the increase in import volumes;

- the government decided to exempt the import of potatoes from VAT from the beginning of 2018 until January 1, 2019.

In 2019, potato production increased by 6% compared to the previous year (3 times more than the population growth rate in the same year), the volume of imports increased to almost 300,000 tons, the turnover for the sale of local potatoes was exempt from VAT, and that’s all. This together allowed to ensure price stability. Potato prices rose only 12%, below inflation.

In 2020, the price of potatoes rose 42%, nearly 4 times the headline inflation rate in the same year. Five factors can be distinguished here:

- Due to the global coronavirus situation and the loss of jobs, about 600,000 Uzbek labour migrants returned to their homeland. A significant part of potential labour migrants is seasonal workers who leave for work in early spring and return home in autumn with the onset of cold weather. In the second half of March and early April 2020, Uzbekistan introduced a quarantine and closed its borders. The traditional labour markets for Uzbeks – Russia and Kazakhstan – did the same, which is why seasonal labour migrants stayed at home. The borders were closed until the end of the year; Russia still does not accept labour migrants. The return of 600,000 people plus seasonal migrants who remained at home created additional demand for potatoes.

- The pandemic is not the only thing to blame for price increases. Potato production in 2020 increased by only 1.7% below the population growth rate in the same year (1.9%). Given the growing trend in per capita consumption per year, the increase in production was much lower than the level to ensure sufficient supply in the domestic market to maintain price stability (close to the level of general inflation).

- The volume of imports also turned out to be insufficient to compensate for the rather weak growth in production.

- The cost of import logistics as well as trade risks have risen sharply due to quarantine restrictions at the borders. This forced importers to include in the price a much higher shipping cost, which, of course, was shifted to the wholesale and retail prices.

- The demand for seed potatoes, given the high retail and wholesale prices, has grown sharply. The profitability of growing potatoes has increased. Accordingly, part of marketable potatoes was reserved for seed and therefore did not hit the market.

Growing Volumes of per Capita Consumption

From 2000 to 2020, the per capita consumption of potatoes increased 3.3 times from 30 to 100 kg per year. The fastest growth was observed from 2006 to 2008, then at a more moderate pace until 2016. Despite the slowdown in growth (i.e., a decline in the rate to 4% of annual growth over the past 4 years), it is too early to talk about it being a fading trend. The fact that this indicator remained unchanged last year is rather an exception due to the significant increase in potato prices.

Combined with the accelerating population growth rates in Uzbekistan, this puts serious pressure on demand. A kind of alliance of these two factors means that in order to ensure price stability, the annual increase in the supply of potatoes in the domestic market (production + import) should be 5.5-6.5%. With regard to the current year, the projected volume of supply in the domestic potato market of Uzbekistan to balance such demand is 3.63-3.67 million tons.

Seed Growing

There is another important factor that does not allow reducing the prices for potatoes in Uzbekistan. This is a factor in the lack of production of quality seed potatoes within the country. Considering the climatic conditions of the country, most of the international experts who visited Uzbekistan agreed that it would be quite difficult, if not impossible, to establish the cultivation of high-quality seed potatoes in the country.

In order to obtain high yields of potatoes of the required quality, the country needs to constantly import seed potatoes. In 2018, Uzbekistan even took 12th place in the world for imports of seed potatoes, importing more than 34,000 tons! The main suppliers of seed potatoes to Uzbekistan are Kazakhstan, the Netherlands, and Russia. The cost of such potatoes, due to the transport component and the seller’s margin, is at least two times higher than in countries where they can be grown independently. Seed potatoes are usually one of the largest contributors to the cost of growing.

Therefore, in order to ensure the necessary growth rates of production of affordable potatoes within the country, Uzbekistan should attend to finding suitable agro-climatic zones for growing potatoes. Perhaps a good solution could be a program of growing seed potatoes even in one of the neighbouring countries that are close to Uzbekistan and its duty-free imports.

We would like to emphasize that we are not talking about breeding our own varieties. We are talking specifically about seed production (i.e., importing the elite or super-elite of productive varieties of the Dutch or any other selection) and reproducing it to the second reproduction, which could be used as planting material in Uzbekistan to increase the average yield, quality, and reduce the cost of growing potatoes in the country.

The industrial cultivation of early or young potatoes in the southern regions of the country in April-May for exports to Russia and other colder countries could be an excellent way to compensate for the costs of expensive imported seed potatoes. Prices for marketable potatoes are usually relatively high. Potatoes with thin skin, which fall into the category of early or young, may even cost 5-10 times more, which would more than compensate for the high transport costs.

Conclusions and Forecasts

High prices for potatoes in Uzbekistan are justified by a number of insurmountable factors, the most important of which is the high demand by the population. However, the experience of developed countries shows that potatoes, as a source of cheap calories, are consumed in smaller quantities with increasing incomes of the population. As a rule, with an increase in the income of the population, there is a growing interest in processed potato products for consumption in the form of frozen french fries. The per capita consumption of fresh potatoes is falling.

Therefore, in the future, the corrective value on the growth rate of potato consumption in Uzbekistan will be influenced by the growth of the income level of the population. Since the problem of seed potatoes will not be resolved quickly, the level of prices for potatoes in Uzbekistan is likely to remain relatively high for a long time.

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.

2 comments