EastFruit analysts note that in 2021 the season of strawberries in Uzbekistan was very short. It was shorter than in 2020 by at least two weeks. At the same time, prices for strawberries were significantly higher than last year.

The first large volumes of strawberries became available on the wholesale markets of the capital of Uzbekistan at the beginning of the third decade of April 2021, and the season ended in early June, while in 2020 strawberries were available on wholesale markets until June 20.

Thus, the strawberries were available on the Uzbek market for only about one and a half months, despite the excellent conditions for growing strawberries in Uzbekistan almost throughout the year.

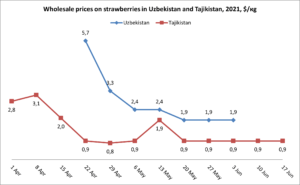

The reduction in the period for the sale of strawberries was partially offset for farmers by higher prices – this season began with average wholesale prices of 60,000 sums per kg ($ 5.7) and ended at 20,000 sums per kg ($ 1.9). A year earlier, prices did not exceed $ 2 per kg and even dropped to $ 1.2 per kg.

Although average wholesale prices increased by 25% in 2020 by the end of the season, they were still below the levels recorded in 2021.

The duration of the season-2021 of strawberries in Uzbekistan turned out to be shorter in comparison with neighboring Tajikistan, where there are similar climatic conditions for strawberries production. At the same time, wholesale prices for this berry in Uzbekistan are noticeably higher than those of its neighbors, both this and last season.

Excluding the factor of weather conditions and other anomalies that occur from year to year, according to EastFruit experts, the main reason for the differences in the length of the season and price levels is that the strawberries production, both indoor and outdoor, is much better developed in Tajikistan. More productive American and European strawberry varieties have been used for many years there, that also have excellent taste.

However, the main disadvantage of Tajikistan is the lack of technologies for processing and packaging berries for exports, as well as the absence of deep or shock freezing of berries. Indeed, with such prices for berries, their processing could give a new impetus to the development of the country’s berry business.

Read also: Blueberries, the most promising berry business in Central Asia – Andriy Yarmak

EastFruit analysts note that Uzbekistan should pay attention to the introduction of modern technologies, the selection and adaptation of productive varieties of strawberries, as well as their cultivation in greenhouses for exports in winter. An example of how year-round cultivation of strawberries in greenhouses for exports can be organized is available in the presentation by Sergey Yastreb.

This is true for all berry crops. Berries are the fastest growing segment of the global fruit and vegetable market. Global trade in berries is growing at an average of 8% per year, and export sales of berries have long exceeded international trade in apples that are much better stored and transported. In addition, the domestic demand for different types of berries in Uzbekistan is also constantly growing.

“Russia is constantly increasing imports of fresh berries, especially off-season imports at a time when prices are high and berries can ripen successfully in Uzbekistan, Tajikistan and other Central Asian countries. I would like to note that in terms of import volumes strawberry is the first and blueberry, the most profitable berry crop now, ignored by producers from Central Asia, is the second,” Andriy Yarmak, economist of the Investments Centre of the Food and Agricultural Organization of the United Nations (FAO) explains.

“I would also like to point out that the excellent weather conditions for obtaining a high level of sugar in berries grown in Uzbekistan and other countries of the region with affordable labor, mean there are great prospects for the production of frozen berries for exports. The sales of frozen berries solve another major problem – they eliminate the complexity of long-distance logistics. Frozen berries can be stored for as long as you like and delivered to any country in the world,” Andriy Yarmak says.

So far, the main suppliers of fresh berries to Russia are Morocco, Serbia, Turkey, Peru, Mexico, Egypt, Armenia, Chile, Moldova and Georgia. None of the Central Asian countries is even among the twenty largest suppliers of berries in the Russian Federation.

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.