The weekly monitoring conducted by EastFruit on wholesale onion prices in Uzbekistan has revealed a significant decline. Last week, the wholesale price for this commodity dropped to 1500 Uzbekistani som, equivalent to 12 U.S. cents. In practical terms, this means that in Uzbekistan, you can now purchase over 830 kg of onions for just 100 U.S. dollars.

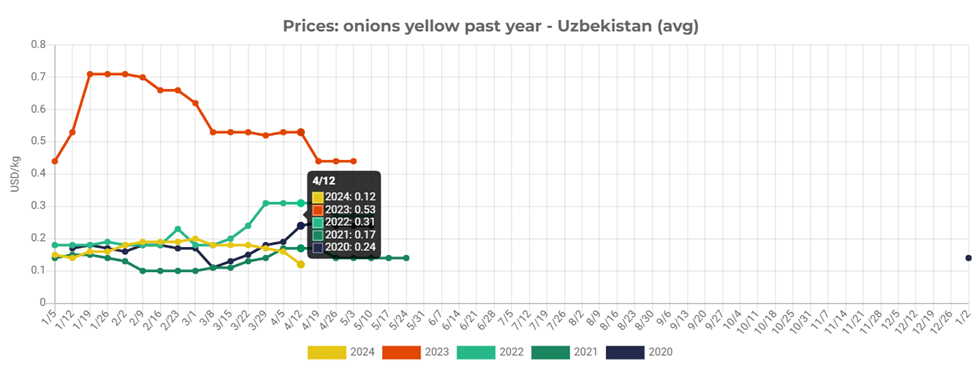

The graph below illustrates a historic low in onion prices during this time of the year. Compared to a year ago, when onion prices were 4.4 times higher, the current situation is unprecedented. Typically, the usual price range for this period hovers around 24-26 U.S. cents.

However, the issue extends beyond what the graph portrays. The prices we track represent small wholesale transactions. If we delve into the perspective of farmers or traders who bought onions in the fall for resale in spring, the actual price for such onions is approaching zero. Selling all the onion stocks from the 2023 harvest becomes an insurmountable challenge.

Our estimates indicate that in Uzbekistan alone, 150-200 thousand tons of onions may need to be discarded or repurposed as cattle feed – a situation already unfolding among farmers in Kazakhstan. Consequently, it should come as no surprise if prices for last year’s onions plummet even further this week.

This predicament weighs heavily on farmers, and those who had hoped to profit from onion resale in spring are facing staggering losses – reaching 100%. Understanding the underlying reasons for this tragic onion overproduction in Uzbekistan and the broader region is crucial. Similar challenges persist in Kazakhstan and Kyrgyzstan.

Read also: Will Asia’s acute onion shortage become the norm in coming years?

Andriy Yarmak, an economist from the Investment Department of the Food and Agriculture Organization (FAO), sheds light on this phenomenon. He explains that onion demand is inelastic. Whether prices are high or low, people’s consumption of onions remains relatively constant. When prices are low, consumers won’t suddenly consume more onions because they primarily serve as ingredients in other dishes or garnishes. Conversely, when prices are high, there’s no viable substitute for onions, compelling people to purchase them.

Last year, EastFruit analysts repeatedly warned about the looming threat of onion overproduction in Central Asia. Our article titled “Will Uzbekistan be able to avoid a collapse in onion prices?”, published in August 2023, prompted numerous inquiries from those considering onion purchases for resale in spring. It’s gratifying to know that our analytical assessments helped several entrepreneurs avoid substantial losses by reconsidering their plans.

Interestingly, despite the sharp decline in demand for onion seeds in the region this new season, high onion prices are not guaranteed. Onions remain a highly profitable crop. In our Telegram channel, onions lead by a significant margin among all vegetable crops in terms of profitability forecasts for the upcoming season.

Maintain full control over fruit and vegetable prices in Turkey, Egypt, Ukraine, Uzbekistan, Russia, Moldova and other markets subscribing to EastFruit Premium.

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.