EastFruit reports that Morocco is on track to break a new record for the import of nuts and dried fruits in 2023. From January to October 2023, Moroccan importers have already brought a record 66 thousand tons of this product to the country’s market, which is 12% more than the whole previous year.

Being one of the fastest-growing exporters of fresh fruits and vegetables in the world, relies entirely on the import of nuts and dried fruits. In 2022, Morocco imported more than 26 times as much of these product as it exported!

The main surge in imports of this product happened between 2018 and 2021, when the volumes more than tripled. In 2022, due to the slowdown of the global economy, the rise of logistics costs and other economic challenges, Morocco slightly reduced imports of nuts and dried fruits. However, this was only a temporary setback, and by mid-2023, the Moroccan market showed signs of recovery.

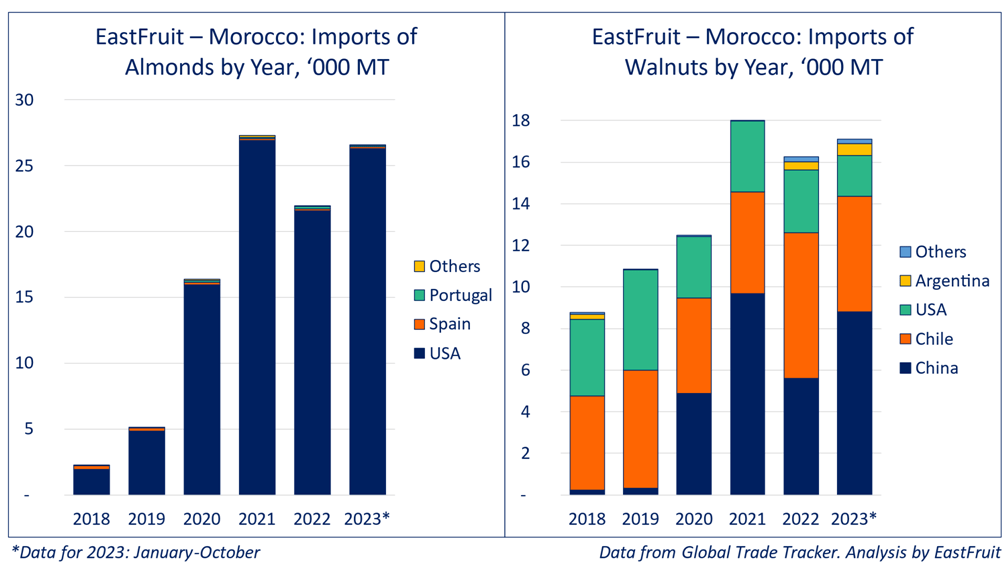

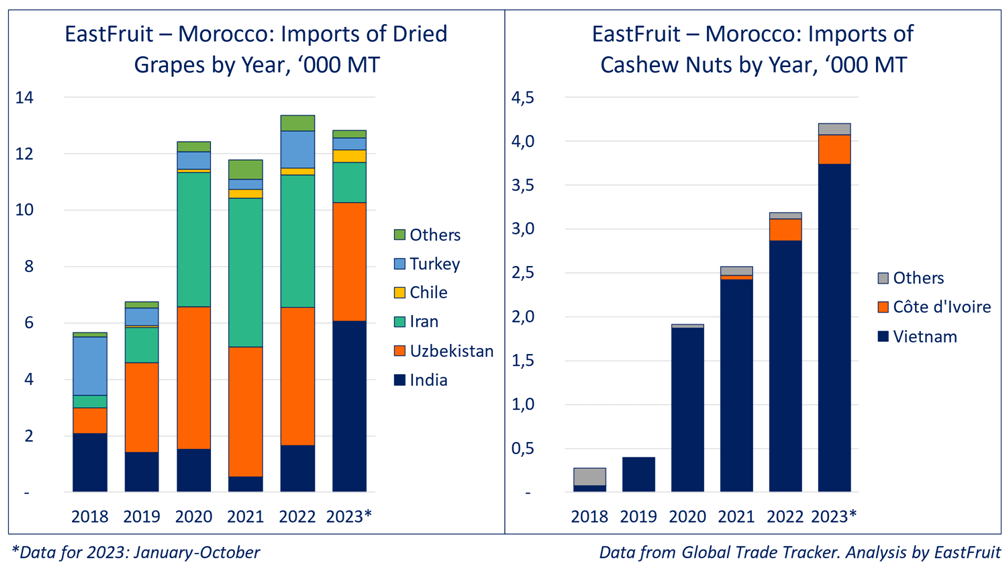

Almonds, walnuts, and dried grapes are still the top three categories of imports of nuts and dried fruits in Morocco, but their combined share dropped from 91% in 2018 to 88% in 2022. Meanwhile, imports of the latter two categories doubled on average over the same period, while the purchase volumes of almonds increased almost tenfold. The segments of cashew nuts and prunes saw even more active growth rates of imports. The imports of cashews increased 12 times, and the purchases of prunes grew 19 times!

The United States remains the main supplier of almonds and walnuts to the Moroccan market. In the almond segment, American exporters dominate, supplying almost all of the Moroccan imports. However, in the walnut market, the United States is losing ground to its competitors from China and Chile. The supplies of walnuts from the United States to Morocco decreased by 18% to 3 thousand tons from 2018 to 2022, while the exports from Chile grew by 50% to 7 thousand tons, and the exports from China increased more than 23 times to 5.6 thousand tons. The situation was similar in 2023: the United States is likely to export a record low amount of walnuts to the Moroccan market, while China continues its expansion.

Read also: Morocco’s mango mania: how mango imports have skyrocketed in recent years

The structure of imports of dried grapes in Morocco is also changing. In 2018, the main suppliers of raisins to the country were India and Turkey, but they were joined by Uzbekistan in 2019 and Iran in 2020. By the end of 2022, these four countries accounted for 94% of all supplies of dried grapes to the Moroccan market. Meanwhile, the segment of imports of cashews in Morocco is characterized by almost complete domination of Vietnam, while the share of other countries-suppliers is relatively small.

There are also some less important categories of Moroccan imports of nuts and dried fruits, such as pistachios, prunes, hazelnuts, dried apricots, Brazil nuts, etc., and the imports of almost all of them are growing.

Imports of pistachios in Morocco quintupled to 1.8 thousand tons from 2018 to 2022, and the United States was almost the only exporter of these nuts to the Moroccan market. The main suppliers of prunes to Morocco are Spain, Uzbekistan, Romania, and Moldova, and the main suppliers of hazelnuts are Turkey, Georgia, and Azerbaijan. Turkey is also the most important exporter of dried apricots to Morocco, and South American countries (Peru, Bolivia, and Brazil) supply Brazil nuts to the Moroccan market.

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.