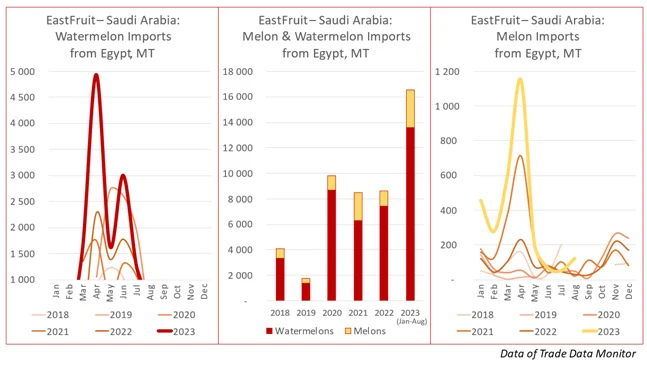

Egypt has already managed to double its export volumes of melons to the Saudi Arabian market in just the first eight months of this year, reports EastFruit. This increase in shipments includes both watermelons and melons, with the latter expected to continue rising until the end of the year.

From January to August 2023, Egypt exported 16,500 tons of melons to Saudi Arabia, which is twice as much as last year and two and a half times more than the average over the previous five years. Notably, watermelon shipments have already exceeded last year’s total by 80%, and melon exports are currently 2.4 times higher. Moreover, Egypt has a good chance of significantly increasing its melon exports in the remaining four months of this year, as exports to Saudi Arabia from September to December typically account for about a quarter or a third of annual shipments.

Egypt is one of the world’s most important producers of melons. In terms of production volume in Africa, it is second only to Algeria (for watermelons) and Morocco (for melons). However, unlike Morocco, Egypt’s exports of watermelons and melons have not yet brought significant dividends to the country’s economy. In 2022, export revenue from these two categories amounted to only $7.3 million, whereas Egypt exported peaches and nectarines – traditionally not associated with North Africa – for nearly $23 million.

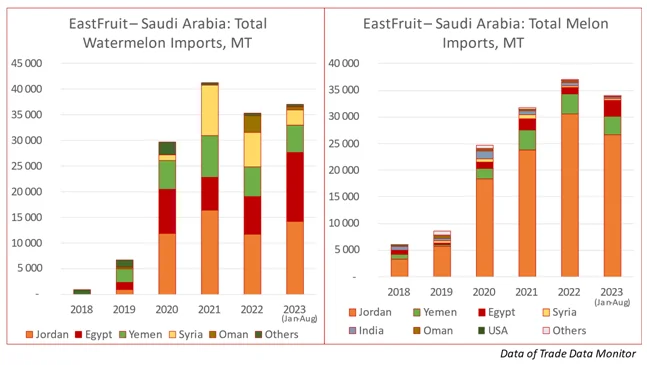

Saudi Arabia is not a leading importer but is still a significant player in the global melon and watermelon market, offering opportunities for product placement on premium supermarket shelves as well as in stores with less stringent quality requirements. In 2023, the country is likely to set a new import record for both watermelons and melons.

Read also: Rise of Egyptian dates: historical achievement in Moroccan market

Last year, Saudi Arabia was the ninth-largest importer of melons globally and ranked second in the Middle East region for melon purchases after the UAE. For watermelon imports, Saudi Arabia held a more modest position: 25th place globally and third-largest importer in the Middle East after the UAE and Qatar.

Saudi Arabia is also a considerable producer of melons and watermelons: according to FAOStat data for 2021, production was 55,000 tons for melons and 624,000 tons for watermelons. Nevertheless, these volumes are insufficient to meet domestic demand, and the country annually imports up to 40,000 tons of watermelons and up to 35,000 tons of melons.

Jordan, Yemen, and Egypt are the three largest suppliers of melons to the Saudi Arabian market. Other less significant exporting countries (Syria, Oman, India, etc.) are also located close to Saudi Arabia’s market. Interestingly, Saudi Arabia also imports several hundred tons of melons from the USA each year, which is quite far from its region.

In the watermelon segment, Jordan has managed to maintain its lead in exports to Saudi Arabia so far, but Egypt is rapidly reclaiming its market share. As for melons, Jordan’s dominance remains unchallenged so far, with Saudi Arabia depending on Jordanian supplies for 75-80% of its imports.

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.