In the MY 2022/23, Egypt has set a historical record for exporting dates to the Moroccan market, more than doubling its export volume in this direction, according to EastFruit. Such a rapid growth of exports allowed Egypt to also become the second largest date supplier to Morocco.

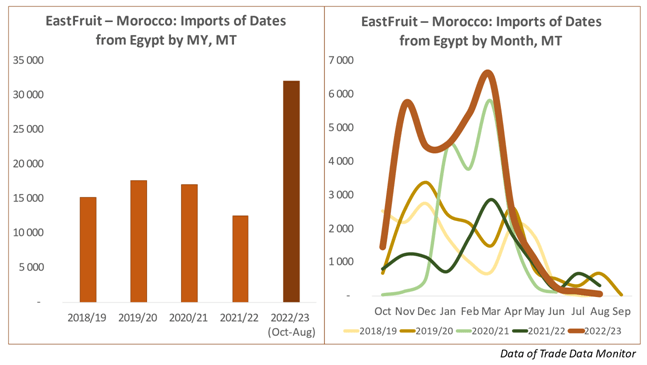

From October 2022 to September 2023 (i.e., over 11 months of the past MY), 32 thousand tons of dates were exported from Egypt to Morocco. This volume is two and a half times as high as in the entire MY 2021/22, and twice as high as the average export volume for the previous four marketing years! Moreover, unlike the previous season, Egyptian exporters managed to significantly extend their presence in the Moroccan market, setting records for shipments at its very beginning, from October to December.

“Morocco is the second largest date importer in the world, despite having quite serious volumes of its own production. Moreover, dates for Morocco are the most important category of fruit and vegetable imports, accounting for almost a third of them in the value terms. Egypt, on the other hand, is the largest date producer in the world, so it is not surprising that trade in dates between the two countries is developing rapidly,” explains Yevhen Kuzin, Fruit & Vegetable Market Analyst at EastFruit.

Morocco is the largest export market for Egyptian dates. Other important importers of Egyptian products include Southeast Asian countries (Indonesia, Malaysia, Thailand, Vietnam, etc.), although exports in this direction have declined in the past season. However, unlike Morocco, Egyptian dates appear on Southeast Asian markets a bit later and are mainly present from January to April. In addition to Morocco and Southeast Asia, dates from Egypt are also supplied to Middle Eastern countries, Turkey, EU, and many other markets.

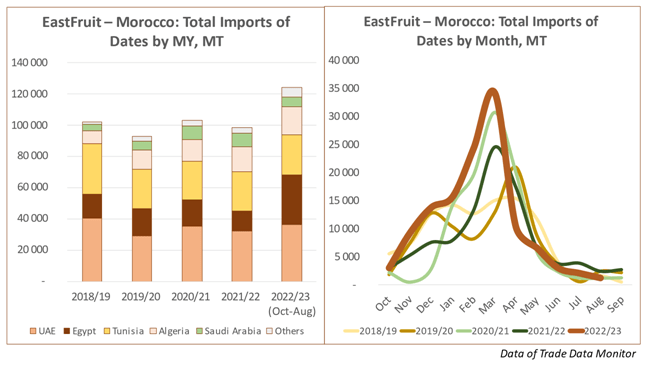

“Despite having a rather high level of date production and being the homeland of Medjool variety, one of the most popular date varieties in the world, Morocco still has to rely largely on imports of this product. With production at 130-150 thousand tons annually, import volumes of dates in the Moroccan market rarely drop below 90 thousand tons. Moreover, dates are imported immediately after the start of the local season in October, and imports reach their traditional peak in February-March,” emphasizes Yevhen Kuzin.

In the first 11 months of the 2022/23 season, Morocco has already set a record for date imports, purchasing almost 125 thousand tons of this product from foreign suppliers. The UAE remained the leader in date supplies to Morocco, and Egypt took second place in the ranking, overtaking Tunisia, Algeria, Saudi Arabia, and other countries. The main reason for the record volume of imports was drought in Morocco, which hit local producers last year. In response to weather risks, ambitious plans to replace old varieties of date palms with new ones adapted to the changing climate are now being discussed in the country

“However, it is still too early to talk about full substitution of date imports in Morocco, let alone exporting Moroccan dates abroad, although they are present in very limited quantities in the EU and Sub-Saharan Africa. Nevertheless, if plans to increase local date production in Morocco are successful, the demand for imported products will decrease here. As for Egypt, judging by the trends of recent years, exports will only be increasing due to the launch of several large investment projects in the country. And this, against the backdrop of a possible decline in demand from Morocco, the second largest date importer in the world, could lead to quite radical changes in the global market for this product, as price pressure will only intensify in this case,” concludes Yevhen Kuzin.

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.