EastFruit continues a series of articles on the horticultural market in Morocco. The country is confidently increasing exports of several categories of high-quality fresh fruits and vegetables, including Moroccan watermelons.

Watermelon is one of the main fruit and vegetable export categories for Morocco and its exports are ranked third (after tomatoes and mandarins) in the country’s overall sales to foreign markets.

Watermelon is one of the main fruit and vegetable export categories for Morocco and its exports are ranked third (after tomatoes and mandarins) in the country’s overall sales to foreign markets.

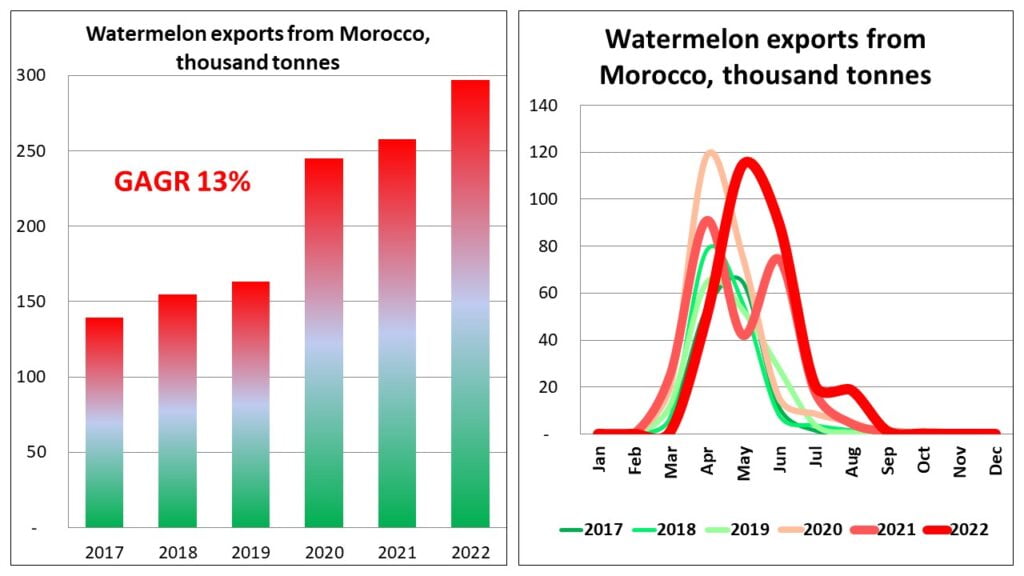

The exports of Moroccan watermelons have been increasing gradually and steadily over the past six years, at an average annual growth of 13%. Local producers increased the supply of watermelons in 2022 to almost 300 000 tonnes, which is twice as high as in 2017. As a rule, the export period lasts from February to September and peaks in April-May.

At the same time, producers of Moroccan watermelons are facing grave problems in growing due to the lack of water in the country. EastFruit wrote that climate change and the effects of the worst drought in 30 years in the summer of 2022 forced the Moroccan Ministry of Agriculture to take serious measures to limit the use of water resources in the country.

Due to the depletion of the water level and lack of rainfall in the region, the local government decided to limit the cultivation area to 0.5-1 ha per producer. Moreover, in some Moroccan areas with sources of drinking water (for example, in the Zagora region), a decision was made to stop the cultivation of watermelons.

However, despite all the difficulties, Morocco became 4th among the global exporters of watermelon in 2022, having overcome Italy. Morocco became second after Spain in the ranking of suppliers in the EU. The exports of watermelons from both Italy and Spain have been showing a downward trend in recent years, while the supply of Moroccan watermelons has been steadily growing.

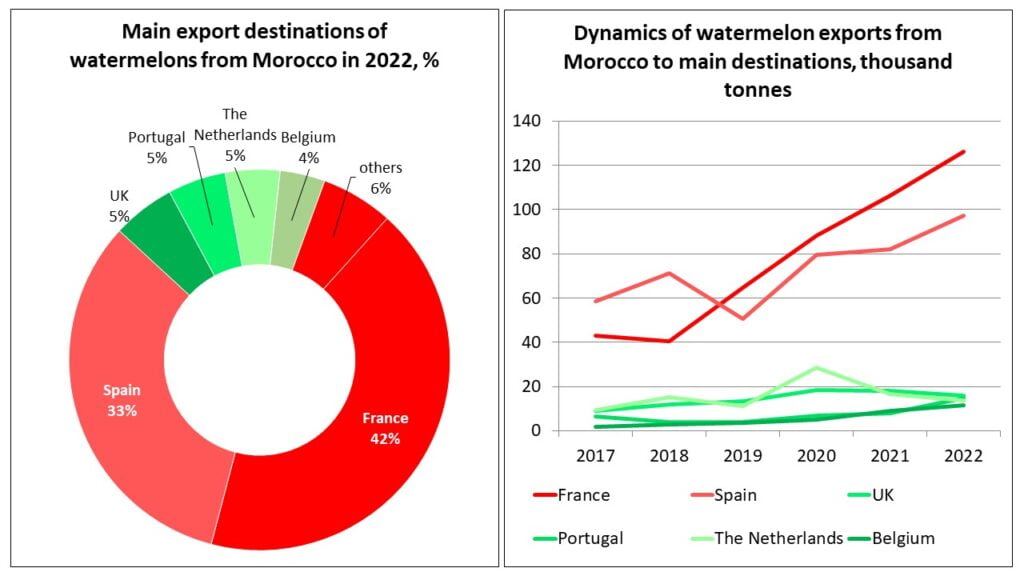

In the supply of watermelons, Moroccan producers traditionally focus on buyers in European countries. Moreover, French consumers turned out to be the biggest lovers of these North African watermelons – 42% of the total volume is imported to the country’s markets, and exports to France have tripled over the past four years. This growth was also influenced by the global trend to increase the consumption of seasonal fruits in the off-season, and the development of export infrastructure in Morocco itself.

Exports to Spain are growing significantly, with 33% of the total supply going to local markets. The country itself is a top exporter of watermelons, therefore, in order to extend the season, it buys Moroccan watermelons for further re-export.

Read also: Morocco ranked third in the global tomato exports!

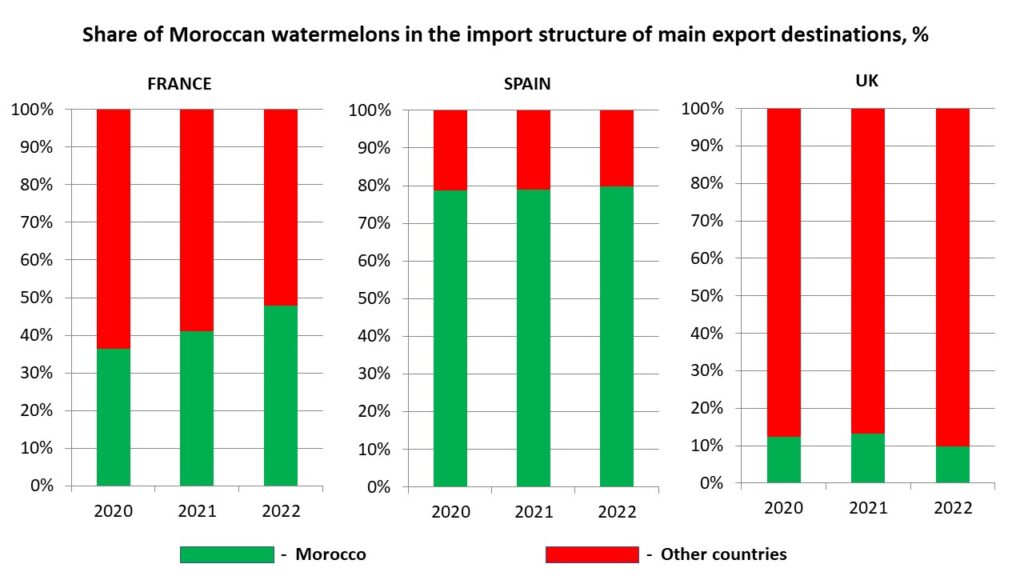

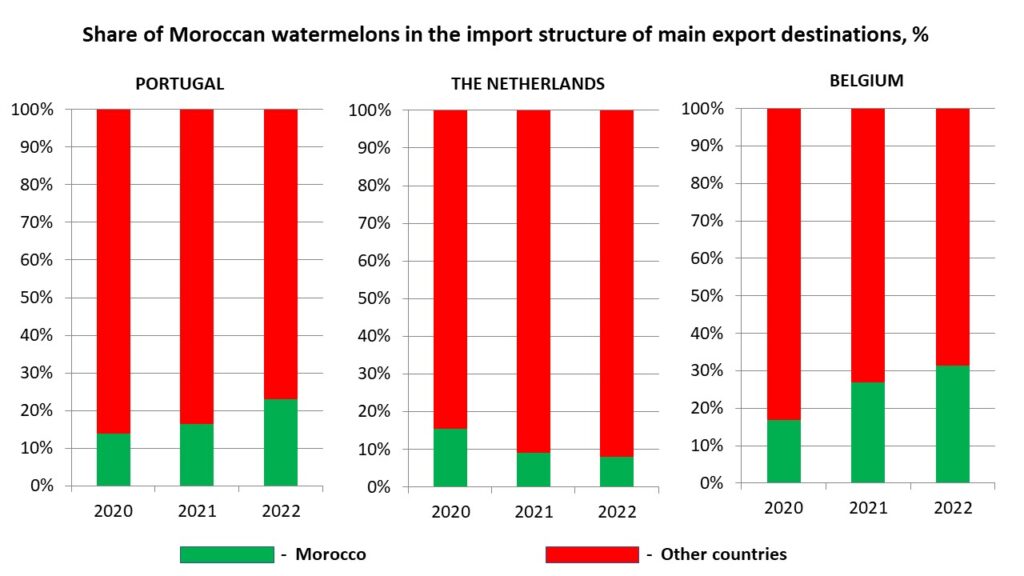

By the way, the share of watermelons supplied from Morocco in Spain is 80% of all watermelon imports, and the figure has remained stable for the third year in a row. As can be seen from the graphs, the share of imported Moroccan watermelons in the Netherlands and the UK has slightly decreased. And in Portugal, Belgium, and France, the proportion of watermelons from Morocco in the structure of imports shows an upward trend.

Note that the new watermelon season has recently started in Morocco. Whether the country will be able to increase the export of watermelon again, taking into account the new realities and to which markets the main export flow will be directed, we will see at the end of the season.

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.