Farmers in Uzbekistan have been actively expanding the area cultivated with pomegranate in recent years. At the same time, the cultivation of pomegranates in Uzbekistan seems to be promising for both its farmers and officials.

Appetite for pomegranate is increasing – especially on paper

In September last year, EastFruit wrote about the country’s plans to increase the total area of pomegranate orchards in the Fergana region to 20 thousand hectares, from which more than 200 thousand tons of pomegranate would be harvested per year. Two months later, the Ministry of Agriculture announced an increase in pomegranate plantations in the Kashkadarya region of Uzbekistan by another 2 thousand hectares.

However, the appetite for pomegranate continues to increase. An even more ambitious plan to expand the production of this crop in the southernmost region of the republic was revealed last week. The Uzbekistan National News Agency informs about the increase in pomegranate production in the Surkhandarya region and raising the annual volume to 300 thousand tons in the foreseeable future. However, it is rather difficult to define what “foreseeable future” means in this case.

Taking into account the plans in the Fergana and Kashkadarya regions, as well as existing plantations in other regions of the country, the annual volume of pomegranate production in the republic may reach to at least 600 thousand tons in the next 5-10 years.

Will the plans be realized?

It should be mentioned that these are still only grandiose plans, the implementation of which may be hindered by many factors.

First of all, it is the climate of Uzbekistan, which is not the best for cultivating pomegranates, even in the southern regions of the country, pomegranates periodically freeze in winter. As a result, pomegranate bushes are often covered for the winter and this is a very labor-intensive process even when growing pomegranates on a 1-hectare surface. However, if plans to establish tens and hundreds of thousands of hectares are realized, it is difficult to imagine how these areas can be protected from the cold in the winter.

The second factor is the ambitious yield indicators estimated in the business plans. Reality tends to be less optimistic than the plans.

The third factor is the varietal composition. The global pomegranate market is indeed growing, but it needs high quality fruit of certain varieties, while in Uzbekistan the emphasis is made on local selection, which is not highly valued in the world market.

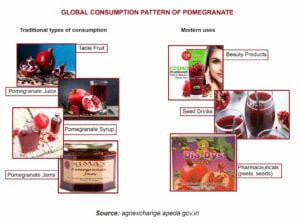

It might be worth thinking about industrial processing of pomegranate for Uzbekistan, if production continues to grows so rapidly, and traditional local varieties are used for cultivation. After all, as we will describe below, pomegranate is a very interesting crop not only for the fresh fruit market, but also for the processing market, both food and cosmetic and even pharmaceutical.

Uzbekistan is not a major player in the international fresh pomegranate market yet, so it will inevitably face export difficulties when selling fresh products. The country exports an average of 10 to 15 thousand tons of fresh pomegranates per year, and almost all of this is exported to the former USSR countries. The growing supplies of pomegranates from Uzbekistan to the markets of South Korea and the UAE inspire certain amount of optimism.

World market: is pomegranate a new avocado?

Uzbekistan is betting on the role of one of the leading producers of pomegranates in the world and the largest in the Central Asian region.

Despite the fact that pomegranate accounts for a very small share in the total turnover of fruit and vegetables in the world, its consumption is growing rapidly. Total global pomegranate imports from 2014 to 2018 grew by 24%. At the same time, many market experts expect the global pomegranate market to grow at almost the same rate as the avocado market. Especially against the background of the coronavirus pandemic, pomegranate, which contains a large amount of antioxidants, is highly demanded by the population concerned about immunity and the search for “superfood”.

Not only healthy food, but also cosmetics and even pharmaceuticals!

Pomegranate has two unique components that are considered to be very healthy. Punicalagin is a powerful antioxidant found in the seeds and skin of pomegranate, an antioxidant activity of which is almost 3 times higher than that of red wine or green tea. Punicid Acids, obtained from pomegranate seed oil have powerful biological effects. Due to its unique properties, pomegranate is in constant high demand on the world market, and world prices for it continue to grow, despite the growth in the area of pomegranate orchards in many countries of the world.

According to research by the Special Department for the Development of the Export of Agricultural and Processed Foods of the Ministry of Commerce and Industry of India, the total global market for pomegranate and pomegranate seeds was estimated at $8.2 billion in 2018, and is projected to increase to $23.14 billion by 2026 – almost 3 times (!). The main factor underlying this forecast is the growing demand for products made from raw pomegranates and there are a lot of them: pomegranate powder, pomegranate juice and various drinks from it. Moreover, pomegranate is used not only in food, but also in the cosmetic industry, where it is becoming more and more widespread. Pomegranate is also used in pharmaceuticals.

The largest segment of the pomegranate processing market is the consumption of pomegranate powder. 4.8% average annual growth rate of this segment is projected in the next 5 years. Second in the market share are concentrates, which are used to produce pomegranate juices, syrups and sauces. In addition, the popularity of the consumption of pomegranate juices and cosmetics made with the use of pomegranate (extracts of grains, seeds, peels, etc.) is growing.

Largest pomegranate importers and consumers

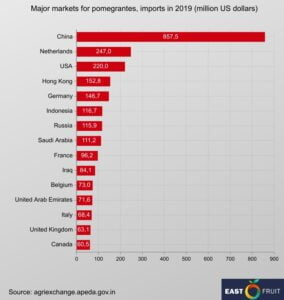

The largest consumer of pomegranate in the world is the Asia-Pacific region (APR). It accounts for about half of the global consumption (45-50%). It is followed by Europe (20%), North America (15%), the Middle East and Africa (10%) and Latin America (5%).

As the world’s largest consumer, the Asia-Pacific region is also home to leading pomegranate producers such as India, Iran and China. At the same time, the first two countries are net exporters of this product, and the demand for pomegranate in China far exceeds the volume of domestic production, so China is a major importer of pomegranate.

About 65% of the total volume of pomegranate consumption in the world falls on the food industry (fresh consumption, juices, syrups, sauces, jams, etc.), about 20% falls on cosmetics and 15% falls on the pharmaceutical industry.

As for pomegranate importers, China is the absolute leader. In 2018, China imported pomegranates worth of $857.5 million, and if counted together with Hong Kong, of a little more than $1 billion.

Producers and exporters of pomegranate

India is the largest pomegranate producer in the world. India is increasing its production of pomegranate by 20-25% annually. The most popular pomegranate grown in India is Bhagwa, which has a very sweet taste and high quality. The pomegranate ripening period lasts 11 months a year there, which gives India a huge advantage over other leading producers and exporters.

The geography of export of fresh pomegranates from India covers about 35 countries of the world, the largest of which are the United Arab Emirates (32% of India’s total exports), the Netherlands (11%), Saudi Arabia, Oman, Nepal and Qatar.

Despite the fact that China and Hong Kong are the largest importers of pomegranate in the world, they account for a small share of the total supply from India. It is believed that the reason for this is the political tensions between China and India. Accordingly, this situation gives Uzbekistan a great advantage, since other leading world producers of pomegranates are located further from China than Uzbekistan.

At the same time, it should be noted that China is also a major producer of pomegranates, and the harvest season in China lasts from July to November, while in Uzbekistan it lasts from September to November, thus the seasons in Uzbekistan and China overlap, which makes the Uzbek pomegranate less attractive to the Chinese market. The prospects for exporting pomegranates from Uzbekistan to the Chinese market can be increased by improved technologies for long-term storage of pomegranates to extend the supply season.

Other major producers of pomegranates in the world are Turkey, Iran, Tunisia, Peru, Israel and Azerbaijan. Due to their geographical location, all of them are the main competitors of Uzbekistan in the markets of the European countries and Russia. In addition, pomegranates are harvested in most of these producing countries almost in the same period as in Uzbekistan.

Russia imports its biggest share of fresh pomegranates from Turkey. Large suppliers also include Iran, Azerbaijan, Egypt and Peru. Uzbekistan and even Georgia have in recent years joined the countries that are actively increasing the exports of fresh pomegranates to Russia.

Therefore, the trend for large-scale pomegranate cultivation in Uzbekistan is very promising but the prospects of this business will depend on the thoughtfulness of decisions made by producers and the level of technologies for growing and processing products.

The results of research on the global pomegranate market conducted by the Agricultural and Processed Food Products Export Development Authority of the Ministry of Commerce and Industry of India were used in this material.

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.