Onion market in Eastern Europe is in a serious turmoil – EastFruit has recently published several important materials on onion and problems producer face. At the same time, Uzbekistan and other Central Asian countries have already started harvesting early onions.

High interest in the topic makes it important to clarify what the general situation on the regional onion market is, what to expect in the coming weeks and in the new season, whether production falls, prices recover, how export niches change, and who can make profit on onions.

These issues will be covered in this voluminous material. We advise you to read it to the end to get a complete picture of the “onion perspectives”. Let’s start with the analysis “from west to east”.

The most western market included in the EastFruit wholesale price monitoring is Poland. To understand in more detail the current situation in Poland, we should look at the situation in the EU as a whole in the 2020/21 season.

Onion market of the European Union and Poland

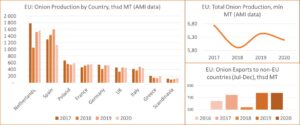

According to the AMI agency, the total onion production in the EU decreased by 4% in 2020 compared to the previous year to 6.2 million tons, but this was due to a sharp drop in production in Spain. Spain is the largest producer and second largest exporter of onions in the EU after the Netherlands.

The production of onions in Spain fell immediately by 30% in 2020 compared to the previous year and was 20% lower than the average for the previous 3 years. In other countries, production has either been at an average level of the past few years or increased compared to 2019.

Thus, there was an abundant supply of onions on the EU market, while the demand remained the same or decreased in some segments. Firstly, due to new waves of COVID-19 Pandemic, the demand for onions from HoReCa enterprises and processors has not returned to pre-pandemic levels. Secondly, consumers have realized that eating onions does not help prevent coronavirus infection, therefore, the surge in demand recorded in the spring of 2020 has not been repeated. Thirdly, the demand for onions has also decreased in the traditional export markets for EU producers, and the export of onions to countries outside the EU remains at the level of the previous year.

Since the domestic demand has significantly decreased in the EU, price levels depended, among other things, on the export capacity and quality. For instance, Poland exported the same volume of onions in the first half of the 2020/21 season as in the previous season (69 thousand tons), although production in Poland increased by 8% compared to the previous year. As a result, although the situation in Poland developed from the beginning of autumn as it did last year, prices were decreasing, and there was no jump in prices in the second half of April, unlike last year.

At the same time, onion exports from Netherlands in the first half of the season were at their highest level in the last five years (1 million tons). In addition, Dutch exporters managed to take over those markets where Spanish producers were previously present. Accordingly, prices were slightly higher in autumn and winter than last year.

For example, the average price for assorted yellow onion from a packing facility in the Netherlands was $ 0.31/kg in November 2021. But exports fell sharply since January and prices fell to last year’s level. Price for sorted yellow onion from a packing facility in the Netherlands is currently $0.23/kg. In fact, the price of onion in the Netherlands is now even lower than in Poland, as it also includes the costs for sorting. Similar trends are observed in Germany, and a significant increase in onion prices in the EU in the spring of 2021 was recorded only in Spain, where, production fell significantly.

Ukrainian onion market

Moving further to the east, we move in Ukraine, where several negative factors coincided on the onion market in the current season. Firstly, the production of winter onions increased significantly in spring 2020, and the sales season for winter onions extended, causing the delay of the sales of later varieties. Secondly, one of the highest yields of onions for storing was harvested in the fall. Thirdly, the lack of systematic approaches to the exports of onion has led to insufficient export, although it has potential to achieve record results this season , and in April, onion exporters from Ukraine even knocked down the rise in prices in neighboring Belarus.

As a result, the lowest price for onions in the region is in Ukraine. The main volumes of onions of acceptable quality are offered at $0.11-0.13/kg, and the maximum price for export-quality onions is $0.16/kg. Nevertheless, there are quite a few such producers on the market, since, according to the farmers, the quality of the stocks is now quite low. Moreover, the surface cultivated with onion is said to be reduced sharply in 2021. Ukrainian onions of below-average quality can be purchased even at $0.07-0.09/kg, but the demand is very low.

Russian onion market

Onion producers in Russia are also unhappy with the situation in spring 2021. Market players here also discuss a possibility of reducing the surface cultivated with onion in the new season. Supermarket chains and large wholesale companies prefer to buy either last year’s imported onions from Central Asian countries, or not to rush into purchases the new harvest from this region. In addition, the imported onion harvest in 2021 from Egypt is present on the market despite the higher price.

At the moment, buyers are ready to pay up to $0.16/kg for high-quality local onions. Russian second-class onions are offered from $0.09/kg, and processors buy onions starting from $0.05/kg.

Meanwhile, there are shipments of last year’s products from Kazakhstan, Uzbekistan and other Central Asian countries in significant volumes in Russia, and their price reaches $0.23/kg at its maximum. There are onions of a new harvest from Egypt, but due to the relatively high prices they are mostly supplied to supermarket chains. Egyptian onions are offered from $0.45/kg in the southern regions, and in Moscow, can be sold at $0.52-0.57/kg.

It is also obvious that Russian retailers are now interested in new harvest onions from Central Asian countries, where harvesting has already begun. This will be discussed below.

Onion Market of Moldova

Dissatisfaction with the situation on the onion market is now not limited to Ukraine and Russia, but is felt in other markets as well. For instance, there are farmers in Moldova that are ready to give onions for free , in order to not spend money on disposal. Most of the producers are also certain that the area cultivated with onion will decrease in the new season, and according to local seed suppliers, it may decrease by 40% this year.

At the moment, prices for onion in Moldova vary within the range of $0.15-0.17/kg and are already 2.6 times lower on average compared to the same period last year! The main reasons for the lack of price growth are the active imports, which begins immediately after local farmers attempt to raise prices, and the absence of exports.

In Romania, which previously bought onions from Moldova, Moldovan exporters are losing to exporters from the Netherlands and Poland, and exporters from Ukraine do not let Moldovan producers raise prices in the local market.

Onion market in Belarus

Another country where Ukraine knocked down the rise in onion prices this spring is Belarus. Although the average price for onions in Belarus rose from $0.27/kg to $0.37/kg in March, imports from Ukraine immediately stabilized the prices, and it even dipped slightly to $0.35/kg.

Onion market of Georgia

The next country where onion prices are currently significantly lower than last year is Georgia. At the same time, for the second season in a row, onion imports to Georgia have been kept at the highest level for the last five seasons. Thus, Georgia imported almost the same volume of onions in July 2020 – February 2021 as in the previous season (21 thousand tons).

In fact, the pricing on the market for onions in Georgia is again based on imports, and prices are lower than in April last year, due to their decline in the markets of neighboring countries and the generally weak demand in the market due to the pandemic. In addition, onion cultivation in Georgia were seriously affected by heavy rainfall and hail in September 2020, so onions of initially unsatisfactory quality were often stored.

Onion market of Uzbekistan and Tajikistan

Meanwhile, in Uzbekistan and Tajikistan, prices for last year’s harvest are also lower than a year earlier, although importers from Russia continue to purchase significant volumes of onions produced in 2020.

In Uzbekistan, this price decline is due to the devaluation of the local currency, as prices in Uzbek currency have remained on last year values in the past few weeks.

Onion production in Tajikistan increased in 2020, and the country approached the second half of the season with rather high stocks, which continues to put pressure on prices. In addition, market players are preparing for an active start of the early production season and are stepping up sales of last year’s stocks. The minimum price for onions of the 2020 harvest in Tajikistan fell to $0.05/kg in the middle of this week.

Early onion market in Central Asia

The first batches of early onions arrived in the countries of Central Asia at the beginning of April. So far, the onions are not matured enough, but Uzbek and Tajik exporters of fruit and vegetables are ready to ship 15-20 tons of early onions and guarantee their high quality. According to the information from the producing regions, the size of the onion bulbs meets the required minimum standards. Nevertheless, buyers are not enthusiastic to import products for the time being, fearing that the onions are not dry enough to withstand long-term transportation. The second limiting factor is the relatively higher price, because last year’s onions of acceptable quality can be bought 2-3 times cheaper in these countries.

Winter onions are now sold at an average of $0.29/kg in the wholesale markets of the capital of Uzbekistan, and the prices at producer’s level start at $0.21-0.22/kg in the southern region of the country. So far, most of the winter onions here are still unsuitable for export, and the intensification of supplies from the southern regions of Uzbekistan to foreign markets is expected in the third decade of April – early May, and from the central zone it is expected 2-3 weeks later.

In Tajikistan, winter onions arrived on the market a little earlier – at the beginning of April and it was offered on the markets and supermarkets at a retail price of about $1.00/kg. As of mid-April, farmers sell at $0.30/kg, while in wholesale markets the price is $0.40-0.45/kg. Currently, the demand for early onions is quite high, but the supply on the market is still insufficient. Considerable quantities of early onions from the southern regions of Tajikistan will begin in early May, and from other regions – 2-3 weeks later.

It should be noted that wholesale companies from Russia, the main market for onion exporters from Central Asia, are ready to supply onion of the new harvest at $0.44-0.52/kg in the hope of a quick decline in prices in the coming weeks. Market players in Tajikistan also report an active demand for the future harvest from importers from Afghanistan, who are already contracting onions for delivery in 10-15 days at an average price of $0.14/kg.

It should be considered that the price of early onions began to fall immediately, last year it happened short after the first large batches of products appeared on the Central Asian market. Prices in both Uzbekistan and Tajikistan fell threefold by the end of May 2020 compared to the beginning of April. Market players attributed the fall in prices in the spring and summer of last year to Covid 19 restrictions that impeded the normal export of early onions to Russia, although Tajikistan had a certain alternative in export supplies to Afghanistan and Pakistan. Many farmers suffered significant losses and were forced to sell their products on the domestic market, which sharply increased the volume of supply. Part of the harvest was given to the population for free.

However, the situation may develop in a slightly different way this year. According to interviewed farmers in the Tashkent region, after last year’s price collapse, winter onion producers have reduced their surfaces cultivated with onion in Uzbekistan, some of them up to 50%. In addition, the onset of early cold weather in November-December last year had a negative impact on the winter onion crop, which led to a reduction in the 2021 harvest. In the southernmost region of the country (Surkhandarya), farmers did not experienced reduction in the cultivated area, but they also noted the negative impact of early winter on the winter onion yield, which led to a decrease in the harvest volume and an increase in the quantities of small-sized onions.

On the other hand, winter onion producers in Tajikistan increased the cultivated area last fall due to active exports to Afghanistan and Pakistan. Spring frost in 2021 certainly affected the harvest, but it is still too early to quantify the impact of the weather factor.

Summary and prospects of the onion market in 2021:

- Many of the countries of the EastFruit region can enter the new season with high stocks of the 2020 harvest (as in Ukraine, for instance) and their constantly deteriorating quality (as in Russia).

- However, the start of the early production season in Eastern Europe will be delayed by at least two weeks, which could help farmers to sell off their last year’s stock.

- On the other hand, exporters of early onion from the countries of Central Asia can also take this opportunity, especially since a large supply of their early export quality onions will be available in the near future. However, early onion will not be cheap, which means that there are still hopes for an increase in onion prices in May-June among those farmers in Ukraine, Russia and Belarus who have stocks of high-quality products in modern storage facilities.

- At the same time, it will be difficult for producers of early onions in Russia and Ukraine to get a high price, and Ukraine may completely lose the market of Belarus if the latter switches to Central Asia.

A decrease in onion cultivated area can be expected in most Eastern European countries in 2021. However, farmers often change their plans during the season, and the clearer picture will be seen only by the end of summer. If their plans do not change, onion prices in Europe may begin to recover as early as July.

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.