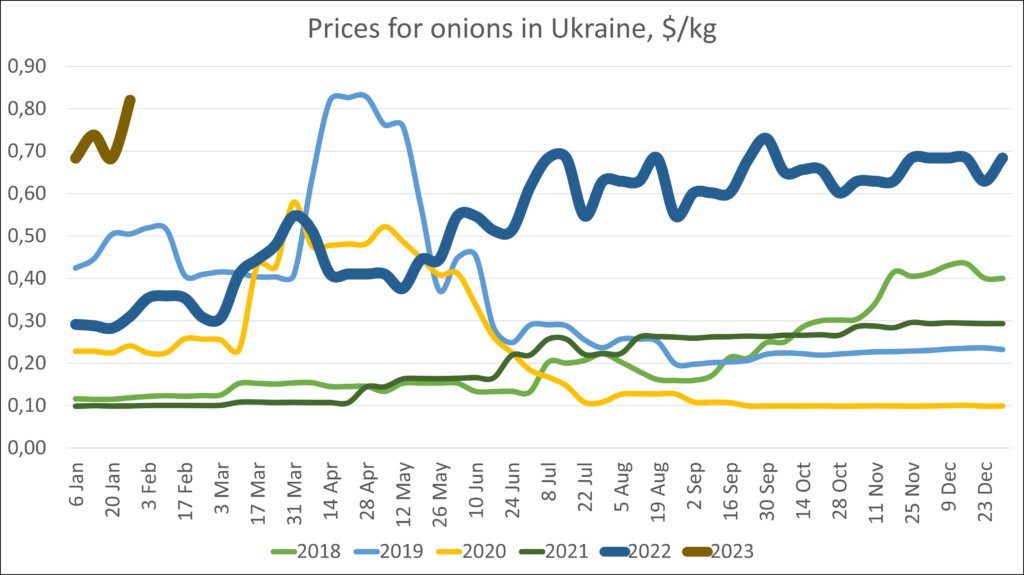

The onion crisis, which in recent weeks has reached a global, or at least continental scale, is now one of the most widely discussed topics in the horticulture business. Ukraine was no exception in this regard, and we have seen the interest of easy money lovers and players in the “vegetable casino” to enter the onion business at least since the summer of 2022, when, according to EastFruit monitoring, unprecedentedly high onion prices were established in the country.

“Since the prices for onion in Ukraine did not decrease during the current season, the interest in earning money on onion production in the country became only higher over time. The current key issue that disturbs the minds of Ukrainian farmers is a possible price limit in the spring-summer of 2023,” comments Evhen Kuzin, head of the analytical division of the APK-Inform: Vegetables and Fruits project.

As a result, two expected events took place on the Ukrainian market, which will have a direct impact on the price prospects for the end of the current and the beginning of the next season.

Firstly, a few farms that still have stocks of high-quality onions in Ukraine have suspended sales since the beginning of February, setting a declarative price of up to $0.96/kg.

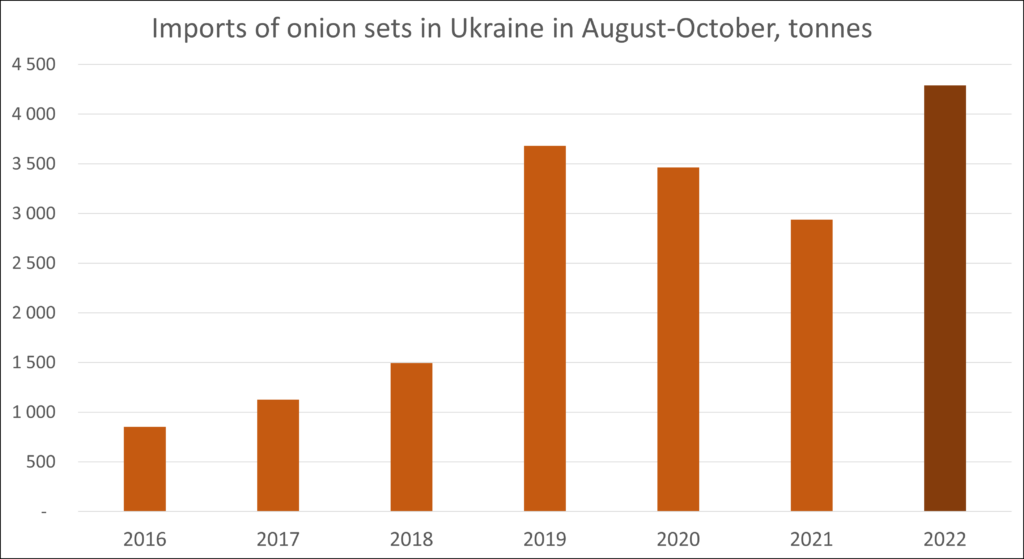

Secondly, a sharp increase in demand for onion seeds was recorded in the country, and imports of onions for planting extra-early winter onions reached a record in 2022.

“Farmers with stocks of last year’s harvest, and those who will harvest onions this year, expect to take advantage of the onion crisis, while receiving super profits. At the same time, producers with last year’s stocks have very good prospects for this, but the new 2023/24 season may still begin with bitter disappointments,” Evhen Kuzin believes.

It should be noted that due to difficult conditions in the spring-summer of 2022 and the occupation of the southern regions of the country, the number of Ukrainian producers who can store high-quality onions in storage until April-May 2023 has greatly decreased. Nevertheless, they are still there, and it is quite natural for them not to force sales now in the hope of setting new price records in the spring of 2023, which are quite possible.

“First of all, the list of countries that will be able to export onions to Ukraine in the spring of this year has recently become noticeably shorter. Temporary bans on onion exports were introduced in Kazakhstan, Tajikistan, Uzbekistan, Kyrgyzstan, and Azerbaijan in the last three weeks, and similar measures were introduced in Turkey back in November last year. Moreover, according to unconfirmed information, the government of Iran has introduced an export duty and is also considering export restrictions in the future,” Evhen Kuzin continues.

As a result, the list of possible onion suppliers to the Ukrainian market by March-April may narrow down to just a few countries. One of the key players in the spring of 2023 may be Egypt, where just at that time farmers will be harvesting onions of a new crop. However, there are two hitches when it comes to Egyptian onions.

Firstly, the spring harvest of Egyptian onions is not suitable for all categories of buyers, as during this period bulbs are unripe and do not have enough skin there. Secondly, the demand for Egyptian onions will be booming in Ukraine and throughout Europe due to onion crop failure. And this means that there may be not enough Egyptian onions for all importers.

“Importing is a necessary measure for Ukraine during the seasons of a poor harvest of local onions, but, for example, the UK alone imports 260 000-360 000 tonnes of onions annually, regardless of the season. As for EU countries, the Netherlands annually imports 250 000-360 000 tonnes, Germany – 250 000-290 000 tonnes, Poland – 160 000-220 000 tonnes, and France – 130 000-150 000 tonnes. For comparison, the annual record of onion imports to Ukraine was only 80 000 tonnes. In other words, the Ukrainian market will remain an important sales market for onion exporters in the spring, but they will have other areas of priority,” Evhen Kuzin analyzes.

Besides Egypt, onions will be imported to the EU countries from more distant countries. In addition to traditional New Zealand, there may be onions from South Africa, Chile, and several other countries of the Southern Hemisphere on the EU market. Theoretically, they may become available in Ukrainian supermarkets this spring, but the volumes will be minor and, most likely, will be limited to a few premium stores in large cities.

“Ukrainian producers that can store onions until March-April are likely to take advantage of the unprecedentedly high prices, which by that time may grow even more significantly. This expectation is also based on the fact that the governments of the countries of Central Asia and other regions are unlikely to lift the export ban earlier than the announced dates, fearing public outrage at high prices within these countries,” Evhen Kuzin believes.

At the same time, the situation of the Ukrainian onion market may change dramatically starting from May, because the number of variables on the market will increase significantly then.

Firstly, the dependence of the Ukrainian onion market on imports will reach its peak by April-May. Recall that already now onion prices in Ukraine are formed according to the prices in Germany since it is currently the key supplier of onions to the Ukrainian market.

By the end of spring (and possibly by the beginning of summer), the bans on the export of onions in the countries of Central Asia and some other states may well be lifted. Given the so far unconfirmed rumors that winter onion crops in Central Asia were practically not affected by frosts (for example, Tajikistan is concluding a contract with Kazakhstan on the supply of onions of new harvest), significant volumes of imported onions of acceptable quality may become available on the market in early summer.

Secondly, in no case can one ignore the growth factor in demand for onion sets and seeds, which is a rush one in the Ukrainian market. Earlier the production of winter onions was concentrated in the currently occupied regions of Ukraine, which allowed such farmers to enter the market several weeks earlier than the earliest varieties of spring onions were harvested.

Theoretically, the areas for planting onions before winter should have expanded in the Odesa and Mykolaiv regions in the fall of 2022, because the climatic conditions there are similar to the Kherson region. Naturally, many farmers expanded their plantations of winter onions in the southern areas, but, as it turned out, everything was not limited to them.

Many migrants from the Kherson region that fled from the Russian army, tried to launch the production of winter onions in 2022 not only in the south but also in the west of the country.

In the absence of supplies of the earliest varieties from the Kherson region, local onions of a new crop may be harvested in the Odesa region at the end of May, and in more northern regions in June, that is, during the expected peak of prices in the Ukrainian market.

However, this is where two pitfalls of the Ukrainian onion market in 2023 lie. Firstly, this market is not isolated from other global players and is only a part of the global onion industry. As we have pointed out, the situation on the global market may change dramatically by the summer, and large volumes of onions may well flow into Ukraine, for example, from the countries of Central Asia and Azerbaijan or Iran.

Secondly, the infrastructure for growing onions in the west of Ukraine is not designed for a sharp increase in the supply of winter onions, not to mention spring ones. The key limiting factor is that the grown products must either be sold immediately or dried, which will be the main problem in the west of the country.

“A sharp increase in imports of onion sets for planting before winter and an increase in the harvest of winter onions in western Ukraine may lead to periods of oversupply in these regions, as, incidentally, happened earlier in the Kherson region. A large harvest of winter onions in 2020, followed by a no less record harvest of spring onions, more than halved prices from $0.40/kg in June-July. Then the price in July fell again by half and rarely exceeded $0.11-0.13/kg until mid-April next year,” recalls Evhen Kuzin.

Naturally, it will most likely not be possible to fully compensate for the loss of parts of the Kherson and Zaporizhzhia regions by expanding the production of winter onions in the south and west, as well as spring onions throughout the territory of Ukraine. However, the rapid and massive ripening of significant volumes of onions in regions without drying capacities can lead to temporary and rather unpleasant price drops for farmers.

In 2020, record volumes of winter onions were not sold before the start of the season of early varieties of spring onions, the sale of which was not completed as planned, too. This led to price stagnation because the harvesting and sales overlapped each other until the end of the season.

This scenario is very unlikely, but a price drop is possible when the supply of winter onions of the new crop starts. Further stagnation of prices in the face of a sharply increased supply of low-quality spring onions from market newcomers and seekers of “easy money” cannot be ignored. In addition, the global situation cannot be ignored, although it is hard to forecast now.

“Nevertheless, we are sure that the dependence of the Ukrainian onion market on imports will significantly decrease in the 2023/24 season, although it will remain quite high, especially in the second half when low-quality local onions will leave the market. In this case, we will most likely talk about prices that are not quite attractive for players in the “vegetable casino”, – Evhen Kuzin sums up.

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.