As soon as the prices for any fruits on the Ukrainian market decrease, people nostalgic about the times when there was a free trade between Ukraine and Russia start to complain. These are mostly farmers who believe that if there was access to the Russian market, Russia would buy all these fruits and prices would not go down.

However, if we put aside emotions and politics and look at the facts, it becomes obvious that it was the loss of access to the market Russian market that allowed Ukraine to make a real breakthrough in the fruit and vegetable business, significantly increasing both the value of exports and the quality of fruit and vegetables.

I want to emphasize that I express my personal point of view, which is based on more than 25 years of experience in international agribusiness and professional analysis of agricultural markets. My experience shows that any protectionism is harmful, primarily for a country that restricts competition. However, the Russian Federation decided to ban Ukraine and other countries from selling food products on its territory, and other countries mostly did not reciprocate. Therefore, we will just take it as a the fact and analyze the actual consequences.

I will consider the main theses of those who believe that Ukrainian farmers would be in a much better position if Ukraine had access to the Russian market and comment on them.

Thesis 1: “The exports of fruit and vegetable products from Ukraine decreased after the loss of access to the Russian market”

This is wrong. The exports of fruit and vegetable products has increased, and it happened much faster than at the time when there was access to the Russian market. Export statistics are available free of charge, for example on Trademap.org. Objections may arise that “statistics were falsified by Ukraine,” but skeptics are mistaken here – this is a statistics system created by the UN and WTO, and the data therein can be verified by requesting mirror statistics. I do this regularly, and there are no significant deviations in the data.

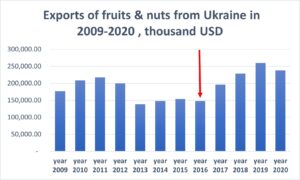

Let’s move on to specifics and consider the dynamics of export volumes from 2009 to 2020.

The red arrow marks 2016, when Russia banned the import of vegetables and fruits from Ukraine. It is easy to compare the indicators of 2020 and 2015, when trade was free.

It turns out that since the ban on supplies to the Russian Federation was imposed, Ukrainian fruit exports have grown by 55% or $ 84 million. 2020 was tough – abnormally late frosts destroyed the berry harvest and sharply reduced the harvest of other fruits, which makes this comparison even brighter, as we do not take as a basis any particularly successful year for exports.

By this we could put an end to the question whether there was growth or decline in exports. Obviously, without access to the Russian market, our fruit exports began to increase rapidly and are now higher than ever before.

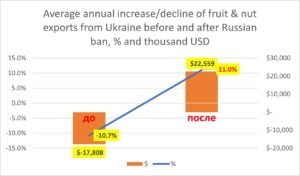

However, it is also worth comparing the growth or decline rates of exports before and after the ban on the supply of fruits, berries and nuts from Ukraine to Russia was imposed.

To avoid data distortions, let’s take a long period before the ban, from 2009 to 2015 inclusive, and see what happened to the exports of Ukrainian fruits, berries and nuts. We estimate the trends for this period and find that Ukraine annually exported 10.7% less fruits and reduced export income by $ 17.8 million per year during this period! It means that exports showed a steady downward trend during this time considered favorable by many farmers.

Now let’s look at what happened after the ban. In 2016-2020, the average exports growth rate was 11% per year, and the revenue of Ukrainian farmers grew by $ 22.6 million per year!

What is better – an 11% drop or an 11% increase per year? What is better – minus $ 17.8 million in revenue each year, or plus $ 22.6 million?

It may seem that Russia has not influenced the Ukrainian horticultural business at all, and the growth is a coincidence. Instead, I will later explain that the ban on supplies to the Russian Federation had a huge positive impact on Ukrainian horticulture. For now, however, I will move on to the following erroneous and manipulative theses.

Thesis 2: ” European countries do not need Ukrainian fruit, berries and nuts – without Russia, there is no one to sell them to!”

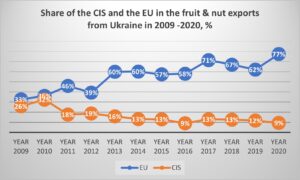

In fact, such statements do not hold water and the following chart explains why.

The share of EU countries buying fruit products from Ukraine has always been higher than the share of Russia and other CIS countries. Even in 2010, when the two figures were as close as possible, the EU provided 36% of revenue, and the CIS – only 32%. In 2020, 77% of Ukrainian fruits, nuts and berries went to the EU, and only 9% to the CIS. Thus, Ukrainian fruit products were in demand in the EU even during the times of free trade between Ukraine and Russia.

Then why do many Ukrainian farmers have this wrong opinion that their products are demanded in Russia, and not in the EU? The reason is that among horticultural products Ukraine mainly sold apples to Russia. The Russian market accepted low-quality and even unsorted apples, while the EU market doesn’t need them at all.

However, farmers nostalgic about selling low-quality apples to Russia forget about two important points:

1) The Russian market has changed, and several years before the ban on supplies to Russia, the volume of Ukrainian apple exports to the Russian Federation was rapidly declining because Russia also demanded higher quality of apples.

2) Apples have never been the main export commodity of the Ukrainian fruit segment. The share of apples in the exports of fruit products of Ukraine in 2012-2015 was about 3%. By the way, in 2016-2020, the share of apples in exports increased to 5%, even despite the aforementioned overall sharp increase in export earnings!

Thus, the figures once again confirm that only farmers who have poor growing technologies and apple quality think Russian market was essential for the Ukrainian horticultural industry. It is also obvious that they still do not have credible information about the developments on the Russian apple market.

Thesis 3. The Russian market is the most promising one for selling Ukrainian fruits

Undoubtedly, Russia is a huge sales market. However, Ukraine and Russia are located in similar climatic zones, so the range of fruits, berries and nuts grown in these two countries will be similar. Also, if something is grown in Ukraine and is demanded but not grown in Russia, there is no reason why it cannot be grown in the Russian Federation. Therefore, it is more reasonable to target markets where your products can be unique.

Let’s analyze the trends in the Russian market in order to understand whether it is promising, or, conversely, dying?

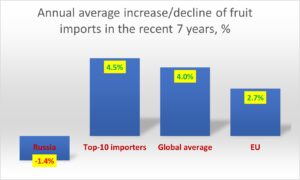

To begin with, let’s look at the top 10 world importers of fruits, nuts and berries and analyze long-term import trends. Russia became seventh at the end of 2020. Among the 10 largest world importers of fruit products, Russia is the only country that reduces imports of fruits, berries and nuts! We analyzed all the products, including the exotic! This means that among the 10 largest importers, Russia is the least promising fruit market.

Is the global fruit market declining? Do other regions also show a drop? Let’s look at global trade statistics again and get this picture.

The global average growth rate of imports of fruits, berries and nuts is an impressive 4.0% per year, and the top 10 importers are increasing imports even faster – by 4.5% per year. At the same time, Russia is reducing imports by 1.4% per year. By the way, the European Union, which allegedly does not need Ukrainian fruit, is also increasing imports, unlike the Russian Federation, and the growth rates are relatively high – 2.7%, although lower than the world average.

Undoubtedly, the European Union is a more promising sales market for fruits, nuts and berries from Ukraine than the Russian market, given market trends.

Even if these facts, which are easy to verify, are not convincing enough, you can turn to the example of neighboring Moldova that has free access to the Russian apple market. In 2020, apple harvest in Moldova was at a record low for recent years. At the same time, as of June, apple stocks of Moldovan farmers were record high, prices were almost record low, and still there was no demand for Moldovan apples in Russia. As a result, having grown and stored them for 8-9 months, Moldovan farmers were forced to sell high-quality apples for processing at bargain prices.

Why doesn’t Russia need Moldovan apples? The reason is the same for why open access to the Russian market would not solve the problems of Ukrainian farmers having poor fruit quality – there is a wide choice of fruits in the world and Russian consumers prefer higher quality products. In our article on the reasons for the low prices for Ukrainian apples this season we wrote in detail about the rapid expansion of Turkey. And Iran may even become the world leader in apple exports at the end of the 2020/21 season!

Nevertheless, Russia has continued to develop its own production all these years. It also has serious problems with its product quality. Therefore, low-quality fruits remain in low demand in Russia – there are too many of them. And, as you know, the cheaper the product, the less profitable it is to transport it, because transportation has a greater share in the cost of cheap products than in the cost of expensive ones.

5 or 10 years ago the Russian market was completely different. Now it does not need cheap apples of low quality, and if it does, their price is the same as in Ukraine. The picture for any product in the fruit segment will be absolutely the same. For instance, Uzbekistan, despite the damage from frosts, was forced to sharply reduce the prices for cherries supplied to the Russia this year.

Many countries invest in fruit production and quality, so being nostalgic about past is useless. It is better to invest this time in becoming better yourself and finding new, more promising sales markets.

Why do I believe that the loss of access to the Russian market had a positive impact on the fruit and berry segment of the Ukrainian horticulture business?

I convinced Ukrainian farmers to diversify fruit exports even before there were the first signs of losing access to the Russian market. There were several good reasons for this:

- Business risk is too high if all products are sold at one sales market.

- The risk is even higher if the requirements and preferences of this market are very different from all other leading sales markets, as in this case you find yourself completely dependent on the buyer. The example of Moldovan apples is a proof of it.

- Russia has similar climatic conditions and grows or can grow similar products as Ukraine, which makes Ukrainian fruits not unique and weakens Ukraine’s position in this market.

- Russia has proven itself to be one of the least reliable and predictable trading partners, as evidenced by numerous, often politically motivated, bans on access to its market for Poland, Moldova, Turkey, Georgia and other countries. This means that the business risk is even higher, if you trade only with the Russia.

- Russia, despite the widespread misconception, paid less for Ukrainian fruits in comparison with what could be obtained in other sales markets, which we subsequently proved many times, helping to diversify Ukrainian fruit exports.

- Russian population does not have a high level of income, which means it is much more difficult to sell high-quality products at a premium price there.

- Since Russia has always lagged far behind the global trends in fruit and vegetable consumption, orientation towards this market reduced Ukraine’s chances of receiving higher export earnings due to its rapid focus on trend niches and segments of the horticulture business.

Therefore, when Ukrainian farmers realized that the Russian market was closed, they began to use the information that we provided as part of projects to diversify Ukrainian food exports. We helped organize a number of trade missions, selecting and preparing participants, and found that Ukrainian fresh berries could well reach even Malaysia and Singapore at a premium price, not to mention apples. Having put in 10% more efforts, Ukrainian farmers managed to receive several times higher prices for quality apples in Southeast Asia, Middle East, Great Britain and other countries than importers from Russia paid.

A sharp decline in demand for low-quality fruits forced Ukrainian farmers to change the varietal composition of orchards, invest in storage and processing of products, and, most importantly, in their marketing and export promotion, which has returned a hundredfold. Now Ukrainian apples are sold more expensive than Polish ones in almost all countries of the world, because we managed to convince in our uniqueness and ability to make apples a finished high-quality product.

One of the main breakthroughs in Ukrainian horticulture was active investment in niche crops and the rapid development of the berry segment. Ukrainian berries are almost exclusively exported to the EU fresh and frozen, and this trend will only accelerate.

The focus on higher quality has also benefited Ukrainian consumers that can now buy high-quality Ukrainian apples at an affordable price even in June or July.

That is why the loss of access to the Russian market led to such a rapid growth in the exports of fruit from Ukraine. When access to the neighboring country’s market is resumed, it will only become an additional bonus for Ukrainian horticulture. While there is no access, it would be good for Ukrainian farmers to demand the authorities to open access to new markets where our products would be unique. I often say that it is very important for Ukraine to gain access to the Vietnamese fruit market and improve the access to the Egyptian fruit market. However, this should be covered in a separate article.

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.