EastFruit experts in Moldova spoke to farmers and representatives of fruit growers’ organizations in Moldova regarding the updated apple harvest outlook for 2023. It seems that due to the very hot second half of summer the outlook for fresh apple harvest in Moldova needs to be revised further downward. Now the total harvest is estimated at 480-500 thousand tons.

It is at least 50-70 thousand tons less than the estimates from the Ministry of Agriculture and Food Industry in July 2023 when apple harvest was expected at around 550-600 thousand tons. In August, at the Prognosfruit conference in Trentino, Italy apple production forecast for Moldova was out at 548 thousand tons.

Despite lower production forecast, apple harvest in Moldova in 2023 would still probably exceed last year’s 446 thousand tons. However, it is going to be a lot smaller than usually, as in 2021 Moldova harvested – 650 thousand tons of apples, in 2019 – 610 thousand tons, and in 2018 – 665 thousand tons. The only year when harvest was lower than what’s expected for 2023 is 2020, when frosts had a major negative impact and the harvest of fresh apples in Moldova fell down to 430 thousand tons.

According to the agronomists, there are a lot of apples on the trees, but due to the drought and hot summer, many of the fruits have not reached their optimal size. Also, in some old non-irrigated apple orchards, farmers seemed to not carry out all necessary operations on time trying to reduce costs, which also impacted the quality of apples negatively. Considering all of the above, it seems that there will be fewer high-quality apples in Moldova in 2023.

Read also: Moldova continues to promote apple to the Indian market

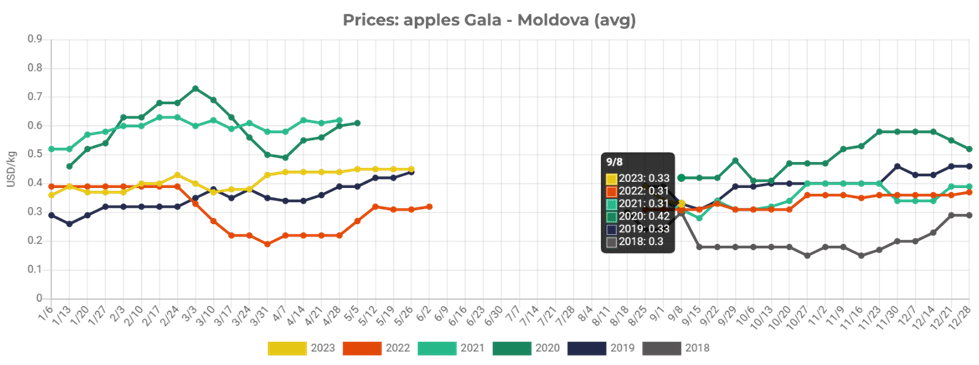

At the moment, “Gala apples” are sold on the Moldovan market at a wholesale price of 6-7 lei/kg ($0.31-0.33/kg). This is the usual price range for mid-September over the past three years, EastFruit analysts report. However, the autumn apple harvest has recently begun and has not yet entered the most active stage.

“Despite lower availability of high-quality apples in 2023, Moldova’s apple growers might actually make more money in 2023/24 thanks to expected increase in apple prices in Europe, Middle East and in the prices for industrial apples thanks to the growing apple juice concentrate prices”, says Andriy Yarmak, economist of FAO’s Investment Centre. He also notes that a rapid decrease in apple production area in Moldova actually helps the industry. “In Moldova we see an accelerating trend for uprooting the older non-irrigated apple orchards with outdated varieties, which have no demand on the international markets. This lowers the market pressure but the apple growers in Moldova need to continue investing into quality improvement as well as into international marketing of their apples to diversify their markets”, adds Andriy Yarmak.

In September 2023, six Moldovan apple juice concentrate production factories were loaded at 20-40% capacity. Processors raised purchase prices for industrial apples by 15-20% – up to 1.7-2 lei/kg ($0.09-0.11/kg). Factory managers note that they will accept all the apples that farmers offer to processors, fearing the deficit.

Considering the high share of low-quality fruits in the 2023 harvest, as well as the high demand for industrial apples, it can be assumed that a relatively small amount of apples will be stored. This means that apple prices on the local Moldovan market in the spring of 2024 might end up being very high.

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.