According to EastFruit analysts, in the first half of 2023 Ukrainian farmers managed export record volumes of fresh potatoes, despite Russian aggression against Ukraine. Yet, these records have bitter aftertaste and indicate serious problems for the sustainability of this industry.

Let’s start with facts and figures. Exports of commercial potatoes from Ukraine in the first half of 2023 amounted to 19.8 thousand tons – an absolute record. The last time Ukraine exported more than 10 thousand tons of potatoes in the first half of the year was 10 years ago, i.e. in 2013, when exports amounted to 14.7 thousand tons.

In addition, potato exports in the first six months of 2023 were 2.3 times higher than in 2022 for the same period and 3.8 times higher than the average over the past five years. The numbers look great, so what’s the problem?

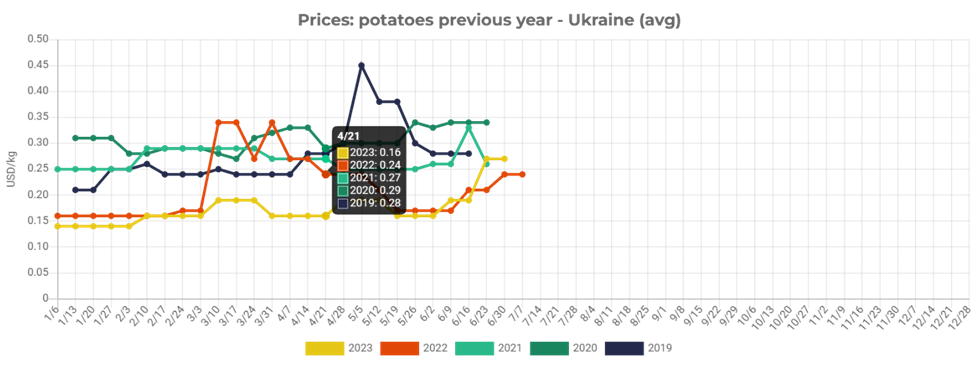

And the problem is what we have already mentioned many times. High potato exports from Ukraine usually coincide with huge problems for growers. The price chart for potatoes in the first half of the year says it all.

Only US $0.16 dollars per kg was the wholesale price of potatoes at the end of March 2023 in Ukraine. For any farmer who has ever grown potatoes, it is obvious that such a low price cannot possibly cover the costs of growing and even the costs of high-quality seed material.

The second bad news is that 91% of the record volume of potato exports from Ukraine went to one country – Moldova. Why? The answer is low quality.

“In Ukraine most potato growers do not see the difference between raw materials and finished products. Products dug from the field could get to the store’s shelves without any further cleaning, sorting, sizing, and packaging. At the same time, those who invest in potato post-harvest handling often find that after potatoes look even worse than before. This means we need to start with a complete revisit of approaches to cultivation, as Thomas Carpenter, a potato grower from Ireland, very clearly demonstrated through personal example at one of our conferences. Alas, the industry’s response to comments regarding product quality is usually completely unconstructive, and this leads to the fact that for many years in a row, producers continue to fall into the trap of low quality, which makes Ukrainian potatoes “unexportable.” Consequently, the absence of export possibilities causes prices to fall below the production cost,” says Andriy Yarmak, economist of the Investment Centre of the Food and Agriculture Organization of the United Nations (FAO).

As an example of more positive approaches, he cites Ukrainian apple producers who had the same problems when they lost access to the Russian market. However, they were able to adapt faster, although in this industry production cycles last much longer than in potatoes. As a result, Ukraine, which previously sold apples to only one neighboring country, now exports them all over the world, even to such distant countries as Singapore and Malaysia.

“For those who say that exporting potatoes is more difficult than apples, and that Ukraine still does not have access to the EU potato market, I immediately want to disappoint – the world trade in potatoes is growing quite quickly, while the apple trade quickly decreasing. However, access to the market will not appear on its own – to gain access to the market it is not enough to criticize the government – one needs to work with the government and help it open new markets,” says Andriy Yarmak.

In his opinion, any potato growing project in Ukraine that does not initially plan to export at least 20% of its output will be doomed to losses. See his old blog “Why low-quality potatoes are more expensive for the consumer, the grower and the supermarket in Ukraine” for more information.

This year we showed a practical example of what happens to potatoes from Ukraine on the Georgian market when products from Turkey enter the same market. Read the details of this story in the resonant blog of Fedir Rybalko “Why does no one need Ukrainian potatoes (available in russian and Ukrainian only)?”

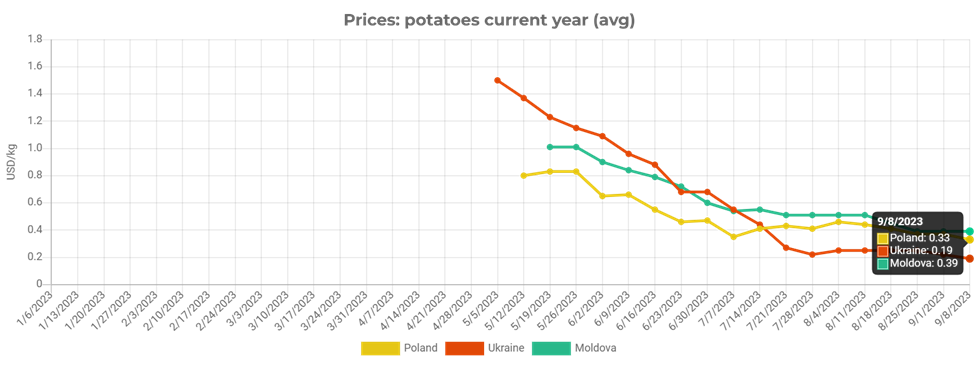

“Last season, and this season too, potato prices in Europe remain unusually high. However, Ukrainian potato producers continue to operate at a loss. Ukraine imported thousands of tons of onions from Uzbekistan, which is the world’s largest importer of potatoes for the fresh market. In the first five months of 2023, Uzbekistan imported 20 times more potatoes than Ukraine exported in total. However, Ukrainian potato growers did not export a single ton of potatoes to Uzbekistan. An industry that claims to annually produce millions of tons of marketable products would do well to spend at least a minimal amount on a systematic approach to promote exports and improve access to the markets,” says the FAO expert.

This season, potato prices in Ukraine again remain critically low. Lower than ever before. At the same time, potato prices in Poland are already almost twice as high as in Ukraine. Accordingly, Ukrainian potato growers are again predicting a rather difficult potato season.

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.