During the First International Retail Forum, held within the #FTrade Club 2021 in early December 2021, much attention was paid to new formats of fruit and vegetable retail. In particular, Fedir Rybalko, an expert on the fruit and vegetable market and an international consultant to FAO, made many interesting statements. Together with the FAO and EBRD Project team, he completed the first study of the retail trade of fresh produce in 2021, which revealed a number of noteworthy and unexpected trends.

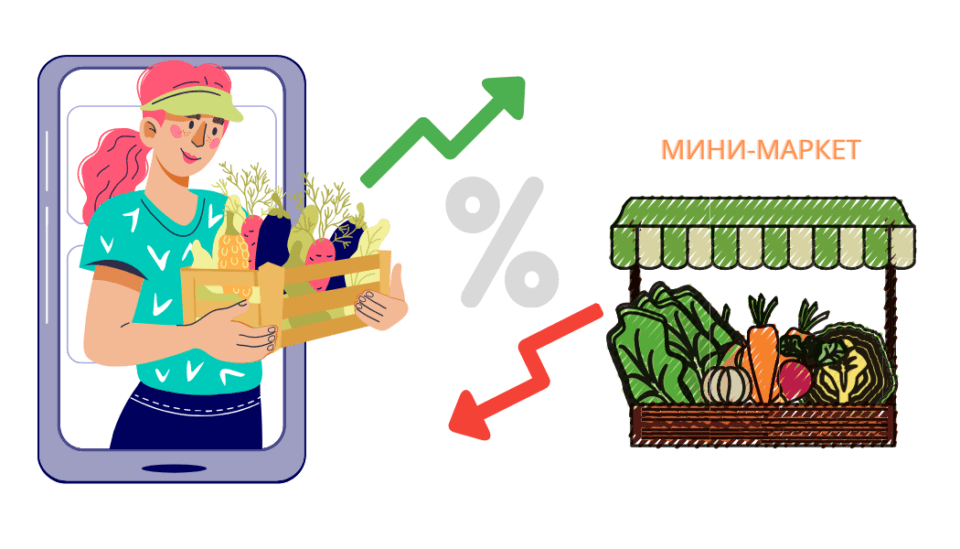

“The question that has become relevant during the COVID-19 pandemic is whether online sales will become a new trend in the produce market. When we discussed this issue at the conference of the APK-Inform: Vegetables and Fruits project in 2016, it seemed to be a look into a very distant future. However, the share of online sales of fruit and vegetables in Ukraine reaches about 1.5% today, and this segment is growing many times faster than the rest. Dozens of delivery services operating on various platforms were formed in Ukraine during lockdowns, and almost all large market operators entered this segment, trying to take their niche in it,” Fedir Rybalko notes.

He believes this trend will be fundamental in the future, as investments in online sales continue to grow. Kyiv region will remain the driver of online sales in Ukraine in the next 5-7 years.

Nonetheless, taking into account the development of the retail market, Ukraine is not yet of interest to large players in the online sales market who are ready to present innovative solutions, Fedir Rybalko says.

“For example, investments in a project to create a competitive delivery service amount to about $100 million. I believe that the Ukrainian market is not yet ready for these large investments. However, I think such a project can be implemented in 3-5 years,” the expert explains.

In addition, the increase in the fiscalization of non-chain retail continues. In particular, it takes the form of an increase in wages and rental costs. This puts pressure on the business of small retail operators in the market, which are forced to increase their margins and, consequently, prices. According to Fedir Rybalko, it can be assumed that the share of non-chain retail in the market will decrease.

Another important trend Fedir Rybalko notes in the development of the market, is that Ukraine may become attractive for immigrants in the future. “This will happen when the average salary reaches $800 in the country. They will be new consumers of fruits and vegetables, about whom we do not know much so far.” the expert sums up.

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.