According to the monitoring of wholesale prices for vegetables and fruits by EastFruit, one of the most popular grape varieties in Uzbekistan, black Kishmish (seedless) “Kora”, has risen in price by 29% over the past two weeks. However, despite such rapid growth, it is sold 25% cheaper than at the same time in 2020. EastFruit analysts investigated the reasons for it.

Kora table grape variety is a seedless and is in the greatest demand both in the Uzbek domestic market and on the part of exporters to Russia, Kazakhstan and other post-Soviet countries. Fresh grapes are also exported in small volumes to ethnic shops for Russian-speaking residents of the European Union. In addition, this grape variety is used for the production of raisins – dried grapes.

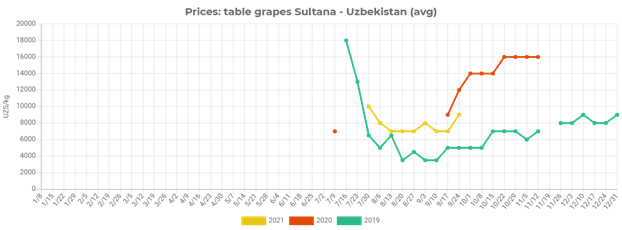

Wholesale black Kishmish can now be sold at 9000 UZS/kg ($0.84). According to Uzbek winegrowers, the rise in its prices is due to a seasonal factor. Winegrowers from different regions of the country interviewed by EastFruit experts confirmed the end of the peak harvest season for this variety. Prices for Kora grapes also began to grow rapidly at about the same time in 2020, but in 2019, they began to rise only in mid-October.

The last batches harvested from vineyards are now available on the market and the supply is decreasing, as grapes in refrigerators are normally stored by traders and producers until a significant increase in prices for the New Year holidays.

However, as wholesalers and exporters say, large volumes of grapes were not stored in refrigerators this year, which gives reasons to expect further growth in prices for black table grapes. At the same time, it is likely that more grapes were laid for storage than in 2020, but less than usual.

Market participants explain this by a decrease in the average yield of grapes in 2021 due to unfavorable weather. On the other hand, the vineyards in the country continue to expand. Moreover, Kishmish grape varieties are among the leaders in terms of the rate of area expansion. Therefore, it is possible that the production of grapes in Uzbekistan in 2021 was still higher than in 2020.

Then why is Uzbek black Kora significantly cheaper than in 2020, but much more expensive than in 2019? It turns out that the grape yield in the country is lower than usual for the second year in a row, but in 2019 the harvest was good, since there were no significant weather anomalies.

Accordingly, the supply of Kora table grapes to the market was significantly higher in 2019. More grapes were stored, and naturally, the prices were much lower than now, as we see in the graph above.

Prices for black Kora grapes could well have been higher this year, but Uzbek producers and exporters faced an increasing competition in the Russian table grape market. As a result, even though the harvest was moderate, Food City, the largest fruit and vegetable wholesale market in Moscow, was literally oversaturated with grapes from Uzbekistan in early September, with prices being extremely low.

One can only guess what happens to the prices of Kora and other less popular grape varieties in Uzbekistan, if in 2022 there are no severe weather conditions and the country has a normal harvest for the first time in three years. Since 2019, the areas of vineyards that have begun to bear fruit in Uzbekistan have grown significantly. Accordingly, the volume of the crop and its supply will increase.

Meanwhile, in Russia, the main market for Uzbek grapes, the real income of the population continues to decline, and the supply of grapes from competing countries such as Turkey, India, Moldova, Egypt, Chile, Peru, South Africa, Armenia and Azerbaijan continues to grow. Many of them offer more modern varieties in more modern and retail-friendly packaging.

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.

2 comments