In the first part of this article, we described the real and unexpected issues, or, more precisely, the problems most investors face when they enter the fruit and vegetable freezing segment. These are the questions that they did not pay attention to before they started investing.

Today we will talk about “forced investment”. Yes, there is such a category of frozen fruit and vegetable investors, and it is no less common than all other types of investments.

Let’s consider 3 options for forced investment in freezing:

- A farmer with orchards, berries, or vegetable plantations who no longer can sell to the fresh market for any reason is forced to invest in his own freezing facilities to maintain his fruit, berry, or vegetable business.

- Freezing company with its own plantations, which used to sell some of the products on the fresh market and freeze some. But it can no longer sell fresh products partially or completely, therefore it is forced to invest in increasing the production of frozen products or purchase additional freezing equipment, or modernize it.

- The assortment of an enterprise for fruit and vegetable freezing may become irrelevant due to changes in the market. As a result, the owners of the enterprise are forced to invest in expanding the product line or partial reorientation of the production.

Let’s look at each case in more detail.

1. A farmer owning orchards, berry, or vegetable plantations who can no longer sell to the fresh market, for whatever reason

A drop in demand for berries and fruits, an increase in the logistics route, embargoes from some countries, and other reasons can become an issue for plantations and orchards that will soon produce a crop. A farmer who has recently planted his plantations or is used to selling his berries and fruits in proper order must either quickly switch to new markets (and this is not always possible for a variety of reasons), or uproot still productive, and often even young orchards. That means leaving the business and losing income.

Possible ways out for a farmer:

– uprooting;

– development of new possible markets, as a result, the possible certification with Global.G.A.P (if he wasn’t certified) or other certificates (this is possible only if varieties demanded on other markets are grown in such a way as to obtain a high percentage of products of the desired qualities, etc., and it is often unreal);

— selling fresh products to processors at a low price (often this option is also impossible because there is no processing for such volumes, or the processing enterprise is ready to pay less than the cost of growing and harvesting, which makes this option also inappropriate);

— construction of his own processing.

As one way out, many see the creation of industries that, depending on the crop, can reorient the business, keeping the company afloat with a new product.

A good example is the planting of sea buckthorn plantations in Moldova since 2017. The state offered preferential programs, and many decided to develop a new crop in the country by planting sea buckthorn plantations of various sizes. As a result, when the harvesting season started, it turned out that it was inconvenient to collect it on the fresh market (many varieties are hard to harvest by hand, as they can be easily damaged) and unprofitable. In much larger volumes, sea buckthorn was sold frozen for the HoReCa. As a result, some farmers turned to freeze services, while others built small freezers to produce a new sought-after product from existing plantations.

Sea buckthorn for freezing is harvested on a branch by cutting a tree (by pickers with gloves) and it is also frozen on a branch, after which frozen berries are crushed from the branch and processed into the final product.

However, it was a good example.

There are also bad ones, when in place of a business in distress, a new one worth a lot of money is established, which turns out to be a failure even at the planning stage. For a systematic freezing business, you need to have answers to all the questions we described in detail in the first part. As a result, it usually turns out that the losses of a farmer in his orchard or field are multiplied by the losses in freezing.

2. A freezing enterprise with its own plantations, which previously sold part of the products on the fresh market and froze the other part.

In a dynamically changing market for frozen vegetables, fruits, and berries, many producers are looking to get the most out of available facilities and plantations. In the case when an enterprise owns both cultivation and processing, it has more options to respond to changes in the market.

At the same time, if growing and selling to the fresh market, which has worked successfully until today, is no longer possible, the company may take a forced measure to invest in refining production. These can be inspection lines, lines for taking out stones, trimming stalks, packaging lines, and additional storage rooms for frozen products.

For example, you have 80 ha of good-quality strawberry plantations and a freezing plant. You used to sell 80% of strawberries to the fresh market, and 20% were frozen, just because the price of strawberries (with rare exceptions of raspberries in some years and in some countries) on the fresh market is usually much higher than that of a frozen berry. The natural desire of the owner is to increase profits.

And now the country where you have always exported fresh strawberries suddenly imposes an embargo on their supply from your country. There is no other alternative market where your strawberries will reach fresh, or you cannot meet quality requirements in alternative countries.

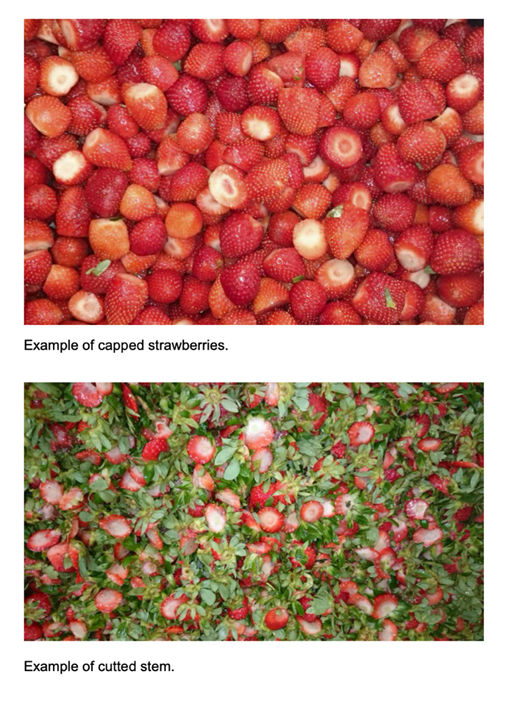

There are workers at your plant that processed 20% of the crop (manual capping), but they can’t cope with 90-100%. You have enough freezing power to freeze this volume, but you need to solve the issue of capping. The company may then decide to purchase a line for tailing strawberries, and this is an additional forced investment.

Of course, these investments are expedient only if there is a demand for frozen strawberries in such volumes, you know where to sell them and they are competitive in price.

Below is an example of the automatic capping of strawberries. Automatic capping is used at some enterprises in Egypt, one of the main strawberry-producing countries.

3. An enterprise for fruit and vegetable freezing, the assortment of which may become irrelevant due to changes in the market.

The season is approaching, and freezing companies are analyzing what to produce this season. Probably the berries that have been at the peak of their price in recent seasons may not be interesting at all. Perhaps the price for them will be too low. There are a lot of things difficult to forecast.

Nevertheless, no one can afford to stop the current production, so they must decide how to minimize possible losses, or better, to make a profit from the upcoming season.

Systematic analytical work can become a way out, if, of course, the enterprise can afford its own analytical department. Nothing has changed in the world, and, as before, information is money. Of course, if this information is of high quality and correctly interpreted.

Based on their own market analytics, some companies decide to expand the range. And this requires serious investments. For example, those who previously dealt only with fruits and berries are purchasing vegetable processing lines, investing in the development of a raw material zone for growing these vegetables for freezing, increasing options for final packaging, expanding the offer within one crop (half, slice, cube), or launch new projects to create a different product, for which frozen products will be raw materials.

Of course, it will not be possible to build a new plant so quickly – it takes at least two years. But you can modernize the production before the start of the season. Additional equipment should be ordered in advance (approximately 5-8 months in advance), depending on the crop, the required power, the installation location, and the technical complexity. It is important to assess the timing to install, debug, and test equipment by the beginning of the harvesting season.

Also, modernization can allow for the optimization of the prices of products: process automation, renewable energy sources, logistical improvements in production, etc. Thus, it is possible to reduce the cost and increase the profitability of a crop or all products.

It is obvious that 2022 has knocked down many freezing enterprises. Therefore, spending 100, 200, 300, or more thousand euros after a bad year just to stay afloat may not seem like a good idea. Moreover, if a company doesn’t have this money, the entrepreneur is forced to turn to credit funds, which are unavailable or have risen in price a lot.

In an unstable market, where you sold with a high margin a year ago, and today you are selling with a big minus, such changes, and fluctuations are inevitable. That said, those who remain in the market may well expect (but should not hope so) that margins will rise sharply again in a year.

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.