Raspberry season in Georgia started with climate-related challenges resulting in lower quality and quantity of the first harvest in June. Long rains coincided with the first harvest, causing certain farmers to suffer complete losses of early crops. Despite these challenges, the market supply has stabilized as the season progressed. However, with the conclusion of the summer picking phase and the anticipation of autumn harvesting resuming in the second half of August, slight price increases are expected in the upcoming weeks.

Raspberry season in Georgia started with climate-related challenges resulting in lower quality and quantity of the first harvest in June. Long rains coincided with the first harvest, causing certain farmers to suffer complete losses of early crops. Despite these challenges, the market supply has stabilized as the season progressed. However, with the conclusion of the summer picking phase and the anticipation of autumn harvesting resuming in the second half of August, slight price increases are expected in the upcoming weeks.

Climate-related difficulties are not new to this sector, prompting significant number of farmers to exit the market. However, those determined to stay actively seek ways to minimize risks associated with the weather. One potential solution discussed by the sector players is the production of raspberry in high tunnels, but unfortunately, only a few can afford this technology due to its high cost. Considering financial constraints and market uncertainties, many farmers are advocating for the involvement of state or donor organizations to support the adoption of high tunnel technology.

EastFruit reached out to different stakeholders within the sector to assess the current market conditions and explore possible future developments.

The farmers’ perspective

Farmers are facing a challenging dilemma. From the beginning, those who were unlucky to plant high-quality seedlings in suitable climates for open-field raspberry production are now contemplating whether to abandon their orchards altogether or, conversely, invest in technology to improve production. The current issue is that farmers are dissatisfied with the quality and quantity of their produce, as neither of these aspects meets their expectations, frequently leading to unprofitable production.

Those facing the most challenging circumstances have already exited the market. In 2022, the Georgian Berry Growers Association reported that more than 20% of the interviewed farmers, primarily from Kakheti and Kvemo Kartli regions, had left the market. However, as of 2023, the situation has worsened significantly, with TBC Capital, citing the association, reporting that over 50% of producers have left the market.

Zura Alavidze is among the affected farmers. He has cultivated raspberries on a 2.5-hectare plot in the Kakheti region since 2019. While the first two seasons showed moderate success, the harsh climate, specifically the heat in Kakheti region had a detrimental effect on the raspberry bushes. As a result, he decided to cut down the affected branches. In the current season, he is anticipating the first harvest after the renewal process, but the challenging climate remains a significant obstacle for his orchard. Alavidze thinks that protected cultivation is the only way to have stable quality which is crucial factor for price formation in both fresh and processed raspberries, even within the domestic market.

Even producers who rarely encountered climate issues earlier are now experiencing negative impacts. Inga Beruashvili, who owns a small orchard in Kvemo Kartli, Tetritskaro municipality, faced difficulties this season due to heavy rains, resulting in the wastage of up to two tons of early harvest raspberries. Despite the setbacks, Beruashvili remains optimistic about the upcoming autumn harvest, though making forecasts has become challenging for her given the uncertainties caused by the changing weather conditions.

Despite facing challenges in open field production, most farmers stay in this practice or contemplate exiting the market. However, a few have successfully transitioned a portion of their production into high tunnels, either through their efforts or with the financial backing of donor organizations. Producers like P&K Berries and Izolda Kitesashvili have taken this step forward. Kitesashvili has embarked on blackberry production in a tunnel, while P&K Berries focuses on raspberries. These farmers have already experienced the benefits of protected cultivation, enjoying increased yields and better-quality crops from a significantly smaller area. Additionally, they can now produce off-season, further enhancing their productivity and profitability.

As per Vasil Purtseladze, co-founder of P&K Berries, investing in covering one hectare with iron construction and polyethylene film amounts to approximately 200 thousand GEL ($77,987), which covers also drip irrigation systems. Purtseladze’s calculations suggest that the payback period is about two seasons, primarily due to the higher prices for raspberries during the off-season.

Farmers claim they cannot make the mentioned investment using their funds since they have already taken loans from commercial banks, making it challenging to secure additional funds. Some think this investment might even be risky for them without additional support.

Prices and selling markets

Despite some producers leaving the market, the overall raspberry harvest is not declining. According to Geostat data, the raspberry harvest in Georgia doubled in 2022 compared to the 2021 season, reaching a remarkable 1200 tons. This upward trend is expected to continue in the coming years as newly planted orchards mature and should reach their full potential.

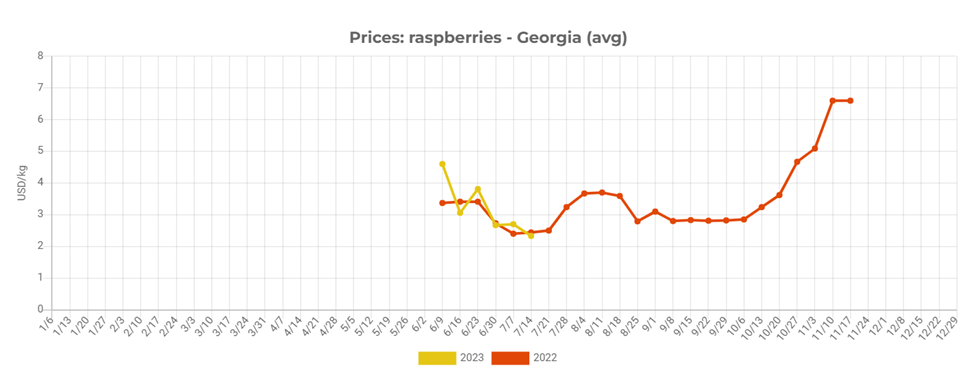

Source: EastFruit

Source: EastFruit

The average wholesale prices of raspberries in the local market have not seen a rise this season despite the higher prices at the beginning. Based on EastFruit’s price monitoring data, prices have been notably unstable at the beginning of the monitoring. However, when comparing the most recent prices (July 14) to the previous year, the wholesale price of one kilogram of raspberries in dollars shows little to no change from the same period in 2022. At the same time, prices in GEL have decreased from 7 GEL/kg to 6 GEL/kg. Due to this situation, some farmers are apprehensive about potential sales issues if supply increases.

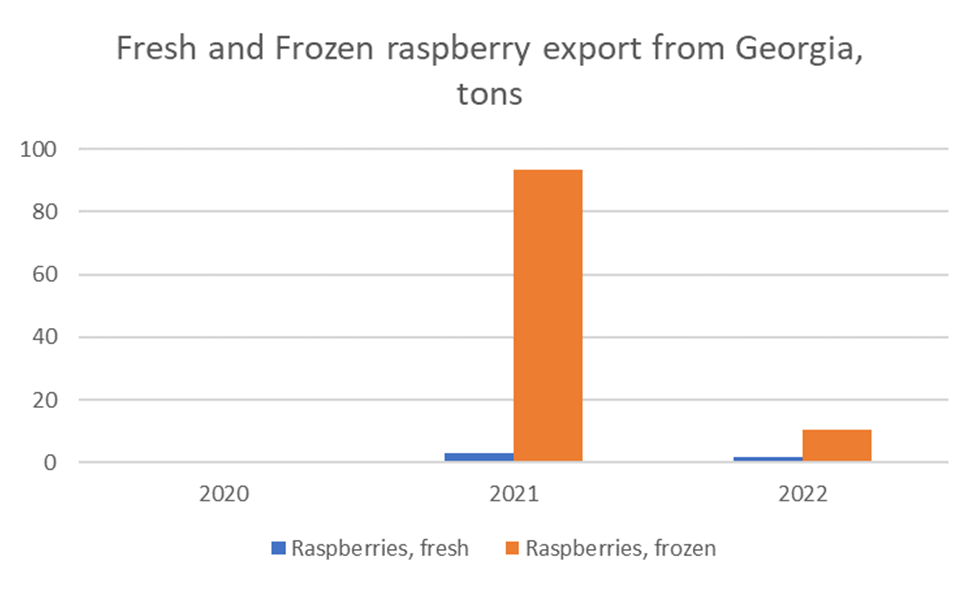

Source: Ministry of Finance of Georgia

Source: Ministry of Finance of Georgia

Most raspberries produced in Georgia are currently sold within the local market. Export data shows that fresh raspberry exports from Georgia were minimal in the 2021-2022 seasons, and in 2020, exports were almost non-existent. However, the highest quantity of frozen raspberries was exported in 2021, though a significant drop was observed in 2022.

Local farmers have various options to sell their raspberries within the domestic market. Small orchards often directly sell their crop to resellers, who afterward sell to farmers’ markets, bakeries, and other retail outlets. Some producers sell their raspberries directly to supermarkets under their brand names by investing in branding and packaging. Additionally, selling for processing (freezing or drying) is another option. However, during the peak season, when the market is flooded with raspberries, farmers often find it challenging to secure profitable prices for their produce.

Future developments

Farmers, as well as specialists from the field, acknowledge that protected cultivation is a solution enabling farmers to grow more raspberries on less land, improve the quality, and extend the harvest season. However, farmers are still determining the sales markets and whether additional investments will help them secure stable offtake. They should decide whether to focus on the local fresh market, opt for processing, or explore the option of exports. These questions still need to be answered, posing a significant challenge for farmers to make informed decisions about their production strategies.

Representatives from a local frozen fruit and vegetable producing company shared their assessment of the frozen raspberry market in Georgia, and the outlook appears challenging. Mambo Frost, a company that made frozen raspberries in Georgia, purchased up to 200 tons from the local market last year. However, this year, they still have stocks remaining from the previous year, leading them to decide against buying raspberries for this season. Meanwhile, another company used to buy raspberries for freezing, Glenberries, has ceased operations due to a legal dispute between co-founders. These factors indicate the expected decreased demand for raspberries for processing this season.

It is worth mentioning that the developments in the relatively small frozen raspberry market in Georgia are influenced by the dynamics of the broader European market, where prices are experiencing a decline due to the cyclical nature of this industry.

Commercial raspberry production is an emerging industry in Georgia, despite facing challenges, farmers strive to achieve positive developments, including by exploring potential export opportunities that remain largely untapped today. However, to ensure the continued growth of the sector, it is essential to address the existing challenges related to production practices, costs, and quality. Farmers believe that adopting closed-field cultivation methods can offer a viable solution to convert existing orchards into profitable businesses.

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.