In March 2022, EastFruit published an article calling on all companies to stop doing business with Russia. Many organizations, experts, and business representatives from many countries of the world made similar calls then. This had a significant effect because numerous multinational corporations and smaller companies stopped supporting the aggressor country.

McDonald’s sold its restaurants in Russia to a local company, Renault transferred its assets to a Russian state-owned corporation, Maersk divested itself of a joint venture in favor of a local partner, and many companies that respect their reputation and are unwilling to support the killing of Ukrainians have acted similarly.

Examples of fruit and vegetable corporations that have withdrawn from the Russian market or at least significantly reduced cooperation include McCain Foods from Canada (one of the global leaders in the French fries sector), Anecoop from Spain (one of the largest fruit and vegetable groups in Europe), Intercomm Foods from Greece. a major supplier of canned fruit), Olvi from Finland (beverage and juice market operator) and many other companies.

Nevertheless, even though trade in any goods with the aggressor state is an indirect, and sometimes very direct support for the Russian army, Moscow supermarkets were full of imported vegetables and fruits, imported seeds and seedlings were used in the production of Russian products, and Russian goods were present in the markets of neighboring and distant countries.

February 24 of this year was the anniversary of the invasion of Russian troops into Ukraine, and now, in my opinion, we can assess which horticultural businesses listened to the requests and persuasions of an adequate part of humanity and stopped supporting the aggressor, and which did not. In addition, import and export statistics for most countries of the world up to December 2022 are now available allowing us to sum up the past year.

By the way, Russia itself has closed the access of international organizations to its statistics since February 2022, so the figures given in my blog are the minimum assessment of cooperation between other states and the Russian Federation in the fruit and vegetable sector, and real numbers can be even higher!

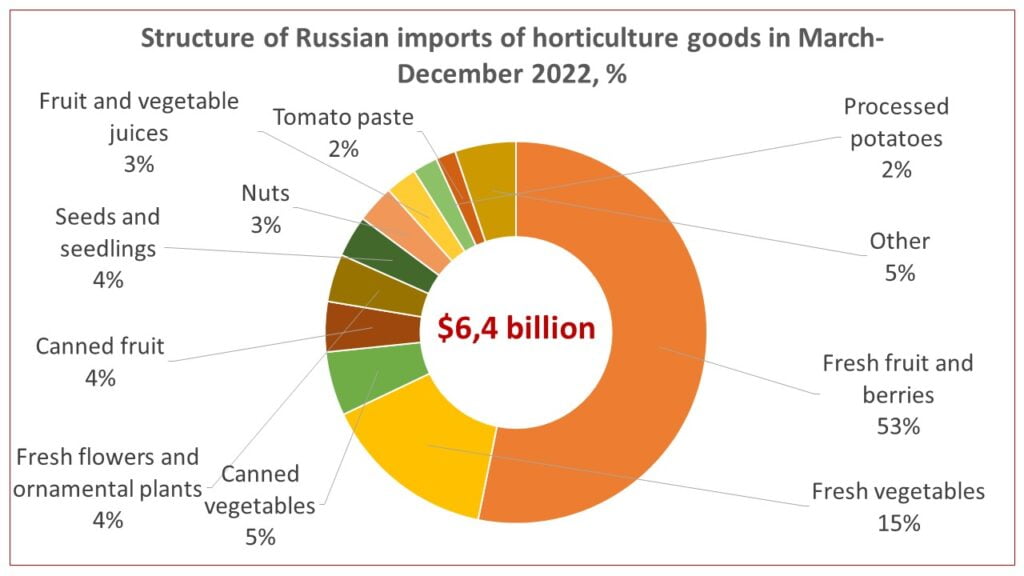

To assess Russia’s international trade in commodities of the fruit and vegetable group, I took the following categories, which can directly or indirectly relate to them – fresh vegetables, fruits, potatoes, berries, etc., most of their processed products, seed material and seedlings used for their production, fresh flowers and some other goods that are essentially related to the fruit and vegetable sector.

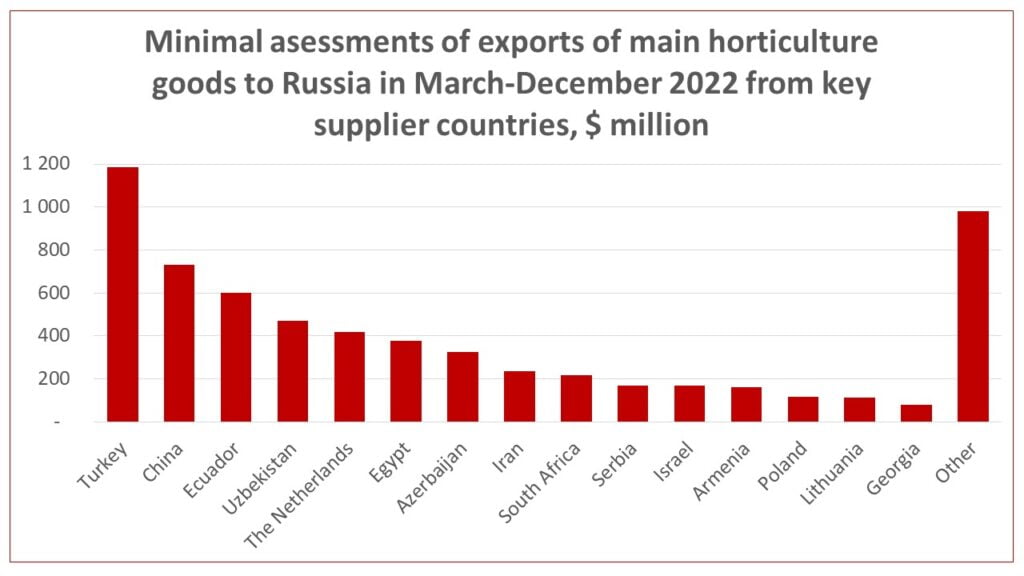

Key countries exporting fruits and vegetables to Russia in March-December 2022

In other words, these are countries that supplied their products to Russia when it invaded Ukraine thereby supporting the actions of the Russian army in an independent country. Such goods were used both directly in support of the aggressor’s army (for example, for army food or the production of dry rations), and indirectly, because the way of goods from the Russian port to the kitchen of consumers involves the payment of import duties, taxes, and other fees, a large part of which is used to finance the army and military-industrial complex of Russia.

In total, during the months in question, Russia imported $6.4 billion of such goods, and key supplier countries constituted a wide list of countries in Europe, Asia, and more distant regions. At the same time, rather unexpectedly, direct and indirect support to Russia was provided not only, for example, by China or Iran, which can be considered its indirect allies, but also by the Netherlands, Poland, and Lithuania, whose governments worked hard on programs to support Ukraine and its armed forces. I suggest we look at this in detail.

In the case of several countries, everything is clear. Turkey or Egypt did not want to impose any serious restrictions on cooperation with Russia, in China or Iran this was not even a question, the countries of Latin America or Sub-Saharan Africa are always very cautious about events in Europe, and the states of the post-Soviet space have not yet had the time or were unwilling to diversify their exports. This is reflected in the rating of suppliers.

Quite expectedly, Turkey became the #1 country in the export of fruits and vegetables to Russia in March-December, once again confirming the status of their main exporter to the Russian market. The main part of Turkish exports to Russia (almost $1.2 billion) was still fresh vegetables, fruits, and berries (about 84% of total sales) – citrus fruits, grapes, stone fruits, tomatoes, etc.

There were also no surprises in the definition of countries #2 and #3. China exported fruits and vegetables worth $733 million to the Russian market, while exports from Ecuador over the same period amounted to $602 million. By the way, Ecuadorian exports traditionally consisted almost exclusively of bananas, while exports from China were more varied.

Fresh vegetables and fruits accounted for half of the total exports from China to Russia, and canned – a little less than a third. About 8% was tomato paste, and 4% was dried vegetables – these two categories are important ingredients for products in the Russian army dry rations. At least, we can thank China for supporting the Russian army so far with the supply of dried onions or tomato paste, and not with weapons or ammunition.

The same cannot be said about Iran, and, besides supplying Shahed kamikaze drones, it indirectly supported the killing of Ukrainians through the supply of fruits and vegetables. Iran (the eighth country in the ranking of suppliers) exported fruits and vegetables worth $236 million to Russia and the key positions of Iranian exports were greenhouse vegetables, pistachios, melons, stone fruits, and kiwi.

The inclusion of most other countries in the list of the largest suppliers is also quite understandable and relatively justified. However, what kind of justification can we talk about when the aggressor country is supported?

Uzbekistan ($470 million in fruit and vegetable exports to Russia), Azerbaijan ($324 million), Armenia ($161 million), and Georgia ($80 million) are countries that have historically been tied to the Russian market and cannot quickly abandon it, although some of them have been recently enforcing diversification. Armenia is neighbors with Turkey and Azerbaijan, and the Russian sales market is actually a salvation for local exporters.

Although, if you remember how quickly Russia came to help Armenia in the last war, the situation becomes not so unambiguous… As for Georgia, it had armed conflicts with Russia three times. By the way, if the rating was based on the results of March-September 2022, Moldova would take the place of Georgia in it (there are data on Moldova only until September). It is another country where Russia continues its policy of the “Russian world” with support for political instability, inspirations of separatism, and economic pressure.

Egypt ($377 million) and South Africa ($218 million) are, as I said, representatives of a region that is very cautious about European affairs and tries to stay out of any major problems. However, it is in this region that there are examples of other approaches. Morocco not only supported Ukraine by supplying tanks and imposing restrictions on Russia but also continued to diversify its exports, not wanting to be tied with such an unstable partner.

Serbia ($168 million) and Israel ($168 million) are countries with historical or cultural ties to Russia, so their presence on the list of top suppliers is no surprise either. Nevertheless, it seems that the situation with Serbia, at least, may change in 2023, because it recently announced the possibility of joining the anti-Russian sanctions.

Now we are getting to a more interesting part. The #5 country on the list was the Netherlands with fruit and vegetable exports to Russia worth $419 million, of which 38% were fresh flowers and ornamental plants, 27% were fresh fruits and berries, and another 22% were seeds and planting material. That is, at a time when the government of the Netherlands was accepting Ukrainian refugees, organizing financial assistance to Ukraine, and sending weapons to strengthen the Armed Forces of Ukraine, local businesses considered it necessary to please the women of the Russian military with fresh flowers, their families with vitamin products, and Russian agriculture with high-quality seeds and seedlings.

By the way, the imports of fresh fruits from the Netherlands to Russia have been banned for many years, so these are transshipment in the Dutch ports. In addition, the share of Russia in the total exports of fresh flowers and ornamental plants from the Netherlands was 3.5%, its share in the segment of fresh fruits was 1.8%, and in the export of seeds and planting material – 1.2%. That is, the loss of the Russian market for suppliers from the Netherlands did not pose a serious threat. Nevertheless, cooperation continued, although financially it was a “drop in the ocean” for Dutch companies.

Similar questions about the morality of cooperation with the aggressor country are also posed to Poland and Lithuania, two more states that have supported and continue to support Ukraine and its armed forces tremendously. Companies from Poland exported fruit and vegetables worth $116 million to Russia and $114 million to Lithuania, and in both cases, it was mainly fruit and vegetable juices, canned food, seeds, and seedlings. Lithuania was also exporting fresh flowers to Russia ($19 million).

Key countries importing fruits and vegetables from Russia in March-December 2022

The export of non-military goods to Russia can still be somehow explained by humanitarian objectives, but the imports of Russian products directly support the functioning of the business of the aggressor country, which then pays taxes and fees to finance the hostilities in Ukraine, missile attacks on peaceful infrastructure, deportation of the Ukrainian population and other options for the so-called Special Military Operation.

Fortunately, the volumes of fruit and vegetable production in Russia for most positions have always failed to meet the requirements of the domestic market, not to mention exports. In addition, Russian goods were usually of low quality, which also did not contribute to the development of exports.

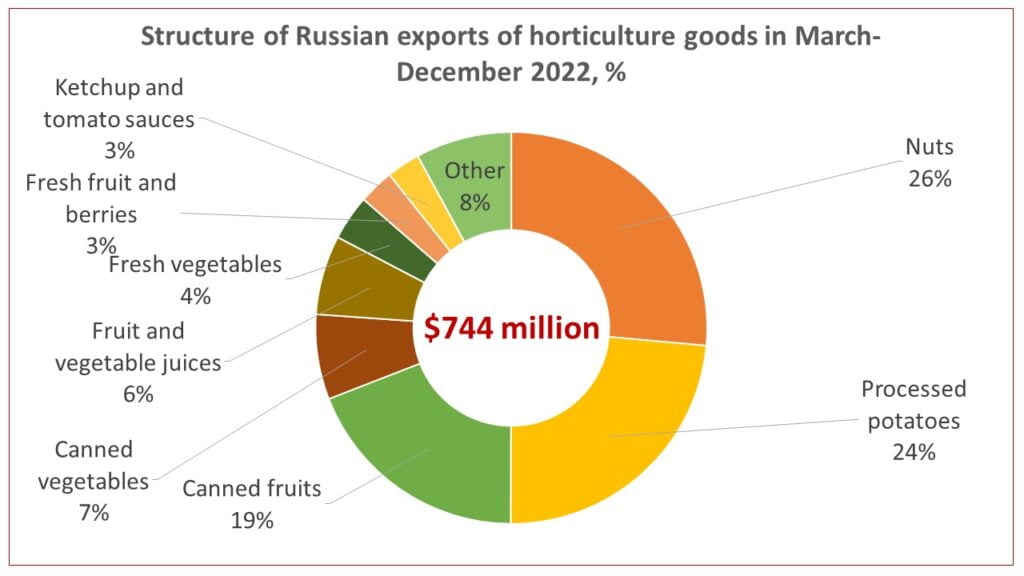

Nevertheless, in March-December 2022, Russia exported fruits and vegetables worth $744 million to various countries of the world, including the United States. Approximately half of this revenue was provided by only two product categories – nuts and potato products.

As for the former, wild-growing pine nuts were mainly represented in Russian exports, which is a huge problem for the global market. Russia is the second largest producer and exporter of these products after China, so quickly finding a worthy alternative for global players is a very difficult task.

As for potato processed products exported from Russia, these were dried potatoes and potato chips, which are mainly supplied to the countries of Central Asia and other states of the post-Soviet space.

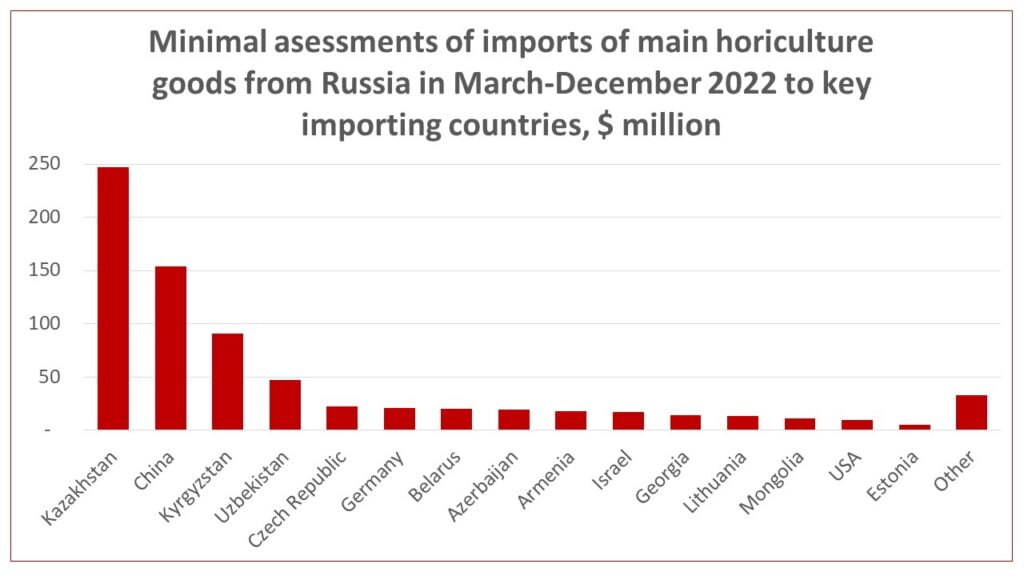

By the way, Central Asia is the largest importer of fruits and vegetables from Russia – three Central Asian countries got to the top of the rating – Kazakhstan (#1 with imports worth $247 million), Kyrgyzstan (#3 – $91) million) and Uzbekistan (#4 – $47 million). Given the historical and trade ties and logistical remoteness of these countries, they are still very dependent on imports from Russia, including some categories of vegetables and fruits.

The main part of Russian exports to the countries of Central Asia are potato products and fruit and vegetable juices, and Kazakhstan still imports quite a lot of Russian-made canned fruits and vegetables. Central Asia (especially its more southern regions and countries) is also partly dependent on the supply of fresh potatoes from Russia, which takes over the market during periods of seasonal lack of local production.

It should be noted that in recent years, the share of Russia in the structure of imports in Central Asian countries has been gradually decreasing. Local market operators built new logistics routes and invested in their own production. In addition, for example, in Kazakhstan, Russia has been likely inspiring separatism, which official representatives of the latter have stated quite often.

One of the most important alternatives for Central Asia, by the way, is China, and its share in the local trade structure is constantly growing. China is one of the key importers of fruits and vegetables from Russia with a purchase volume of $154 million in March-December 2022, although it is mainly the exports of Russian pine nuts (96% of the purchase volume).

In addition to Central Asia, the exports of Russian fruits and vegetables to other countries of the post-Soviet space are quite significant. Belarus imported fruits and vegetables worth $20 million, Azerbaijan financed the Russian fruit and vegetable business for $19.6 million, and exports to Armenia and Georgia amounted to $18.1 million and $14.2 million, respectively. Again, as in the case of the countries of Central Asia, it was mainly about potato processing products, canned fruits and vegetables, and juices. Belarus also imported rather big volumes of fresh vegetables and fruits from Russia due to the joint trade and logistics routes and the business ties between the countries.

Russian exports to Israel ($17.3 million) and Mongolia ($11 million) can be considered special cases. The first, in addition to traditional canned vegetables and fruits, as well as pine nuts, also imported a large volume of dried sweet corn from Russia. Mongolia, due to logistical dependence on Russia and China, has practically no alternatives, and it imported canned vegetables and fruits, potato products, ketchup, and tomato sauces, as well as fresh fruits and vegetables.

Finally, a little about the countries that supported Ukraine in its struggle and can be considered its most important allies. Despite this, they continued to finance Russian businesses with millions of US dollars. The Czech Republic imported Russian goods worth $22.4 million, Germany brought Russian exporters revenue of $21.2 million, Lithuania and the United States purchased Russian fruit and vegetable products worth $13.5 million and $9.9 million, respectively, and Estonia spent $5 million on imports from Russia.

Of course, compared with the military and financial support of Ukraine from these countries, such amounts are critically small, so in this case, we are talking primarily about the moral responsibility of importers. Could the Estonian importers find an alternative to the Russian frozen blueberries they bought for $4.1 million? Will German importers be able to do without importing roasted nuts from Russia ($10.3 million)? Would it be a tragedy for wholesale companies from Lithuania if they stopped importing chanterelles from Russia ($7.9 million)? Is the life of Ukrainians worth the export of Russian pine nuts to the Czech Republic ($22.3 million) and the USA ($8.1 million)?

All these are ridiculous sums in terms of global trade, but every dollar counts when it comes to human lives, the fate of those whose homes were destroyed, and the future of those who lost their health and loved ones. Stop supporting the aggressor, Russian conservation or pine nuts are not worth it, help us in our fight!

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.