Following up on the conversation about the record exports of Moroccan blueberries, EastFruit highlights the sharp increase in their deliveries to Saudi Arabia. In the current marketing year (the period from July to June), Morocco has doubled its blueberry exports to the Saudi Arabian market and become the leading supplier there.

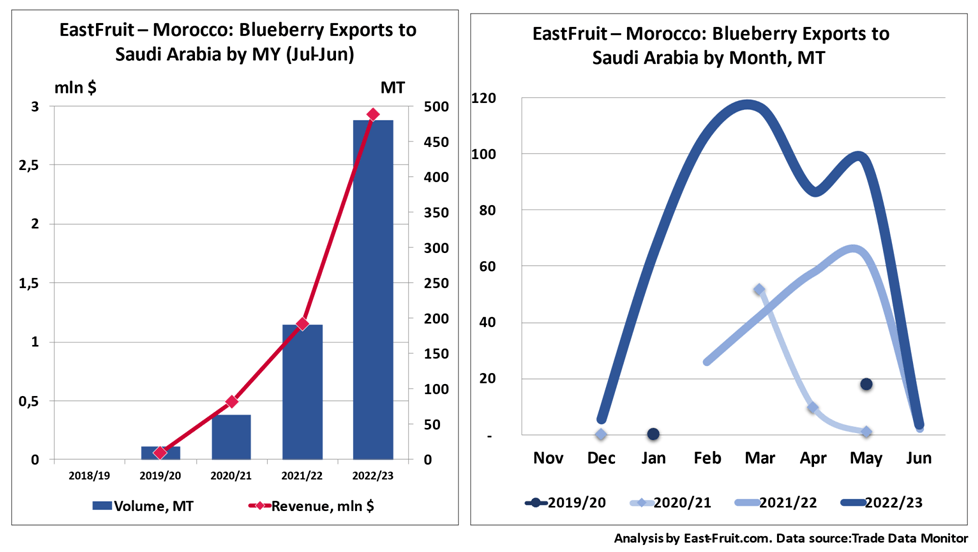

In the MY 2022/23, Morocco exported 480 tons of fresh blueberries to Saudi Arabia, compared to less than 200 tons a year earlier.

In the MY 2022/23, Morocco exported 480 tons of fresh blueberries to Saudi Arabia, compared to less than 200 tons a year earlier.

It is noteworthy that Moroccan farmers started to supply blueberries to this destination only three seasons ago and have since managed to double or triple their sales volumes every year. For instance, over the last two seasons, deliveries from Morocco to Saudi Arabia increased sevenfold, and in the current season, sales brought Morocco almost $3 million of export revenue.

Read also: Brexit boosts Moroccan blueberry sales to the UK, leaving Spain behind

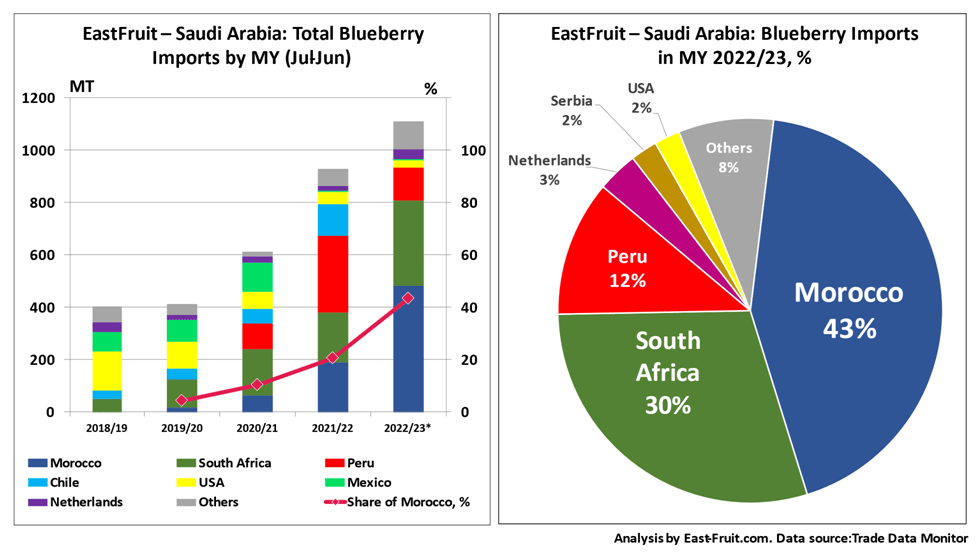

Saudi Arabia ranks 38th among the world’s largest importers of blueberries (2022) and its imports from abroad are steadily growing – over four years, external supplies have almost tripled. Thus, in the current season, more than 1,100 tons of berries were imported to the local market from 16 countries.

Until recently, the main exporters of blueberries to Saudi Arabia were South Africa, Peru, the USA, and Mexico. The leading position changed hands several times over the years. Four seasons ago, the USA was the top supplier, and a year later, it was overtaken by South Africa. In the last season, the largest volume was imported from Peru (almost a third of total imports).

Peru is the undisputed leader in the export of blueberries, far ahead of other producers, and accounts for about 30% of total blueberry sales in the world.

Peru’s exports to Saudi Arabia (until the last season inclusive) grew most dynamically. However, in the current season, the export of blueberries from Peru plummeted. EastFruit explained in detail the reasons why the country had significantly reduced production. Moreover, Peruvian exports fell so much that the global leader in the blueberry export growth rates has changed. Furthermore, Peruvian berries’ external sales dropped in most export markets, including Saudi Arabia.

And since Morocco managed to sharply increase the export of blueberries at the same time, the North African country became the top supplier to Saudi Arabia in the MY 2022/23, surpassing Peru and South Africa by a large margin. Moreover, Moroccan blueberries accounted for 43% of exports to Saudi Arabia, and in the peak months (from January to May) it exceeded 80%.

Morocco ranks 7th among the largest global suppliers of fresh berries and 4th in exports of cultivated blueberries (according to the results of 2022). In the MY 2022/23, Moroccan berries reached 37 foreign markets. Blueberries were in fourth place in the country’s export revenue last year, and in the first six months of 2023, they rose to second place, behind only tomatoes.