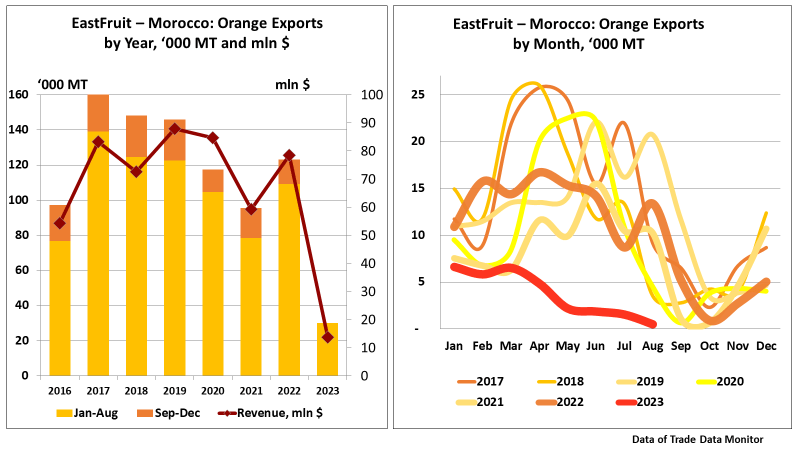

Despite being one of the world’s largest producers of oranges, Morocco has significantly reduced its exports of this product. According to EastFruit, only 30 thousand tons of oranges worth 13.7 million dollars were imported from Morocco to foreign countries in 8 months of 2023. For comparison, in the same period last year, local growers managed to deliver 109 thousand tons of these citrus fruits to foreign markets, receiving the export revenue of 71 million dollars.

“Morocco is the third largest country in Africa in terms of orange production after Egypt and South Africa. However, unlike its continental neighbors, Morocco will greatly reduce its exports of these citrus fruits for several reasons by the end of the current season. According to our calculations, the export of Moroccan oranges for the 2022/23 season will collapse to the lowest level in at least the last 8 years,” warns Yevhen Kuzin, Fruit & Vegetable Market Analyst at EastFruit.

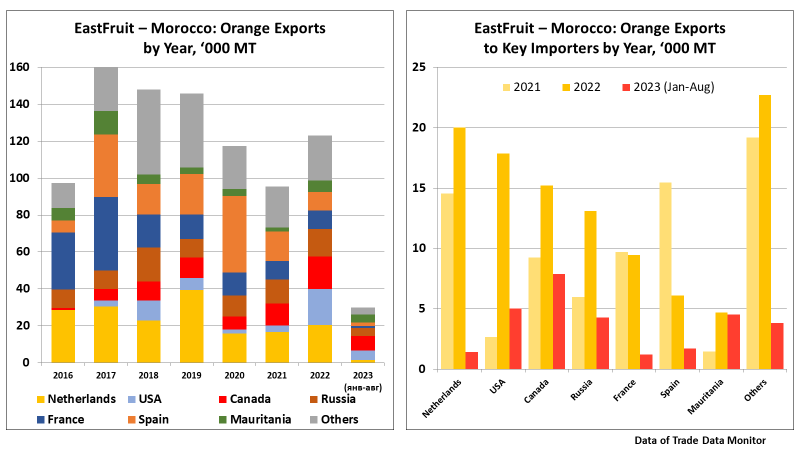

The peak of Moroccan orange deliveries abroad was recorded in 2017, when the country imported more than 160 thousand tons of this product to foreign markets. Since then, sales volumes have decreased almost annually, reaching a minimum in the current year, and Morocco has moved from 11th position (2022) to 13th place (according to data for January-August 2023) in the list of world exporters.

The main factor affecting the rapid decline in orange exports is unfavorable weather conditions. Climate change and water scarcity affect the increase in frequency and intensity of drought periods in Morocco, and the temperature rises to critically high levels.

For example, in August of this year, an absolute temperature record was recorded in the country (while local growers hoped that high temperatures would not cause damage to citrus fruits). Nevertheless, abnormal heat affected yields, and, accordingly, production decreased and harvesting areas were reduced.

It should be noted that the decline was observed not only in Morocco – global production of these citrus fruits also demonstrated a downward trend. Drought in Spain and Italy, hurricanes in the USA, frosts in Turkey – natural anomalies that key suppliers of oranges faced, negatively affected orange production.

“At the same time, orange exports from Egypt, which is the world’s largest exporter, are expected to reach a record level in the 2022/23 season. In addition to Egypt, export growth is expected from South Africa (the second leading exporter of oranges in the world), where, as in Egypt, weather conditions were quite favorable. As a result, Egyptian oranges will be able to take the segments, where previously products from Morocco or Spain were present, increasing future competition in the main global markets,” warns Yevhen Kuzin.

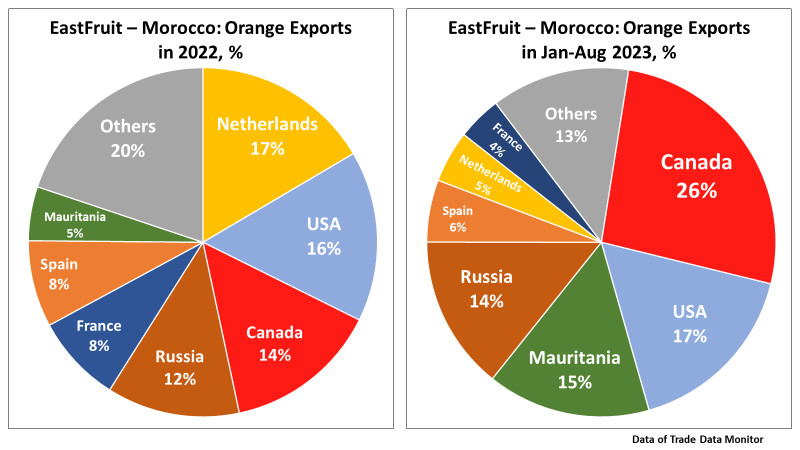

The geography of orange exports from Morocco has also narrowed somewhat. Last year, citrus fruits were supplied to 54 countries, and in 8 months of 2023 this product was exported to 44 foreign markets. The main importers of Moroccan oranges are the Netherlands, USA, Canada, Mauritania, Russia, and it should be noted that this year supplies have decreased almost in all directions. EastFruit wrote that Morocco sharply reduced the volumes of fruit and vegetable exports to the Russian market, and the most significant decrease rates were in exports of oranges to the Netherlands, a country that ranks first among global importers.

Read also: Rise of Moroccan Brussels sprouts in the British market from scratch

The reduction of total exports of Moroccan oranges did not affect the only market, as sales to Mauritania did not change significantly. For this country, Morocco remains the main supplier and covers almost 100% of all imports. At the same time, European countries remained the main export destination for Moroccan orange exporters, and local farmers do not lose hope that after a difficult season caused by drought, the next season will mark a rise in the citrus industry.

“The main guarantee of success for future citrus seasons in Morocco will be the ability to offset weather factors, as climatic anomalies were the key reason for the collapse of orange exports from the country in the current season. In addition to this, a significant problem for Moroccan growers is the increasing deficit of water resources. Moroccan exporters will also have to get used to much more serious competition from suppliers from Egypt, where production is now on the rise, as growing Egyptian exports can put more and more pressure on prices in the global market,” summarizes Yevhen Kuzin.

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.