According to EastFruit analysts, Ukrainian growers can uproot record orchard areas in the 2022/23 season. Meanwhile, the developments in the fresh apple market in Ukraine are becoming very dynamic and may lead to a sharp increase in the price of fruit No.1 soon. Let’s figure out why, with the rising prices for apples, growers consider apple production not profitable enough.

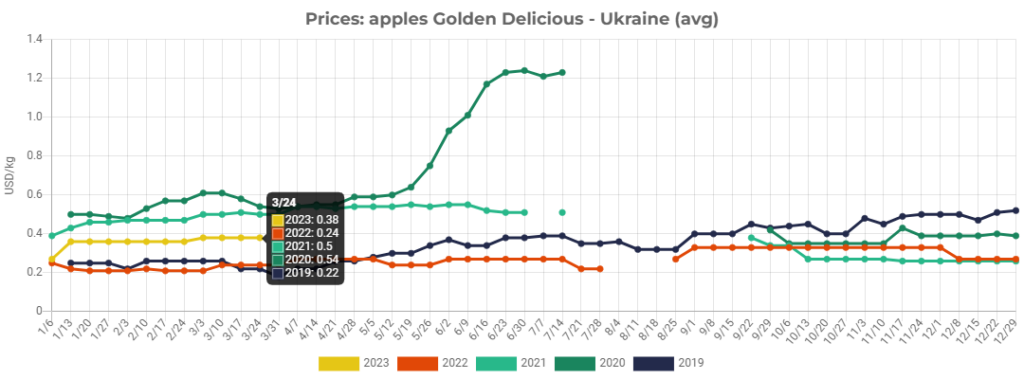

If you look at the wholesale prices of apples in the current season, even in US dollars, the situation does not seem catastrophic. Prices are right in the middle between the best price seasons like 2019/20 and 2020/21 and the low price seasons like 2018/19 and 2021/22. The prices for one of the most popular apple varieties, Golden Delicious, are now 58% higher than a year ago and 73% higher than in 2018/19 when some farmers fertilized their fields with apples.

Moreover, we believe that from the end of March to July 2023, the average wholesale price for apples in Ukraine may increase significantly, which will lead to an increase in imports of fresh apples, mainly from Poland. Why, then, do Ukrainian growers uproot orchards?

To answer this question, it is necessary to understand the reasons for the likely increase in apple prices in the coming weeks. By the way, the rise in prices has already begun at the end of last week, affecting mass varieties. The increase in prices for high-quality export-quality apples began even earlier, mainly influenced by domestic demand.

“Apple prices may indeed rise in the coming months because Ukrainian fruit storage facilities have almost run out of stocks of quality apples. This is due, first of all, to terrorist attacks on Ukrainian civilian infrastructure – on power supply systems, which forced many Ukrainian growers to abandon plans to store apples. Since even minor interruptions in the power supply of storage facilities are fraught with temperature fluctuations in the chambers, this can lead to the complete loss of fruits stored there. At the same time, Ukrainian ports remained blocked for apple exports, which limited the possibility of exports. As a result, the supply of apples in autumn and in December 2022 greatly exceeded the demand, and prices were record-low while the cost of growing apples in 2022 was a record high. This resulted in losses for many apple growers and forced them to uproot,” Andriy Yarmak, economist at the Investment Center of the Food and Agriculture Organization of the United Nations (FAO), explains.

“In general, due to the sharp increase in the cost of plant protection products and the shortage of labor, not all growers carried out treatments on time. This also affected the storage of apples, if someone still made the decision to store them, despite the risks. Storage conditions, due to power outages, were poor. This caused a situation when, at the end of March, there were not enough high-quality Ukrainian-produced apples on the market to meet domestic needs, so now prices are starting to rise even in the segment of average and low-quality apples,” the FAO expert adds.

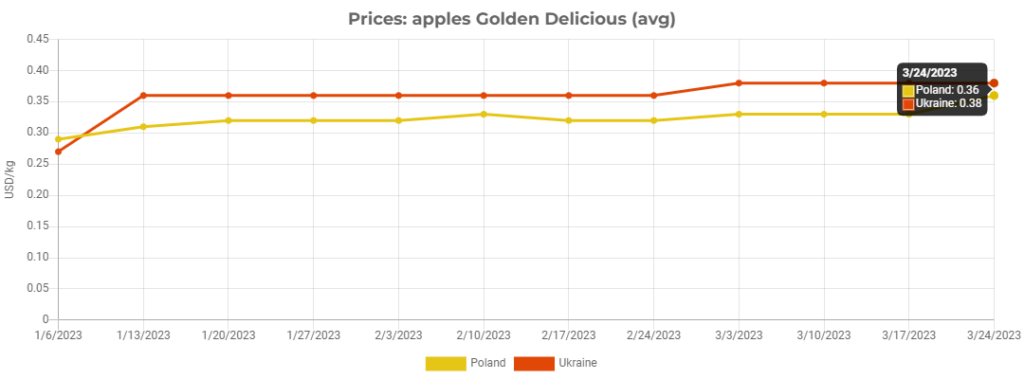

In this regard, supermarket chains may start actively importing imported apples from Poland in April, where stocks are higher due to a large harvest, and prices are slightly lower than in Ukraine.

However, in Poland, there has recently been a tendency towards an increase in prices for good-quality apples. The main reason is similar – the sharp increase in electricity costs has forced Polish growers to sell apples more actively than usual in the first half of the season. This was also facilitated by the relatively high prices for apples for processing, which made it possible to get rid of apples of low quality and unpopular varieties much faster.

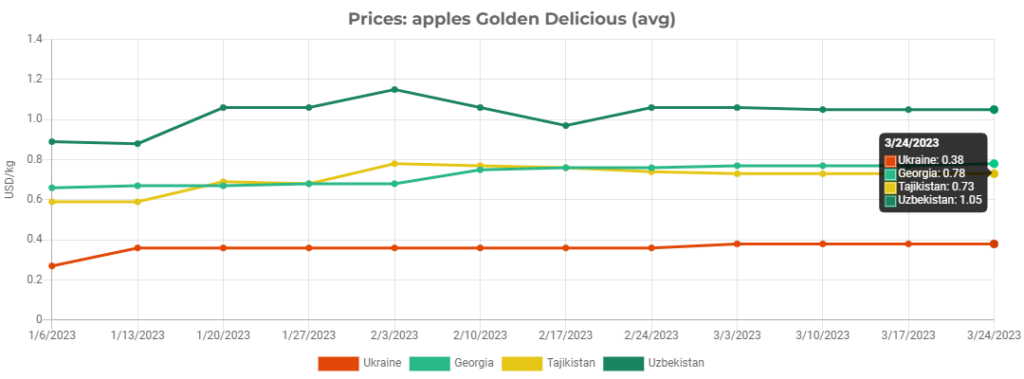

Interestingly, high apple prices in Georgia, Uzbekistan, and other Central Asian countries stimulate apple exports from Ukraine, Poland, and Moldova, further driving up prices. Apple stocks in all of the above countries are also far from sufficient to meet domestic demand.

Another reason why apple prices in Ukraine may rise is the high prices for vegetables and the poor prospects for the supply of early vegetables, berries, and fruits from the southern regions of the country, since they are still occupied by Russian aggressors, and the infrastructure for growing products in the region is predominantly damaged or destroyed. Accordingly, until July, even with a fairly dynamic price increase, apples will remain one of the most affordable products in the fruit and vegetable sector. Accordingly, the demand for it will be quite high, even if prices for it double.

The uprooting of orchards by Ukrainian farmers is now carried out mainly in farms that either have insufficient area for the construction of their own modern fruit storage facilities or those that grow varieties currently not demanded. First of all, these are popular, but not demanded on the international market, and losing popularity in the domestic market varieties, such as “Champion”, “Jonagold”, “Jonagored”, “Idared”, “Ligol”, “Renet Simirenka”, etc.

At the same time, we believe the long-term prospects for the apple business in Ukraine to be quite good. A decrease in the supply of unpopular apple varieties, the consolidation of the apple business, and the increase in its efficiency, which is currently seen, may lead to an increase in the average level of wholesale prices for apples in the coming seasons. And this, in turn, will help increase the return on investment for apple growers.

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.