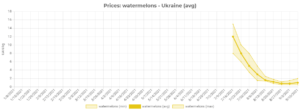

September keeps breaking anti-records for Ukrainian producers of watermelons – according to EastFruit analysts, the prices remain at one of the lowest levels among other countries monitored by the project as it was a month ago. Although the end of last week showed a slight upward price trend for Ukrainian watermelons – the average wholesale price increased from 0.8 UAH/kg ($ 0.03) at the beginning of the previous week to 1 UAH/kg ($ 0.038), this price range is two times lower than in the same period of 2019 and 2020.

In this context, the average price of watermelons on the Russian market has remained stable for 2 weeks and amounts to 10 RUB/kg ($ 0.14). The situation is similar in Belarus – the average wholesale price of watermelons is in the range of 0.65 BYN/kg ($ 0.26). The price on the Georgian market, on the contrary, increased from 0.4 GEL/kg ($ 0.13) to 0.7 GEL/kg ($ 0.23).

As EastFruit reported, Ukrainian watermelon market is now characterized by the lowest prices over the past four seasons given a large harvest, despite poor weather conditions in spring and early summer in the main producing region – Kherson region.

At the same time, local growers note that today they cannot sell their products in wholesale even at 0.3-0.5 UAH/kg ($ 0.011-0.019) – half the cost of watermelon production.

A producer from the Kherson region Mykola Moiseenko notes that he has invested about 300,000 UAH ($ 11,275) in the field of watermelons this year. At the same time, the proceeds from the sale of Talisman watermelons amounted to only 100,000 UAH ($ 3,758).

“Of the 6 hectares planted by us in spring, we have managed to sell products only from 3.5 hectares, even though the melon season in Ukraine has shifted by about 3 weeks due to the cold spring and early summer. We are ready to give the rest of the harvest from the field for free, but we have not found yet people to take it, “the producer notes, adding that most likely he will have to plow the field along with the remaining harvest on it during the autumn cultivation of the field.

Mykola Moiseenko also adds that watermelons are now starting to overripe, and there are many more sellers than buyers in local wholesale markets.

According to market players, as a rule, large farms sold all their harvest, as they had pre-signed contracts for supplies to retail chains.

“Based on this, small and medium-sized producers of watermelons in Ukraine should follow the example of large farms, namely cooperate to create batches and look for buyers even at the stage of planting,” a consultant to the Food and Agriculture Organization of the United Nations (FAO) Kateryna Zvereva says.

The FAO consultant adds that in order to find buyers, watermelon growers should do market research and invest in marketing. “Growing a product for which there is a long-term demand is the right strategy for a producer of fruits and vegetables. Otherwise, small and medium-sized producers are at a disadvantage with the goods they cannot sell,” Kateryna Zvereva notes.

According to Kateryna Zvereva, a producer of fruit and vegetables, in particular, watermelons, gives employment and pays many people – suppliers of seeds, technologies, plant protection products, workers in the fields, processors, retailers and traders. “But without systemic marketing and reliable sales channels, he becomes hostage to the situation – when he needs to pay employees, service providers, but there are no sales, or the price offered by the market does not cover the grower’s production costs,” the FAO consultant summarizes.

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.