According to EastFruit analysts the first wholesale batches of Uzbek onions have already become available in the wholesale markets of Ukraine. We reported the high probability of such developments more than a month ago in the article “Will record high onion prices in Ukraine lead to imports from Uzbekistan and Moldova?”, when the harvesting of onions in Ukraine was still going on. This is especially noteworthy after the season of record high Ukrainian onion exports over the last 8 years.

Despite onions from Uzbekistan offered in Ukraine being 15-25% more expensive than locally produced ones, the demand for them is quite good. As market participants explain, the main reason for the willingness of Ukrainian buyers to pay more for imported Uzbek onions is their higher quality. The fact is that Ukrainian producers, waiting for an increase in onion prices in winter and spring, tried to put all high-quality onions in storages. Thus, the local market is dominated by onions of average quality, creating opportunities for the import of high-quality ones.

We are also informed about the purchases of onions by Ukrainian traders not only in Uzbekistan, but also in Kazakhstan. The latter exports up to 100 thousand tonnes of onions per year, has a well-developed infrastructure for storing onions and cheaper and faster logistics to Ukraine. Purchases of onions in Tajikistan where prices are lower than in Uzbekistan seem even more interesting. However, we are not talking about the supply of Tajik onions to Ukraine, since logistics from Tajikistan will be more expensive, and it is more difficult to collect sufficient volumes of export-grade onions there than in Uzbekistan and Kazakhstan.

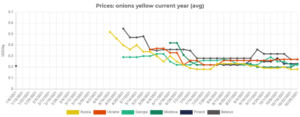

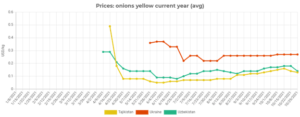

Despite quality issues, average wholesale prices for onions in Ukraine are on average 2.5 times higher than at the same time last year and higher than in 2019. By the way, they have not changed since mid-August 2021, which is typical for seasons with balanced supply and demand. The last time onion prices rose in the fall in 2018, but they began to decline closer to 2019 and kept declining until April 2019. This was followed by a sharp price rise to a record level in May 2019, but it was due to the general shortage of onions in Europe.

Onion prices in Ukraine are now higher than in any other Eastern European country. Only in Belarus wholesale prices for onions are comparable to those in Ukraine. It is interesting that wholesale prices for onions in Russia are currently 33% lower than in Ukraine, although product quality is also problematic there.

As for Central Asian countries, onion prices are significantly lower than in Ukraine. Onions in Tajikistan and Uzbekistan can now be bought two times cheaper than in Ukraine but the difference in absolute prices is moderate (about $0.15), forcing importers to look for the cheapest logistics options. Even this will not allow importers to earn money, if imported onions are not sold at a higher price than Ukrainian ones.

That is why the first onions from Central Asia are offered on the Ukrainian market at a higher price than local ones. By the way, cheap logistics will be unavailable with the onset of cold weather, perhaps that is why importers are in a hurry to deliver onions to the Ukrainian market.

However, the downward trend in onion prices in Uzbekistan and Tajikistan of the past two weeks is noteworthy. It significantly increases the chances of exporting to Ukraine. Ukrainian traders believe that soon when the farmers run out of onions that cannot be stored long, their prices will start to rise rapidly. Therefore, they are actively concluding contracts for the purchase of onions stored in Central Asia to be delivered in the winter.

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.