Exports of early onions from Uzbekistan have been increasing at a very high rate in recent years. However, not everything in this business is so rosy, despite the fact that the government of Uzbekistan encourages vegetable producers (though not with financial incentives, but with regulations) to grow more winter onions.

According to EastFruit price monitoring data, wholesale prices for early onions in Uzbekistan are a source of concern – they are almost a third lower than last year’s and have a tendency to decline. In neighboring Tajikistan, last year’s onions are sold at 7 US cents per kg – twice as cheap as in Uzbekistan. In Russia, the stocks of 2020 harvest onions are still large, and the price is two and a half times lower than last year!

EastFruit experts figured out if there are any prospects of early onion exports from Uzbekistan, and what segments of the onion business are the most attractive for the country.

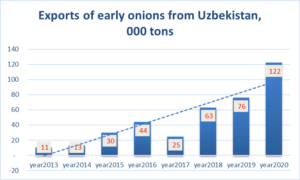

The exports of early onions from Uzbekistan has been growing by 24% or 21 thousand tons per year over the past five years, according to EastFruit estimates. Due to the fact that harvesting of early onions in Uzbekistan starts in April, when the stocks of last year’s harvest are decreasing in northern countries, a window of opportunity of about three months opens up for Uzbek onions exports.

Why three months? In Russia and Belarus, early onions become available on the market only at the end of June. Around the same time, stocks begin to deplete, and prices often rise quite rapidly.

It would seem that everything is going well – since exports are growing, there is a demand for early Uzbek onions, isn’t it? However, there are a number of problems related to the exports of Uzbek onions that we want to warn the producers about.

We consider onions exported from April to June as early ones, and below we will explain the reasons for such estimates. Theoretically, there may also be “old” onions of the previous year from high-quality storage facilities. Moreover, as the infrastructure for storing vegetables in Uzbekistan develops, it is possible that onions of the old harvest will actively compete in the market with those of the new harvest, especially considering that last year’s onions are more transportable, as a rule, because they are drier. By the way, this is one of the reasons why the further expansion of winter onion crops, encouraged by the government document “On Measures to Increase the Production and Export of Garlic and Vegetable Products using the Tuksonbosti method” can be a very risky idea.

Other reasons why further expansion of winter onion production in Uzbekistan should be carefully analyzed are listed below.

- Onions are relatively inexpensive, with prices rarely exceeding 50 US cents per kg. Therefore, all the world’s largest onion exporters have access to cheap logistics, i.e. by sea or are located near importing countries (for example, Poland). The main production regions of Uzbekistan’s winter onions are thousands of kilometers away from sales markets, and the cost of logistics per kilogram, for example, to Moscow, is higher than the average wholesale price for onions in Moscow today. Also, Uzbekistan is one of the most remote countries in the world from the world’s oceans.

- The explosive growth in onion exports in recent years was due to a number of non-standard factors: an abnormal drought in the EU, which sharply reduced production for two years in a row and stimulated high onion prices, as well as the COVID-19 pandemic, which contributed to a sharp but short-term surge in onion consumption in post-soviet countries. However, it is obvious that the coronavirus factor has already ceased to influence the market, and new weather disasters are still likely, but probably should not be counted on.

- About 90% of early onions from Uzbekistan are supplied to the markets of Russia and Kazakhstan, where local production is actively developing and storage facilities are being built, which reduces dependence on imports. The total imports of onions to Russia and Kazakhstan from April to June grew by 4.7% per year or 11.8 thousand tons during the last five years – almost twice as slow as the exports of onion from Uzbekistan grew. While Uzbekistan is issuing orders to expand winter onion culture, Russia is allocating subsidies to vegetable producers for the development of onion storage infrastructure, which leads to smoothing of price fluctuations, and onion prices increase less sharply by spring. In developed countries, where the storage infrastructure is sufficiently developed, onion prices are completely stable throughout the year. Moreover, onion prices are often lower in spring than during harvesting in autumn. In Ukraine, for example, this happens once every three years in average. It means that the unique “window of opportunity” for the supply of Uzbek onions to Kazakhstan and the Russian Federation is very likely to gradually disappear.

- Considering the above-mentioned factors, there is a need to diversify the geography of onion exports from Uzbekistan. However, the main global importers of onion – the USA, Malaysia, Great Britain, the EU countries, the UAE, Saudi Arabia, etc. are located even farther from Uzbekistan than Russia, and the logistics is even more complicated and expensive. This does not mean that Uzbekistan cannot find a way to new sales markets, but it will be much more difficult for Uzbekistan than for countries that have access to the sea or are located closer to sales markets.

- The cost of onion production in Uzbekistan is high and it will grow as the income level of the population rises – a significant part of onion production in the country is carried out manually. At the same time, onion cultivation in Russia is completely mechanized. Therefore, the profitability of growing early onion in Uzbekistan will decline, unless, prices for it suddenly rise. So far onion prices are expected to rather stabilize at lower levels than rise. For example, onion prices did not exceed 10 US cents per kg throughout the season in Ukraine this year. In general, onions were cheap everywhere this season, as we already wrote.

- Market competitors are also active – in neighboring Tajikistan, as we have already mentioned, onions cost about 7 US cents per kg – two times cheaper than in Uzbekistan. Transport costs for exports are not much higher than for those from Uzbekistan. At the same time, the cost of producing onions in Tajikistan is lower, taking into account the structure and specifics of production, as well as the cost of labor.

- Of course, there is another important factor that could help Uzbekistan find alternative sales markets – quality. However, to ensure the required quality, the country needs to significantly modernize production and create an infrastructure for processing (sorting, grading, packaging) onions. It is also necessary to invest in marketing and differentiation from competitors. However, it is not entirely clear why invest in a relatively inexpensive product, that arrives on the Russian market at less than 1 US dollar per kg, if you can invest in the production of blueberries, for example, which are 10-20 times more expensive.

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.