Frozen raspberries are currently the main export product of the Ukrainian fruit and vegetable business in terms of foreign exchange generation. What makes this segment of agribusiness unique is that it involves tens of thousands of producers of all forms and sizes. Both large farmers, who have dozens of hectares of berry plantations, and owners of plots with 0.05 hectares of raspberries – they all participate in the raspberry export value chain.

In this regard, raspberry pricing for many agricultural regions of Ukraine is one of the most sensitive and pressing issues. Consequently, the EastFruit team could not ignore such an important issue.

First of all, let us remind you that prices for frozen raspberries in Europe are growing as we publish this and are already much higher than a year earlier. There is a shortage of frozen raspberries in the region, despite the start of the export season from Morocco. Stocks of frozen raspberries in Ukraine are very low, and price offers for high-quality products have already increased to the level of 2.3-2.4 euros per kg. You can read a comprehensive overview of the European frozen raspberry market here.

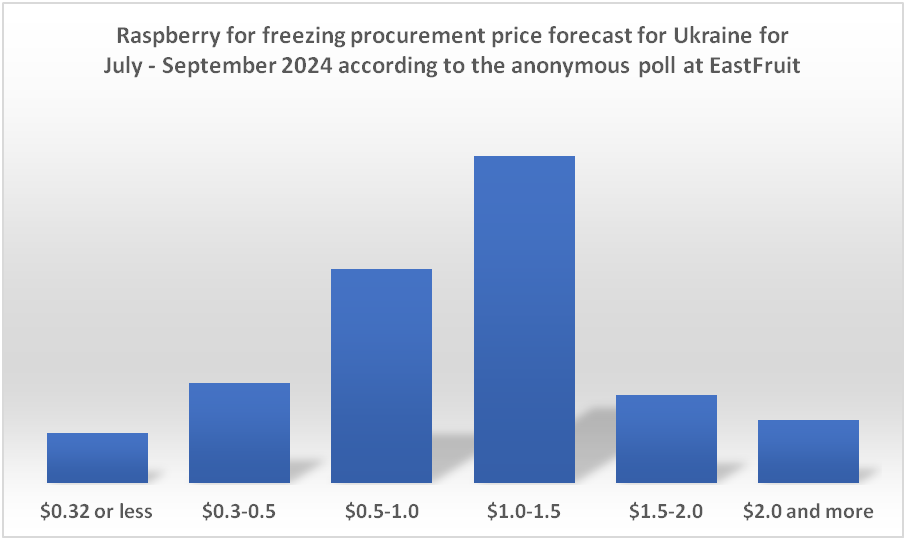

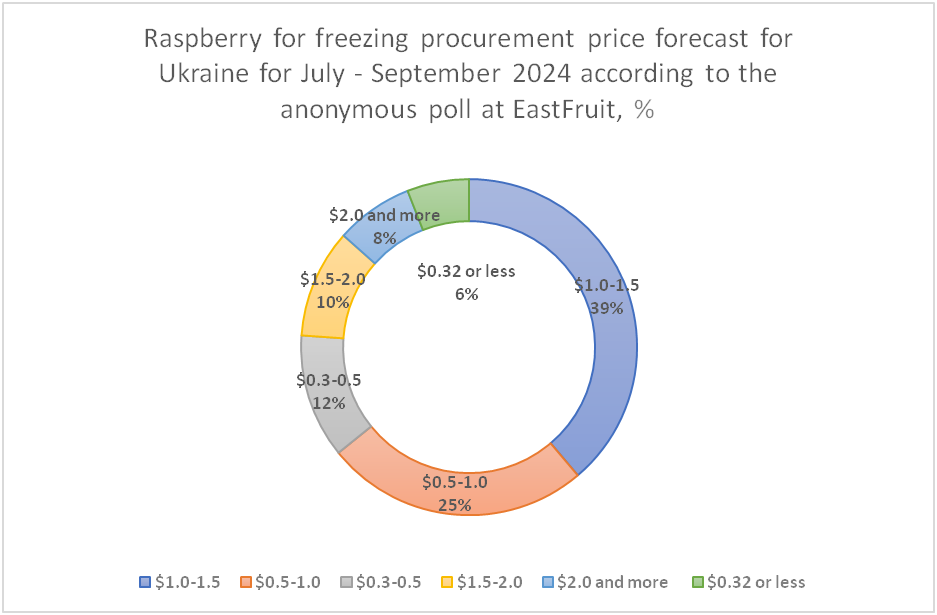

We conducted an anonymous survey of market participants about the prospects for pricing raspberries for freezing in July-September 2024 on the EastFruit telegram channel. More than 100 people shared their opinions, and the results of the survey generally largely coincide with the vision of the freezers and traders of frozen produce. Although many of them are trying to suggest lower prices to protect themselves from possible risks that they faced in the 2022/23 season, which is fully understandable.

Considering that in 2023 procurement prices for raspberries for freezing dropped even to 12 UAH per kg (around US $0.3 per kg), such a forecast can be called optimistic. However, if we consider that three years ago purchase prices for raspberries sometimes reached 2.8 euros per kg, which is equivalent to today’s 115 UAH/kg, then this forecast is moderately optimistic.

Almost 40% of respondents believe that raspberries for freezing can be sold at prices from 40 to 60 UAH/kg or from 1 euro to 1.5 euros per kg. Another quarter of participants believe that prices will be two times lower than this level – 20-40 UAH/kg.

Almost 40% of respondents believe that raspberries for freezing can be sold at prices from 40 to 60 UAH/kg or from 1 euro to 1.5 euros per kg. Another quarter of participants believe that prices will be two times lower than this level – 20-40 UAH/kg.

By the way, it is interesting that those who see the price of raspberries in the summer of 2024 at 12 UAH/kg and below are one and a half times less than those who expect more than 80 UAH/kg, but those who expect 12-20 UAH /kg is 20% more than those who predict 60-80 UAH/kg.

Read also: Ukraine has overtaken Poland and Morocco on the market of frozen raspberries in Canada

Do experts agree with this forecast?

First of all, we advise you to read our article “The Cyclicality of Raspberry Prices,” which has already been read by more than 20 thousand people in the recent few months. It clearly explains all the factors impacting the pricing of raspberries and it helps foresee the prices much easier.

In this regard, Andriy Yarmak, FAO economist, draws attention to the reasons for the current increase in raspberry prices: “Prices began to rise at the beginning of 2024, because food manufacturing companies approved recipes for the next year based on the cost and availability of different types of raw materials. Raspberries are just one of many fillings for yoghurts, confectionery, baking, and other types of food industries. Thanks to the fact that in 2023 prices dropped to a very competitive level, raspberries were returned to the recipes and demand for them immediately increased.”

Therefore, in his opinion, prices for raspberries will continue to rise until the start of the new harvest, because stocks are rather low compared to the level of demand. “Once the raspberry harvest begins, much of the pricing will depend on how the harvest turns out. If there are no natural disasters, then prices may stabilize somewhat, because the price reached by then may turn out to be the equilibrium price. On the one hand, in Ukraine there was no significant reduction in the area under raspberries, but in Poland, Serbia and Bosnia and Herzegovina the area decreased slightly. However, psychological aspects are also important in the market, so price fluctuations in the direction of continued growth are also possible,” says Andriy Yarmak.

However, he cautions that rising prices too sharply could set the stage for another price crash as early as next year and is undesirable.

According to EastFruit analysts, the price of high-quality frozen raspberries in Europe by the start of harvesting in Ukraine could reach 2.6-2.8 euros per kg.

What raspberry price can farmers in Ukraine expect to receive?

The experience of past years shows that freezers, as a rule, can painlessly pay producers for high-quality raspberries the price calculated according to the formula: E-1.1 = X, where “E” is the price for high-quality frozen raspberries in the European Union (not in Poland, but in Germany, France, the Netherlands or Belgium) minus 1.1 euros.

If the price of raspberries by the time harvesting begins in Ukraine reaches 2.6 euros per kg, then in Ukraine freezers will be able to pay up to 1.4-1.5 euros per kg, which is equivalent to today’s 55-60 UAH/kg. However, we repeat that here we are talking about high-quality raspberries, supplied directly to the freezer in the required volume in the absence of natural disasters in all the main producing countries in Europe. Accordingly, the likelihood of such a scenario remains quite low.

You need to understand that freezers will not rush to raise prices to this level in any case, and the starting price will obviously be significantly lower. After seasons like the previous one, we are seeing a trend of them trying to increase margins to 1.3-1.4 euros per kg. Accordingly, most likely, the season will begin with a purchase price close to 30-40 UAH/kg per kg for quality products in significant volumes.

However, given the commissioning of several new powerful berry freezing enterprises in Ukraine in 2024, competition for raw materials promises to be more intense than ever before, which could lead to an increase in prices as the harvest progresses.