On March 16, 2023, the EastFruit project held the first online conference on the current developments in the market of frozen fruits, berries, and vegetables. The video of the conference “Shock freezing of berries, fruits, and vegetables 2023: a market overview, investments, prospects” is available at this link (in Russian).

One of the most urgent problems of the event was the forecasting of prices for raw materials for freezing and for finished products. In this regard, the most frequently raised issue was the price of frozen raspberries and the prospects for pricing fresh raspberries in 2023.

Andriy Yarmak, economist at the Investment Center of the Food and Agriculture Organization of the United Nations (FAO), who has been analyzing global food markets and forecasting prices for more than 25 years, explained that the prices of almost all goods in the agricultural sector are characterized by a cyclicality.

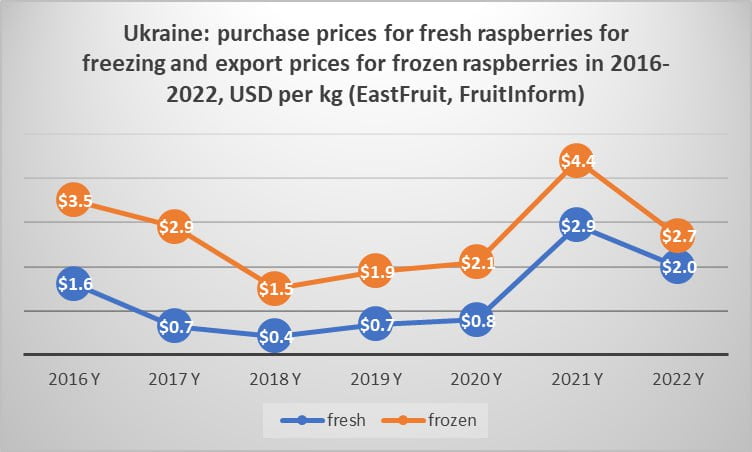

“Pricing cycles depend on the features of the products. In the case of raspberries, the full price cycle usually takes about 4-5 years, unless it is affected by some unusual factors, such as severe weather disasters, wars, global recessions, etc. In 2016, prices for raspberries in Ukraine were formed at the level of 40-45 UAH/kg, because frozen raspberries were exported at prices close to $3.5 per kg and even more. After that, of course, there was a wave of investments in raspberry production, because, at such a price, the investment in a good-quality raspberry plantation could be recouped in the first year! Naturally, the increase in supply led to a decrease in prices for raw materials, but Ukraine also exported more finished products, collapsing global prices. Respectively, in 2018, the leftover frozen raspberries were sold from Ukraine for export in May, sometimes at prices close to the incredible 1 EUR/kg, although a year earlier entrepreneurs from the freezing business convinced me that “frozen raspberries will never cost less than 2 EUR/kg!”. As you see, never say never,” explains Andriy Yarmak.

“Of course, with such prices for frozen raspberries, raw material prices also collapsed. In the summer of 2018, some freezers bought raspberries even at 8 UAH/kg, although, high-quality raspberries could be sold more expensive, but not much – 12-15 UAH/kg. This is not the price that allowed us to talk about the return on investment in growing raspberries. Therefore, many got rid of raspberry plantations in Ukraine, Poland, Serbia, Montenegro, Bosnia and Herzegovina, and other countries of the world in 2018. At the same time, the global market “tasted” raspberries. Due to the incredibly low prices for frozen raspberries, which unexpectedly became one of the most affordable raw materials on the market of frozen fruits and berries, raspberries began to be massively introduced into the recipes of dairy and confectionery products, teas, breakfast cereals, snacks, bakery products, etc. This means that the demand for raspberries rose sharply just when everyone was massively getting rid of their plantations. I want to point out this – it is often missed by many when liquidating a business that is about to bring huge dividends,” says the FAO expert.

If you look at the price chart for fresh raspberries for freezing and for frozen berries offered for export, provided by the APK-Inform: Vegetables and Fruits project, you can understand that the price cycle for raspberries in 2018 reached its lowest level, after which years of profit-making for the industry followed.

Andriy Yarmak explains what happened to the market after 2018: “By the end of 2018, prices for raspberries began to recover, both in the raw material market and in the frozen market. However, the still relatively high supply of frozen raspberries in the world did not allow them to grow quickly. In 2019 it began to decline sharply, but global demand remained high. Therefore, when the weather factor was added in 2021 (a poor raspberry harvest in Serbia), prices literally jumped, exceeding even the level of 2016. Thus, the cycle for the fifth year was closed, and a new cycle has begun in 2022, with the price trends that can be forecasted based on the experience of the previous cycle.”

By the way, a raspberry plantation is usually planted for a seven-year period. If the plantation is of high quality, the average yield can be 10-12 tonnes per hectare per season. Of course, there are also more productive plantations, however, taking into account various cataclysms, let’s take an average of 10 tonnes per hectare and multiply it by the revenue for 2016-2022, based on price statistics. It turns out that the producer, who did not uproot the plantation in 2018, received about $90 000 in revenue from one hectare.

Experts estimate investments in planting a hectare of raspberries in Ukraine at $12 000-18 000, and the cost of harvesting and other production operations and materials and equipment per year is about $4 000-5 000. Thus, the total costs for 7 years per 1 hectare of the plantation will be about $50 000, which indicates a good marginality of this business, despite the cyclical nature of prices and demand for products.

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.