It is a difficult season for Uzbek fruit business this year. The production of many key fruits decreased due to frosts. As a result, their prices are high, which negatively affects the volume of exports and domestic consumption.

EastFruit experts draw attention to the fact that prices for early apples of the 2021 season in Uzbekistan are at least 2.5 times higher than the average price in the 2020 and 2019 seasons. As of June 24, 2021, the average wholesale price for early apple varieties is 13,000 sums per kg ($ 1.23). Their average wholesale prices were 2.5 times lower in the second half of June 2020, and 3.5 times lower in the same period of 2019.

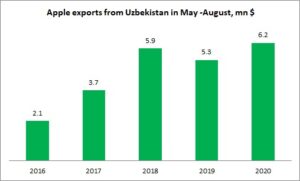

According to EastFruit experts, the dynamics of exports of early apple varieties from Uzbekistan showed steady growth and export revenue increased from $ 2.1 million to $ 6.2 million from 2016 to 2020. But in 2021, we will probably see a sharp decline in this indicator, given the prices in the domestic market.

As in the case of apricots, almonds and cherries, high prices for early apples in Uzbekistan in the 2021 season were caused by weather anomalies – a sharp warming in February 2021 and subsequent frosts. Judging by current prices, the damage caused by weather to the harvest of early apple varieties in Uzbekistan is significant.

EastFruit has already written that growing late varieties of apples in Uzbekistan for export can lead to serious losses for local farmers. However, this article also noted that with regard to early varieties of apples, the situation is completely different. In large apple-producing and exporting countries, the harvest begins in the second half of August, as a rule. In Uzbekistan, due to the climatic conditions, early apple varieties become available on the market in the end of April. Late varieties, such as Golden Delicious, are often available at the end of July – almost two months earlier.

Therefore, from May to August inclusive, Uzbekistan has a window of opportunity for exporting apples to northern countries, primarily to Russia. Statistics confirm that Uzbekistan continues to use this export niche for early apples.

Source: Trade Map

As you can see on the chart, the export of early apples from Uzbekistan has a steady upward trend. In 2020, exports reached a record 6.2 thousand tons.

“The main advantage of early apples as an export niche for Uzbekistan over late ones is that no investments in expensive infrastructure for storage and processing are needed. Many farmers and investors underestimate this factor, and for 1 hectare of orchard, investment in a modern fruit storage facilityexceeds the investment in laying a farm with irrigation, seedlings, support, hail protection netting and even equipment! The second important advantage is the high price in summer, as high-quality apples for the Russian market at this time are normally exported from the countries of the Southern Hemisphere: South Africa, Chile, New Zealand, etc. At the same time, Uzbek apples are also very fresh, provided that the cold chain is maintained,” Andriy Yarmak, economist at the Investments Centre, Food and Agriculture Organization of the United Nations (FAO), explains.

However, Uzbekistan is unlikely to increase the export of early apples this year compared to previous years. With very high domestic prices, there is another negative factor – record high apple stocks in Russia and their record low prices in June.

In neighboring Tajikistan, the damage from frosts to early apples turned out to be much less significant than in Uzbekistan. Therefore, the average wholesale price of early apples as of June 24, 2021 is $ 0.62 per kg, i.e. 2 times lower than in Uzbekistan. Considering such a difference in prices and the close distance, Uzbekistan can become their importer, as in the case of apricot or raspberries.

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.