EastFruit’s meticulous weekly price analysis, now in its sixth year for Tajikistan, paints a dire scenario for local farmers with plummeting prices for two vital vegetable commodities: carrots and onions.

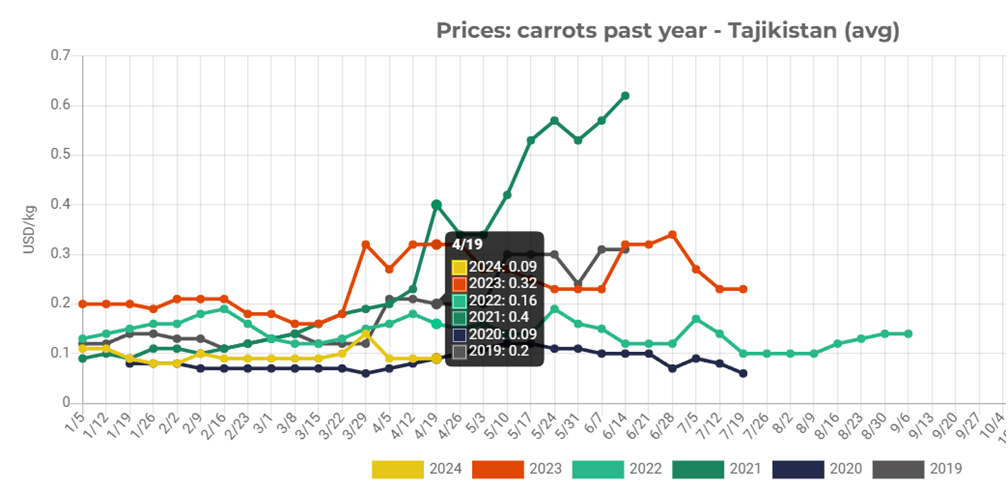

Carrots, in particular, are trading at a mere 9 US cents per kilogram—a figure that’s a staggering 3.5 times less than last year’s and marks an all-time low for this season in recent memory. EastFruit records indicate a similar price point back in 2020, which coincided with the onset of the coronavirus pandemic, leading to widespread border closures and market turmoil. It’s important to note that due to significant dollar inflation since then, the value of 9 cents has considerably diminished.

Currently, carrot prices in Tajikistan are the lowest recorded across the entire region, dwarfing even those in Eastern European nations, where prices are substantially higher.

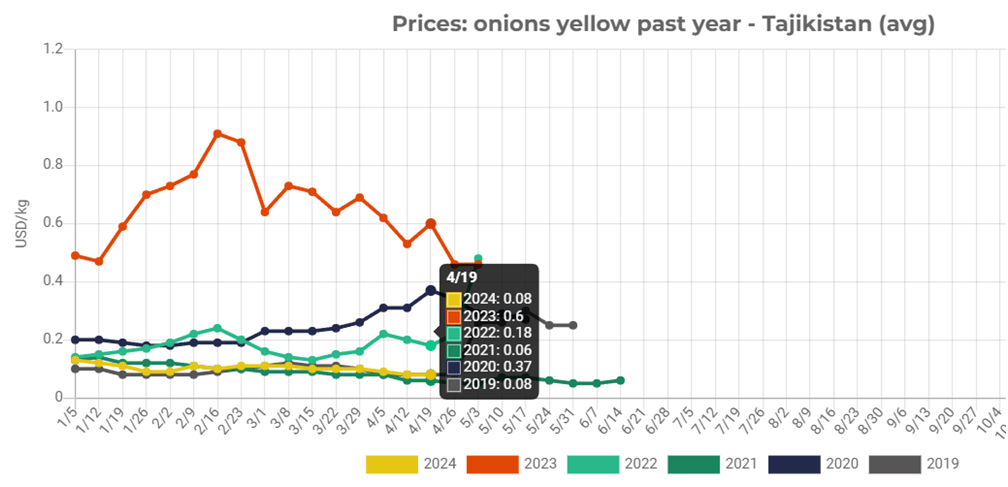

The onion market mirrors this trend. Premium quality onions are being wholesaled at just 8 US cents per kilogram. To put it into perspective, with 100 US dollars, one could purchase 1.25 tons of onions!

This price point is not only a record low internationally but also fails to meet the production and storage costs incurred by Tajikistan’s agriculturalists. Compounding this issue is the influx of new onion crops from the country’s southern regions, already hitting the markets and exacerbating the existing predicament.

Read also: Have onion exports been banned again by Tajikistan?

So, what’s driving these rock-bottom prices for onions and carrots?

Several factors contribute to this situation. Foremost is an informal export ban on these products, implemented early in 2024, which unexpectedly included both onions and carrots. The logic behind this prohibition remains elusive, especially since prices were already near historic lows at its inception, negating any need for consumer price protection. Conversely, exports could have generated substantial foreign exchange earnings. For context, Uzbekistan reportedly exported over 300,000 tons of onions, netting approximately 100 million US dollars, with a notable portion entering the European Union market.

Another contributing factor is the surge in production volumes, spurred by the previous season’s high prices. Farmers expanded cultivation areas, anticipating not only to satisfy domestic demand but also to capitalize on export opportunities. This optimism led to a supply glut, further pressurizing the market.

Lastly, unexpected storage challenges have arisen. Vegetables, being perishable, require consistent low temperatures for optimal storage. This year, however, Tajikistan’s storage facilities have faced frequent power disruptions, hastening the degradation of vegetable quality and compelling farmers to expedite sales, thereby intensifying market and price pressures.

Maintain full control over fruit and vegetable prices in Turkey, Egypt, Ukraine, Uzbekistan, Russia, Moldova and other markets subscribing to EastFruit Premium.