Earlier EastFruit wrote about a Georgian farmer finding it profitable to produce off-season blueberries last year. Now our analysts point out low volumes, but very quick growth, of fresh blueberry imports in the off-season.

Georgian blueberry season is in June and July. After that very small leftovers may be left in August. With some Georgian producers considering producing blueberries in the off-season and some even already started it, this might change, EastFruit analysts suggest.

It is worth noting that during the season, there are practically no imports.

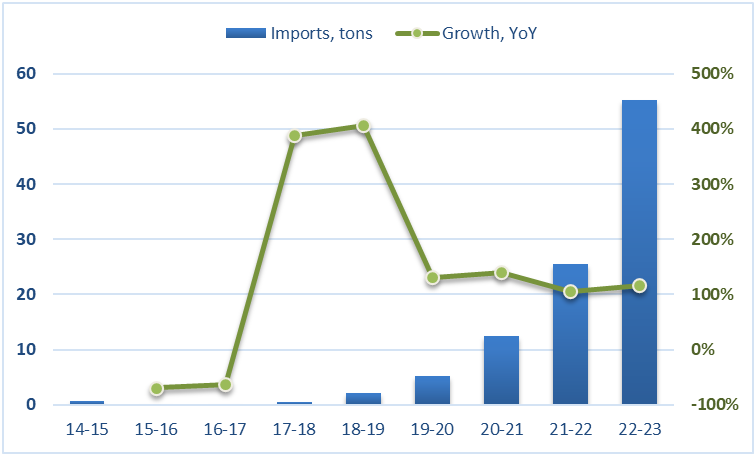

Georgian imports of fresh blueberries in the off-season (August-May)

Data source: Ministry of Finance of Georgia

Looking at the data on blueberry imports in Georgia from August to May, which is an off-season for Georgia, it will be hard to miss out on the exploding growth in the last 5 off-seasons.

Starting from the 18-19 off-season, fresh blueberry imports have been at least doubling each year. Continuing this trend in the latest off-season, Georgia has imported two times the blueberries in the 22-23 off-season than it imported in the off-season of 21-22.

Overall, 22-23 imports amounted to 55 tons, which can be low considering that Georgia exported about 1350 tons last year. So, for now, there might be limited opportunities to produce blueberries on a massive scale for the Georgian off-season. Yet, the trend of very quick growth in imports is apparent, and it is a good sign for the farmers thinking about producing blueberries in the off-season or for the ones that have already started production.

According to the official statistics, import prices for blueberries in CIF terms (Cost, Insurance, Freight) have usually ranged from $9.00/kg to $13.00/kg in the last five off-seasons – a period in which the imports have been the most active. Very rarely, prices have gone below or above the mentioned threshold. Generally, prices are on the higher end of the spectrum in winter.

Read also: 50 tonnes of blueberries exported, and new markets opened – the Georgian Agritouch’s results in 2022

EastFruit has a report of a Georgian farmer selling blueberries in the off-season at about 70% higher than the discussed import prices. Hence, the quality and freshness are very likely to give locals a competitive edge, but keeping an eye on the imports is also important.

The major importer of fresh blueberries to Georgia is the Netherlands. Imports of frozen blueberries are practically non-existent.

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.