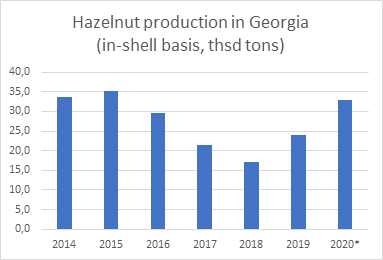

Georgia’s last hazelnut season was successful both in terms of yields and quality. Production recovered from brown stinkbug invasion and reached 33 tnd tons – highest production level in recent five years. Farmers are now getting ready for the next season which starts in August-September 2021 – the activity in orchards’ care is said to be unprecedented. Looks like Georgian hazelnut growers will start to focus more on quality, as it does pay off.

Source: Geostat

*preliminary data; official data for prices is not published yet

After a downward trend, caused by stinkbug invasion, Georgian hazelnut production is seeing growth again, and the rate is rather high – around 8 thsd tons per year beginning from 2017. As a result of recovery, hazelnut harvest in 2020 has almost doubled in quantity compared to the lowest point in 2018.

Prices are also getting better. Comparing to the same period of 2019 (we refrain from comparing to unusual pandemic 2020 year), price of the hazelnuts, in-shell, is 12% higher. Prices went up from $2.2/kg to $2.46/kg and for shelled – by +2% – from $5.78 to $5.88 in 2021.

Representative of Georgian Hazelnut Growers Association Merab Chitanava mentioned in his interview with Agrogaremo TV, that the last harvest was good, yet further increase is underway. Mr. Chitanava highlights very active preparations for the next season – „we have a very good platform, farmers are very active, we had an unprecedented activity in fertilizer use”. Such situation gives the association hopes of a very good harvest in 2021.

Even better Georgian hazelnut harvest in 2021 will very likely result in a new record high quantity. Other than farmers’ increased attention to orchards’ management, major factor will be young trees entering production.

Since 2016, Georgia has planted at least 5,000ha of hazelnut orchards. Given standard Georgian yields, these new supplies will provide an additional 7.5 to 13 tnd tons per year and most of these plantations will start producing hazelnuts in 2021. Thus, Georgia’s 2021 harvest has high chances of being the highest in the recent seven years in terms of quantity and in terms of quality too.

The demand for quality is driven by the fact that one could triple the revenue selling higher quality nut. Thus, farmers are now actively investing in hazelnut quality. EastFruit estimated that if Georgia does not invest in quality of hazelnuts, it risks losing around US $80mn in revenues for the nut business, and we are happy to finally see the change in the approach to nut growing business.

As for the prices for the next season, expectations are mixed. EastFruit estimates that more than 90% of Georgia’s 2020’s harvest has been exported. Therefore, Georgia’s prices are very closely tied to global markets where competition is rising.

Hazelnut production is growing worldwide and according to the International Nut Council, is expected to reach 1 306 900 MT (in-shell) in 2021/22 from 1 183 000 MT last season, mainly due to expected crop increase in Turkey, Chile, Georgia, Azerbaijan, Iran, China, and Spain. Competition is rising with the other tree nuts as well. Even Turkey, a major producer and exporter of hazelnuts, with usually had more than 60% share in the global production, saw a decline in exports in 2020. Annual reduction in Turkish hazelnut exports by volumes was 12.1% and in USD value – 4.1%.

- Rival countries sell hazelnuts at a lower price;

- Confectionary industry in Europe turned to almonds, as almond became affordable due to large increase in supplies and much lower prices, while hazelnut prices went up;

- Some companies, which buy hazelnuts and sell tree nut mixes as a snacks, started to use fewer hazelnuts and more other, more affordable nuts.

Despite the concerns of rising global competition, the move by Georgian hazelnut growers to focus on harvest quality is the right one. It is true that there may be significant downwards pressure on prices in the future, but the payout Georgian farmers will get, will be much better than the prices they would get without focusing on quality.

Another idea for Georgia would to develop hazelnut processing further and to add value to products made from hazelnut. “There are opportunities in confectionary industry. Georgian traditional churchkhela fully complies with the concept of a healthy product and with certain efforts it can become fashionable and in demand all over the world.” – comments Andriy Yarmak, Economist of the FAO Investment Centre. “In Europe, the USA and other countries, there is now a growing trend for healthy eating, and supermarket chains are looking for more and more nutritious healthy products. It is necessary to properly register it at the international level as a product with a protected geographic indication (GI) and to promote it well” – comments expert.

What trends will determine the development of the market for vegetables, fruits, berries and nuts in the season 2021/2022, and what will be their impact on the fruit and vegetable business – market players will be able to get answers to these and other questions during the online conference “Fruits, Nuts and Vegetables of the Eastern Europe ”, which will take place on June 9, 2021.

During the conference, its participants will learn about the opportunities EastFruit platform provides for tracking trade and price changes in the market, as well as methods of establishing business contacts during the absence of exhibitions, trade missions, conferences, with focusing on an overview of typical mistakes of representatives of the produce business.

Participation in the conference is free of charge, but subject to mandatory registration. Please note that the conference will be conducted in Russian language. We are happy to invite producers and exporters from Eastern Europe to register for the online conference. Link for the registration is available here.

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.