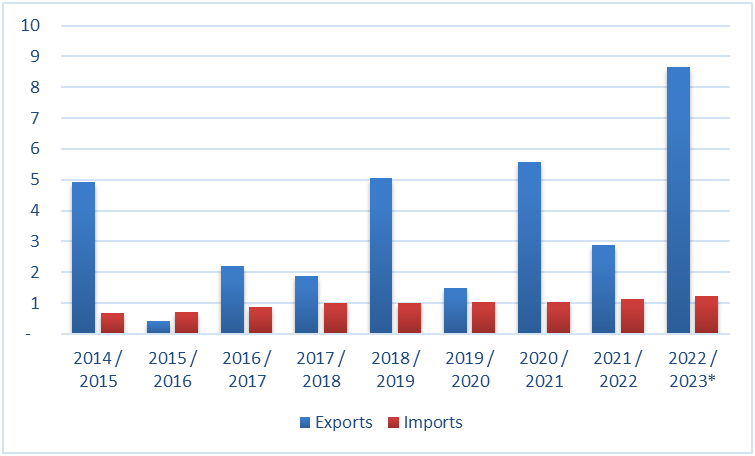

Analysts at EastFruit direct our attention toward Georgia’s external trade with apple juice concentrate. Export volume from the 2022/2023 season is record-breaking and more than the sum of exports in two previous seasons. Two major exporting destinations remain unchanged. However, there are significant changes in shares. Import volumes have remained modest.

Georgia’s external trade with apple juice concentrate, 1000 tons

Data source: Ministry of Finance of Georgia (MoF)

Data source: Ministry of Finance of Georgia (MoF)

*Does not include data for June

Apple juice concentrate export (by volume) almost reached 9 thousand tons in the 2022/2023 season. The season start is taken as July. The 2022/2023 season does not include data for June, as the month is still ongoing. Considering the grown exports and the exports in June in previous seasons, the final result for the 2022/2023 season may be close to 10 thousand tons.

In fresh apple equivalent, apple juice concentrate exports in the 2022/2023 season amounted to 61 thousand tons of fresh apples. This is more than 80% of non-standard apples that went to the processing. The ratio used for conversion is 1kg apple juice = 7kg fresh apple.

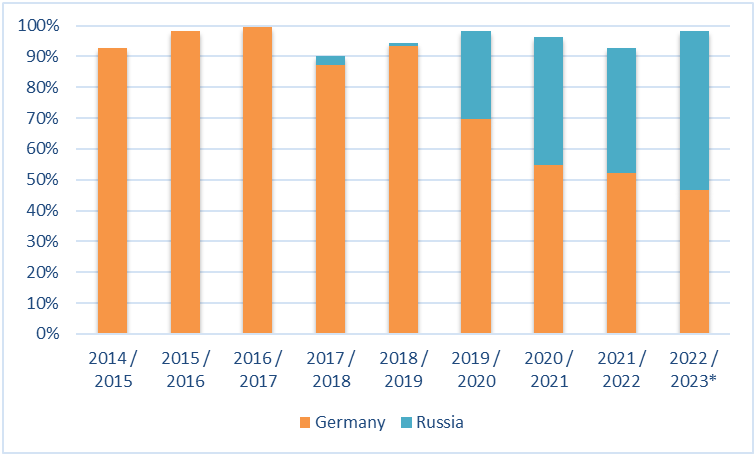

Top export destinations, shares in seasonal exports

Data source: Ministry of Finance of Georgia (MoF)

Data source: Ministry of Finance of Georgia (MoF)

*Does not include data for June

Germany and russia remained as main exporting destinations, but russia’s share has increased significantly. Compared to the previous season, russia’s share has risen by nine percentage points, from 42% to 51%.

Over the nine seasons, Germany’s share has decreased from 93% to 47% in the 2022/2023 season. Meanwhile, russia’s share has reached 52% from practically 0% in just four seasons.

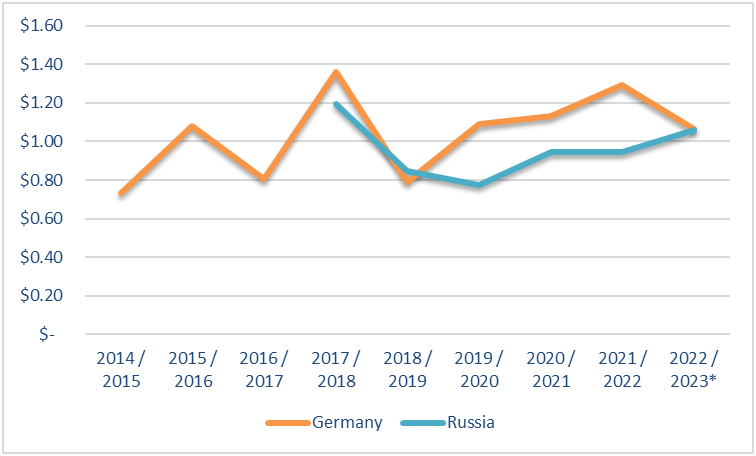

Season average prices for top destinations, USD/kg, FOB

Data source: Ministry of Finance of Georgia (MoF)

Data source: Ministry of Finance of Georgia (MoF)

*Does not include data for June

This season was the second time that the export price to russia came close to that of Germany. Usually, the gap between the prices for the two destinations was much more significant, with German prices being higher. According to the official data, in the 2022/2023 season average export price to russia amounted to $1.06/kg – just $0.01 lower than the price for Germany.

As for the imports, there is an increasing tendency, but overall volumes are still small and around 1 thousand tons. Ukraine was the leading exporter up to the 2022/2023 season. Now, russia is the leading exporter, with a share of 54%.

HS codes used for apple juice concentrate: 200971, 200979

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.