According to the Georgian EastFruit team, Georgia continues to export record volumes of potatoes. Their high demand in Russia that is now having difficulties in finding large suppliers of potatoes forces it to purchase potatoes even in countries that have not previously supplied them to Russia. This leads to an increase in potato prices in most countries of the region and stimulates exports to Russia.

According to official data, Georgia exported 6.6 thousand tonnes of potatoes in November 2021. About 62% of this volume was sent to Russia and another 28% to Azerbaijan. At the same time, Azerbaijan itself exported potatoes to the Russian Federation.

Russia still demanded high-quality potatoes of large caliber, therefore the price for export to Russia was the highest – about $0.42/kg (FOB). When exported to other countries, the average price was $0.30/kg or less.

Since the beginning of the potato harvest in the key potato-producing region, Samtsk-Javakheti, Georgia has exported 22.5 thousand tonnes of fresh potatoes in September 2021 and received $7.2 million of revenue. Such large volumes of potatoes in September-November were exported for the first time in the history of Georgia. In 2014-2020 in total, Georgia exported 18.7 thousand tonnes of potatoes in these three months, which is about 4 thousand tonnes less than in the same months of 2021. Export revenue of $7.2 million in just three months is at least 70% higher than export revenue in any other year in total.

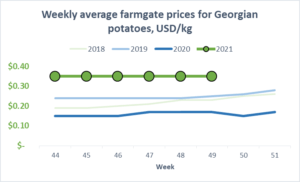

Georgia needed these good results after the unsuccessful previous season in Samtsk-Javakheti, when overall demand was very low. Now Georgian farmers sell potatoes at $0.35/kg, which is twice as much as in the same period in 2020.

At the moment, it is a little unclear whether external demand will continue to stimulate potato exports from Georgia. The gap between potato prices in Georgia and Russia, the main driving force behind Georgian potato exports, has recently narrowed. Russia imported a lot of potatoes to lower domestic prices, and it worked. The average price has dropped from $0.48 about a month and a half ago to $0.38 now.

A smaller difference in prices between the two countries could lead to a reduction in export opportunities for Georgian farmers. Local sources report that Russian importers show little or no activity in the first weeks of December 2021. However, this may not be the end of Russian demand for Georgian potatoes, as the possibility of an acute shortage in Russia has become very real recently.

According to market participants, prices for potatoes in Russia declined when low-quality potatoes were sold and high volumes were imported from many countries, so prices will return to their previous levels in the near future. Indeed, the possibilities of importing potatoes to Russia in winter will be limited.

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.