EastFruit experts note high prices for carrots and beets in Uzbekistan, which is unusual for this time of year. In shops and markets in the capital of the country, Tashkent, both products are sold at prices ranging from 9,000 sums ($ 0.85) to 11 sums ($ 1.04) per kg. About two months ago, their retail prices were 2-3 times lower, although the normal picture should look different – this year’s harvest became available on the market in April and a gradual increase in its volumes often leads to a gradual decline in prices.

What are the reasons for such “unconventional” behavior of prices for carrots and beets this season? According to EastFruit experts, the main reason lies in the abnormal dynamics of prices for these types of vegetables in the Russian market, where carrots and beets are jokingly called new symbols of wealth.

What is pilaf without carrots?

In Uzbekistan, per capita consumption of carrots is higher than in Eastern Europe. The main reason for the high consumption of carrots lies in them being the most important component of the famous Uzbek pilaf. At least one kg of carrots is used per one kg of rice in the popular recipe of pilaf. Although until recently the prime cost of pilaf was determined by the prices of meat, rice and vegetable oil, share of carrots in the prime cost of pilaf is becoming increasingly significant considering their current prices.

In the past few years, meat and rice have become much more expensive in Uzbekistan. Therefore, many noticed that in order to reduce the cost, they began to add a lot of carrots to pilaf as they were cheaper. However, the situation is now changing dramatically, because the prices for carrots are literally breaking records.

Young carrots are not used for pilaf – at least a couple of months should pass after they are harvested. Therefore, old carrots are in demand even when newly harvested carrots become available on the market because they are preferable for Uzbek pilaf.

Carrot price anomalies – prices are five times higher than a year earlier!

In April 2021, prices for carrots from last year’s harvest rose sharply. Having increased in early May, prices for last year’s carrots in Uzbekistan continue to grow, albeit at a slower pace. Although the usual picture should be different in theory, this year’s harvest on the market and a gradual increase in its volumes at least prevent the prices for last year’s carrots from growing.

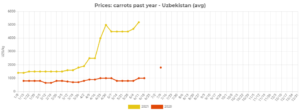

The graph below shows the dynamics of wholesale prices for carrots from last year’s harvest in 2020 and 2021.

As can be seen from the graph, as of June 11, 2021, wholesale prices for carrots from last year’s harvest are 5 times higher than on the same date last year.

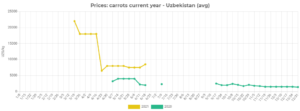

This unusual tendency is also observed in the prices for this year’s harvest. The prices stopped decreasing at the end of April and literally “froze” at the same level. Although, in the first ten days of June last year, prices for early carrots fell by almost 2 times and were almost 3.5 times lower than the current prices.

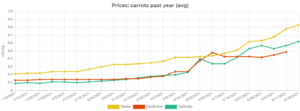

At the same time, the dynamics of carrot prices in Uzbekistan repeats their dynamics on the main export market for the sale of fruit and vegetable products of Uzbekistan – in Russia and in neighboring Tajikistan.

Beet prices are also increasing rapidly.

The situation is similar with beets. Prices for beets in Russia now reach 110 RUB/kg ($ 1.53/kg) in retail stores and 180 RUB/kg ($ 2.50/kg) in open markets.

Accordingly, Uzbek producers and exporters of carrots and beets have excellent opportunities to export them to the Russian market. EastFruit experts note the active export of carrots and beets in this direction, through Kazakhstan as well. Moreover, only early carrots are usually exported from Uzbekistan from April to June. Judging by the dynamics of prices for last year’s carrots, this year the range of exported carrots was expanded with last year’s harvest.

However, the intensification of exports of table beets is worth noting. According to EastFruit experts, about 2,000 tons of beets were exported from Uzbekistan in May 2021. These rates decreased slightly in June which may be due to an increase in the supply of beets in the Russian market from other countries, or to an increase in prices in the domestic market of Uzbekistan as the volumes available for sale decrease.

The conclusion is obvious – since Russia is the largest and main export market for fruit and vegetable products in Uzbekistan, the rise in prices for certain products in Russia is reflected in the rise in their prices in Uzbekistan. Therefore, if you want to know what products will rise in price in Uzbekistan, closely follow the monitoring of wholesale prices for vegetables and fruits in Russia from EastFruit – it is still available free of charge.

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.