There is a clear downward trend in apple exports from Ukraine for the second season in a row both in terms of quantity and in the geography of countries buying one of the main fruits in the world, according to experts of the EastFruit project. Ukrainian market operators, analysts, and the producers themselves note the main reason is the overall decline in the gross harvest of apples in Ukraine for the last two seasons.

EastFruit experts tried to understand in detail the current situation since the intensification of apple production (albeit at a slow pace) is progressing according to the data received from the farmers. In addition, all new apple projects that began in Ukraine over the last 5-7 years were developed exclusively taking into account all the necessary elements of intensive orchards. According to experts, these facts should lead to a higher percentage of high-quality apples and neutralize to the greatest extent possible any negative impacts from the weather on apple production in Ukraine.

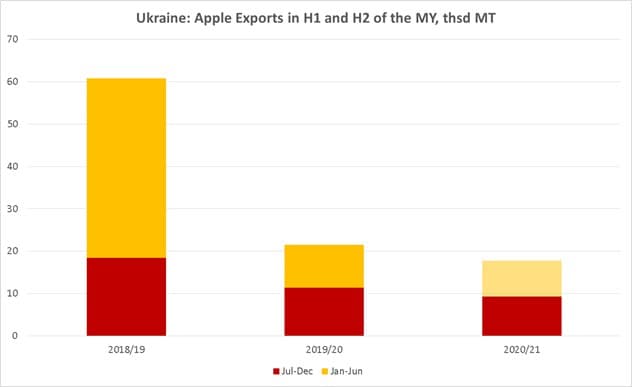

In the 2018/19 season, Ukraine exported record volumes of apples exceeding the mark of 60,000 tons and significantly expanded its geography of importing countries. There are a number of explanations for this.

Without a doubt, 2018 was Ukraine’s most fruitful year in at least a decade. However, in 2019, Ukraine had one of the lowest yields of apples harvested in the same time period. Despite the intensification of apple production in the country, the weather conditions had a very serious negative impact on the orchards – not only in a specific period of time but throughout the growing season. Bad weather factors in 2019 were spring frosts in April-May, multiple hail storms (especially in the western regions of the country), prolonged periods of high air temperatures, absence of rain, and prolonged rainy weather in the main regions of apple production during July.

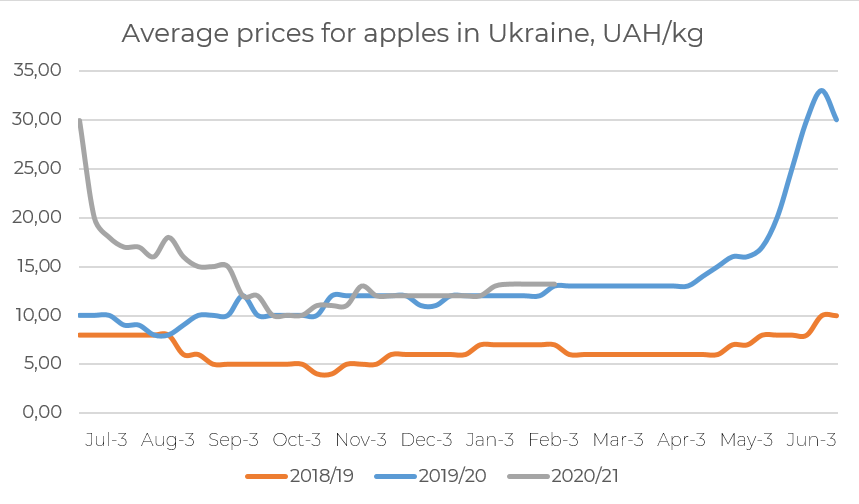

According to EastFruit analysts, the supply of apples in the domestic market exceeded demand several times over as a result of the record gross harvest of apples in Ukraine in 2018. Apple prices remained at fairly low levels of UAH 5-6/kg ($0.18-0.22/kg) throughout the marketing season of 2018/2019. This was the second powerful impetus for the development of new export sales channels for Ukrainian apples. A special role was played by young companies that were just entering the market with their products and their production capacities met the international standards.

The third important factor in the development of apple exports from Ukraine in recent years was the participation of Ukrainian producers at international exhibitions and the organization of a number of trade missions from Ukraine in order to promote exports. Efforts by the Ukrainian Horticulture Association (UHA) played an important role in this.

“Yes, in the 2018/19 season, there was volume, quality, and acceptable prices for foreign buyers. But, as the last 2 seasons in Ukraine have demonstrated, weather factors can completely destroy the entire export mechanism developed previously. It is the correct policy of Ukrainian producers who may not bring all the accumulated export potential in the apple segment to the initial stage of development,” stressed Alexander Khorev, the head of the project APK-Inform: Vegetables and Fruits.

What about the current 2020/21 season? The negative impact of weather factors also took place in 2020, but they clearly could not have caused the same damage to apple production as in the previous season.

“According to survey results in both the spring of 2020 and in August 2020 of the leading Ukrainian farmers, the APK-Inform analysts remained steadfast in their preliminary forecasts that in 2020, apples will be harvested at no less than the volume from a year earlier when weather factors had a significant negative impact on apple production in Ukraine,” says Alexander Khorev. He added: “Despite our forecasts, we fully agree with Ukrainian producers that the percentage of low- and medium-quality apples significantly exceeded the indicators of 2019 notwithstanding the overall growth in the gross apple harvest in 2020. This can only speak of a further reduction in the volume of apples sent by Ukrainian farmers for exports.”

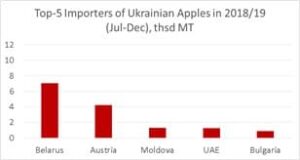

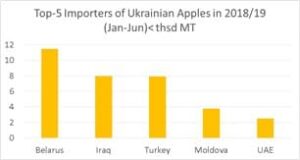

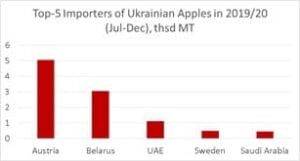

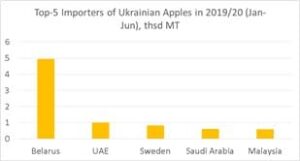

If we take a closer look at the first and second half of the 2018/19 season for exporting apples from Ukraine, we can clearly see Belarus in the lead position primarily as a re-exporter of Ukrainian apples to Russia. The pronounced lead by Belarus in the rating of buyers of Ukrainian apples manifested itself at the start of 2019 when the main offer for wholesale exports from Ukraine began of Idared and Jonagold apple varieties, which always enjoy increased interest from buyers in the Russian market.

In the 2019/20 season, the situation with apple exports from Ukraine changed significantly. As a result of a sharp decline in the gross apple harvest mentioned above, the supply of export-quality apples decreased significantly. The lack of supply of apples on the Ukrainian market from the very beginning of the 2019/20 season brought retail chain buyers directly to farms where they stood in line to purchase the necessary volumes of apples and quality faded into the background. Prices for apples in Ukraine were at least twice as high as last year, which made local producers very happy, but it did not inspire external buyers at all. In most cases, external buyers could not understand why they should pay twice as much for the same product from the same time a year earlier.

As a result, slightly more than 20,000 tons were exported from Ukraine in the 2019/2020 season. The most notable trend was that many producers, even with apples of export quality, were increasingly inclined to sell available volumes on the domestic market since the prices at that time were identical and exports would have required additional effort and time.

However, the most positive result of the previous apple season for Ukrainian farmers was the preservation of all previously developed export destinations such as Southeast Asia, the Middle East, and the EU with a gradual decreasing share of apple exports to Belarus (i.e., to Russia).

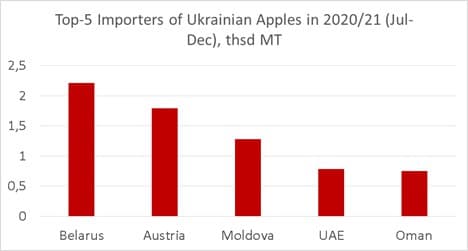

Moldova has returned to the Top-5 rating of apple buyers from Ukraine this season. According to EastFruit analysts, this did not come as a surprise. As previously reported, Moldova lacked at least 30% of the planned apple harvest in 2020. Since this country is actively working to develop exports for its apple business, its imports solve issues in advance with missing volumes for future supplies in order to fulfil previously voiced guarantees to its importers.

If we consider the details of apple exports from Ukraine in the first half of this season and compare them with the data of the previous two, then even according to the most optimistic forecasts, no more than 20,000 tons of apples are expected to ship from the country.

“As the latest survey of Ukrainian producers has shown, despite a significant shortage of high-quality apples in 2020 and more than half of the storage facilities are unfilled, apple exports from Ukraine will continue for the next 2-3 months. Even if the geography of Ukrainian apple buyers does not expand this season, the previously developed main directions of apple exports will be preserved for the next seasons,” summed up Alexander Khorev.

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.