For the second year in a row, prunes are a real hit in Uzbekistan’s exports. In 2022 exports of prunes from Uzbekistan doubled compared to the previous year, and Uzbekistan became one of the three largest exporters of prunes in the world. In 2022 Uzbek prune exporters have built on last year’s success, and over the first 9 months of this year, a record volume of these products was exported. Moreover, the increase in exports of this product is due to significant diversification and active expansion in the Chinese market, EastFruit analysts note.

Unexpected change in trends

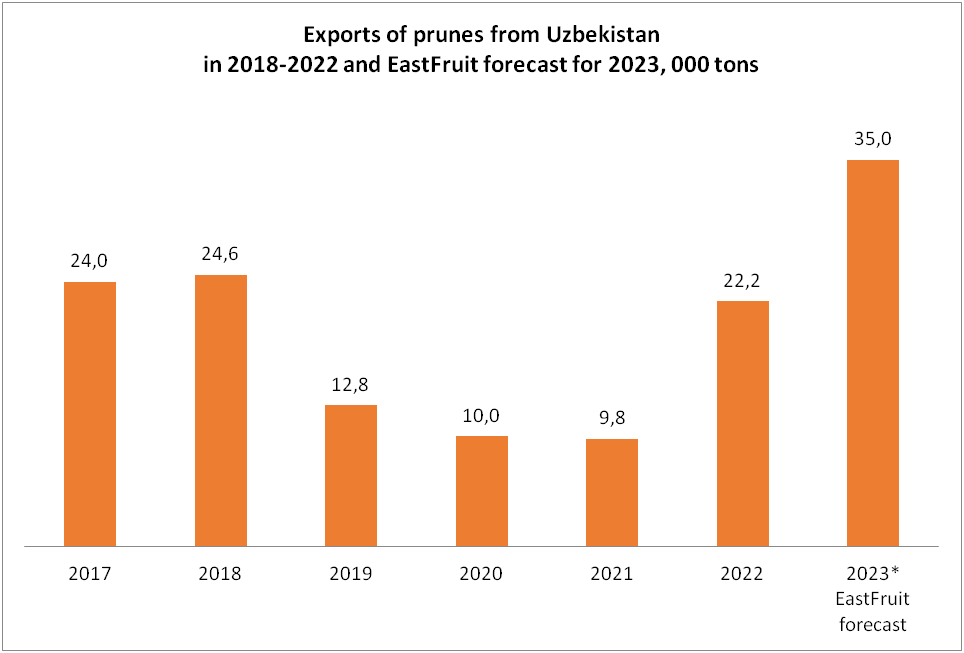

It is interesting to note that until 2022 prune exports were declining. However, large investments into new plum orchards have rapidly boosted supply and availability of raw material for production of prunes. Moreover, varieties of plums planted were suitable for production of high quality prunes, which helped. Thus, in in 2022, the downward trend was reversed, and in 2023 new export record was set.

According to preliminary trade statistics, from the beginning of January until end of September 2023, 26.4 thousand tons of prunes were shipped to foreign markets for a total amount of US $31.9 million, which in physical terms is 7.3% more than for the entire 2018. According to preliminary estimates by EastFruit analysts, by the end of 2023, the volume of exports could reach 35 thousand tons. Thus, exports in 2023 could increase 60% compared to the previous year and 3.5 times compared to 2021.

Return of Uzbekistan to top-3 global exporters

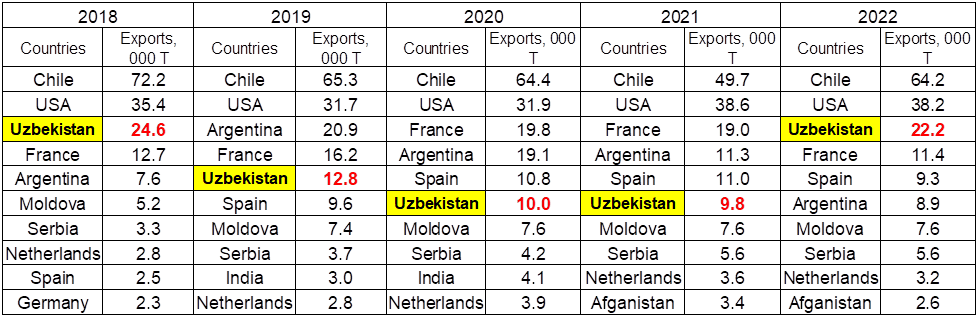

Chile and the USA are the global leaders in terms of prune exports. Third place in this ranking over the past five years has been alternately occupied by Uzbekistan, France or Argentina.

In 2017-2018, Uzbekistan entered the top three world leaders but over the following three years it fell out of top due to a decrease in exports but remained among top 10 largest exporters globally.

As a result of a sharp increase in export volumes, in 2022 Uzbekistan again found itself among the top three leaders in prune exports in the world. Today we can say with confidence that at the end of this year, Uzbekistan will at least maintain its position or could even claims the second place among the global leaders of prunes.

Export diversification away from Russia towards Chinese market

It looks like the main reasons for rapid increase in exports of prunes from Uzbekistan are thanks to opening of new markets, which would have not been possible without an improvement in quality of the product and greater availability of raw material.

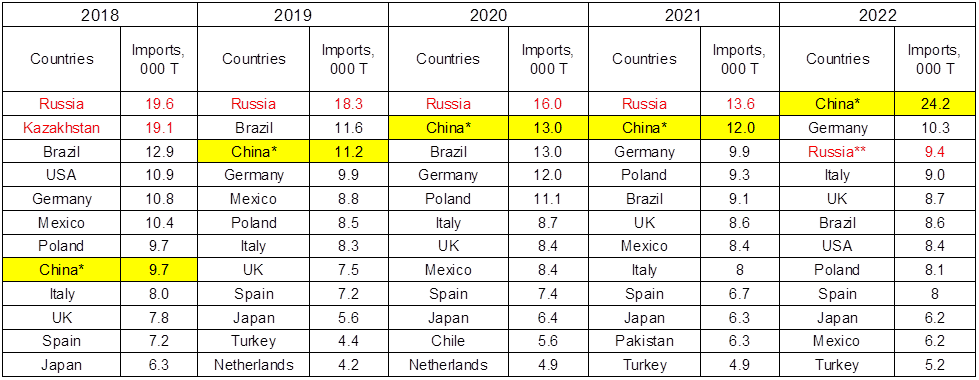

It is also clear that global leadership in imports of prunes has shifted from Russia to China, Latin America and the EU.

Remarks:

Remarks:

* including data for Hong Kong, Macau and Chinese Taipei special administrative regions;

**according to the main suppliers of prunes to the Russian market due to the lack of official data on imports for 2022 to the Russian market

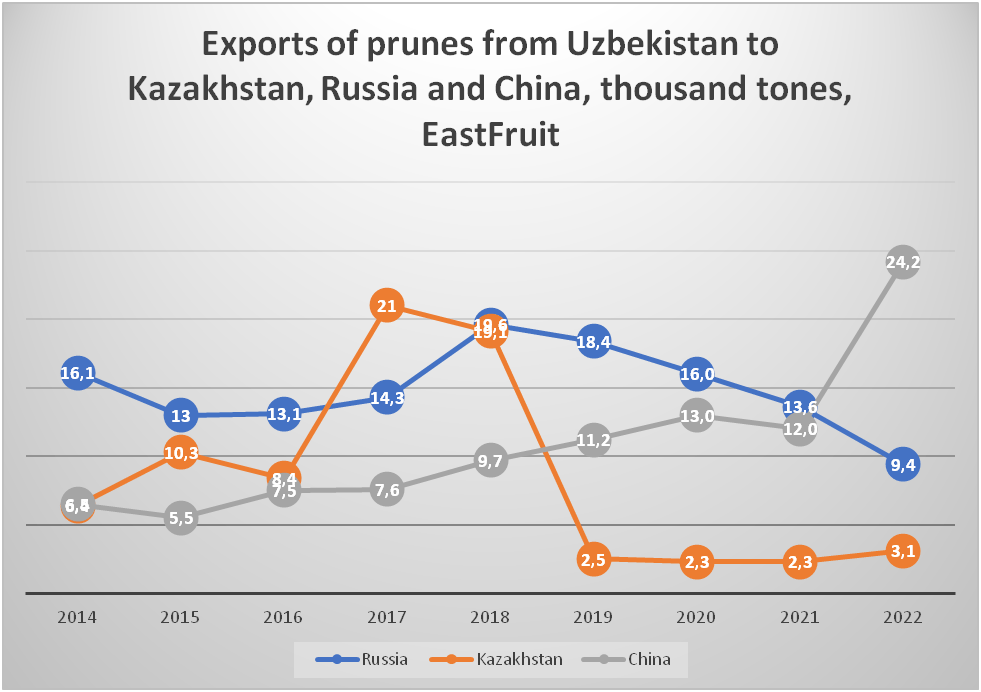

Let’s look at the export trends of Uzbek prunes in 2014-2022 to three selected countries: Kazakhstan, Russia and China to visualize the reasons for increased exports.

As can be seen from the diagram, after record figures in 2018, Russia is importing less and less prunes. As for Kazakhstan, after record import volumes in 2017 and 2018, imports fell sharply in 2019 and have since fluctuated in the range of 2.3 – 3.1 thousand tons per year. Both of these countries are traditional markets for Uzbek fruits and vegetables. Also, it could well be that Kazakhstan was re-exporting Uzbek prunes to Russia in 2017-2018 taking advantages of tax-free exports.

China has been actively developing closer trade ties recently in Central Asia, where Uzbekistan plays one of the key roles and it has opened up its markets for the country. Consequently, in 2022prune exports to China from Uzbekistan doubled. According to EastFruit analysts, China continues to increase imports of prunes in 2023. At the same time, China is also an exporter of prunes and its main export destination is Japan, which accounts for about 80% of China’s prune exports. From 2017 to 2022, prune exports from China to Japan increased from 420 tons to 2 thousand tons, i.e. almost 5 times.

Expanding prune export horizons

In 2017-2020 the number of importing countries with an annual prune import volume of 100 tons or more did not exceed seven while Kazakhstan and Russia amounted for 80%-90% all exports. Although in 2019-2020 the share of these countries decreased significantly, it remained quite respectable, at the level of 32%-34%.

Starting from 2021, the geography of Uzbek prune exports began to expand, and the number of importing countries with an annual imports volume of over 100 tons increased to 12, and the total share of Kazakhstan and Russia decreased to 24%. This year can be called a turning point as the number of importing countries was replenished with one of the world’s largest importers of prunes with a dynamically growing market for these products. For the first time in 2021, China imported 280 tons of Uzbek prunes.

Already in 2022, exports of prunes from Uzbekistan became even more diversified – the number of importing countries with an annual import volume of over 100 tons increased to 18. Moreover, 7.4 thousand tons of these products were supplied to the Chinese market, which amounted to about a third total export volume of Uzbek prunes. In 2022, Uzbekistan became the second largest supplier of prunes to the Chinese market after Chile. The share of Uzbekistan in the total imports of prunes to China was 31%.

In addition, last year Uzbek prunes were supplied to Belgium in the amount of 1.2 thousand tons, Algeria in the amount of 665 tons and Mexico – 110 tons, where Uzbekistan had not previously exported these products. Supply volumes to Latvia, Lithuania, Bulgaria, and Mongolia also increased. At the same time, the volume of supplies to the Russian market increased to 5.1 thousand tons.

This year, Uzbek exporters continued their expansion in the Chinese market. According to preliminary trade statistics, in January-September 2023, Uzbekistan exported 16 thousand tons of prunes to China, which amounted to 61% of the total prune exports during this period. The rest of the exports were distributed among the following importing countries:

Russia – 4.2 thousand tons (16%);

Belgium – 792 tons (3%);

Türkiye – 768 tons (3%);

Belarus – 730 tons (3%);

Kazakhstan – 700 tons (3%);

Ukraine – 643 tons (2%);

Lithuania – 590 tons (2%);

Georgia – 440 tons (2%);

Mexico – 335 tons (1%);

Latvia – 300 tons (1%)

Mongolia, Kyrgyzstan, UAE and Poland – in volumes from 100 to 140 tons to each of these countries;

Algeria, Saudi Arabia, Morocco, Azerbaijan and Iraq – in volumes from 40 to 80 tons to each of these countries;

Turkmenistan, Bulgaria, Spain, Tajikistan – from 16 to 22 tons to each of these countries;

Other countries – 20 tons.

In conclusion, EastFruit experts note that in order to form a stable uptrend in prune exports, Uzbekistan needs to cement its positions in the Chinese markets and continue working on boosting quality and safety of the prunes. It is also essential for the country to continue export diversification efforts via wise marketing. If these efforts are successful, Uzbekistan can potentially claim global leadership in the prune market considering its huge plum production potential and excellent climatic conditions for growing high quality stone fruits.

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.