EastFruit continues its series of analytical materials on the potential impact of Russia’s economic problems caused by its barbaric invasion of Ukraine on the Egyptian market. You can read our analysis on whether the demand for Egyptian potatoes will decrease and what will happen to the exports of Egyptian potatoes here. Our article on how Russian aggression will affect the supply of Egyptian carrots, onions, and garlic to Russia is available here.

In the third, and final, part of our analysis, we assess the prospects for the exports of dried and frozen vegetables, lettuce, and sweet potatoes from Egypt to Russia in 2023.

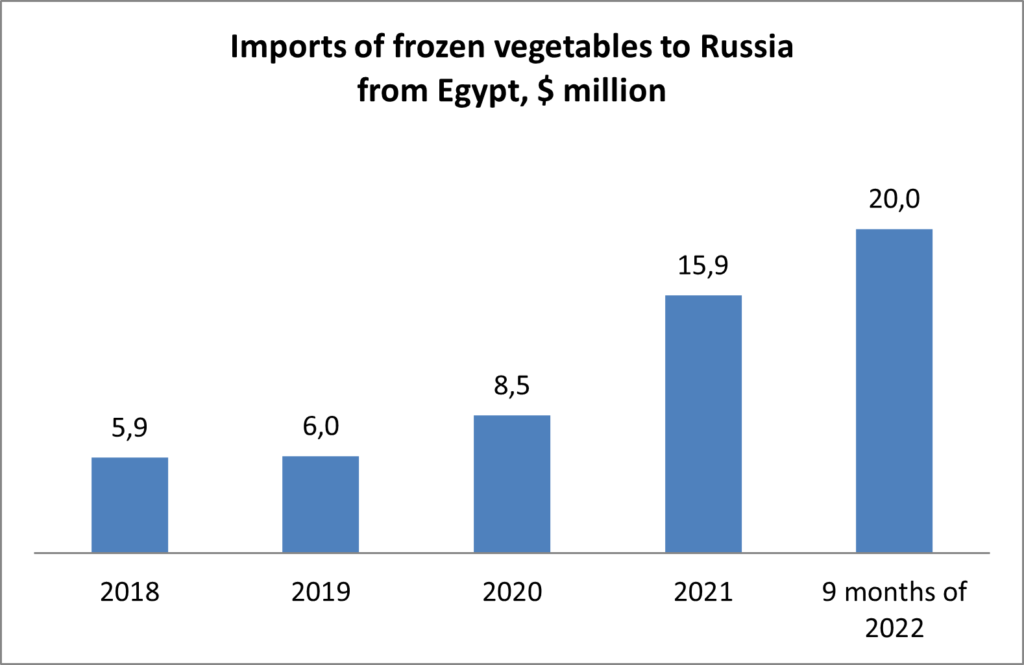

Egypt has been actively increasing the export of frozen vegetables in recent years and the growth rate of their exports to the Russian market is impressive. See the chart below. The deliveries have grown 3.5 times in 4 years!

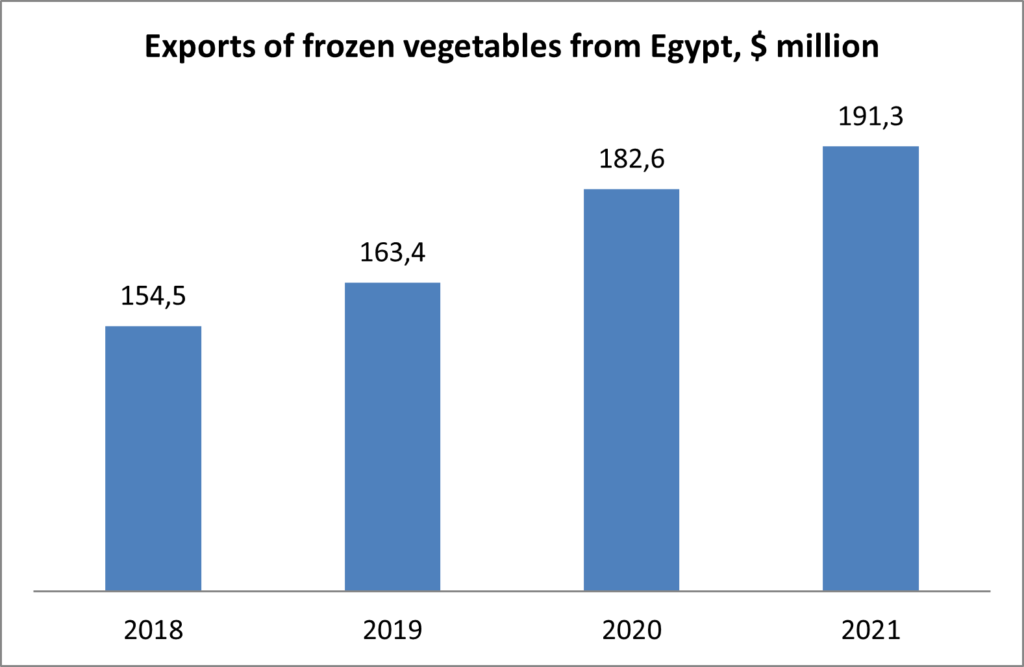

The total export of frozen vegetables from Egypt is also impressive and has been growing since 2019.

It is clear when comparing the data from the two charts that the “Russian factor” was not that important in the increasing total export volume of frozen vegetables from Egypt in 2019 and 2020. However, the total export volume of frozen vegetables from Egypt in 2021 rose to a large extent due to an increase in supplies specifically to the Russian market. If the same picture is observed in 2022, this means that the growth in the export of frozen vegetables from Egypt over the past two years is highly dependent on the Russian market.

Although there was a high growth rate in the volume of imports of frozen vegetables from Egypt to Russia in 9 months of 2022, the outflow of part of the Russian population due to the mobilization announced at the end of September 2022 is not taken into account there. These people of working age, most of whom were employed in various fields and value their free time, often use frozen vegetables in packages for home cooking.

As a result, given the high growth rate of Russian imports of frozen vegetables from Egypt in 9 months of 2022 in the context of the war and the outflow of some consumers in the 4th quarter of 2022, it is not worth counting on high growth rates of these imports in 2023. However, according to EastFruit experts, the demand for frozen vegetables on the Russian market will continue growing, but much more slowly than before. Growth will ensure the affordability of prices for frozen vegetables in winter when fresh vegetables are much more expensive, as well as the convenience of their use.

Therefore, in terms of increasing the exports of frozen vegetables, Egyptian exporters should focus on more reliable markets. In addition, the markets of many countries are already open to Egypt, and the geography of these exports from Egypt is well-diversified. The largest importers of Egyptian frozen vegetables are the United States and Saudi Arabia. At the same time, the volume of exports there is 1.5 times higher than in the Russian Federation. Other major buyers are Italy and the UAE, which buy no less frozen vegetables from Egypt than Russia. In 2021, Egypt exported frozen vegetables to more than 25 countries, 1 000 to 26 000 tonnes each.

Dried vegetables: their imports from Egypt to the Russian market increased from $2.5 million to $3.7 million in 2019-2021, i.e. by $1.2 million. At the same time, the proceeds from the total exports of dried vegetables from Egypt increased from $45.3 million to $66.3 million over this period, i.е. the increase of $21 million. In other words, Russia’s share in the growth of exports of dried vegetables was insignificant. The main role in the growth of exports in this segment was played by Germany (growth from $9.2 million to $13.6 million), the USA (from $2.7 million to $5.9 million), Japan (from $3.8 million to $4.3 million) and Belgium (from $1.1 million to $3.6 million).

As to Russian imports of dried vegetables, we note that even with the growth in their supply to Russia, Egypt’s share in the Russian market in 2021 was only 5.6%. Therefore, mutual dependence in this category is not too high.

Given the good diversification of the geography of dried vegetable exports from Egypt and the low dependence on the Russian market, EastFruit analysts note a low level of risk for Egyptian exporters in fluctuations in demand for these products in the Russian market.

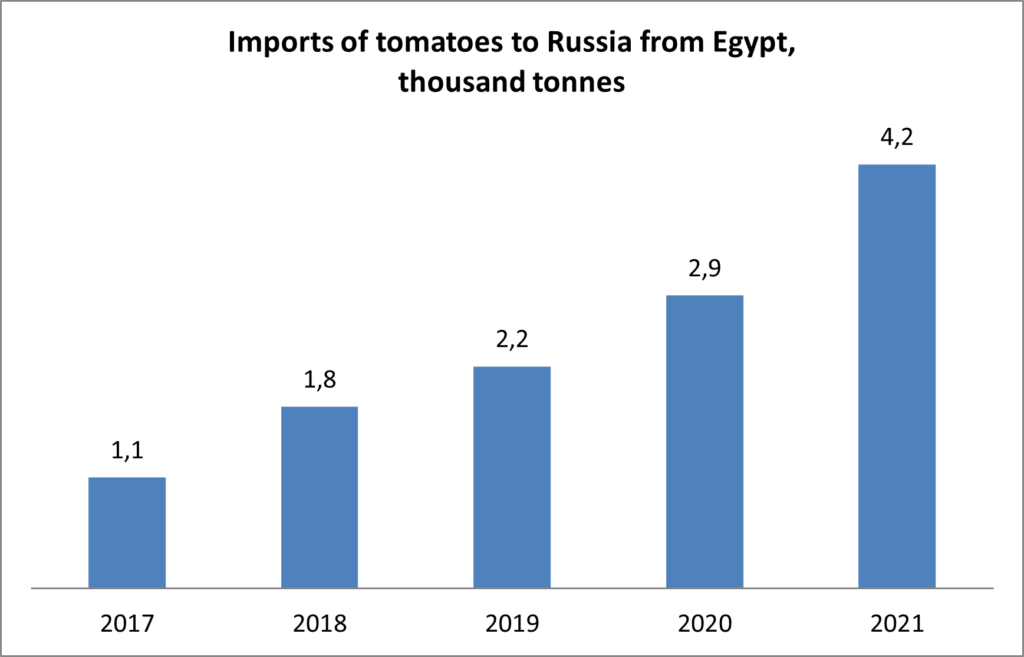

Greenhouse fresh tomatoes: Over the past few years, the volume of Egyptian tomato imports to the Russian market has been steadily growing, while the total volume of tomato imports to Russia has been declining. For example, the total volume of imports of tomatoes to Russia in 2018-2021 decreased from 577 700 to 427 000 tonnes, while the volume of their imports from Egypt increased from 1 800 to 4 200 tonnes in the same period.

Of course, Egypt’s share in the supply of greenhouse tomatoes to the Russian market was negligible. At the end of 2021, it was less than 1%, so there is no critical importance of Egypt for the Russian market and vice versa.

We are likely to see an interruption or stagnation of the growing trend in the supply of Egyptian tomatoes to the Russian market at the end of 2022. Also, EastFruit experts do not expect an increase in demand for imported fresh tomatoes on the Russian market in 2023 and foresee a decrease in their demand due to the worsening economic situation and lower incomes of the population, as well as the outflow of part of the solvent population due to mobilization.

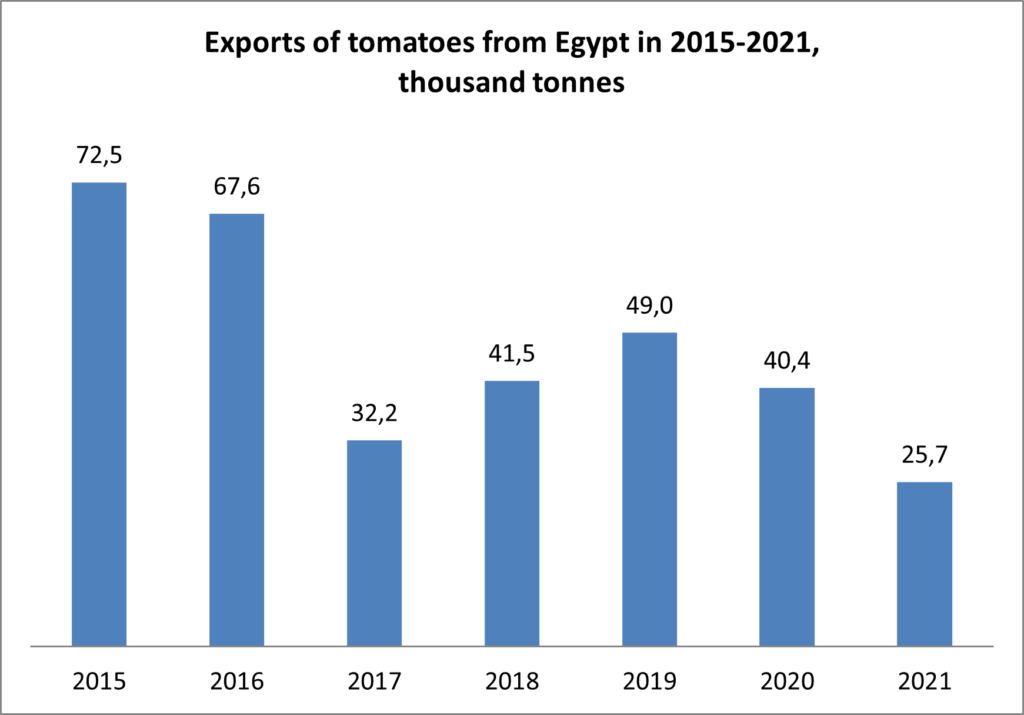

Noteworthy, in contrast to the supply dynamics of Egyptian tomatoes to the Russian market, the total volume of fresh tomato exports from Egypt shows an opposite picture, as you see in the graph below.

The total export volume of tomatoes from Egypt in 2021 was almost 3 times less than the record figure of 2015, and the lowest in the last 10 years. At the same time, the supply of Egyptian tomatoes in 2019-2021 decreased even to rich countries such as the UAE (more than 3 times), Kuwait – (more than 8 times), the Netherlands – (4 times), and Saudi Arabia – (1.5 times). In other words, the supply of tomatoes from Egypt to the Russian market steadily increased with a simultaneous sharp decrease in their supply to the markets of the Middle East and the EU.

Just as in the case of tomatoes and for the same reasons, EastFruit experts see no significant grounds for an increase in demand for head lettuce on the Russian market in 2023.

According to our preliminary estimates, Egyptian exports of head lettuce to the Russian market at the end of 2022 have already shown a decrease compared to 2021. However, unlike tomatoes, Egypt’s lettuce exports to wealthier countries continued to grow.

The export of fresh lettuce from Egypt to the Russian market decreased from $6.1 million to $2.6 million in 2017-2021, but the exports to Saudi Arabia increased from $4.5 million to $11.7 million, to Bahrain – from $307 000 to $1.2 million, in the UAE – from $605 000 to $970 000. However, Egypt continued to lose the fresh lettuce markets of the EU countries, which was due to an increase in the efficiency of greenhouse technologies in this region and a lower need for imports.

Thus, in the face of an expected decline in demand for fresh salads in the Russian market and given the downward trend in the volume of Egyptian lettuce exports to Russia over the past few years, Egyptian producers and exporters should look for alternative markets in their region.

Sweet potatoes: Russia has been actively increasing its imports of sweet potatoes from Egypt in the past few years. The import volume increased from $390 000 to $1.2 million from 2019 to 2021. However, even considering this growth, the share of the Russian market in the total exports of Egyptian sweet potatoes in 2021 was only 2.2%.

The largest buyers of Egyptian sweet potatoes in 2021 were the United Kingdom ($15 million), the Netherlands ($14.9 million), Saudi Arabia ($5.1 million), and the UAE ($3.8 million). Other major buyers were Jordan, Kuwait, Italy, and France with annual volumes from $1 million to $1.5 million. In total, Egypt exported sweet potatoes worth $54.2 million in 2021.

The total volume of Egyptian sweet potato imports to Russia did not exceed 1 000 tonnes per year until 2019 and reached 3 000 tonnes only in 2021. Egypt is the largest supplier of sweet potatoes to the Russian market, and its share in this market in 2021 was 65%. Egypt’s important competitor in this market is Honduras with a market share of about 20%, while Guatemala, Israel, and China share the rest of the market.

On the one hand, Egypt has a quite strong position in the Russian market. On the other hand, Russia’s share in the total export volume of sweet potatoes from Egypt is rather low, and fluctuations in the volume of their demand in the Russian market will not play a large role for Egyptian exporters.

Thus, the “Russian factor” is not yet important for Egyptian producers and exporters of sweet potatoes, as EastFruit analysts conclude.

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.