The potato market in Eastern Europe has been feverish since the beginning of the 2021/22 season. All countries of the EastFruit monitoring presented serious surprises for market participants. Let’s recall the key points.

– Belarus, which was usually an exporter, began to import potatoes even during its own harvest because of serious problems with the quality and volume of production.

– Russia also abruptly switched from exports to a panicky search for opportunities to import potatoes, prices being several times higher than usual for autumn.

– Ukraine, which in recent years has surprised with huge volumes of imports of marketable potatoes, on the contrary, has faced an overproduction of potatoes. At the same time, the exports of potatoes from Ukraine was as complicated as possible for various reasons, and the prices dropped to the lowest level in the region and were significantly lower than in previous seasons.

– Moldova, which has always imported potatoes from Russia and Belarus, unexpectedly began to export them not only to these countries, but also to the Balkans, and the prices long remained the lowest in the region, despite the exports. They were even lower than in Ukraine, leading to the exports of potatoes from Moldova to Ukraine.

– Georgia, which was also usually a net importer of potatoes, began to export rather large volumes of potatoes to Russia this season.

What have the attempts to urgently find suppliers or sales markets for potatoes led to and what are the prospects for the potato market in these countries in the remaining months of the season?

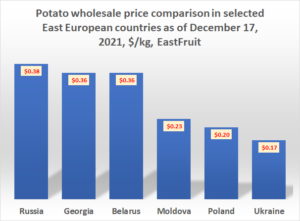

To begin with, let’s compare the level of wholesale prices for potatoes in the countries of the region.

As can be seen, Russia remains the leader in terms of prices, and the average price for potatoes reaches $0.38/kg. Georgia and Belarus are close to Russia, and potatoes are sold only $0.02/kg cheaper there. Obviously, the exports of potatoes from Georgia to Russia has now stopped, and the supply from Belarus to Russia is, most likely, the re-exports of potatoes grown in Ukraine or the EU.

Moldova still sells potatoes relatively cheap. Theoretically, potato exports from Moldova to Russia are still possible. However, as our colleagues from Moldova report, it is no longer easy to collect volumes of potatoes of the required quality in the country.

The lowest prices are in Ukraine – you can buy potatoes two or more times cheaper than in Russia, Georgia and Belarus there. By the way, it’s time to talk about the export of potatoes to Georgia. The supply of potatoes to Belarus is now complicated by new quarantine requirements, as well as logistics issues. It is also difficult to export them to the EU countries due to strict quarantine requirements and problematic quality of Ukrainian potatoes. And prices in the EU, for example in Poland, are now slightly higher than in Ukraine.

How have potato prices changed in recent weeks?

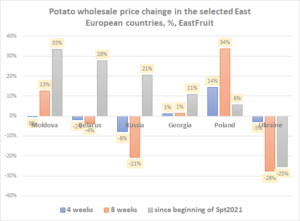

It is interesting to look at the dynamics of potato prices in recent weeks in the analyzed countries of Eastern Europe. These dynamics show how countries deal with deficits or surpluses. The chart below shows the percentage of price change as of December 17 over the past 4 weeks, over 8 weeks and since early September 2021.

As can be seen in the chart, the prices for potatoes have increased in Moldova since the beginning of September – by 33%. It got rid of the surplus of production. At the same time, prices for potatoes have been stable there in the last 4 weeks, which means that supply and demand have balanced. Prices, however, are only slightly higher than last year.

Belarus has slightly reduced wholesale prices for potatoes in the last two months – by 4% average. However, if compared to the beginning of September, the prices are still 28% higher. In addition, potatoes still cost, on average, twice as much as usual at this time of year. This means that the deficit was not completely eliminated.

Russia seems to succeed in tackling the potato shortage, since prices there have fallen by 8% over the past 4 weeks and by 21% over the past 2 months. However, potatoes are now 21% more expensive than at the beginning of September there. And this is not surprising, since there are no longer any sources of cheap potatoes in the world for Russia. Potatoes in Russia are now sold 3 times more expensive than at the same time in 2019 and 50% times more expensive than in 2020.

Potato prices in Georgia are gradually increasing. Since they are twice as high as last year, the season for exporting potatoes from Georgia can be said to be over. At this price level, the country may even start importing potatoes.

In Poland, potatoes are also dynamically rising in price, although prices remain relatively low. Obviously, the country is now successfully coping with the surplus of production.

In Ukraine, prices for potatoes continue to decline, which indicates continuing problems with sales. Without external markets, which producers will not be able to enter without a significant increase in the quality, the situation in the industry will not change. Therefore, Ukrainian potato growers now sell their products almost twice as cheap as usual during this period of the year.

What are the forecasts for potato prices in the coming months?

In order to forecast potato prices with a high degree of probability, fundamental market analysis must be constantly conducted. Only APK-Inform: vegetables and fruits does this in Ukraine, but this forecast is not public and is available for ordering on the company’s website.

Therefore, in forming our opinion, we will rely on available information about trends and opinions of market participants. Accordingly, we will not call this a forecast, but rather the consolidated expectations of the region’s potato market participants.

First of all, where the countries experiencing a shortage of potatoes can buy them?

Pakistan has already started a new harvest of potatoes, but the cost of logistics is so high that there is no point in supplying potatoes to the European part of Russia and Belarus from Pakistan now.

Iran will obviously also start entering the potato market with a new harvest as early as January 2022, just like Egypt. However, the potato harvest in Egypt this year will be much lower than usual, and prices are already very high there. Since it is Egypt that is usually the main supplier of potatoes to Russia in spring, prices there will be decisive for the formation of prices in Russia. Proceeding from this, market participants expect an increase in the price of potatoes in Russia in February. A similar forecast will be made for Belarus.

By the way, there is another reason for the rise in potato prices in Belarus – from January 1, 2022, the import of potatoes, as well as other vegetables and fruits from the EU to Belarus will stop. In addition, prices for potatoes there are directly correlated with prices in the Russian Federation.

In Ukraine, on the other hand, potato stocks remain sufficient, and exports to most countries are either impossible or very difficult. This suggests the prospect of keeping potato prices at a very low level.

In Moldova, the stocks of potatoes of the required quality may turn out to be lower than the market needs in the winter-spring period. Therefore, many market participants are expecting an increase in potato prices in Moldova.

Another interesting feature of the potato season is the high prices for seed potatoes in the countries of the region. The demand has grown, but their supply has decreased.

Recall that the dynamics of prices for potatoes in the countries of Eastern Europe and Central is available in the EastFruit wholesale price monitoring section. You can sell or buy marketable potatoes in the largest Telegram group EFTrade, and seed potatoes in the EFTechnology group.

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.