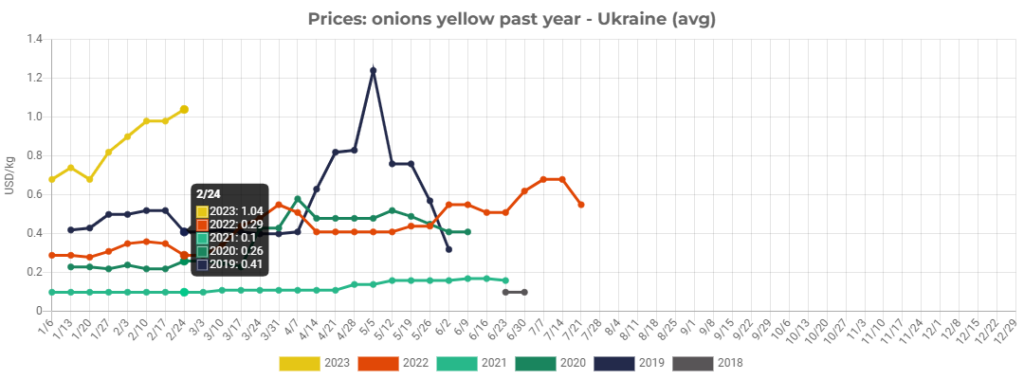

Participants of the fruit and vegetable market accepted the fact that wholesale prices for onions in Ukraine reached $1/kg, as EastFruit analysts forecasted back in mid-January. This happened in the last week of February 2023, and the price rose to $1.04/kg.

By the way, this is an absolute price record not only for Ukraine but also for all other countries of the region. At the beginning of May 2019, there was a short-term rise in wholesale prices for onions in Ukraine to $1.14, but the price fell by half in a week, so this can hardly be considered important.

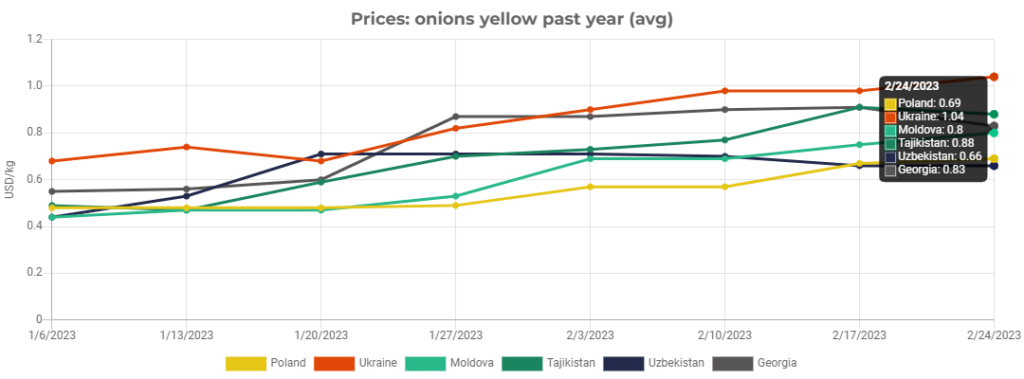

We will show what is happening with prices in the regional market and how this will affect market participants in the new season. To see the pictures clearly, we take prices in US dollars.

As you see, Ukraine remains the “champion” in terms of onion price growth. Previously, the maximum price for onions in the same period of the year was $0.41/kg in 2019. Thus, current onion prices in Ukraine are 2.5 times higher than ever before even in dollar terms.

If onion prices repeat the scenario of the 2019 season when the supply was similarly low, the wholesale onion prices in Ukraine in April 2023 could reach $2/kg, as the price doubled from the end of February to the end of April 2019. In our opinion, this is unlikely, although the upward trend in prices may well continue (read more on the situation with import opportunities here).

The improbability of reaching the price of $2 in Ukraine is explained by the fact that Ukraine is a priority market for onions for all European countries. The price gaps with Poland already now allow to freely import the necessary volumes of onions. It also means that the Netherlands can redirect significant volumes of onions from Africa to Europe, Ukraine, and Central Asia. In addition, already now premium quality onions of large calibers, which are in short supply this season, are coming to Europe from New Zealand, thanks to high price levels.

In other countries, onion prices are much lower than in Ukraine, but still, they are record-high in all of them.

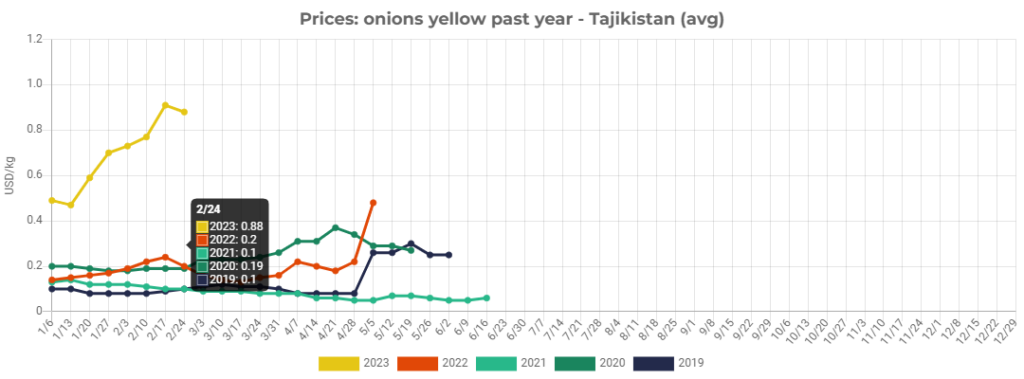

Tajikistan is the second country in terms of onion price – the wholesale price began to decline last week but it still reaches an impressive $0.88/kg there. Recall that two years ago, onion prices in Tajikistan in spring were 22 times lower – they dropped to $0.04/kg in April!

Thus, it is not surprising that the previous record for wholesale onion prices for this period in Tajikistan was only $0.20/kg last year. Current onion prices in Tajikistan are 4.4 times higher than ever before at this time. Let us remind you that onion exports from Tajikistan are currently prohibited.

The third country in the ranking of the most expensive onions in the region is Georgia. There has been a recent downward trend in wholesale prices for onions there, but onions still cost $0.83/kg – twice as much as the previous record set in 2019 and 3.2 times more expensive than a year earlier. The maximum wholesale price for onions ever recorded in Georgia in the winter-spring period is $0.74/kg. It was noted in 2019 in late April – early May.

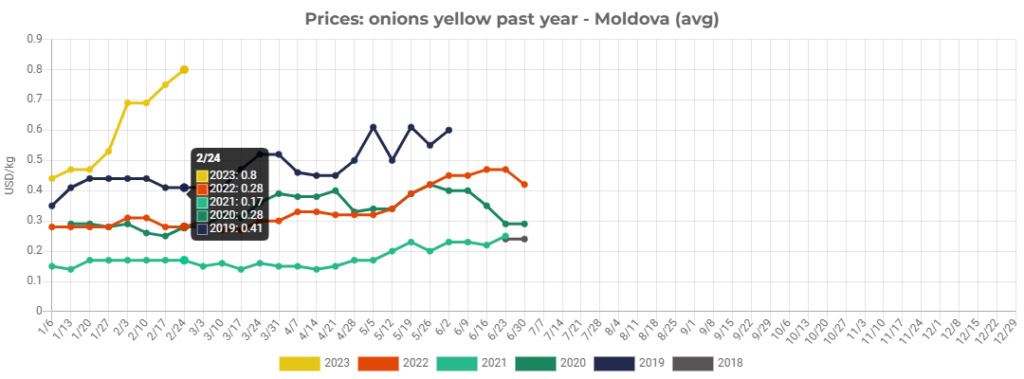

The next is Moldova, which sensationally exported onions in the 2022/23 season – of course, mainly to Ukraine. Onion prices are skyrocketing there because stocks are dwindling and there is a need to import onions.

Wholesale prices for onions in Moldova are twice higher now as the previous record for this period. They are almost 3 times higher than last year and one-third higher than the record prices for the winter-spring period noted in late April – early May 2019.

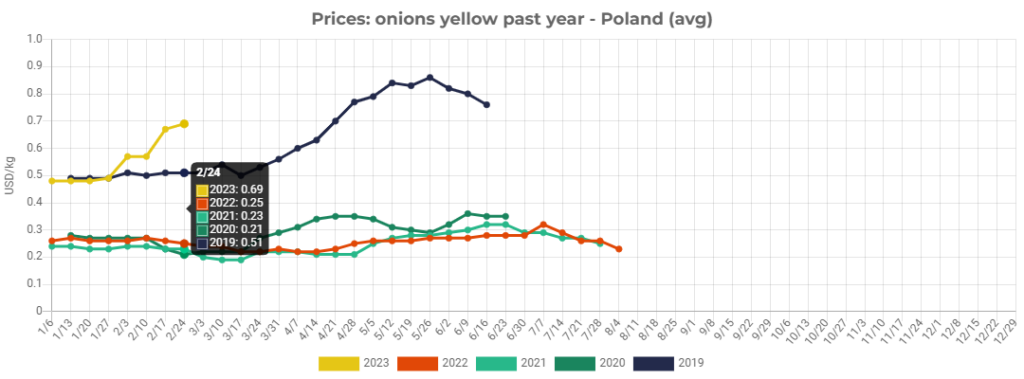

The fifth country in our ranking of high onion prices is Poland. Onions are sold in bulk at $0.69/kg there. This is 35% more expensive than the previous record at the end of February but still lower than the record levels of May 2019, which, however, may well still be exceeded in 2023. In addition, onion prices in Poland are 2.8 times higher than last year.

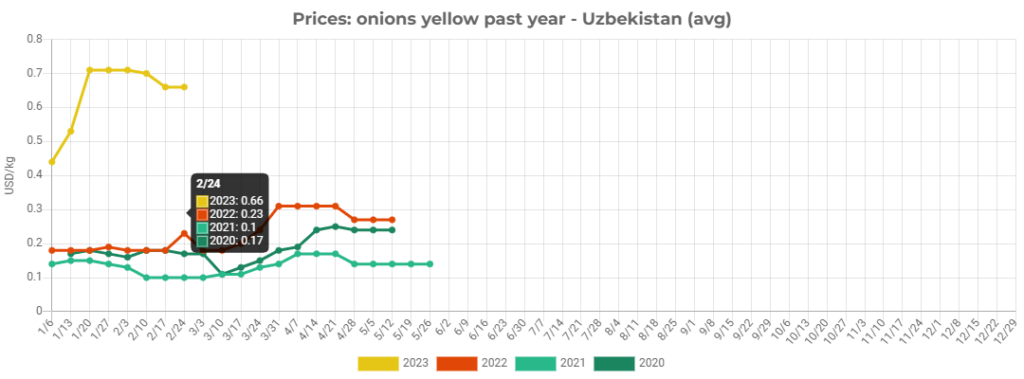

Onion prices in Uzbekistan, which, like most Central Asian countries, has banned onion exports, are now the lowest in the region – $0.66/kg. They have been stable for about six weeks now and have even dropped slightly, but not significantly.

By the way, wholesale prices for onions in Uzbekistan increased by 3.6 times compared to last year (and to the previous price record for this period of the year). It means, the relative rise in prices there was higher than in Ukraine. As we see in the chart below, all previous records have long been broken.

Besides, the harvest of early onions in Uzbekistan is delayed and may be low due to frost.

What can high onion prices in the region lead to?

It doesn’t take an oracle to realize that incredibly high onion prices will attract more investors to the sector, and that onion acreage for the 2023 crop will expand almost everywhere in our region. An indirect confirmation of this is the huge shortage of onion seeds, which all seed companies confirm.

Therefore, the situation with onion prices in the next season may well turn out to be the opposite of today’s almost everywhere, with the possible exception of Ukraine.

In the meantime, wholesale prices for onions are already several times higher than those for apples and are approaching prices for exotic fruits that are transported tens of thousands of kilometers away. According to experts, the limits of price growth are still not exhausted. After all, there are still at least two months before the start of early onion harvesting in the warmest countries of Central Asia. In Ukraine and Moldova, early onions will be harvested only from mid-June 2023.

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.