Over the past two seasons, onions have dominated the headlines in the fruit and vegetable market. In the 2022/23 season, onion prices shattered all records, surpassing the unprecedented level of 1 euro/dollar per kilogram wholesale in many countries. This led to an unprecedented number of countries, including Turkey, Egypt, Uzbekistan, Tajikistan, Kazakhstan, and Kyrgyzstan, imposing export bans, further intensifying the market.

Predictably, the following season experienced a reverse situation. Despite EastFruit analysts’ warnings about a potential price collapse, many investors were lured by the prospect of quickly doubling or even tripling their investments. Unfortunately, they failed to achieve even a break-even point. Onion prices plummeted, forcing farmers and traders to discard high-quality onions or use them as animal feed.

As a result, early onions in the 2024/25 season were incredibly cheap, with very low demand.

So, what is the current state of the onion market?

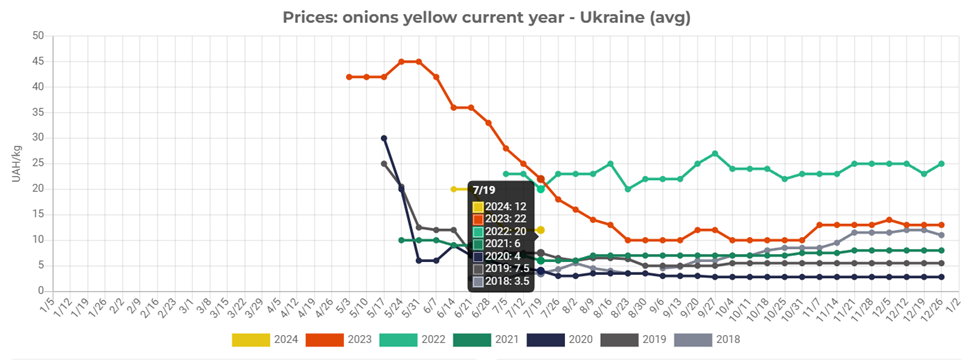

Weekly price monitoring indicates that the onion market has now found a certain balance. In Ukraine, onion prices in hryvnia are relatively high, although still far from the peaks of July 2022 and 2023, EastFruit informs.

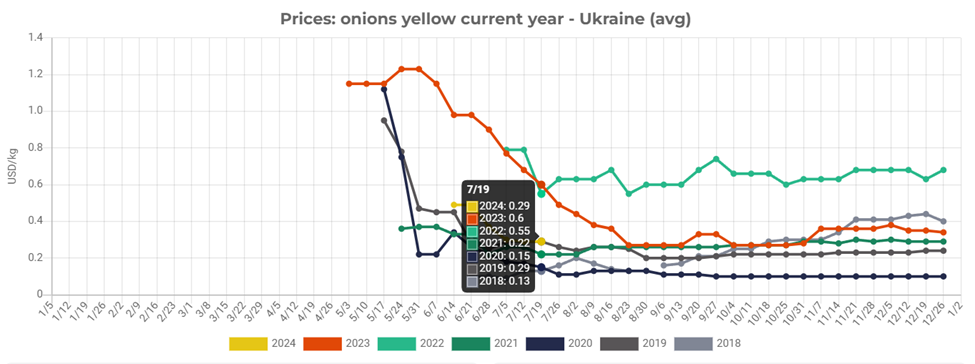

In dollar terms, the situation is less favorable but not critical – prices are slightly above average, allowing for reasonable earnings. The main concern moving forward will be the quality of later onion varieties, with the harvest set to begin soon. Ukraine is currently experiencing abnormal heat, which could negatively impact production volumes and onion quality.

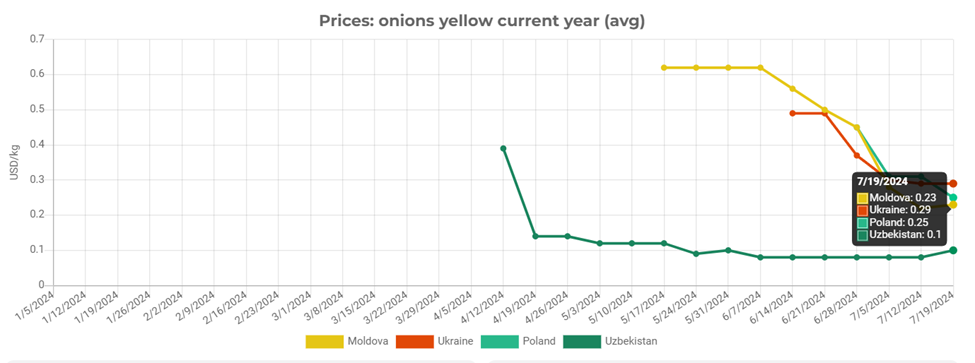

Interestingly, onion prices in Ukraine are currently the highest in the region. In Poland, the wholesale price of onions is 4 US cents per kilogram lower, and in Moldova, it is 6 cents lower.

Interestingly, onion prices in Ukraine are currently the highest in the region. In Poland, the wholesale price of onions is 4 US cents per kilogram lower, and in Moldova, it is 6 cents lower.

Last season, Ukraine actively exported onions to Moldova and Romania, as well as to Bulgaria, Greece, Poland, and Spain. Currently, there are no signs of active exports this season. However, several large companies that previously did not engage in vegetable farming have sown large areas with onions this year, so we may still see significant export shipments of late onion varieties during the season.

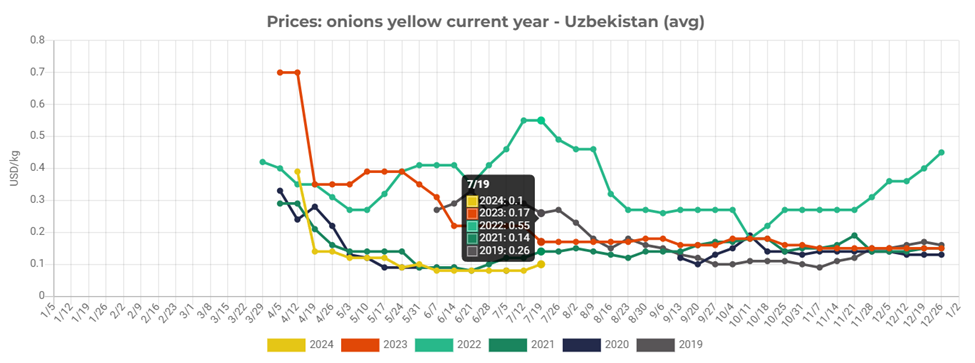

The onion market in Central Asian countries remains challenging. In Uzbekistan, onions are sold with great difficulty, and prices remain at a record low level. Recently, there has been some revival in trade, and prices have slightly increased. However, the window for mass exports is closing, making it likely that early onion prices in the 2024 season will be historically low for Uzbek farmers.

The onion market in Central Asian countries remains challenging. In Uzbekistan, onions are sold with great difficulty, and prices remain at a record low level. Recently, there has been some revival in trade, and prices have slightly increased. However, the window for mass exports is closing, making it likely that early onion prices in the 2024 season will be historically low for Uzbek farmers.

The situation in Tajikistan is even worse. Prices have remained close to 8 US cents for almost the entire season. There is still no clarity on whether onion exports are allowed. Since reports of an unofficial ban on onion exports from Tajikistan emerged in February, traders have continued to report the ongoing ban even as onion prices collapsed and the new harvest began.

The situation in Tajikistan is even worse. Prices have remained close to 8 US cents for almost the entire season. There is still no clarity on whether onion exports are allowed. Since reports of an unofficial ban on onion exports from Tajikistan emerged in February, traders have continued to report the ongoing ban even as onion prices collapsed and the new harvest began.

It is evident that the onion market recovery can be expected no earlier than autumn 2024. “Typically, after a loss-making season, a fairly balanced year in terms of prices follows. However, this fragile balance can easily be disrupted: bad weather, export embargoes, currency devaluations or revaluations, and other factors can change pricing prospects,” says Andriy Yarmak, an economist at the investment department of the Food and Agriculture Organization of the United Nations (FAO). “However, current trends in onion acreage in Eastern Europe and Central Asia, along with other factors, suggest a promising season for both farmers and consumers,” notes the expert.

Maintain full control over fruit and vegetable prices in Turkey, Egypt, Ukraine, Uzbekistan, Russia, Moldova and other markets subscribing to EastFruit Premium.

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.