The frozen raspberry market has been struggling for two seasons, but analysts from EastFruit report that 2024 has finally brought some positive signs of recovery in prices and demand for this berry.

This article refers to different quality categories of raspberries, which you can find the description of here (in Russian).

Currently, the frozen raspberry market is active in all quality categories, from “extra 95/5” to “crumble”.

The main factors that contributed to the market revival are:

· low inventories of frozen raspberries in storage;

· longer lead times from order placement to product delivery;

· disruption of the Ukrainian border by Polish farmers and transporters.

The border disruption by the Polish farmers had a significant impact on the frozen raspberry market, as Ukraine is becoming a major player in the global frozen berry market. Due to the Polish blockade, direct shipments from Ukraine to this country were halted, and alternative routes and border delays increased the logistics costs. This, in turn, drove up the prices of frozen berries in Europe.

Interestingly, the Polish farmers’ actions caused a shortage of the cheapest quality category of raspberries, “crumble”, among many processors in Europe. Customers started looking for raspberry crumble in all countries except Ukraine, which created some hype and also pushed up the prices for this product.

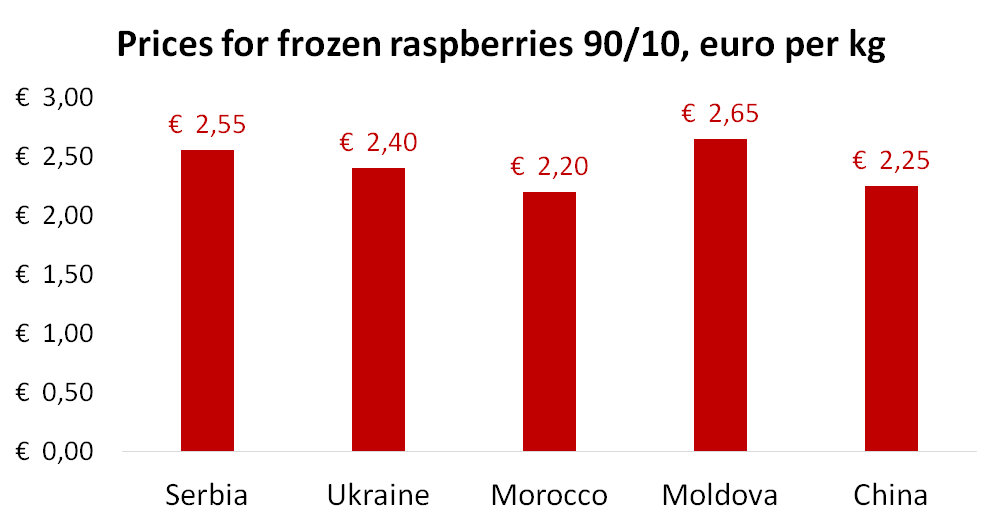

By the time the restrictions on the transport of agricultural products at the Ukrainian-Polish border were eased, there had already been a high demand for berries within Ukraine. Exporters started buying any quality from the remaining stocks in the country, realizing that they were not very large. By the time the border was unlocked, Ukraine was already offering berries 90/10 at average prices of 2.30-2.40 euro FCA Ukraine.

As for other countries, Serbia maintained the prices for whole frozen berries at 2.5-2.6 euro/kg. According to market participants, the frozen raspberry stocks in Serbia are also low. Therefore, not many producers can actually offer this quality when asked.

China, with its complex and long logistics, offers frozen raspberries of 90/10 quality at 2.1 euro/kg FCA China or 2.15-2.35 euro at the port of Hamburg. Frozen raspberries of “gris” quality from China are offered at 1.75-1.85 euro at the port of Hamburg.

Belarus is no longer part of the European supply formula for frozen raspberries, although its stocks are also minimal.

The supply of frozen raspberries from Morocco is gradually increasing, as the expected season there runs from January to May. The current price for 90/10 quality is 2.2 euro/kg FOB port of Morocco. It should be noted that there are not many reliable reviews on the quality of raspberries from Morocco yet.

Moldova is not one of the main frozen raspberry producing countries, but it has about 200 tons of finished products in stock. The price range for raspberries from Moldova for 90/10 quality is 2.6-2.7 euro/kg FCA Moldova.

Central Asia has been increasing its production of frozen berries in recent seasons. However, after the losses of the 2022/23 season, most of the freezers in 2023 refused to buy raspberries. As a result, there was a high domestic demand for this berry in the region, which resulted in higher prices than the European ones!

Central Asia still lags behind in producing whole raspberries of “Extra class” 95/5 or 90/10 quality. This is mainly due to the lack of modern varieties and technologies for raspberry cultivation. As a result, Central Asia is not a major or influential player in the quality raspberry market.

The following diagram shows an estimated price chart for frozen raspberries in January 2024 by the main supplier countries.

You may recall that in January-February of last year, the prices for frozen raspberries dropped to around 2.6 euro per kg, which shocked the market, as the season began with a price of 4.7 euro per kg. You can read more about the market situation before the start of the season and compare the price trends here.

However, in 2024, the average price for frozen raspberries is 8% lower than the “shockingly low” price of the same period last year, but this is seen as very positive and encouraging by the market players. We would like to remind you that the raspberry market follows a traditional cycle, which means that we are now at the beginning of the price recovery phase, after hitting the bottom in the summer-fall of 2023.

Nonetheless, we think it is premature to be too optimistic. The market is still very unstable. On top of all the challenges, new logistic issues emerged due to the attacks of the Houthis on civilian ships in the Red Sea, as well as the strikes of farmers in Germany, France, and Poland.

It is also important to realize that in the next few months, there will be no large supply of frozen raspberries available, so traders and processors of frozen raspberries have to share the remaining stock, as well as wait for the arrival of raspberries from Morocco on the market.

Most market participants expect that the prices for frozen raspberries will not exceed 2.7-3.0 euro per kg. However, whether there will be enough inventory of this berry until the season, we will find out in the upcoming months.

The use of the site materials is free if there is a direct and open for search engines hyperlink to a specific publication of the East-Fruit.com website.